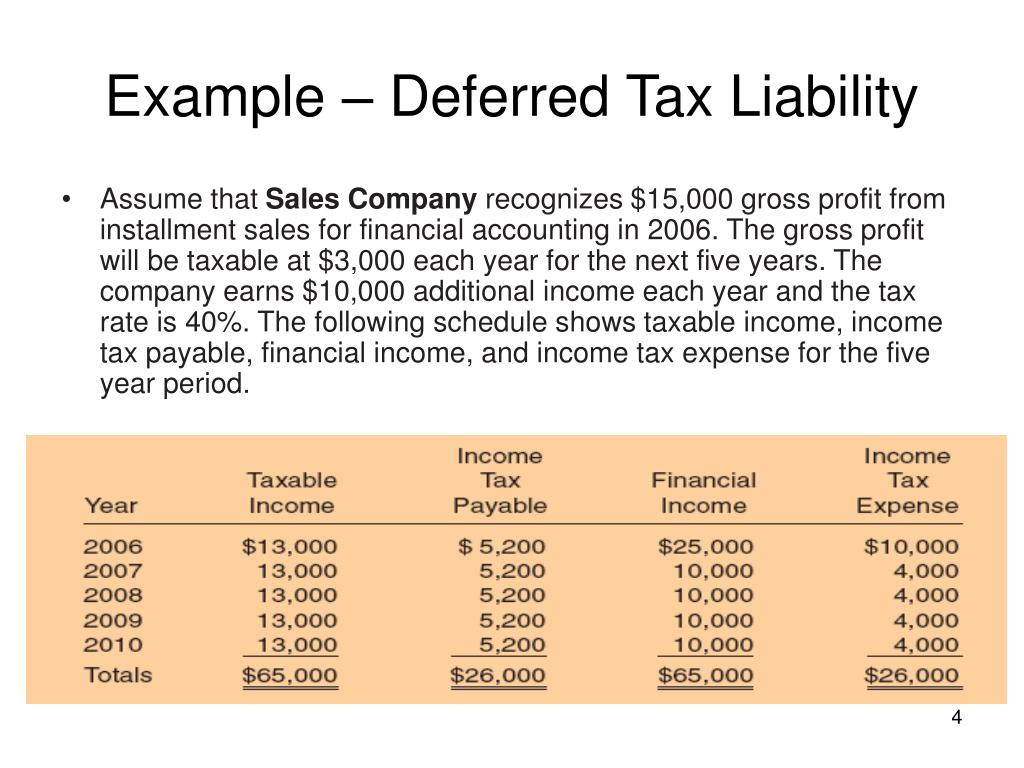

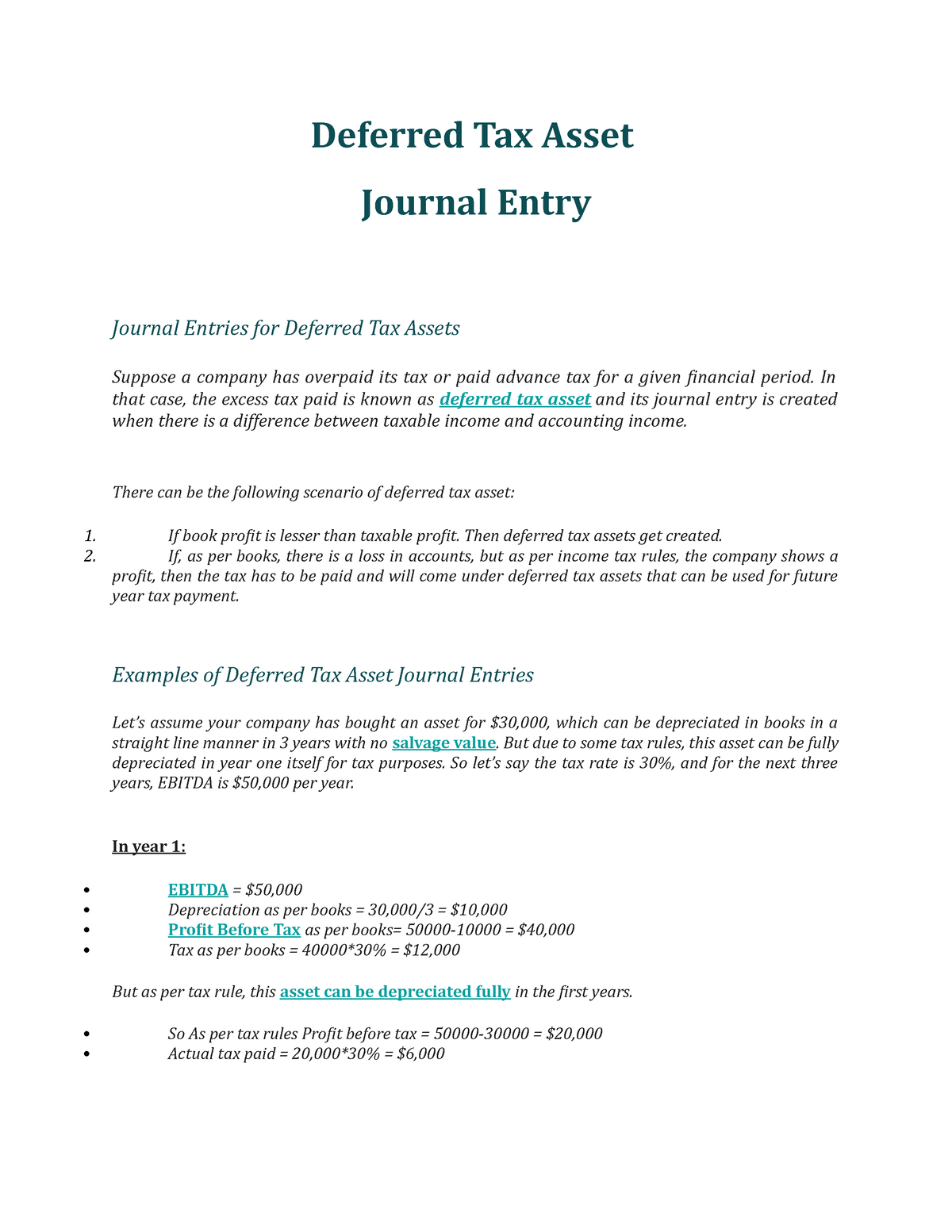

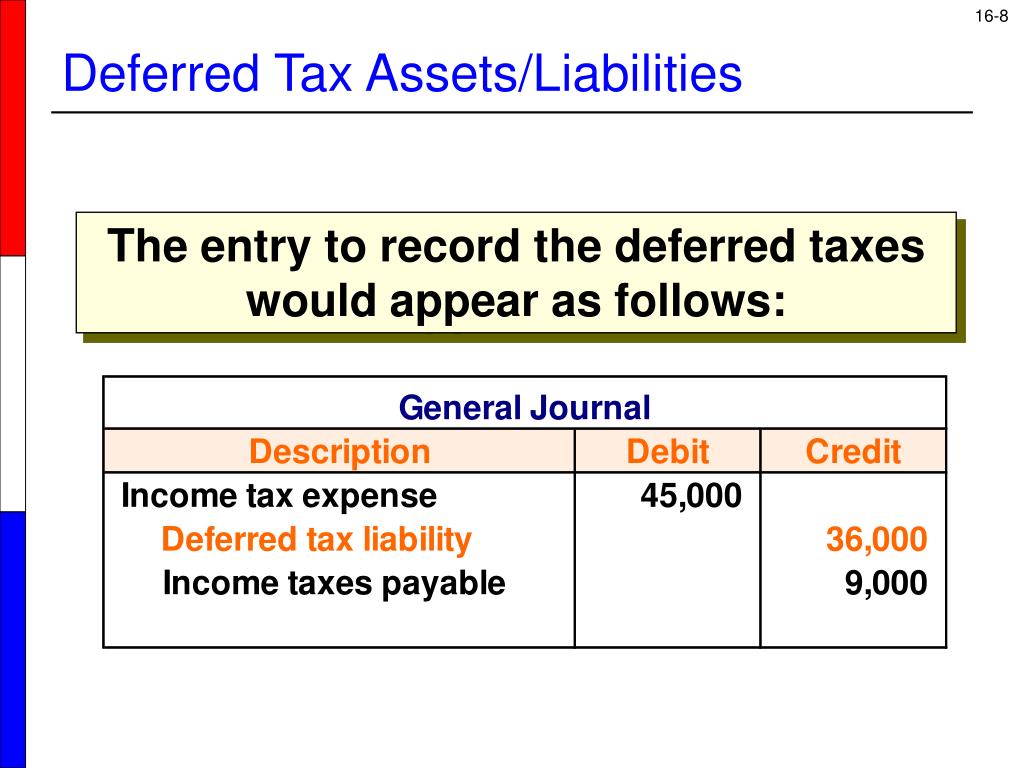

Journal Entry Deferred Tax Liability - What is deferred tax asset and deferred tax liability ( dta & dtl )? A deferred tax liability is when financial income is greater than taxable income,. Web the tax rate is 25%. Web journal entries for deferred tax assets. We have to create deferred tax liability a/c or deferred tax asset a/c by debiting or crediting profit & loss a/c respectively. Web the following journal entry shows the recognition of second year income tax: In that case, the excess tax paid is known as deferred tax asset and its journal entry is created when there is a difference between. Income tax expense will reduce the company profit on income statement. Depreciation expenses—like the annual devaluation of a fleet of company vehicles—can generate deferred tax liabilities. Income tax payable is the current obligation that company needs to pay to the tax.

