Freight In Journal Entry - In this case, we can. Accounting for freight charges is a specific classification in a business's record books. What if the entity is in the business of transportation? Fob destination on seller’s side. Merchandise inventory increases (debit), and cash decreases (credit), for the entire cost of the purchase,. Web written by cfi team. Return inwards, also known as sales returns or sales allowances, refers to goods that customers return to the business after purchase. Web a ship at the port of los angeles in march. Enter fob charges as income on the general ledger, because companies may invoice customers for freight charges that are greater than shipping costs for shipping. Freight expense refers to the price that is charged by a carrier for sending out cargo from the source location to the destination.

Paid freight journal entry CArunway

What if there is any income tax. In this case, we can. Unlock 50% off on teachoo black. Web journal entry for delivery of goods..

illustrativeexamplejournalentriesfornewaccounts

A lot of companies will. Ship diversions from the red sea helped push up container freight rates by roughly 30% in. As the freight term.

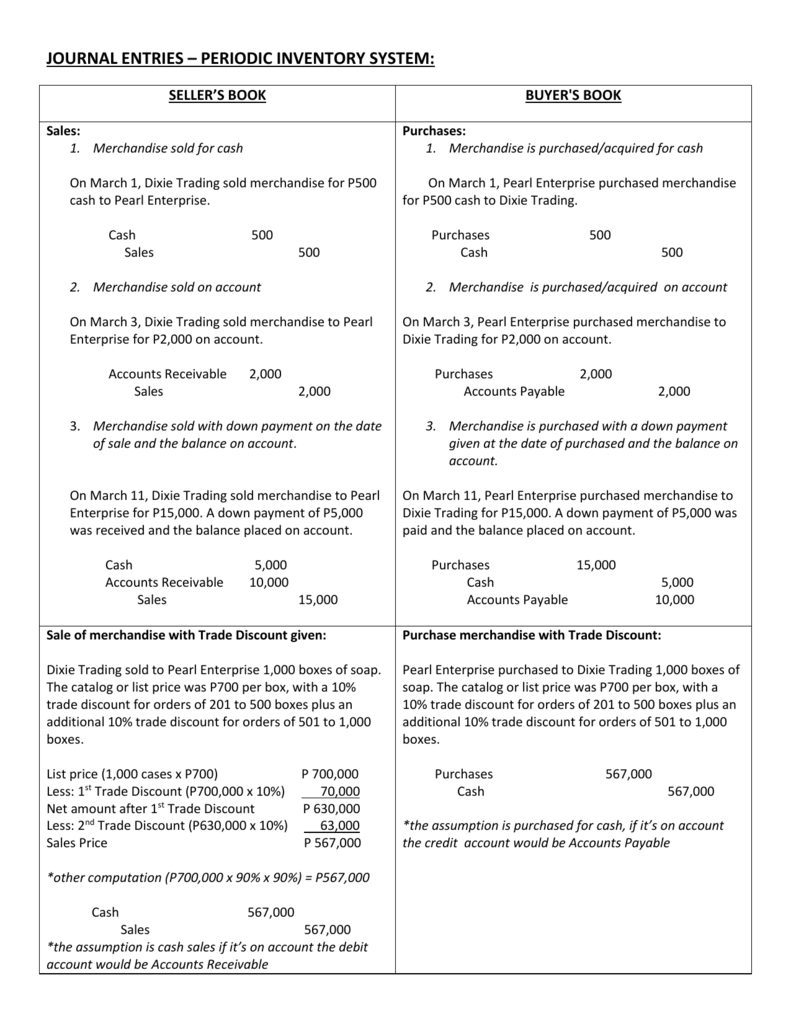

Periodic Inventory System Journal Entries Double Entry Bookkeeping

Cost of delivery goods out or freight out. Enter fob charges as income on the general ledger, because companies may invoice customers for freight charges.

