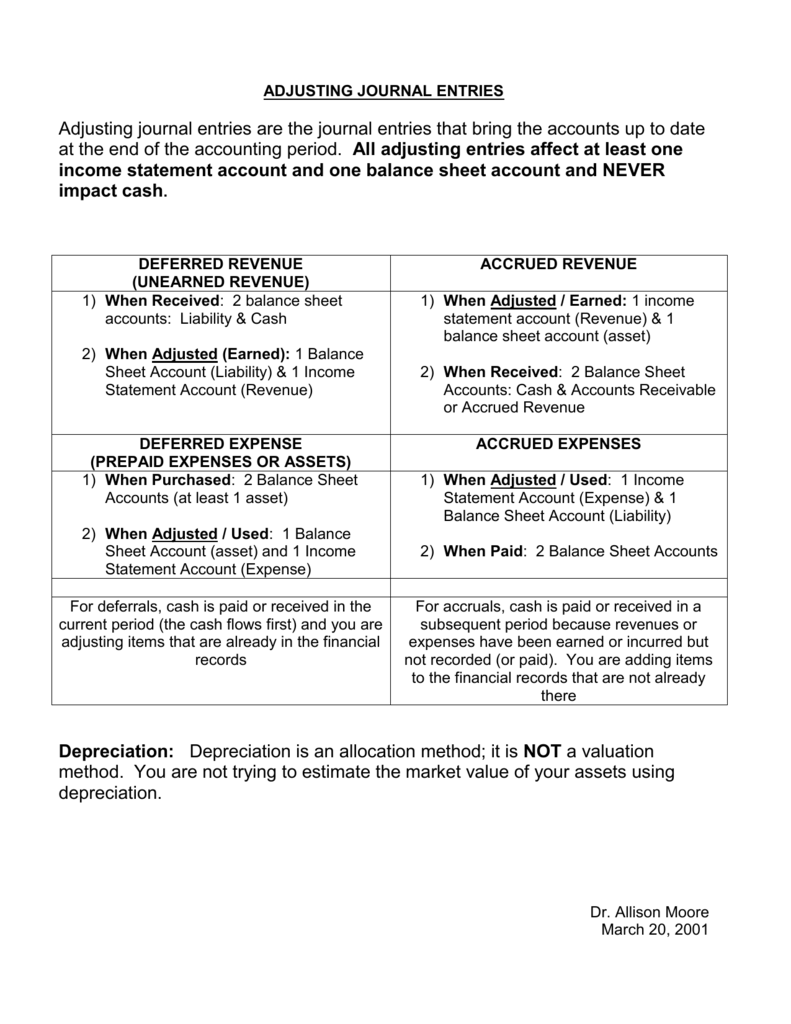

Adjusting Journal Entries Are Needed To Record - Web there are three general types of entry adjustments, those being: How should this error be fixed? Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts. Web adjusting entries update accounting records at the end of a period for any transactions that have not yet been recorded. These are general rules of thumb. Web in order for financial statements to be completed on an accruals basis and comply with the matching principle, adjusting journal entries need to be made at the end of each accounting period. Web adjusting journal entries are a particular type of journal entry that makes corrections or adjustments to transactions that have been previously recorded. Web if you use accrual accounting, your accountant must also enter adjusting journal entries to keep your books in compliance. These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step. Types of adjusting entries adjusting entries are often categorized as follows:

Adjusting Entries Examples Accountancy Knowledge

Merchan, issued instructions to jurors on wednesday that serve as a guide to applying the law in deliberations. Adjusting entries are made to ensure that.

