Capitalization Journal Entry - Capitalized payments create an asset on your balance sheet, while expensed payments reduce the net income on your income statement. What are capitalized software costs? The journal entry for the transfer of the cwip account will be: For example, when you purchase office supplies, you can expect you will use those supplies in the near future. Therefore, when liam purchases the machine, they will record it as an asset on the financial statements (see journal entry in figure 4.8). Web eric gerard ruiz, cpa. The impairment may apply to one asset or a group of assets. The interest cost is then given by the following formula. This type of journal entry is important. Below is an impairment journal entry when the loss is $50,000.

Accounting for Leases Under the New Standard, Part 1 The CPA Journal

What are capitalized software costs? This is most often but is not limited to sales commissions. This approach is used when a cost is not.

Journal Entry Class 11 CA Foundation Concept Building

The interest cost is then given by the following formula. Discover the benefits of asset capitalization and learn how to optimize your business's finances! Web.

Adjusting Journal Entries Defined Accounting Play

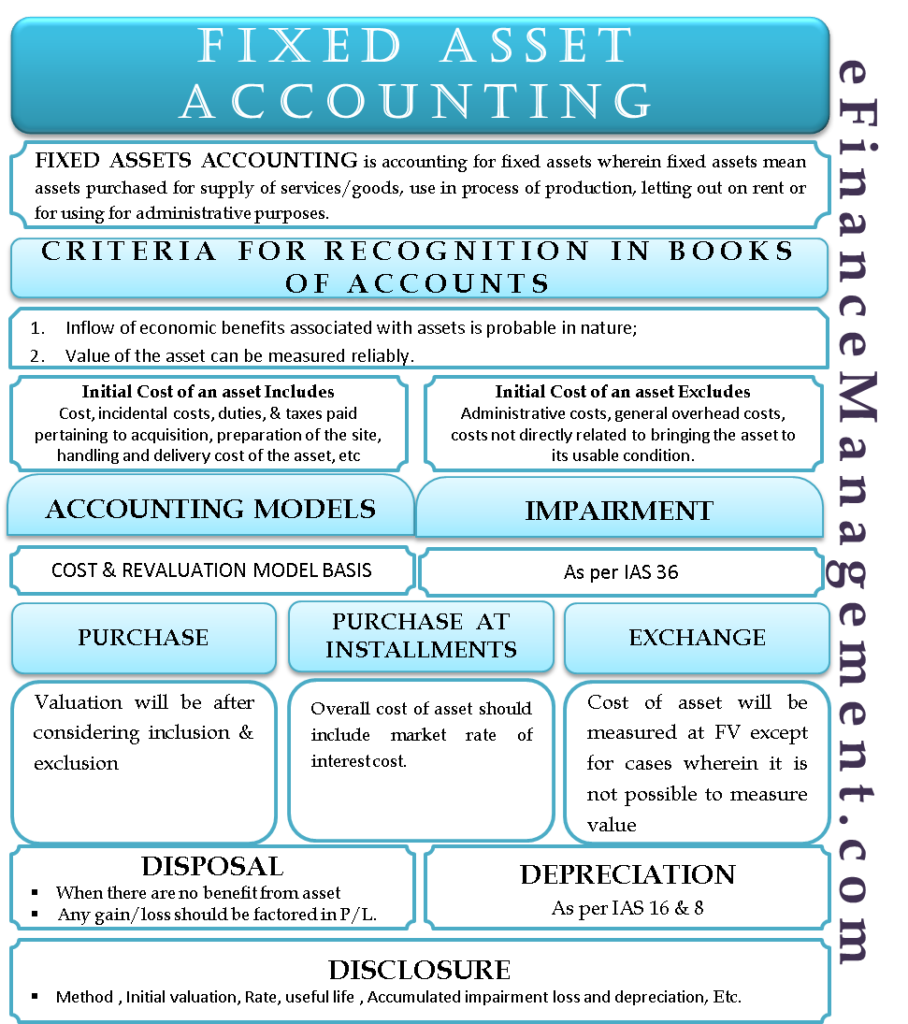

Web when fixed assets undergo a significant change in circumstance that may reduce their gross future cash flow to an amount below their carrying value,.

Capitalizing Versus Expensing Costs Learn accounting, Bookkeeping

Web journal entry of an asset capitalization records the acquisition of the asset on the balance sheet, debiting the fixed asset account, and crediting either.

Fixed Asset Accounting Examples, Journal Entries, Dep., Disclosure

On the second line, record the. Capitalization is the recordation of a cost as an asset, rather than an expense. Therefore, removing the cwip account.

according to the trial balance what is the working capital cash 10 000

Capitalized payments create an asset on your balance sheet, while expensed payments reduce the net income on your income statement. It reflects the amount that.