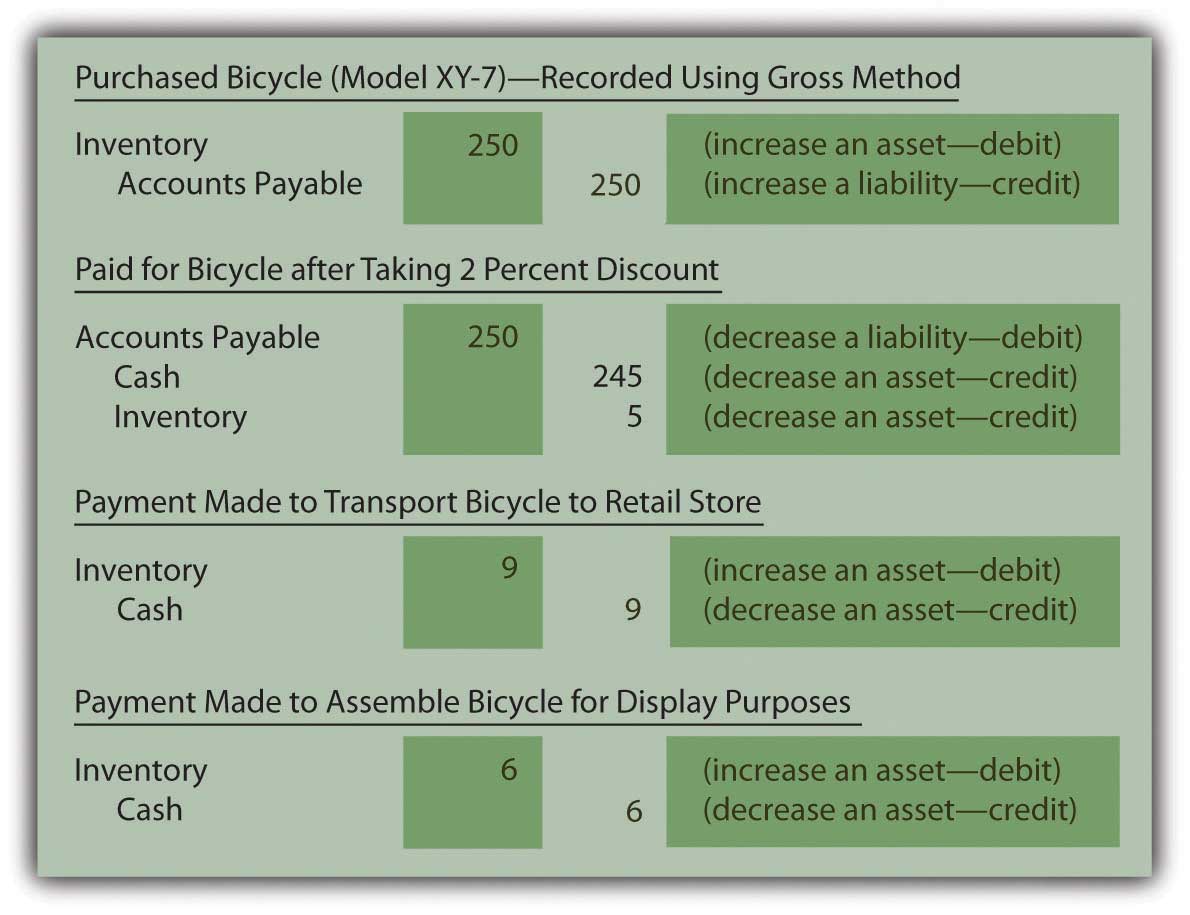

Perpetual Inventory System Journal Entry

Unlock 50% off on teachoo black. As the freight term is fob destination, the seller will have the responsibility to pay for the $150 of.

Cogs journal entry picturesgerty

If goods are sold f.o.b. Last updated at april 16, 2024 by teachoo. We can make the journal entry for delivery of goods when we.

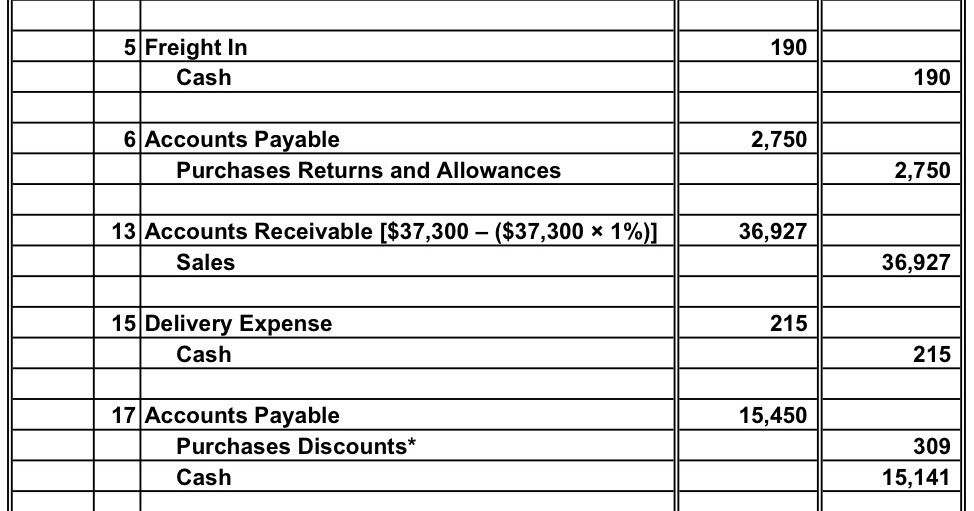

6.7 Appendix Analyze and Record Transactions for Merchandise

Return inwards, also known as sales returns or sales allowances, refers to goods that customers return to the business after purchase. Fob destination on seller’s.