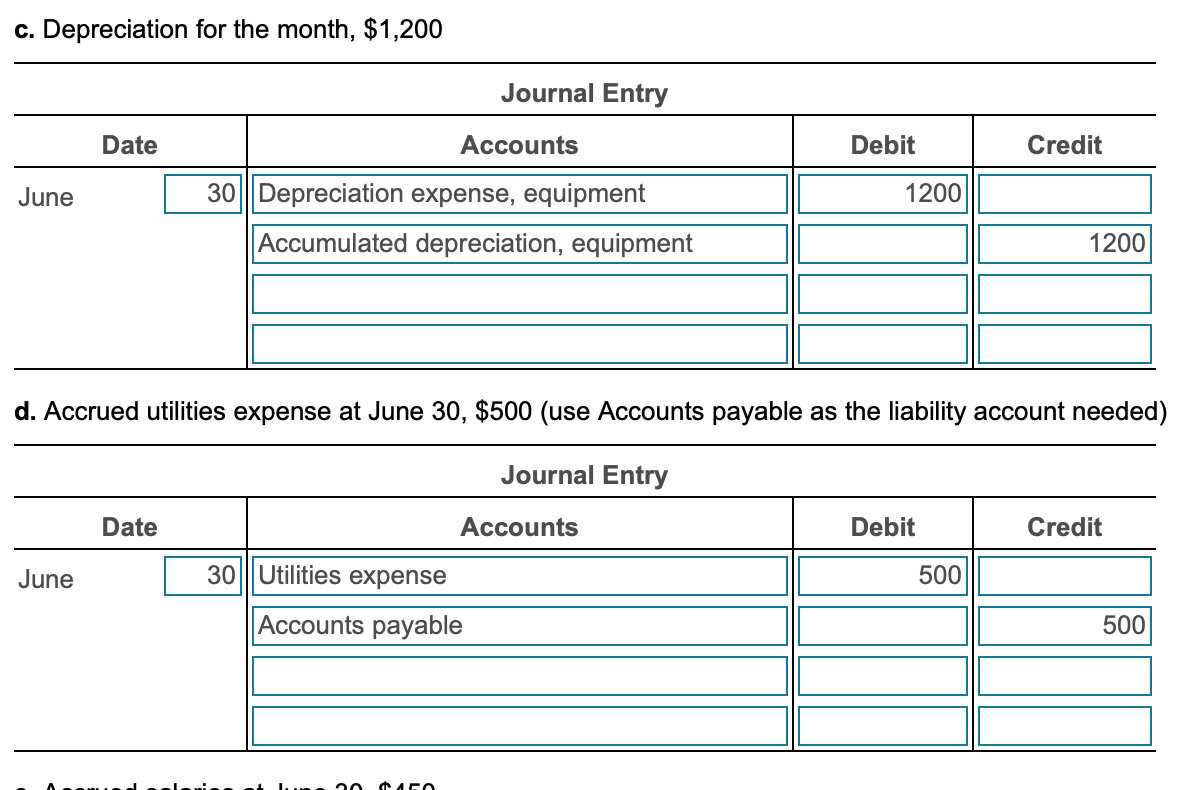

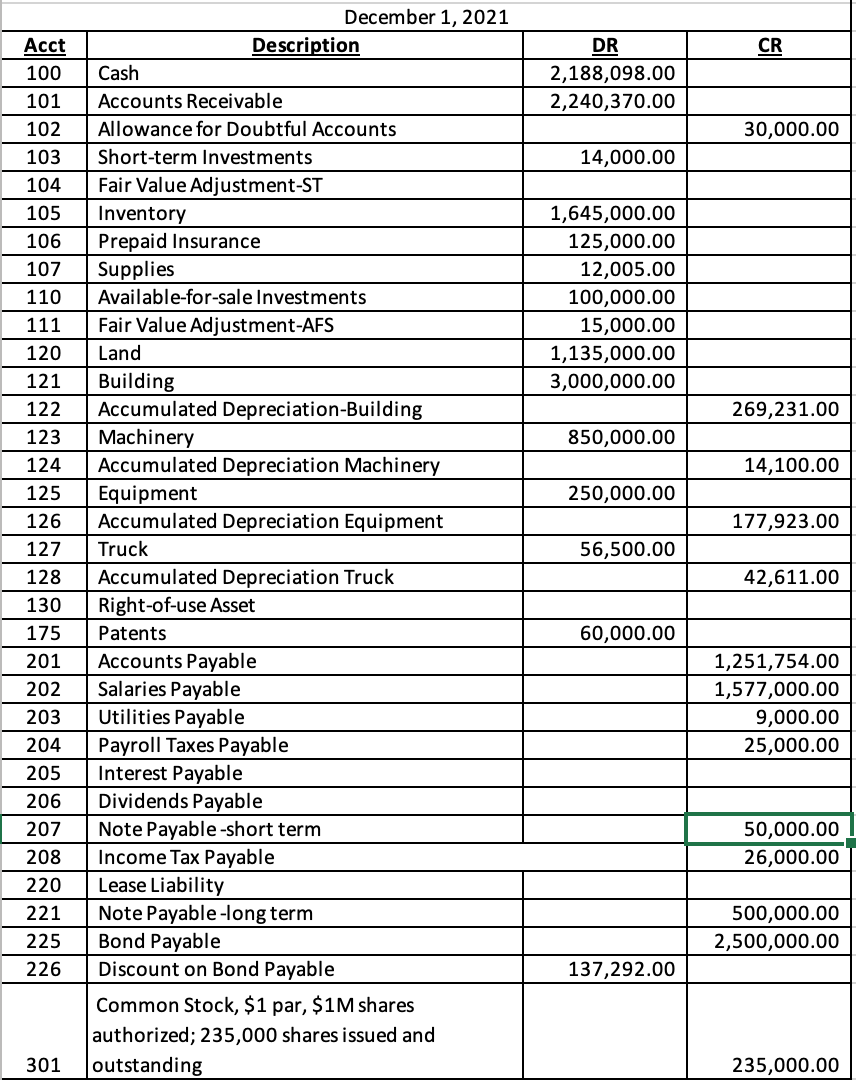

Solved Record the adjusting entries in the a General Journal

Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any.

Solved Requirement 1. Journalize the adjusting entries.

These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step. Merchan, issued.

Adjusting Journal Entries Defined Accounting Play

Web adjusting entries, or adjusting journal entries (aje), are made to update the accounts and bring them to their correct balances. An adjusting journal entry.

Solved Part I Adjusting Journal Entries Record the

How should this error be fixed? How did this error affect the financial statements? Web it is good practice to routinely run checks to catch.

Solved Record the adjusting entries in the a General Journal

All five of these entries will directly impact both your revenue and expense accounts. Web here are the three main steps to record an adjusting.

ADJUSTING JOURNAL ENTRIES

Trump’s manhattan criminal trial, juan m. Web it is good practice to routinely run checks to catch errors and create the necessary journal adjusting entries..

Adjusting Entries Example, Types, Why are Adjusting Entries Necessary?

Here are some common pairs of accounts and when you would use them. These adjustments are then made in journals and carried over to the.

Adjusting Journal Entries Examples

How did this error affect the financial statements? Web in order for financial statements to be completed on an accruals basis and comply with the.

Web Adjusting Entries, Also Known As Adjusting Journal Entries (Aje), Are The Entries Made In A Business Firm’s Accounting Journals To Adapt Or Update The Revenues And Expenses Accounts According To The Accrual Principle And.

