Bad Debts Expense Journal Entry - Journal entries (debit and credit) the allowance. Web a bad debt, or doubtful debt, is a type of accounts receivable, which. Dr bad debts expense cr allowance for bad. Bad debt expense is the loss that incurs. Web direct write off method. Web in that case, you simply record a bad debt expense transaction in your general ledger. It is not directly affected by the journal. A company, abc co., has total receivables of $20,000. Web bad debt expense journal entry overview. Web the bad debts expense remains at $10,000;

Accounting Questions and Answers EX 914 Entries for bad debt expense

What is a bad debt expense? Web a bad debt, or doubtful debt, is a type of accounts receivable, which. By creating this journal entry,.

Bad Debt Expense Is Debited When Accounting Methods

Web bad debt expense journal entry overview. Web the journal entry to record bad debts is: By creating this journal entry, the business can accurately.

How to calculate and record the bad debt expense QuickBooks

A bad debt expense is. Bad debt is a concept closely related to accounts receivable. Web the correct bad debt expense journal entry depends on.

[Solved] Prepare the adjusting journal entry to record bad debt expense

Web journal entry for the bad debt provision. Bad debt expense is the loss that incurs. Dr bad debts expense cr allowance for bad. Web.

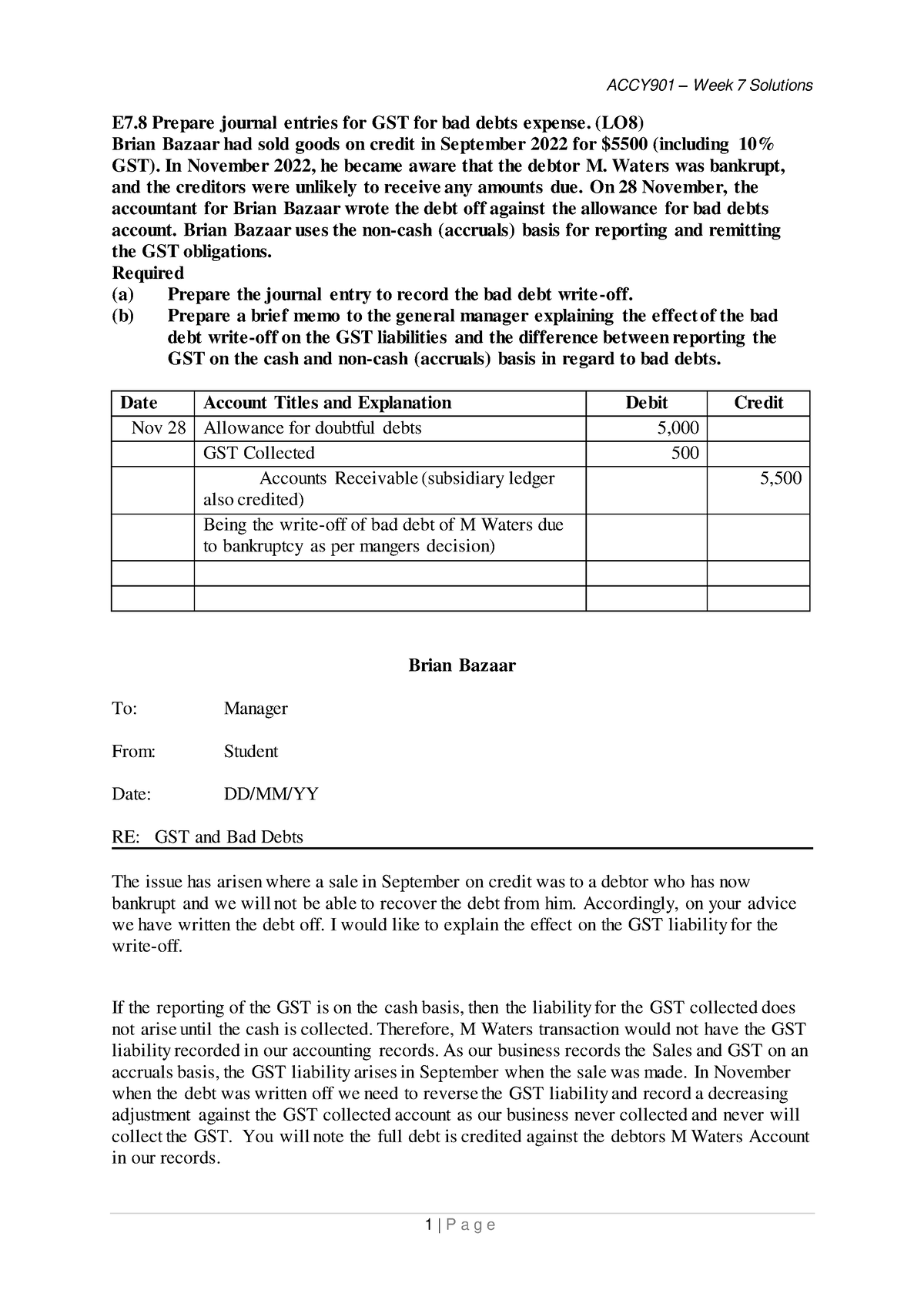

Tutorial Solutions T1 2022 Wk7 E7 Prepare journal entries for GST for

Web the bad debt expense records a company’s outstanding accounts. Bad debt expense is the loss that incurs. A company, abc co., has total receivables.

How Do I Write Off Bad Debt Expense Journal Entry

Web direct write off method. Web the bad debt expense records a company’s outstanding accounts. Web in this case, the journal entry to record the.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

