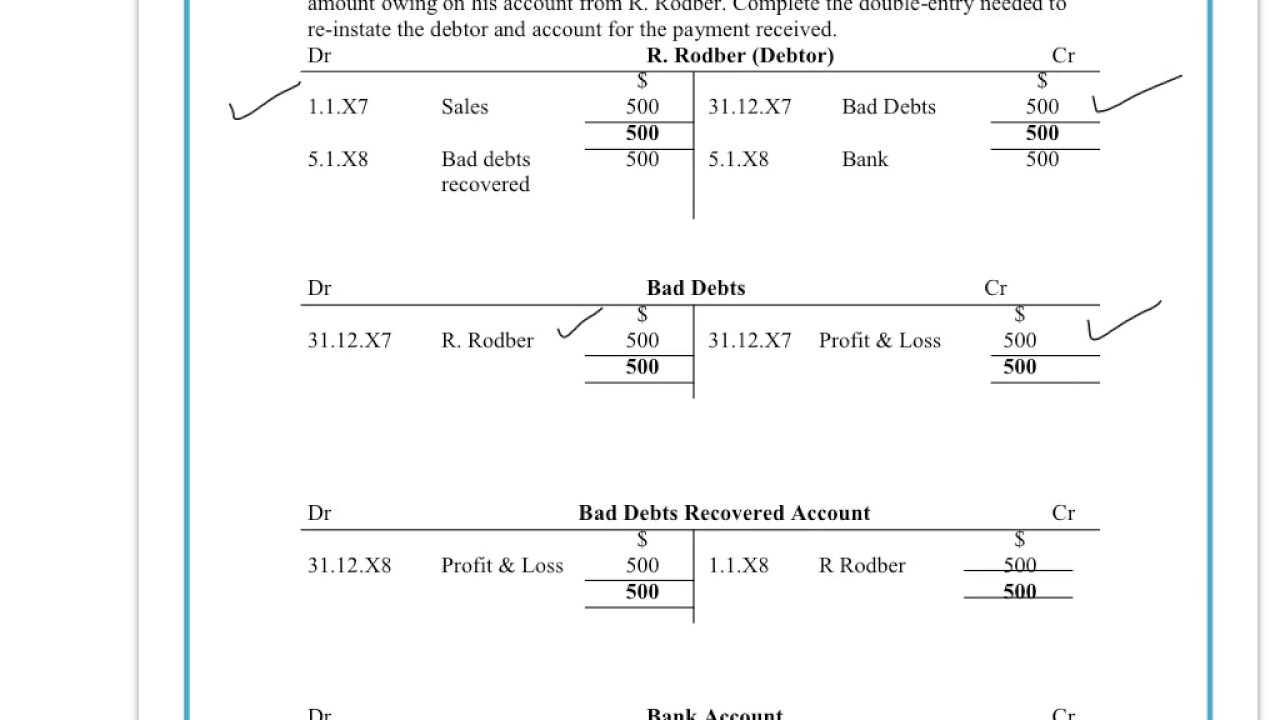

Bad Debt Recovery Journal Entry - When you sell a service or product, you expect your. Web the entry to record bad debt recovery would, therefore, be as follows: Bad debts recovery a/c with the. See examples, advantages and disadvantages of each method, and. When the goods are sold to customers on. Cash (or bank) a/c with the amount recovered. A recovery is a payment received after it has been designated as uncollectible. How to calculate and record the bad debt expense. ( dr.) accounts receivable $5,000 (cr.) bad debts recovered $5,000. It may also be necessary to reverse any related sales.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

When you sell a service or product, you expect your. When the company receives the cash payment from the customer’s account that had been written.

Journal Entry for Bad Debts Examples Quiz More..

