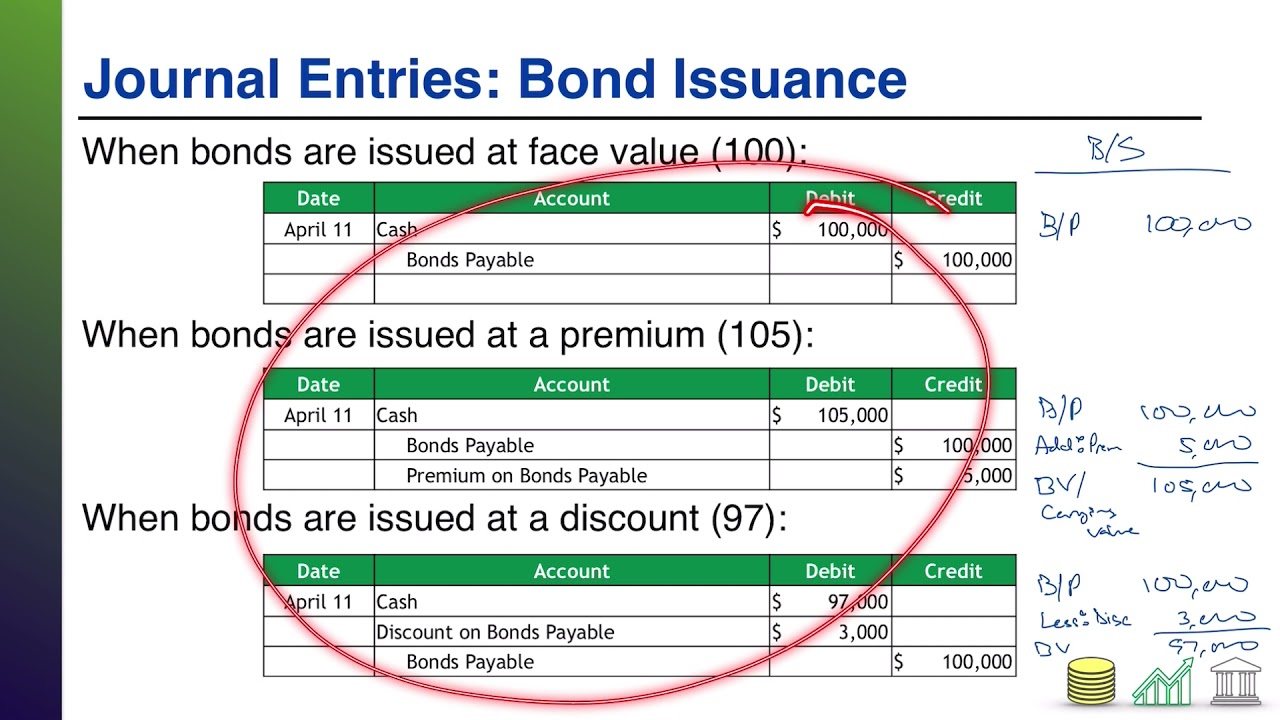

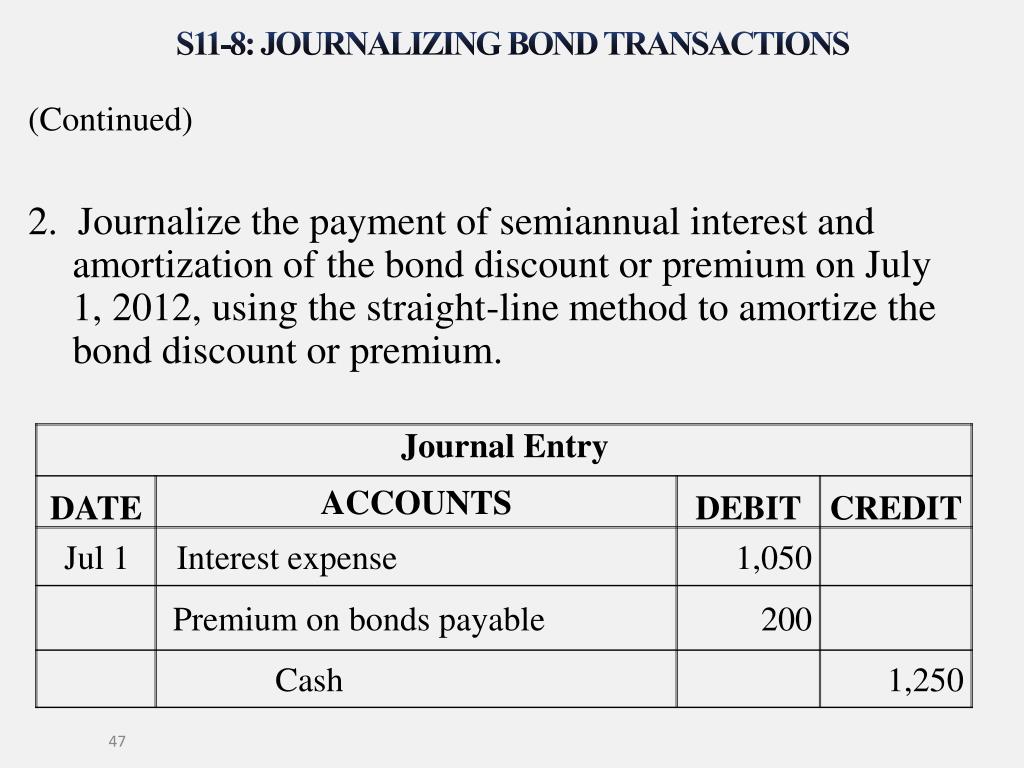

Journal Entry For Premium On Bonds Payable - Web the journal entry is: Web the journal entry for bond issued at par is as follow: 875 ($5,250 premium / 6 interest payments) jun 30 checking account: Total bond liability equals $10 million i.e. Bond issue at par value. Web in this section, we will explore the journal entries related to bonds. The product of 10,000 number of bond. 6,000 ($100,000 x 12% × 6 months / 12 months) jun 30: If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a. Cash account → debit by $1 million.

