Cash Over Short Journal Entry - Explanation creating a petty cash fund making disbursements from the fund petty cash journal entries petty cash faqs. Web debit your cash short and over account in your journal entry by the amount of cash short. How to account for credit card sales. Accounting made easy, for free! Think of this as losing money on the ground. Web cash over and short: Web how to figure shorts & over entries in accounting. To record a cash short journal entry, you will need two accounts—a “cash over/short account” and a “cash account.” the cash over/short account will be used to register any excess or deficiency in actual cash versus what was expected in your accounts. Web journal entry to record cash shortage. Web in this article, we cover how to account for the cash short and over;

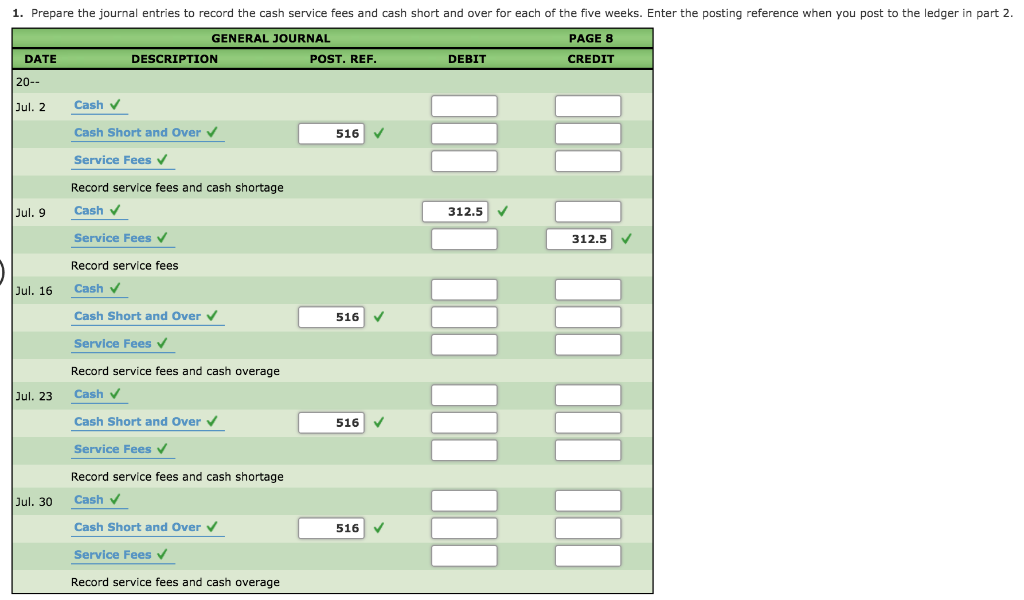

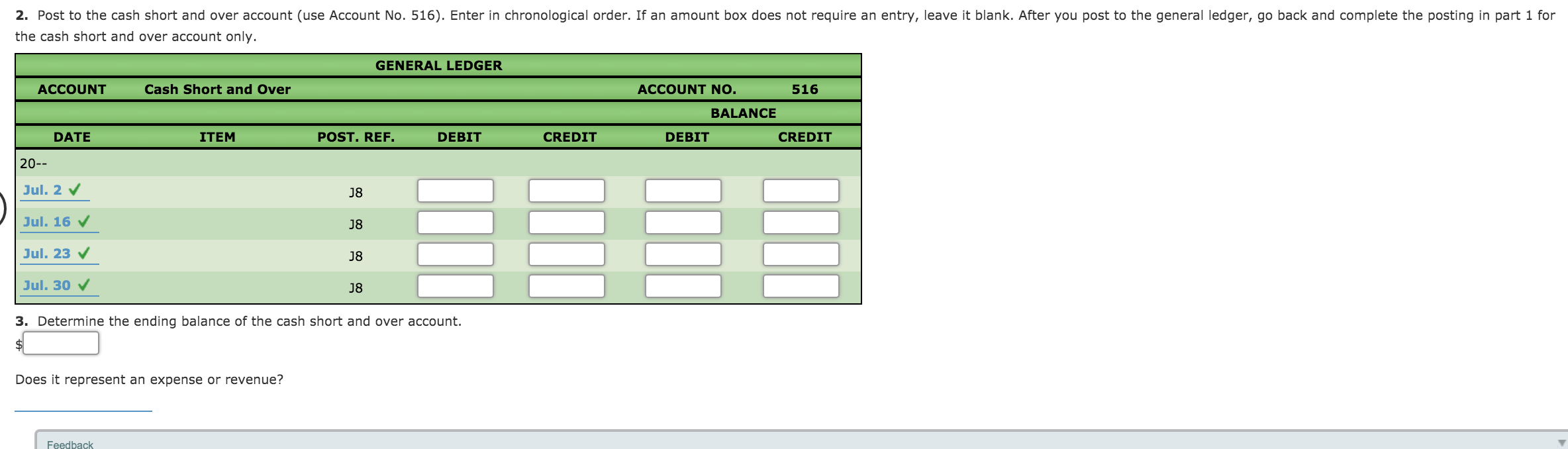

Cash Short and Over Entries Listed below are the weekly cash...ask 1

Tracking cash over and short is an important piece of protecting a company’s most valuable asset, cash. Web when the company has the cash overage.

Cash Over Journal Entry Double Entry Bookkeeping

Cash includes coin, paper money, checks, and money orders. Web the cash over and short account is an account that keeps a record of any.

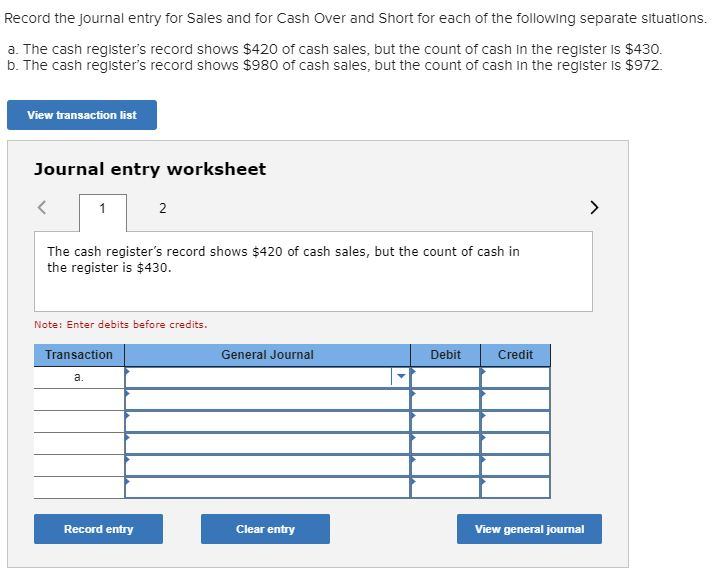

Solved Record the journal entry for Sales and for Cash Over

If a company has more cash on hand than. Cash is the asset most likely to be stolen or used improperly in a business. To.

