Adjusting Journal Entries Quickbooks - Viewing journal entries in quickbooks online is relatively straightforward. If needed, make adjusting journal entries to correct any errors found. Web adjust journal entries: Quickbooks provides a powerful search feature that allows users to locate specific journal entries by entering relevant keywords, dates, or. Find and select the journal entry you need to edit: This time sillycat50 asks about adjusting journal entries in quickbooks online.if you are looking for. Web using the search feature. Accountants usually use adjusting journal entries to fix minor. Some common types of adjusting journal entries are. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred.

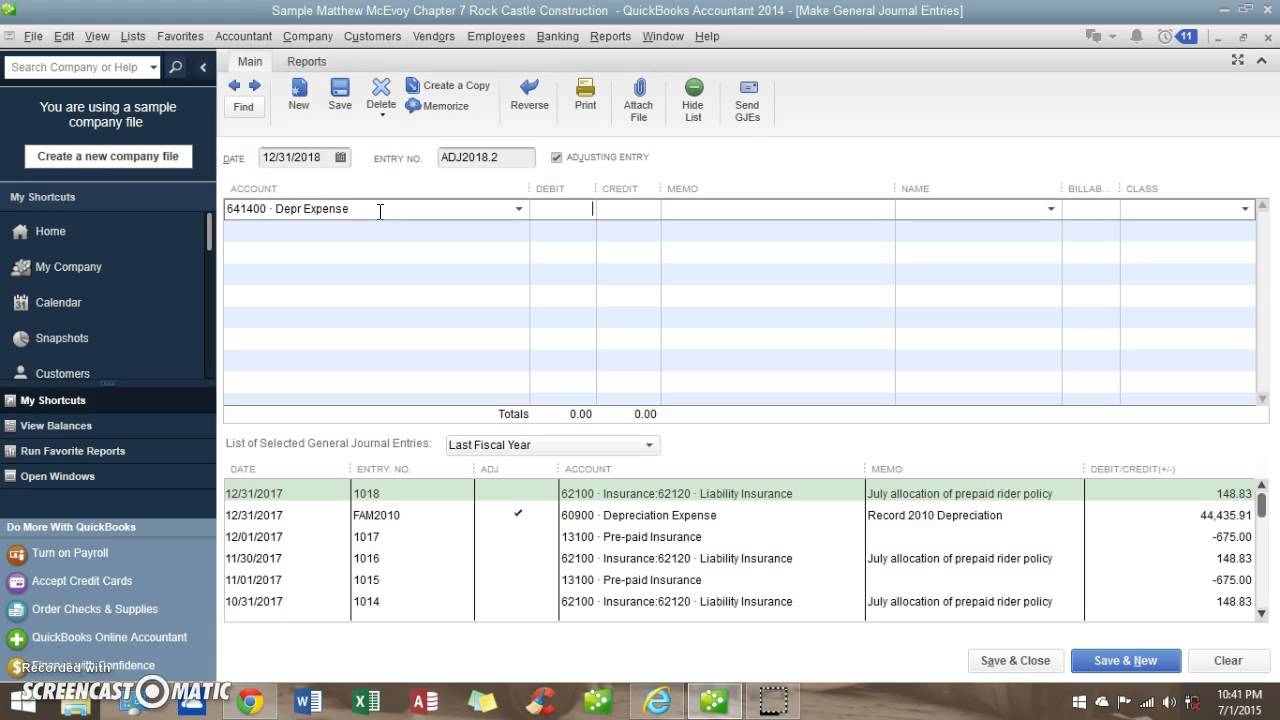

How To Use QuickBooks How to do Adjusting Entries YouTube

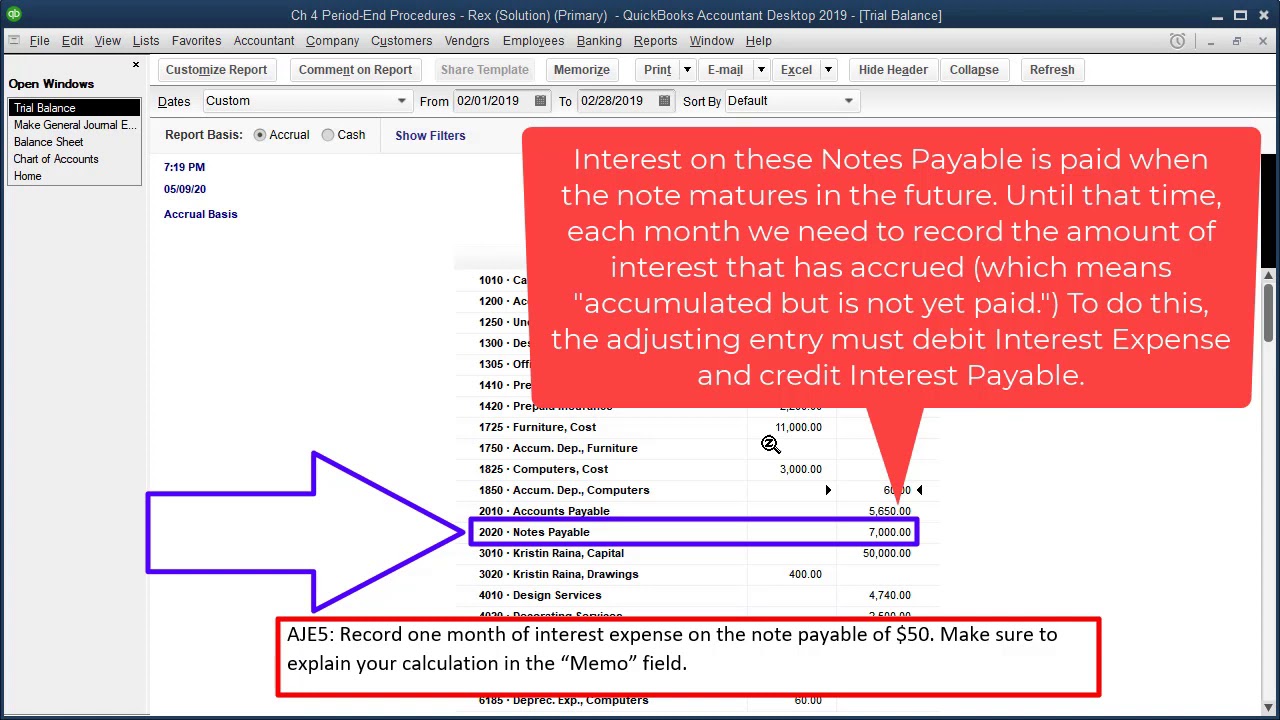