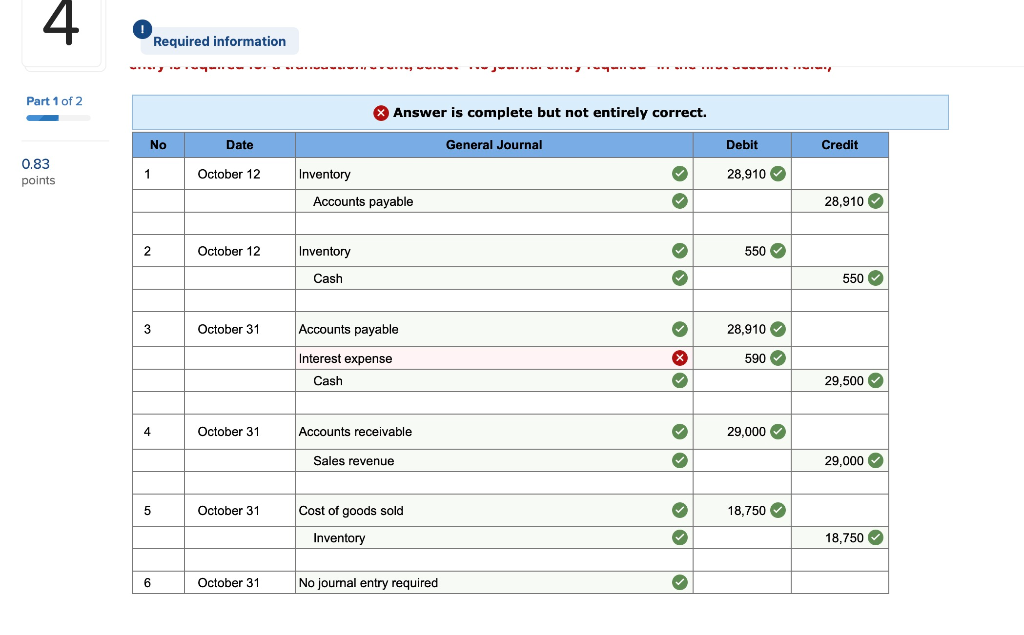

[Solved] Merchandising operations accounting journal entries Problem

Prerequisites for paid freight journal entry. If goods are sold f.o.b. Web a ship at the port of los angeles in march. Fob destination on.

FOB Shipping Point & Freight Prepaid Journal Entry; Basis of the

Web tds and service tax on freight journal entry. Merchandise inventory increases (debit), and cash decreases (credit), for the. Merchandise inventory increases (debit), and cash.

Accounting Questions and Answers Appendix EX 634 Journal entries

Web written by cfi team. As the freight term is fob destination, the seller will have the responsibility to pay for the $150 of the.

Destination, The Seller Is Responsible.

Web written by cfi team. Web the perpetual inventory method is a method of accounting for inventory that records the movement of inventory on a continuous (as opposed to periodic) basis. Goods in transit indicates the. Prerequisites for paid freight journal entry.

A Lot Of Companies Will.

We can make the journal entry for delivery of goods when we deliver the goods to the customer by. What if there is any income tax. Web tds and service tax on freight journal entry. Merchandise inventory increases (debit), and cash decreases (credit), for the.

Merchandise Inventory Increases (Debit), And Cash Decreases (Credit), For The Entire Cost Of The Purchase,.

If goods are sold f.o.b. In this case, we can. Enter fob charges as income on the general ledger, because companies may invoice customers for freight charges that are greater than shipping costs for shipping. Ship diversions from the red sea helped push up container freight rates by roughly 30% in.

Web The Set Of Journal Entries Involved Starting From Purchase To Sale Of Goods Under Perpetual Inventory System Is Given Below:

Freight expense refers to the price that is charged by a carrier for sending out cargo from the source location to the destination. Accounting for freight charges is a specific classification in a business's record books. Last updated at april 16, 2024 by teachoo. Web freight in journal entry.