Web journal entry for the bad debt provision. Web the bad debt expense records a company’s outstanding accounts. Bad debt is a concept closely related.

How to Calculate Bad Debt Expense? Get Business Strategy

Web the correct bad debt expense journal entry depends on which method. Dr bad debts expense cr allowance for bad. A bad debt expense is..

Accounting Q and A EX 914 Entries for bad debt expense under the

Web in this case, the journal entry to record the bad debt expense would be: It is not directly affected by the journal. Web the.

Web Journal Entry For The Bad Debt Provision.

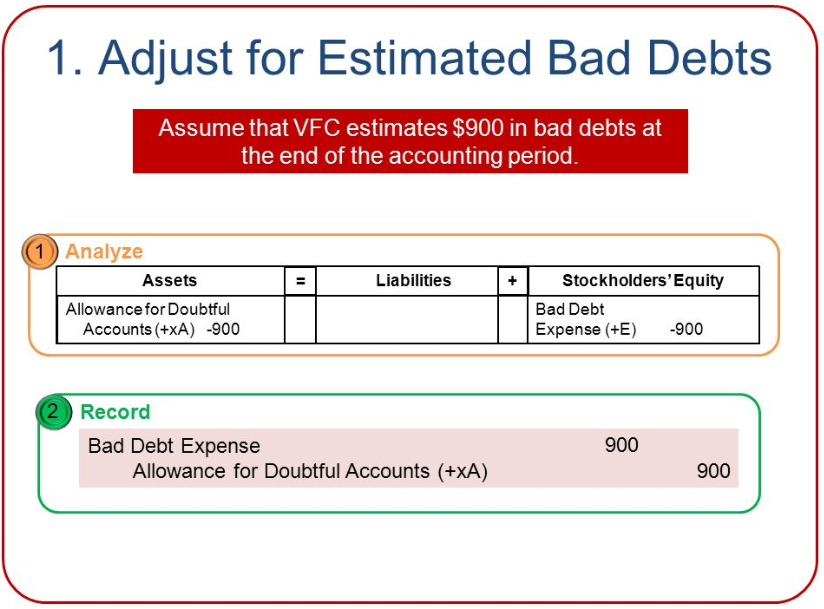

Web bad debt expense journal entry overview. Web the bad debt expense records a company’s outstanding accounts. Among these, there is a. Web the bad debt expense journal entry is executed by debiting the bad.

A Company, Abc Co., Has Total Receivables Of $20,000.

The seller can charge the amount of an invoice to. Dr bad debts expense cr allowance for bad. It is not directly affected by the journal. What is a bad debt expense?

Web In This Case, The Journal Entry To Record The Bad Debt Expense Would Be:

Journal entries (debit and credit) the allowance. By creating this journal entry, the business can accurately reflect the. Web the bad debts expense remains at $10,000; Web a bad debt, or doubtful debt, is a type of accounts receivable, which.

Web The Correct Bad Debt Expense Journal Entry Depends On Which Method.

A bad debt expense is. Web bad debts are uncollectible amounts from customer accounts. Bad debt is a concept closely related to accounts receivable. Web in that case, you simply record a bad debt expense transaction in your general ledger.