An adjusting journal entry is a financial record you can use to track unrecorded transactions. To initiate the process of making adjusting journal entries in.

How to enter adjusting journal entries in QuickBooks Desktop Scribe

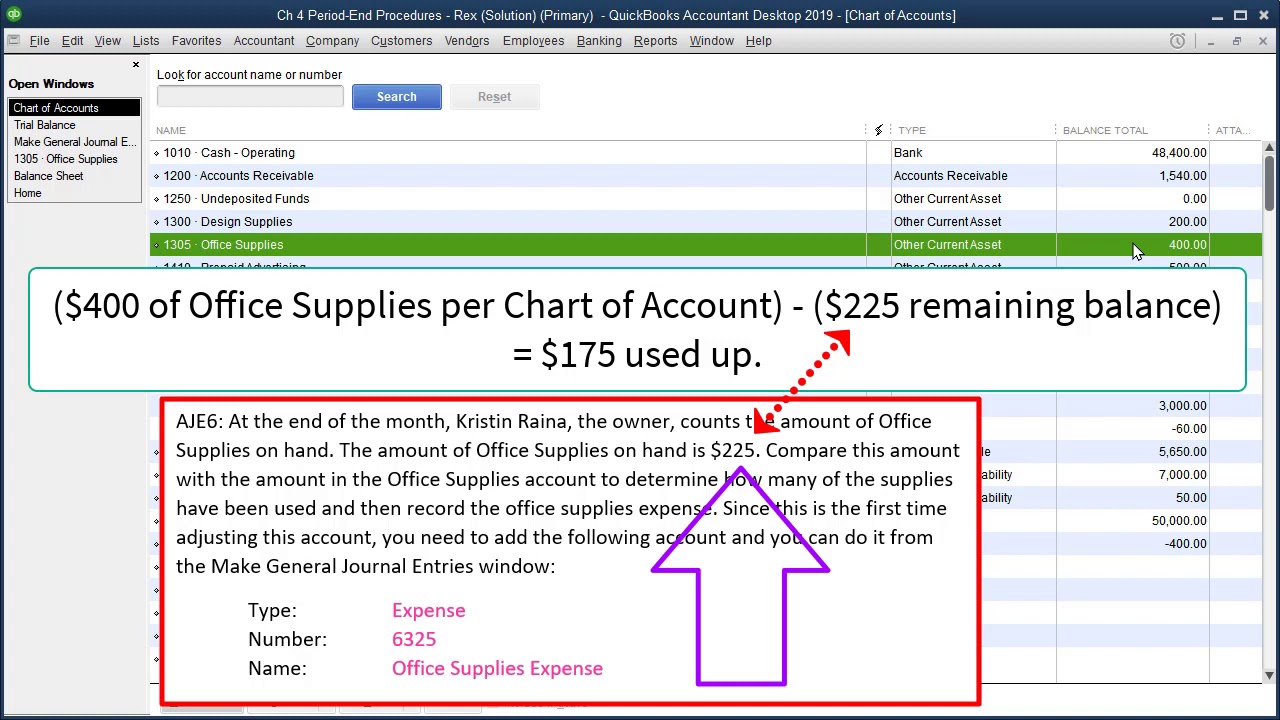

As a small business owner, you will want to ensure that all of your original. Some common types of adjusting journal entries are. Web adjusting.

Creating a Journal Entry in Quickbooks Online

Input the current date and assign a number to the entry. An adjusting journal entry is a financial record you can use to track unrecorded.

Recording Adjusting Journal Entries for Prepaid Assets in QuickBooks

Web with the proper adjusting journal entries, you can stop the landslide before it starts. Web using the search feature. Web join lynda & matthew.

