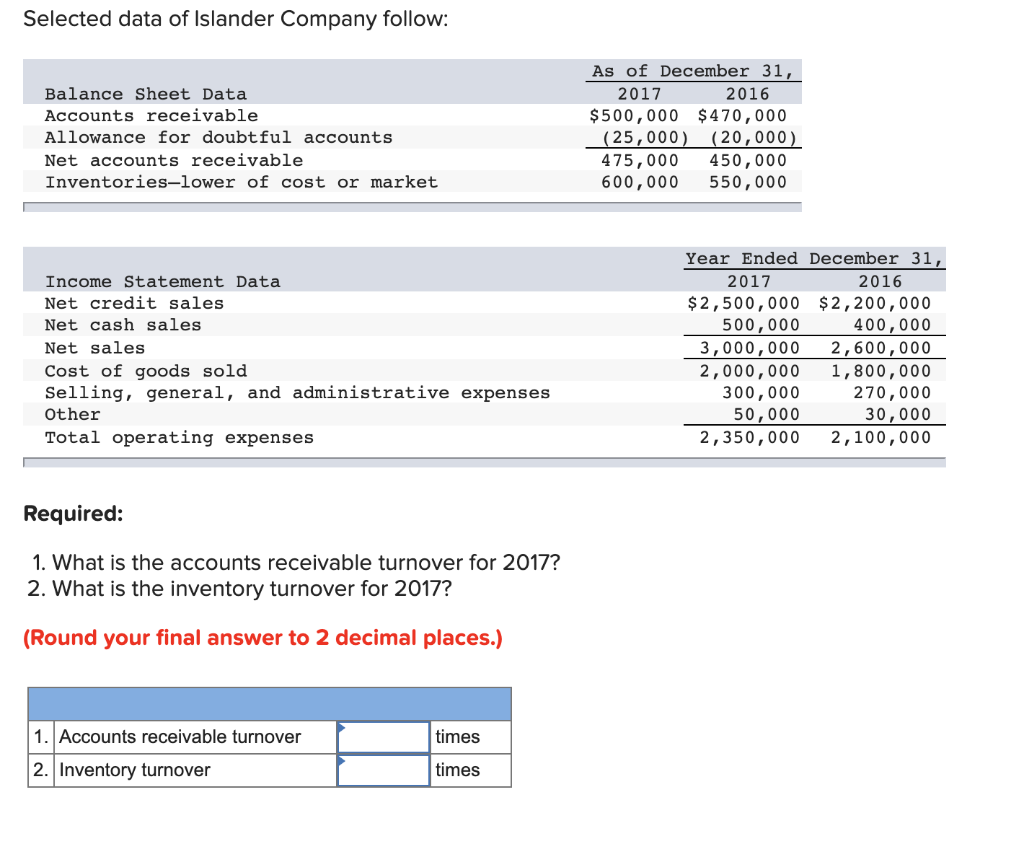

Cost Of Goods Journal Entry - When a company purchases identical. ‘cash’ is a real a/c; ‘sales’ is a nominal a/c; Any expense incurred that (1) is. Web the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. Trump was charged with falsifying business records in the first degree. Knowing the cost of goods sold can help you calculate your. When each job and job order cost sheet have been completed, an entry is made to transfer the total cost. Web what is a journal entry for cost of goods sold? Next, let’s record the sale of.

[Solved] Develop journal entries and find out the cost of goods sold

Chatgpt plus users can also create their own custom gpts. When a company purchases identical. Knowing the cost of goods sold can help you calculate.

What is a Cost of Goods Sold Journal Entry?

Web this entry distributes the balance in the purchases account between the inventory that was sold (cost of goods sold) and the amount of inventory.

How to Record a Cost of Goods Sold Journal Entry insurance1health

Next, let’s record the sale of. This formula can be used to calculate how much it costs. Trump was charged with falsifying business records in.

The Journal Entry to Record Labor Costs Credits

Web cost of goods manufactured (cogm) is a term used in managerial accounting that refers to a schedule or statement that shows the total production.

Recording a Cost of Goods Sold Journal Entry

Instead, as the sporting good store’s accountants, we’ll just use t accounts to describe the entry: To record the cost of goods sold, we need.

