Deferred Revenue Journal Entries - Web the accounting process for deferred revenue involves two main journal entries: Web journal entry for deferred revenue. Web the entries to record such revenue are as follows: Web one example of a deferred revenue journal entry is when a company receives payment for services or goods that have not yet been provided. Let us understand the process of recording deferred revenue with an. Web we would make the following adjusting entry on december 31: Web deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. How to record a deferred revenue journal entry. Web given that a journal entry in accounting works to record business transactions, a deferred revenue journal entry is a recording of revenue not yet earned. Web deferrals are adjusting entries in a company’s general ledger for revenue generated before the actual delivery of the product or service to the customer, and.

Deferred Revenue Understand Deferred Revenues in Accounting

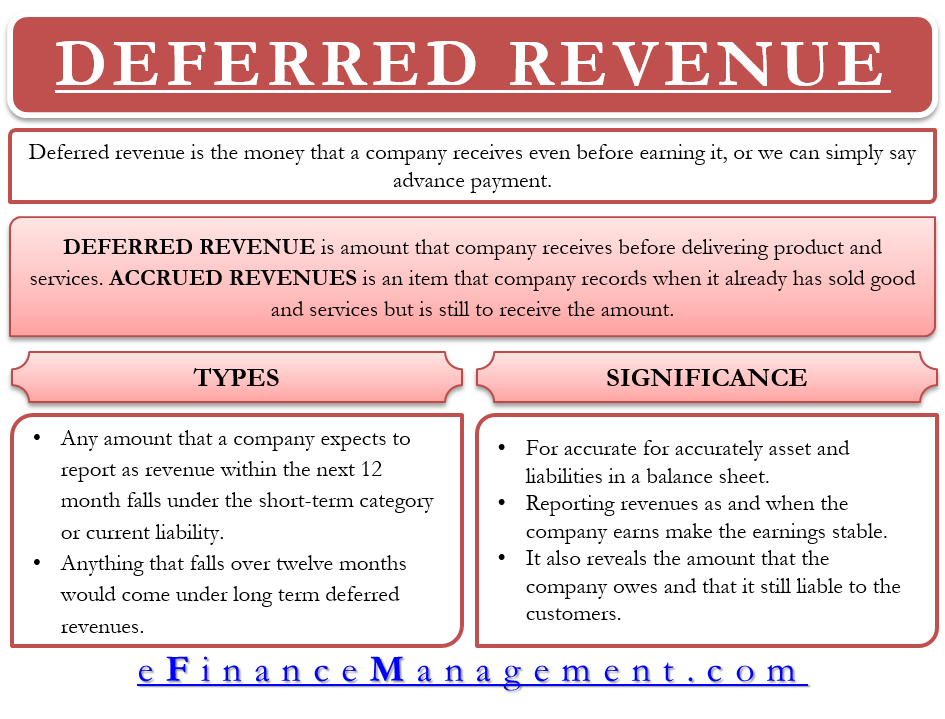

Web deferred revenue refers to the payment received by a company in advance for products or services that have not been delivered to the customer..

What Is Unearned Revenue? QuickBooks Global

Web given that a journal entry in accounting works to record business transactions, a deferred revenue journal entry is a recording of revenue not yet.

Deferred Revenue Journal Entry Double Entry Bookkeeping

Web one example of a deferred revenue journal entry is when a company receives payment for services or goods that have not yet been provided..

Deferred Revenue Journal Entry with Examples Financial

Web given that a journal entry in accounting works to record business transactions, a deferred revenue journal entry is a recording of revenue not yet.

Deferred Revenue Meaning, Importance And More

When a customer pays in advance for goods or services, the company debits the cash account and credits deferred. The balance in the sale of.

What is Deferred Revenue? The Ultimate Guide (2022)

Web deferred revenue is money that you receive from clients or customers for products or services that you haven’t delivered yet. Web deferred revenue is.

What is Unearned Revenue? A Complete Guide Pareto Labs

In this case, company a will recognize the revenue as soon as one match ends, and the balance amount will be deferred. Web deferrals are.

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube

Learn why it’s so important for small businesses to properly recognize it. This journal entry increases cash for the amount received and records a liability.

Deferred Revenues — Odoo 14.0 documentation

Web deferred revenue journal entry. Web one example of a deferred revenue journal entry is when a company receives payment for services or goods that.

Web Deferred Revenue Is Money That You Receive From Clients Or Customers For Products Or Services That You Haven’t Delivered Yet.

Web deferred revenue is a liability account that represents the obligation that the company owes to its customer when it receives the money in advance. Deferred revenue journal entry to record influx of cash that has. When a customer pays in advance for goods or services, the company debits the cash account and credits deferred. Web one example of a deferred revenue journal entry is when a company receives payment for services or goods that have not yet been provided.

At The End Of Each Month:

Web we would make the following adjusting entry on december 31: In accounting, deferred revenue can. When a customer makes an advance payment, it results in two simultaneous accounting entries: Web deferred revenue, also known as unearned revenue or unearned income, is a payment from a customer for a service or a product that has not been provided yet.

Let Us Understand The Process Of Recording Deferred Revenue With An.

Web deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. We recorded an increase in revenue and an increase in money owed to us so that our ledgers, thus our trial balance,. The balance in the sale of tickets account will. Web deferred revenue refers to the payment received by a company in advance for products or services that have not been delivered to the customer.

Web What Is The Journal Entry For Deferred Revenue?

Web in this article, we discuss the definition and purpose of a deferred revenue journal entry, identify how to record it correctly on a balance sheet, highlight an. Web the accounting process for deferred revenue involves two main journal entries: Web the entries to record such revenue are as follows: Web journal entry for deferred revenue.