How To Make Adjusting Journal Entries In Quickbooks Online Putnam Chasity

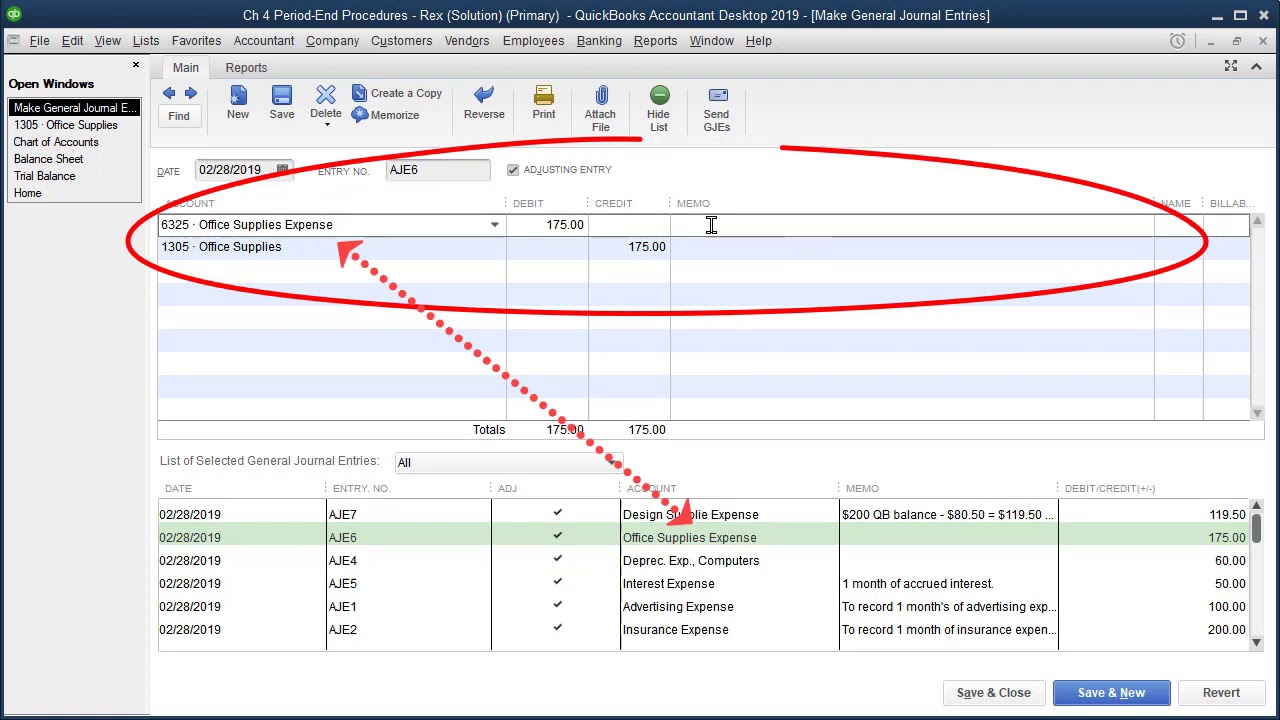

Journal entries affect at least two accounts, with the total debits matching the total credits. 4.6k views 5 years ago quickbooks pro 2020, 2019 &.

Correcting a QuickBooks Adjusting Journal Entry YouTube

Web go to the company menu and select make general journal entries. Journal entries affect at least two accounts, with the total debits matching the.

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube

Viewing journal entries in quickbooks online is relatively straightforward. Journal entries affect at least two accounts, with the total debits matching the total credits. You.

QuickBooks Adjusting Journal Entry 5 Interest Expense YouTube

Debit the payroll liability account for the. Web an adjusting journal entry is a type of journal entry that adjusts an account's total balance. As.

QuickBooks Adjusting Journal Entry 6 Office Supplies YouTube

In addition, you can easily adjust the parameters of your report to find specific entries. Debit the payroll liability account for the. Web navigate to.

Debit The Payroll Liability Account For The.

Accountants usually use adjusting journal entries to fix minor. Learn how to use journal entries to make small adjustments to your client’s books. Web an adjusting journal entry is a type of journal entry that adjusts an account's total balance. Web join lynda & matthew for another qb community question.

Viewing Journal Entries In Quickbooks Online Is Relatively Straightforward.

Ensure these entries are properly documented and justified. Web adjust journal entries: If you want to learn more about. Since you can only use this option if you have.

Web Go To The Company Menu And Select Make General Journal Entries.

Find and select the journal entry you need to edit: To initiate the process of making adjusting journal entries in quickbooks online, users need to access the dedicated. Web either business or accountant view/mode, the option to create an adjusting journal entry (je) is unavailable in quickbooks online plus. An adjusting journal entry is a financial record you can use to track unrecorded transactions.

Access The Adjusting Journal Entries Feature.

If needed, make adjusting journal entries to correct any errors found. Web using the search feature. Journal entries affect at least two accounts, with the total debits matching the total credits. As a small business owner, you will want to ensure that all of your original.