Deferred Rent Journal Entry - Web prepaid rent journal entries. Web a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. The full principal is due on september 1, 2023. Understanding the impact of changes brought by asc 842. Web a common form of lease concession discussed by the staff in the q&a is a deferral of rent, which changes the timing, but not the amounts, of the rental payments. Is prepaid rent an asset? Debit rent expense for $7,650 (to record the expense of rent for three months) credit prepaid rent for $7,650 (to reduce the prepaid asset as it is utilized) transaction b: Accounting for prepaid rent with journal entries. Web deferred rent journal entries required year 1. Identify the journal entry required, if any.

Chapter04

I need to record the adjusting journal enteried for december 31st 2022. Discover how netlease by netgain simplifies asc 842 transition, ensuring gaap compliance by..

Journal Entry For Advance Rent Received Info Loans

Its amount in this journal entry can be. Web prepaid rent journal entries. Web a deferred revenue journal entry is needed when a business supplies.

Journal entries for lease accounting

Web deferred rent journal entries for year 1. Web prepaid rent journal entries. Web a deferred revenue journal entry is needed when a business supplies.

Deferred Rent Journal Entry CArunway

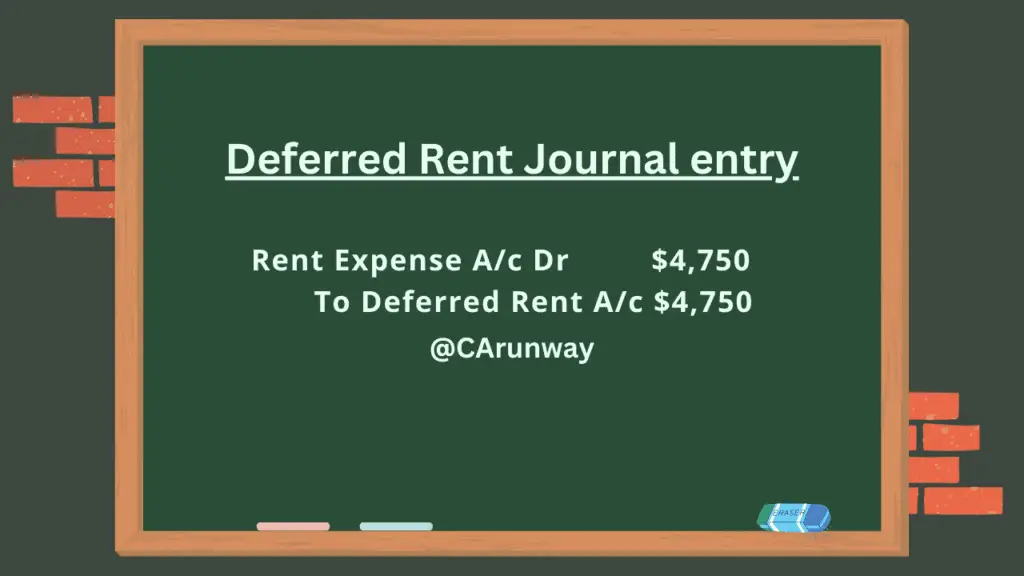

The company can make the journal entry for deferred rent by debiting the rent expense account and crediting the deferred rent account. Debit rent expense.

Deferred Revenue Journal Entry Double Entry Bookkeeping

Initial journal entry on november 1, 2023: Web deferred expenses require adjusting entries. The deferred rent account is a liability account on the balance sheet.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Total lease how of $1,146,388 + $10,000 initial direct charge divided by 10 years. Updated on january 31, 2024. Web following are the steps for.

Deferred Rent Journal Entry CArunway

Web here is a basic example with the journal entries necessary to account for an existing deferred rent liability transitioning from asc 840 to asc.

Deferred Tax Liabilities Explained With Reallife

Is prepaid rent an asset? Understanding the impact of changes brought by asc 842. Updated on january 31, 2024. Accounting for prepaid rent with journal.

ICYMI Accounting for Leases Under the New Standard, Part 2 The CPA

The company can make the journal entry for deferred rent by debiting the rent expense account and crediting the deferred rent account. This note focuses.

The Primary Objective Behind These Adjustments Is To Transition From Cash Transactions To The Accrual.

Deferred rent accounting occurs when a tenant is given free rent in one or more periods, usually at the beginning of a lease agreement. Web upon transitioning to asc 842, in addition to recording the amount calculated above, if the entity has a deferred rent balance, accrued rent balance or an. Understanding the impact of changes brought by asc 842. Edited by ashish kumar srivastav.

Web Prepaid Rent Journal Entries.

Total lease payments of $1,146,388 + $10,000 initial direct costs divided by 10 years. Web a common form of lease concession discussed by the staff in the q&a is a deferral of rent, which changes the timing, but not the amounts, of the rental payments. Under the previous accounting standard, asc 840, accounting for prepaid rent would look like the example below. Web deferred rent journal entries required year 1.

I Need To Record The Adjusting Journal Enteried For December 31St 2022.

The company can make the journal entry for deferred rent by debiting the rent expense account and crediting the deferred rent account. Accounting for accrued rent with journal entries. Dig into a discussion on the changes in how. In this case, the cash account is replaced with a bank account.

Updated On January 31, 2024.

“deferred” means “postponed into the future.” in this case you have purchased something in “bulk” that will last you longer than one. Total lease how of $1,146,388 + $10,000 initial direct charge divided by 10 years. Web here is a basic example with the journal entries necessary to account for an existing deferred rent liability transitioning from asc 840 to asc 842. The deferred rent account is a liability account on the balance sheet in which its normal balance is on the credit side.