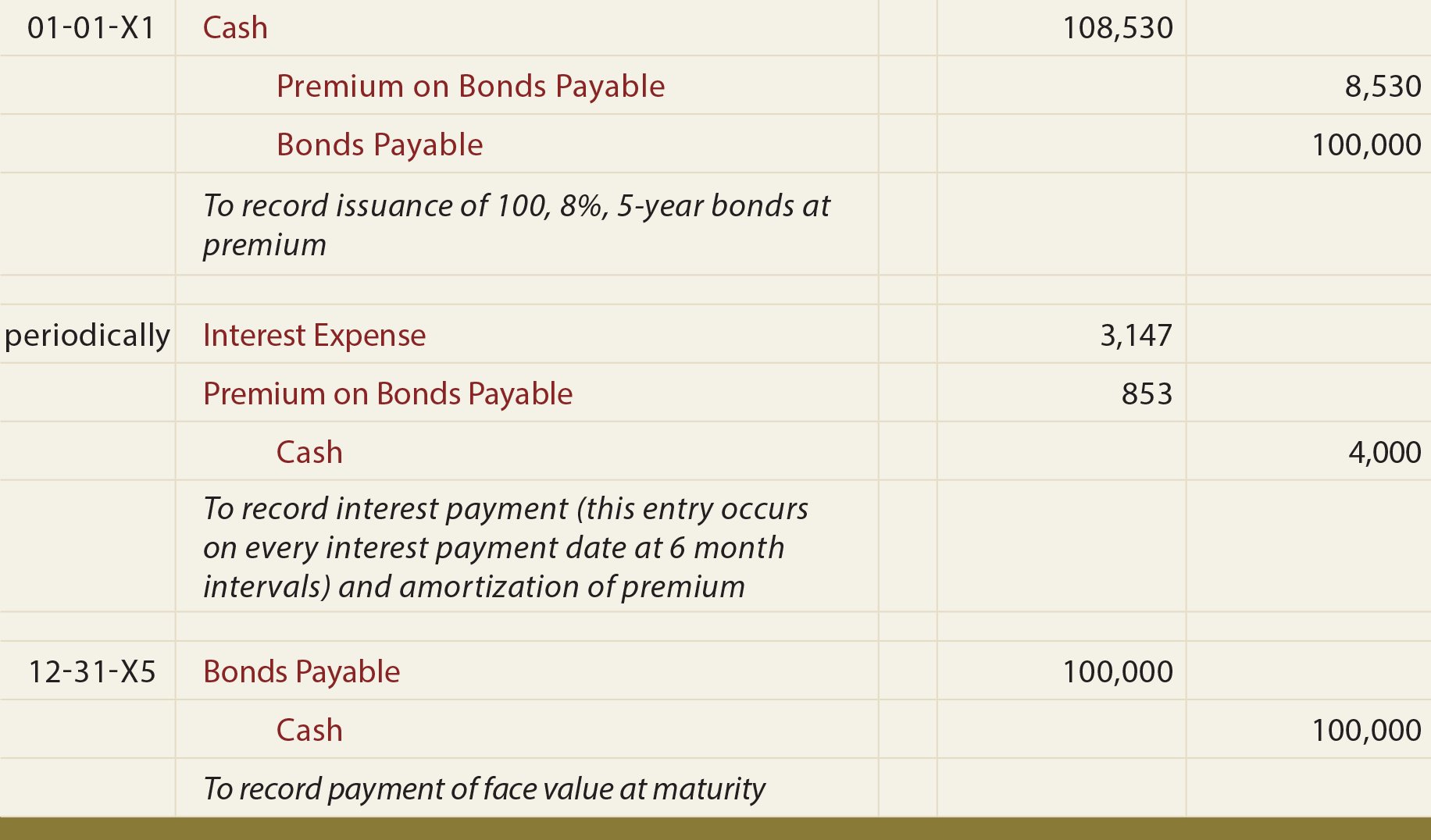

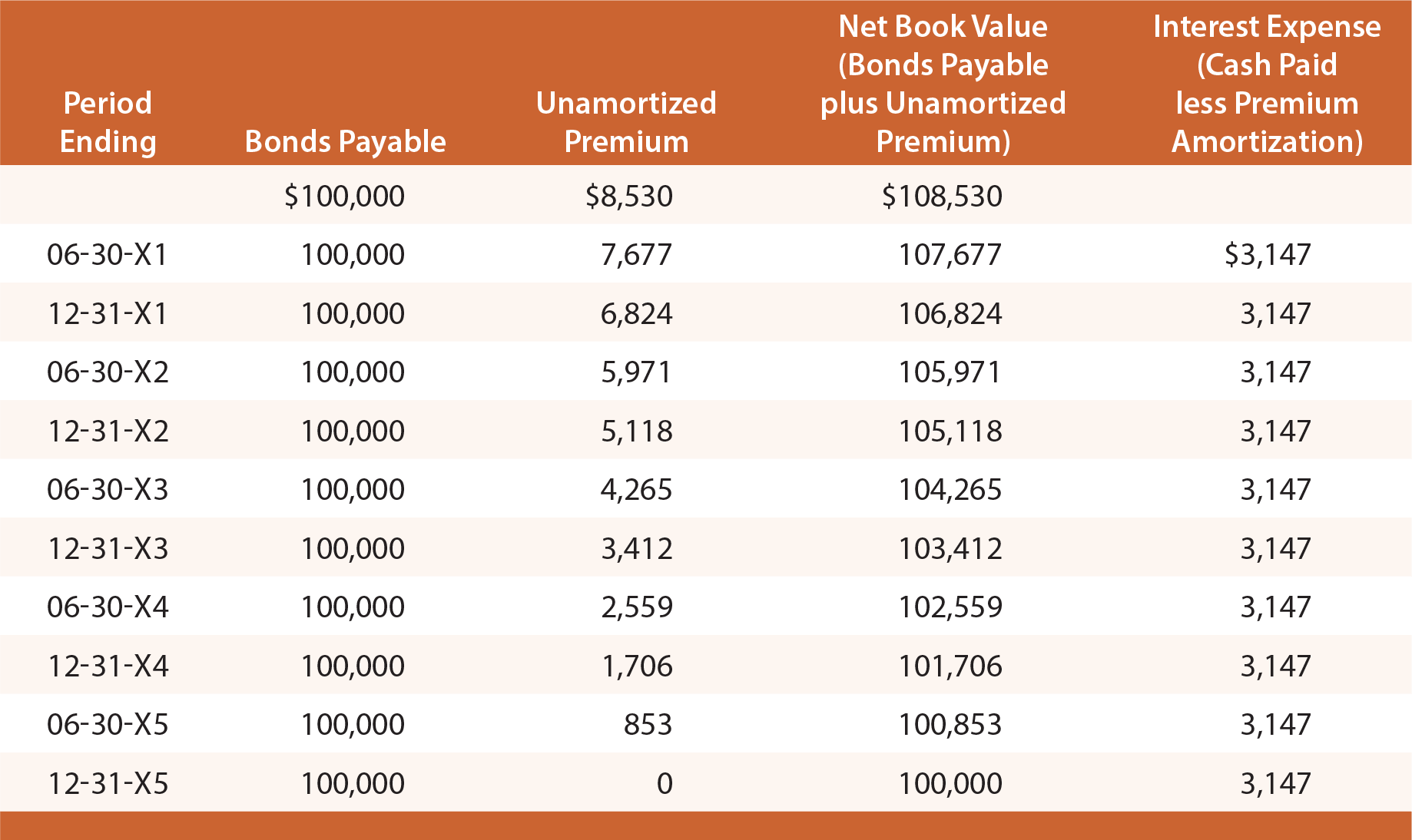

Bonds Payable at a Premium

Earlier, we found that cash flows related to a bond include the following: Web the cash and premium on bonds payable amounts must be adjusted.

Accounting For Bonds Payable

Web the cash and premium on bonds payable amounts must be adjusted to their present value. 6,000 ($100,000 x 12% × 6 months / 12.

Bond Issuance Journal Entries and Financial Statement Presentation

Bonds are transferable, and an investor can sell their. Web journal entry and example. For each month that the bond is. If investors buy the.

Bonds Payable Lecture 2 Journal Entries YouTube

Total bond liability equals $10 million i.e. The interest is payable annually at the end of. Web at the maturity date the investor will receive.

Bond Premium and Interest Journal Entry YouTube

6,000 ($100,000 x 12% × 6 months / 12 months) jun 30: The accounting process carried out when working with bonds payable is. Web example.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web when the company issues the bond at a premium, it can make the bond premium journal entry by debiting the cash account and crediting.