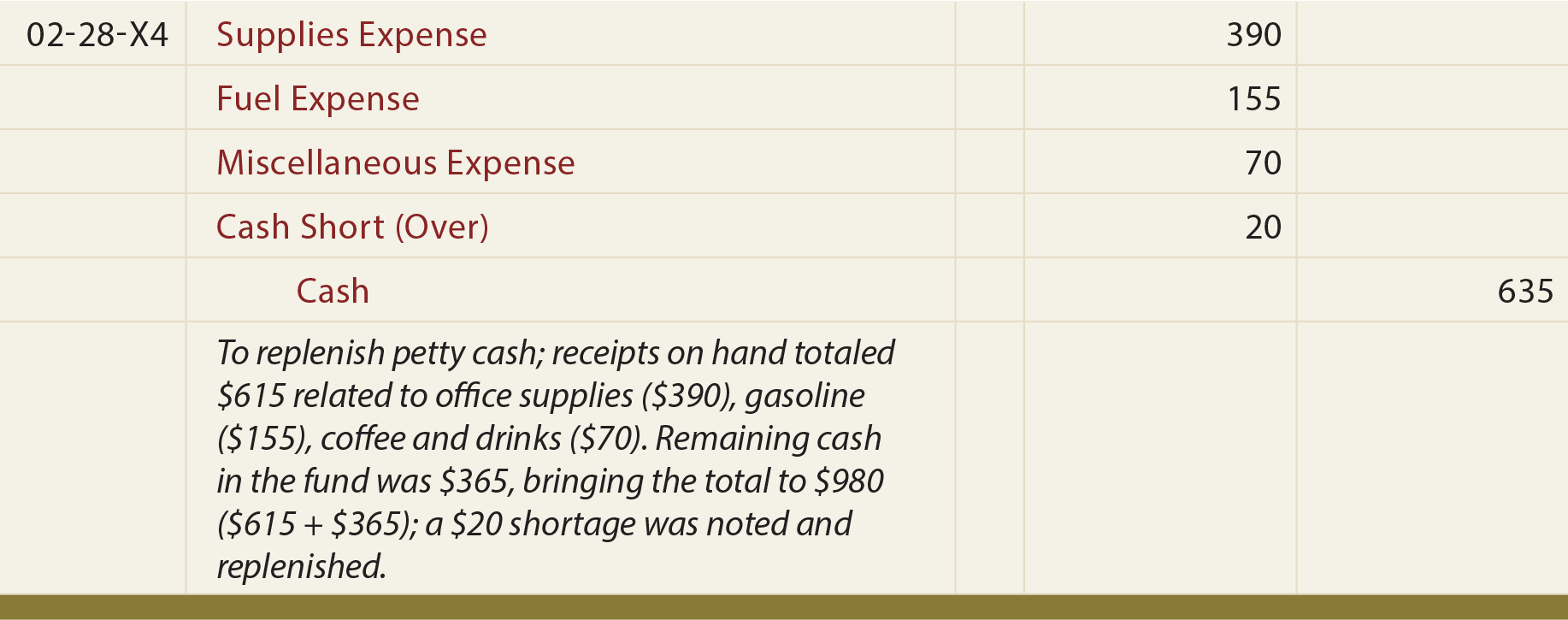

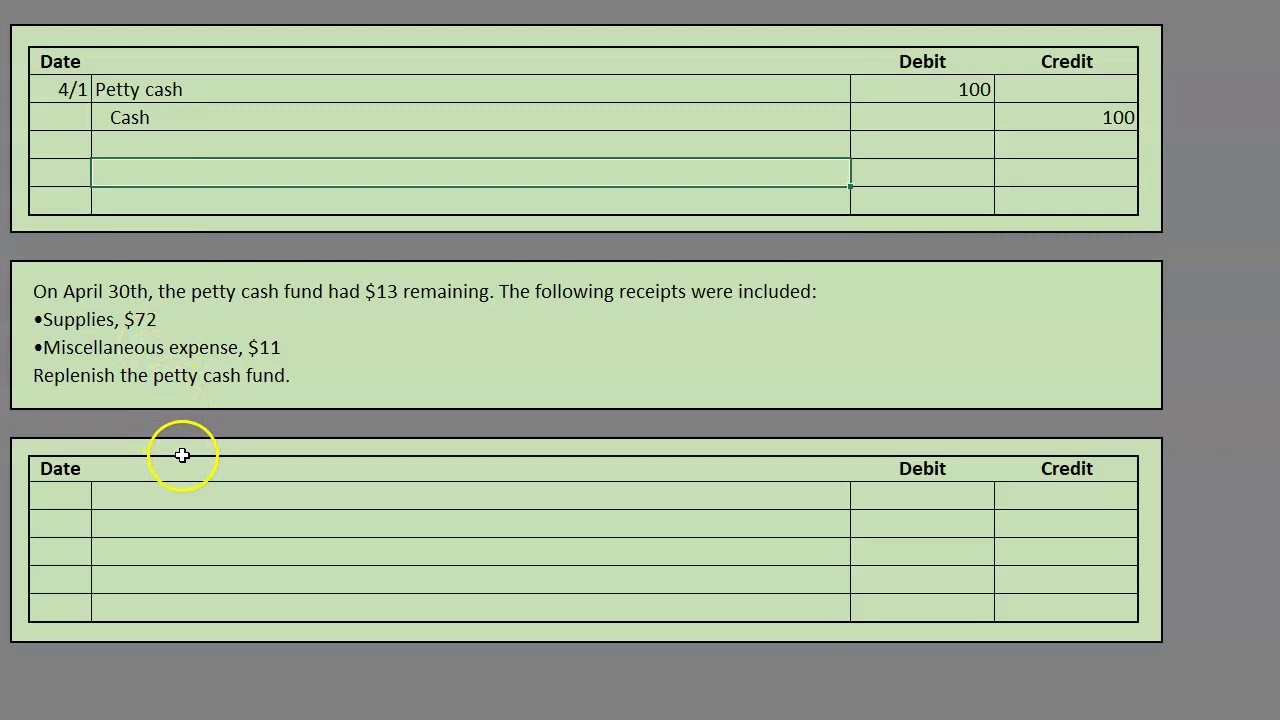

Petty Cash

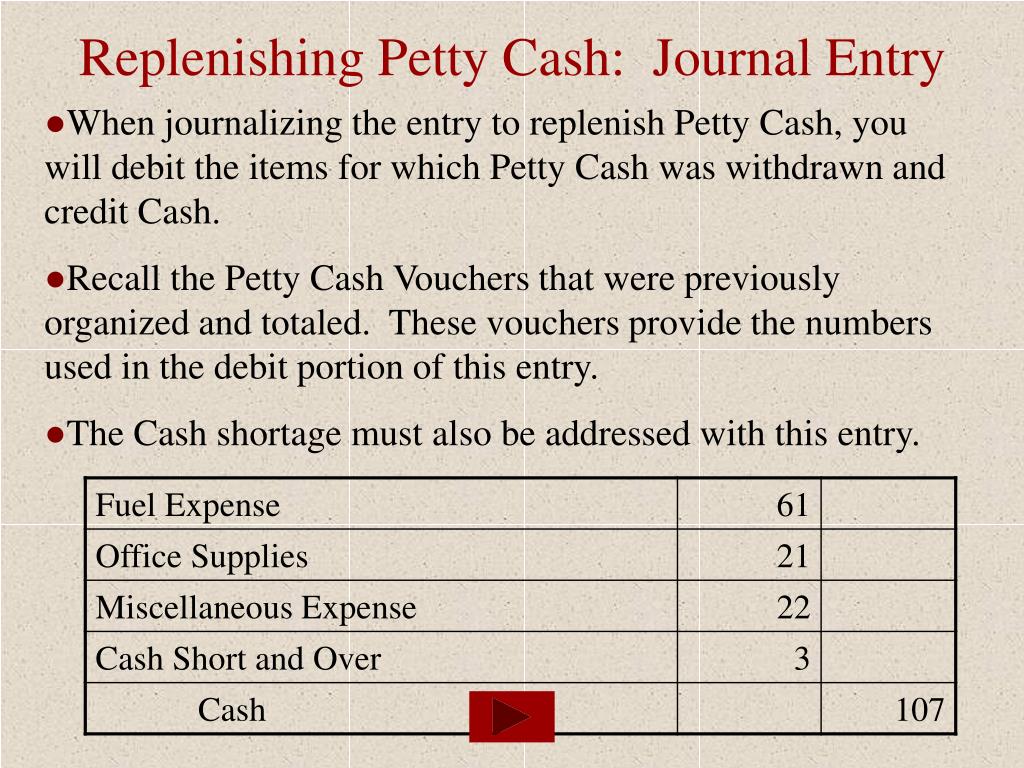

Journal entry for removing money from the petty cash fund. Cash is the asset most likely to be stolen or used improperly in a business..

Petty Cash Journal Entries YouTube

Web in this article, we cover how to account for the cash short and over; This is due to the cash remaining and. Cash short.

Cash Short and Over Entries Listed below are the weekly cash...ask 1

To record a cash short journal entry, you will need two accounts—a “cash over/short account” and a “cash account.” the cash over/short account will be.

Financial Accounting Chapter 7 Cash Short & Over / Petty Cash YouTube

If a company has more cash on hand than. When petty cash is used for business expenses, the appropriate expense account — such as office.