Web adjusting entries, or adjusting journal entries (aje), are made to update the accounts and bring them to their correct balances. By recording these entries before you generate financial reports, you’ll get a better understanding of your actual revenue, expenses, and financial position. These are general rules of thumb. Start the process by asking yourself these three questions when dealing with errors:

Adjusting Journal Entries Are A Feature Of Accrual Accounting As A Result Of Revenue Recognition And Matching Principles.

There are numerous types of adjusting journals, but the four adjusting journal entries examples listed below are among the most common usually. Here are some common pairs of accounts and when you would use them. Web there are three general types of entry adjustments, those being: How did this error affect the financial statements?

Web If You Use Accrual Accounting, Your Accountant Must Also Enter Adjusting Journal Entries To Keep Your Books In Compliance.

Web here are the three main steps to record an adjusting journal entry: Web in order for financial statements to be completed on an accruals basis and comply with the matching principle, adjusting journal entries need to be made at the end of each accounting period. This process ensures that the ledger accurately reflects the financial adjustments made through adjusting entries, maintaining precision in financial. Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts.

The Preparation Of Adjusting Entries Is An Application Of The Accrual Concept And The Matching Principle.

Web adjusting entries are accounting journal entries that are to be made at the end of an accounting period. Web there are five main types of adjusting entries that you or your bookkeeper will need to make monthly. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. What type of error is it?