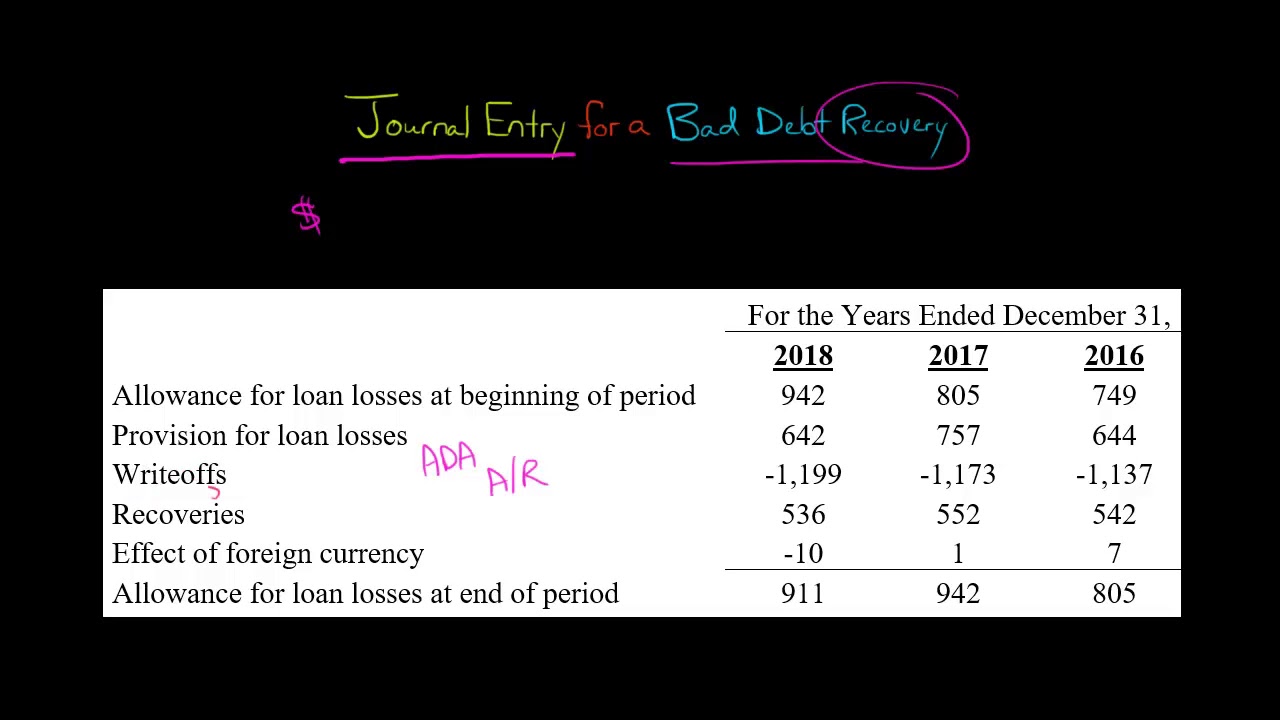

We show how to record. A recovery is a payment received after it has been designated as uncollectible. The main reason that it is recorded.

Understand how to enter Bad Debts Recovered transactions using the

Web compliancelegalfinancetax & accounting january 06, 2021. This may occur after legal action has been taken. It may also be necessary to reverse any related.

What are Bad debt recovered Example Journal Entry Tutor's Tips

See examples, advantages and disadvantages of each method, and. How to calculate and record the bad debt expense. Web when the account defaults for nonpayment.

Journal Entry for Recovery of Bad Debts AccountingCapital

19k views 3 years ago accounting for beginners. A recovery is a payment received after it has been designated as uncollectible. When the company receives.

Bad Debts Recovered How to pass Journal Entry CBSE Board 11th Class

It may also be necessary to reverse any related sales. Web the entry to record bad debt recovery would, therefore, be as follows: Web bad.

Journal Entry for a Bad Debt Recovery YouTube

( dr.) accounts receivable $5,000 (cr.) bad debts recovered $5,000. Cash (or bank) a/c with the amount recovered. Web recovering an account means collecting a.

Bad Debt Recovery Allowance Method Double Entry Bookkeeping

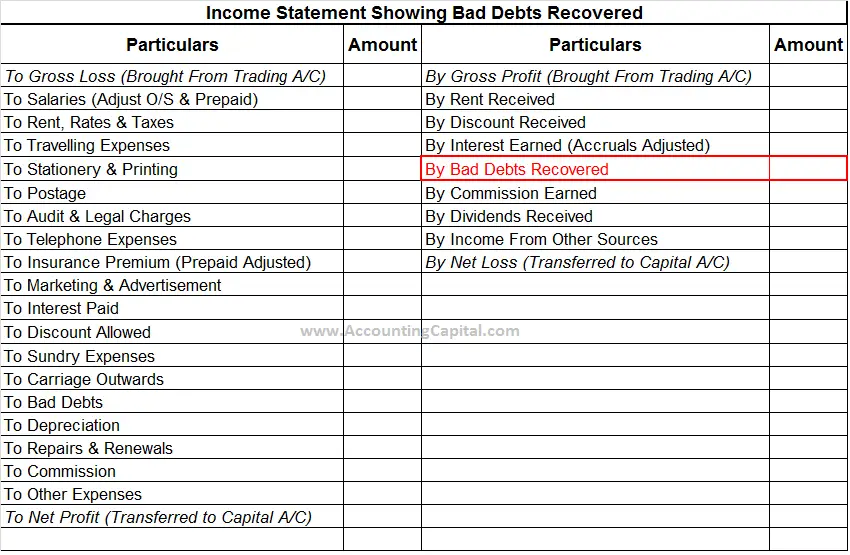

Web bad debt recovery refers to a payment received for a debt that had previously been written off and considered uncollectible. Web the bad debt.

How Do I Write Off Bad Debt Expense Journal Entry

The main reason that it is recorded as the other income since it is not the main source of. Web the journal entry to record.

Cash (Or Bank) A/C With The Amount Recovered.

We show how to record. Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. See examples, advantages and disadvantages of each method, and. In this accounting lesson, we explain what bad debt and bad debt recovered are.

19K Views 3 Years Ago Accounting For Beginners.

Web compliancelegalfinancetax & accounting january 06, 2021. Web learn how to record bad debt expense using two methods: Web first, the entry to write off the debt as shown in section 2 must be reversed as follows: Web bad debt expense | definition + journal entry examples.

Web When The Company Has Enough Evidence To Write Off The Bad Debt, The Accountant Will Seek Approval From The Management To Write Off The Accounts Receivable As Bad Debt.

When you sell a service or product, you expect your. A recovery is a payment received after it has been designated as uncollectible. When the goods are sold to customers on. Because you can't know in advance the amount of bad debt you'll incur,.

How To Calculate And Record The Bad Debt Expense.

The main reason that it is recorded as the other income since it is not the main source of. Web the entry to record bad debt recovery would, therefore, be as follows: Web what is bad debt recovery? When the company receives the cash payment from the customer’s account that had been written off, it needs to make two journal entries for the bad debt.