How to Create a Journal Entry for Cost of Goods Sold in QuickBooks

Introduction to inventory and cost of goods sold, inventory is reported at cost, periodic vs perpetual inventory systems. Web cost of goods manufactured (cogm) is.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Trump was charged with falsifying business records in the first degree. When each job and job order cost sheet have been completed, an entry is.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Web this entry distributes the balance in the purchases account between the inventory that was sold (cost of goods sold) and the amount of inventory.

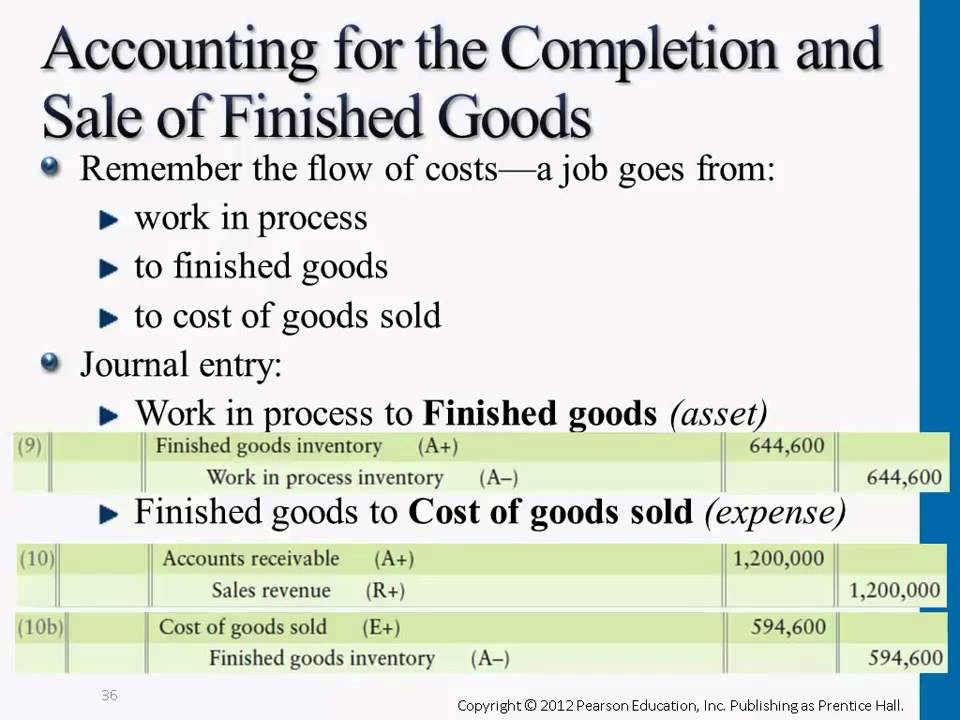

Completion of Sale & Finished Goods Journal Entries YouTube

‘sales’ is a nominal a/c; Web a cost of goods sold journal entry is used to reduce the cost of inventory by the amount of.

Web Cost Of Goods Sold, Commonly Referred To As Cogs, Is The Sum Of Costs Directly Associated With Producing The Goods Sold.