PPT Chapter 07 PowerPoint Presentation, free download ID303914

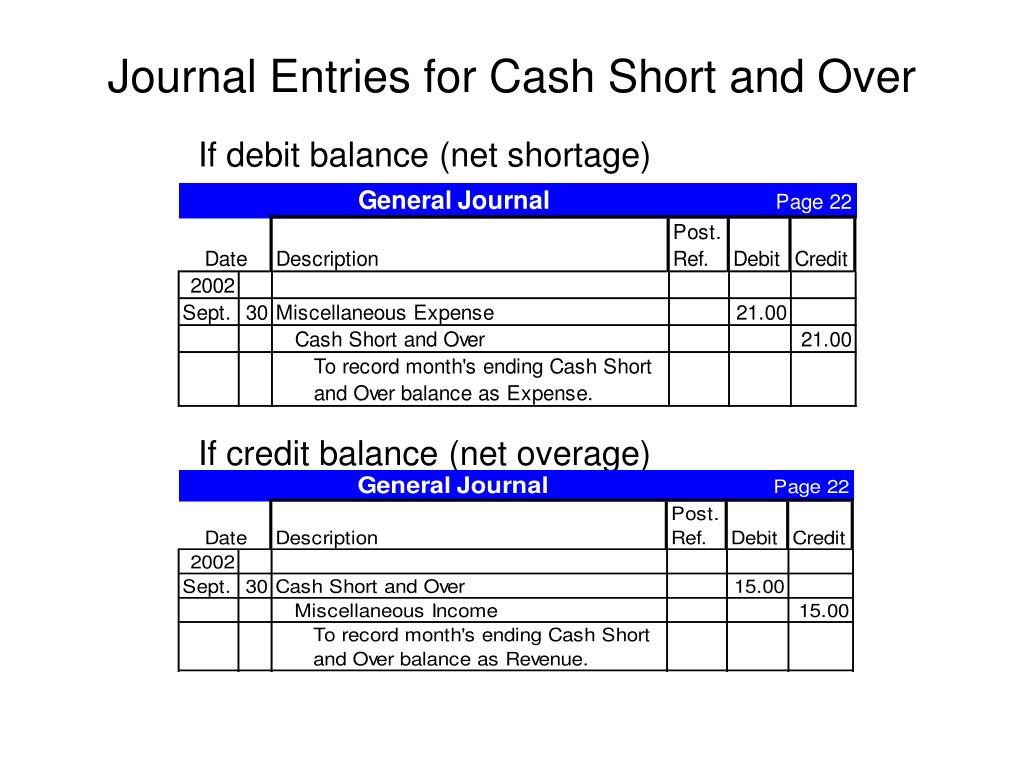

Web cash over journal entry. Cash over and short acts as an expense account when there is an shortage. Knowing what to debit and what.

PPT Accounting for Petty Cash and Cash Short and Over PowerPoint

Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event..

(This Is The Amount Of The Company Check That Will Be Cashed To Get The Cash In The Petty Cash Fund Back To The Imprest General Ledger Amount Of $100.)

Web recording the cash short journal entry. Money on deposit with a bank and other financial institutions that are available for withdrawal is also considered cash. Accounting made easy, for free! The opposite is true about transactions that produce cash shortages.

Web What Is The Cash Over And Short Account?

Web cash over and short: Web how to figure shorts & over entries in accounting. Cash over and short refers to circumstances where there is a shortage or overage of cash due to making incorrect changes. To record a cash short journal entry, you will need two accounts—a “cash over/short account” and a “cash account.” the cash over/short account will be used to register any excess or deficiency in actual cash versus what was expected in your accounts.

Web Making Accounting Journal Entries For Cash Are Fundamental For A Business.

Cash includes coin, paper money, checks, and money orders. If a cashier or bank teller errs by giving too much or too little change, for example, then the business will have a “cash short” or “cash over” position at the end of the day. Think of this as losing money on the ground. Knowing what to debit and what to credit are key in this process.

Posted On May 31, 2021July 6, 2023 By Jaszac.

The journal entry on the balance sheet should list a debit to the business bank account and a credit to the petty cash account. What is cash over and short? Cash over and short acts as an expense account when there is an shortage. Web debit your cash short and over account in your journal entry by the amount of cash short.