Capitalization Anchor Chart Great for Interactive Writing Journal

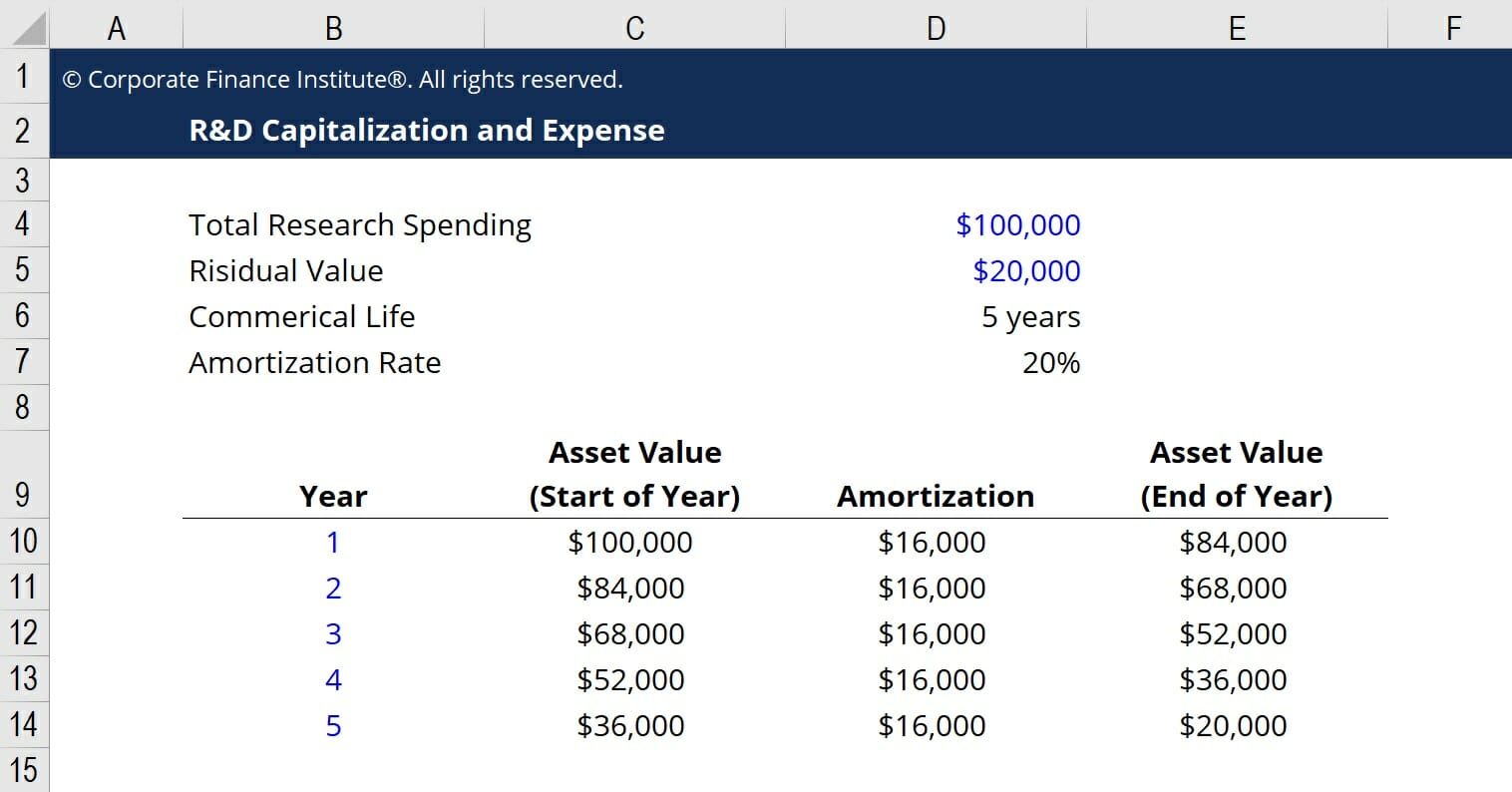

The amount of expenditure on the asset will vary over the accounting period. Revenue recognition under asc 606 requires the capitalization of costs to complete.

Accounting for Share Capital Accountancy Knowledge

Web the journal entry for the same would be: This type of journal entry is important. Web this section includes addition and capitalization journal entry.

R&D Capitalization vs Expense How to Capitalize R&D

Web how to book capitalization and amortization for costs to obtain a contract journal entry. Capitalization period begins when all the conditions are met and.

The Journal Entry For The Transfer Of The Cwip Account Will Be:

Therefore, when liam purchases the machine, they will record it as an asset on the financial statements (see journal entry in figure 4.8). In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. Current and prior period addition. Capitalization is the recordation of a cost as an asset, rather than an expense.

Discover The Benefits Of Asset Capitalization And Learn How To Optimize Your Business's Finances!

After the completion of construction, we credit the cwip account and debit the fixed assets account. This is most often but is not limited to sales commissions. Below is an impairment journal entry when the loss is $50,000. The interest cost is then given by the following formula.

The Amount Of Expenditure On The Asset Will Vary Over The Accounting Period.

Web how to book capitalization and amortization for costs to obtain a contract journal entry. Capitalized payments create an asset on your balance sheet, while expensed payments reduce the net income on your income statement. What are capitalized software costs? Web last updated january 24, 2023.

Web Journal Entry Of An Asset Capitalization Records The Acquisition Of The Asset On The Balance Sheet, Debiting The Fixed Asset Account, And Crediting Either Cash Or Accounts Payable.

For manual additions, oracle assets gets the clearing account from the category. On the second line, record the. Web when fixed assets undergo a significant change in circumstance that may reduce their gross future cash flow to an amount below their carrying value, apply an impairment test. Capitalization period begins when all the conditions are met and ceases when the asset is ready.