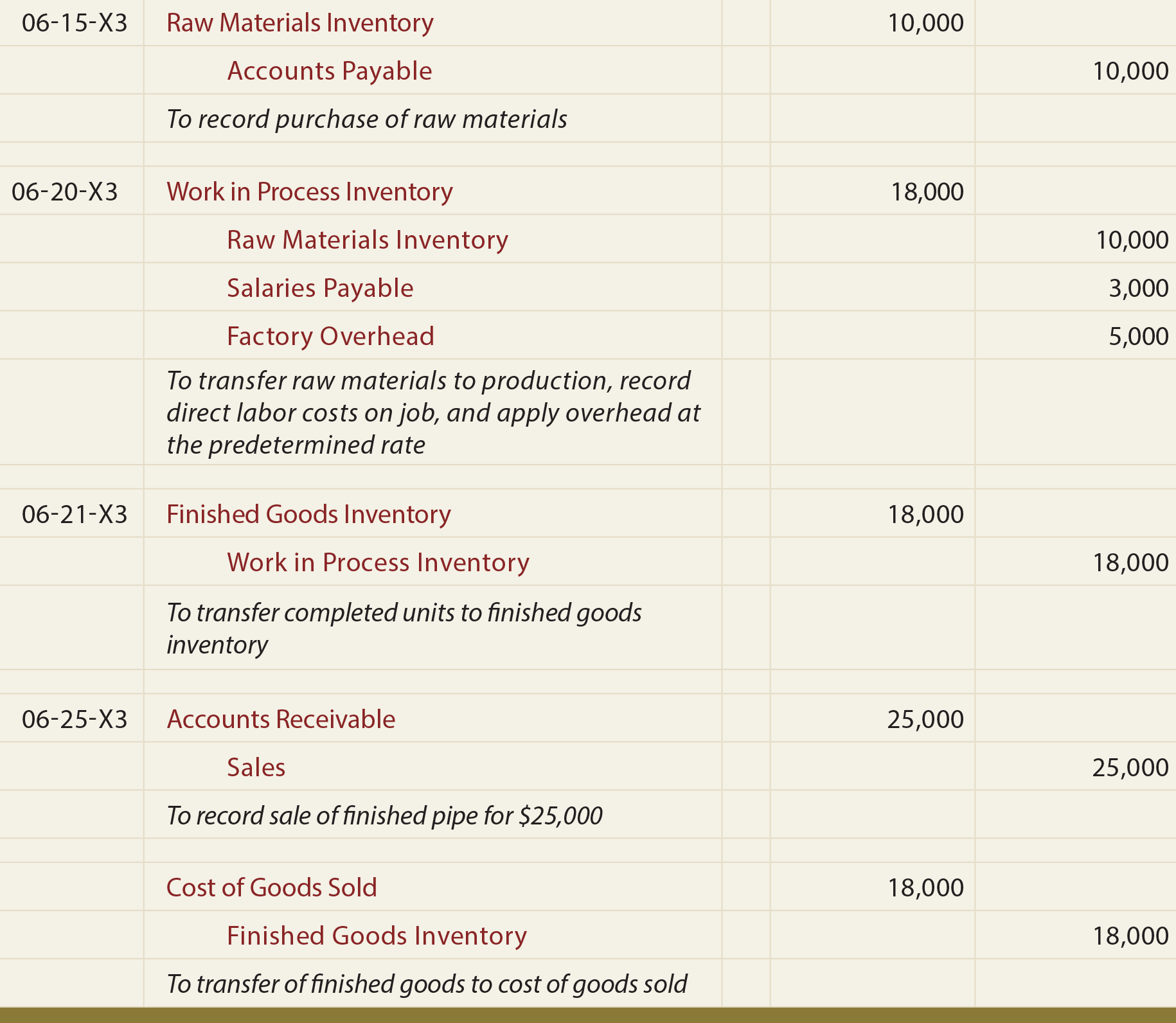

Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue. To record the cost of goods sold, we need to find its value before we process a journal entry. Web we won’t write the journal entry for this transaction. Web journal entry to move work in process costs into finished goods.

With The Information In The Example, We Can Calculate The.

Web the 34 felony counts in trump’s hush money trial. Web the cost of goods sold sometimes abbreviated to cogs or referred to as cost of sales, is the costs associated with producing the goods which have been sold. Chatgpt plus users can also create their own custom gpts. Web explore the gpt store and see what others have made.

Instead, As The Sporting Good Store’s Accountants, We’ll Just Use T Accounts To Describe The Entry:

It is important to realize that this system requires regular. Web the cost of goods sold formula is: These are the basic journal entries that would be made under the periodic inventory system. Introduction to inventory and cost of goods sold, inventory is reported at cost, periodic vs perpetual inventory systems.

When Each Job And Job Order Cost Sheet Have Been Completed, An Entry Is Made To Transfer The Total Cost.

Knowing the cost of goods sold can help you calculate your. ‘sales’ is a nominal a/c; Web the recorded values on the core financial statements (e.g., the income statement, balance sheet, and cash flow statement ), including the supporting footnotes. When a company purchases identical.