Deferred Tax Liability Accounting Double Entry Bookkeeping

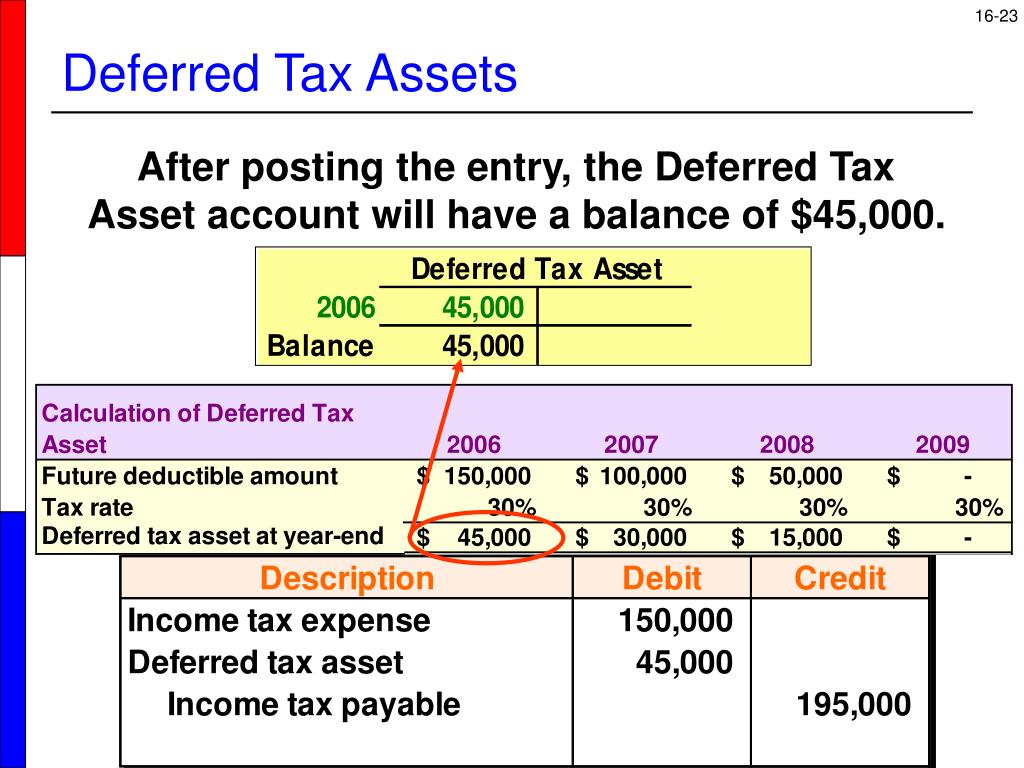

Deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the. However, to understand this.

PPT Accounting for Taxes PowerPoint Presentation, free

Deferred tax liability (dtl) or deferred tax asset (dta) forms an important part of financial statements. Web a deferred tax liability represents potential future tax.

PPT Accounting for Taxes PowerPoint Presentation, free

Web a deferred tax liability represents potential future tax obligations resulting from temporary differences that will likely lead to higher taxable income in the future..

PPT Deferred Tax Examples PowerPoint Presentation, free download ID

What is deferred tax asset and deferred tax liability ( dta & dtl )? Web the journal entry is debiting income tax expense and credit.

Deferred Tax Liabilities Meaning, Example, Causes and More

Temporary differences between book (gaap/ifrs) accounting rules and tax accounting rules give rise to deferred tax assets (dtas) and deferred tax liabilities (dtls). The deferred.

Deferred Tax Assets and Liabilities QuickBooks

By obaidullah jan, aca, cfa and last modified on may 29, 2018. What is deferred tax asset and deferred tax liability ( dta & dtl.

Deferred Tax Asset Deferred Tax Asset Journal Entry Journal Entries

Gaap) and tax accounting, where the actual amount of taxes paid to the irs were less than the amount reported on the income statement. Web.

PPT Accounting for Taxes PowerPoint Presentation, free

This dollar amount is entered as a credit to the deferred. Temporary differences between book (gaap/ifrs) accounting rules and tax accounting rules give rise to.

Deferred Tax Liabilities Explained With Reallife

The carrying amount of a liability is less than its tax base. Web the following journal entry shows the recognition of second year income tax:.

Deferred Tax Is Accounted For In.

A temporary difference occurs when there is a temporary timing difference regarding the. Income tax payable is the current obligation that company needs to pay to the tax. Deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the. Depreciation expenses—like the annual devaluation of a fleet of company vehicles—can generate deferred tax liabilities.

Web The Tax Rate Is 25%.

Web a deferred tax liability is a listing on a company's balance sheet that records taxes that are owed but are not due to be paid until a future date. The carrying amount of an asset exceeds its tax base, or. The income tax payable account has a balance of 1,850 representing the current tax payable to the tax authorities. We have to create deferred tax liability a/c or deferred tax asset a/c by debiting or crediting profit & loss a/c respectively.

The Carrying Amount Of A Liability Is Less Than Its Tax Base.

Web what is the journal entry to record a deferred tax liability? Web a deferred tax often represents the mathematical difference between the book carrying value (i.e., an amount recorded in the accounting balance sheet for an asset or liability) and a corresponding tax basis (determined under the tax laws of that jurisdiction) in the asset. This dollar amount is entered as a credit to the deferred. [1] profit & loss a/c dr.

Company Z Should Record The Following Journal Entries In Acquisition Accounting:

This article will consider the aspects of deferred tax that are relevant to fr. Web journal entries for deferred tax assets. Web ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences. Web the book entries of deferred tax is very simple.