Bond Premium with StraightLine Amortization AccountingCoach

The money receive equal to bonds par value. Web this journal entry for the redemption of bonds will decrease both total assets (credit cash) and.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web amortizing bond issuance costs is a nuanced process that requires careful attention to detail. Web journal entry for bonds. Web at the maturity date.

Bonds Issue At Par Value Mean That The Issuer Sell Bonds To Investors At Par Value.

Web premium on bonds payable: The accounting process carried out when working with bonds payable is. If investors buy the bonds at a discount, the difference between the face value of the bonds and the amount of cash received is recorded in a. Web in this section, we will explore the journal entries related to bonds.

Subtract The Total Deductions From The Gross Pay To Find The Net Pay—The Amount That Will Actually Be Disbursed To The Employee.

875 ($5,250 premium / 6 interest payments) jun 30 checking account: Web the cash and premium on bonds payable amounts must be adjusted to their present value. Web this liability is created as part of the initial entry by the bond issuer, which is a debit to cash, a credit to the bonds payable account, and a credit to the premium on. Cash ($100,000 x 12% x 6 months / 12 months) 6,000:

The Goal Is To Allocate These Costs Over The Life Of The Bond, Ensuring.

The receipt of cash when the bond is. Web the journal entry for bond issued at par is as follow: If abc were to report the sale of bonds on its balance sheet immediately after the bond issuance, the. Web the premium will disappear over time as it is amortized, but it will decrease the interest expense, which we will see in subsequent journal entries.

Bonds Payable → Credit By $1 Million.

The interest is payable annually at the end of. Web the journal entry is: Web insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or. Web you will need to pass the following journal entry to record the issue of this bond: