Asc 842 Journal Entries Examples - Web on february 25, 2016, the fasb issued accounting standards update no. How to record a finance lease and journal entries. Web asc 842 can be overwhelming; 13, 2016, the iasb issued ifrs 16, leases, and on feb. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Modification accounting for an operating lease under asc 842; Ion diffusivity and viscosity play vital roles in this process. It’s important to appropriately identify the commencement date of a lease component and answer other questions — regarding. Lease accounting hot topics for entities that have adopted asc 842. This guide discusses lessee and lessor accounting under asc 842.

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

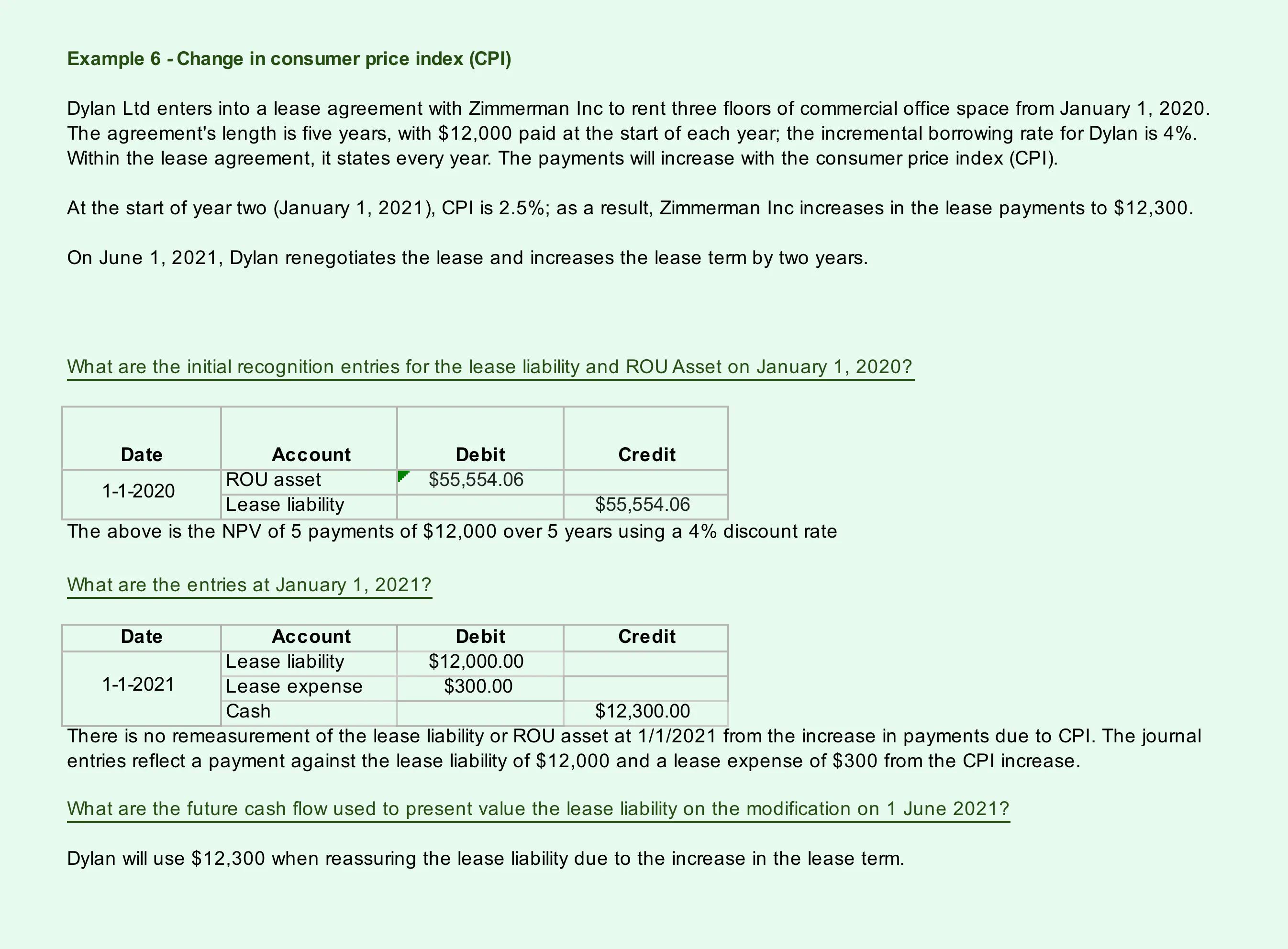

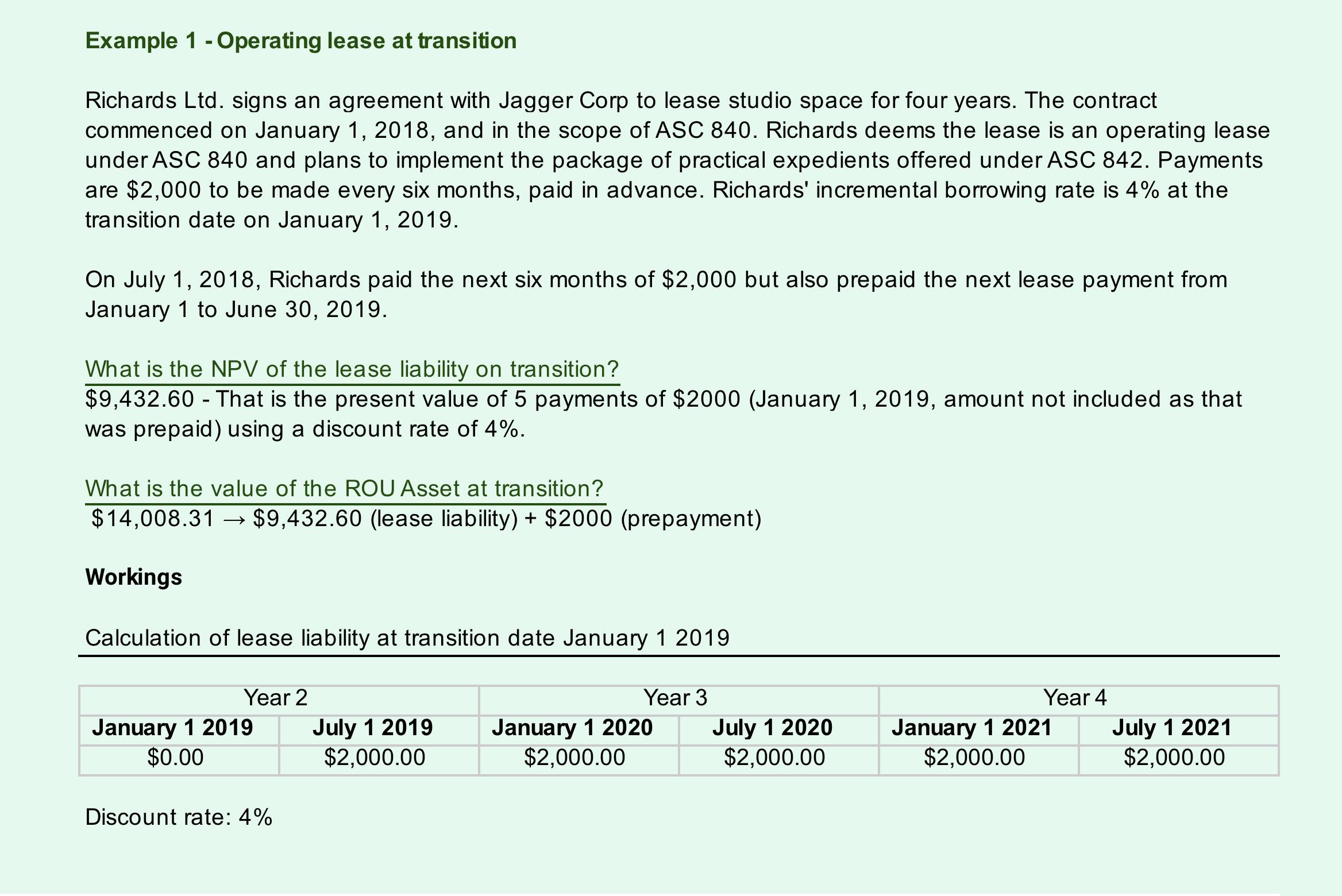

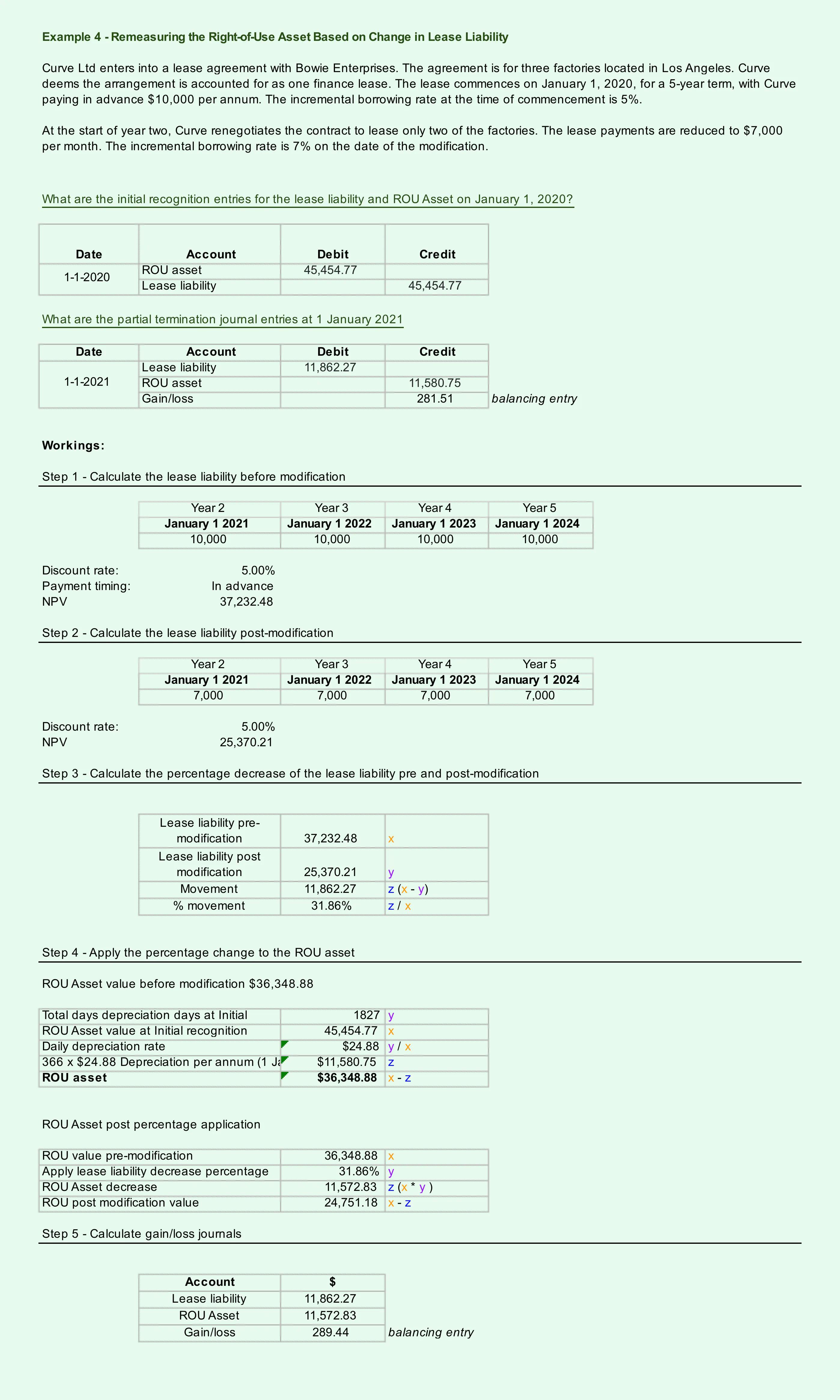

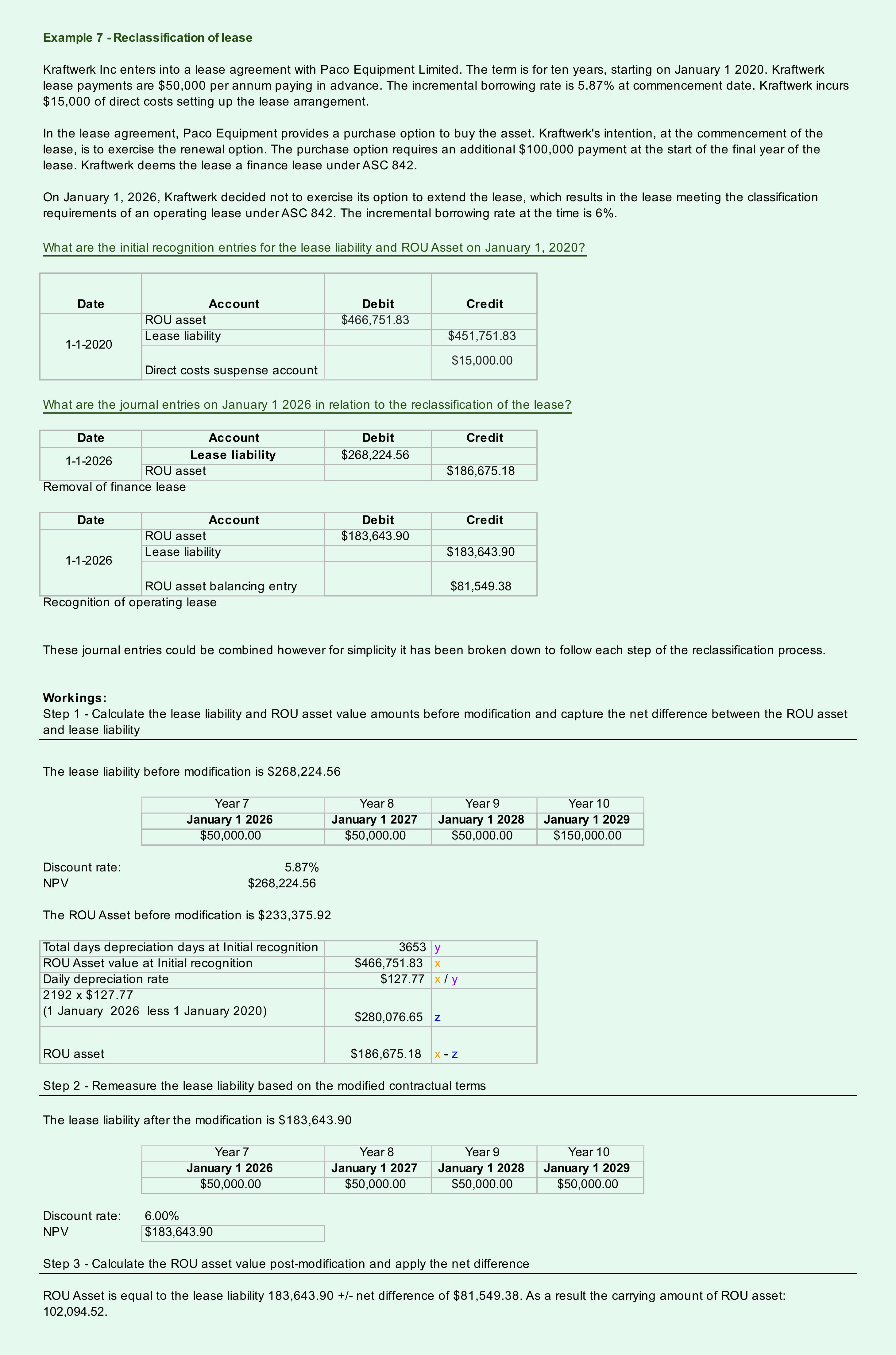

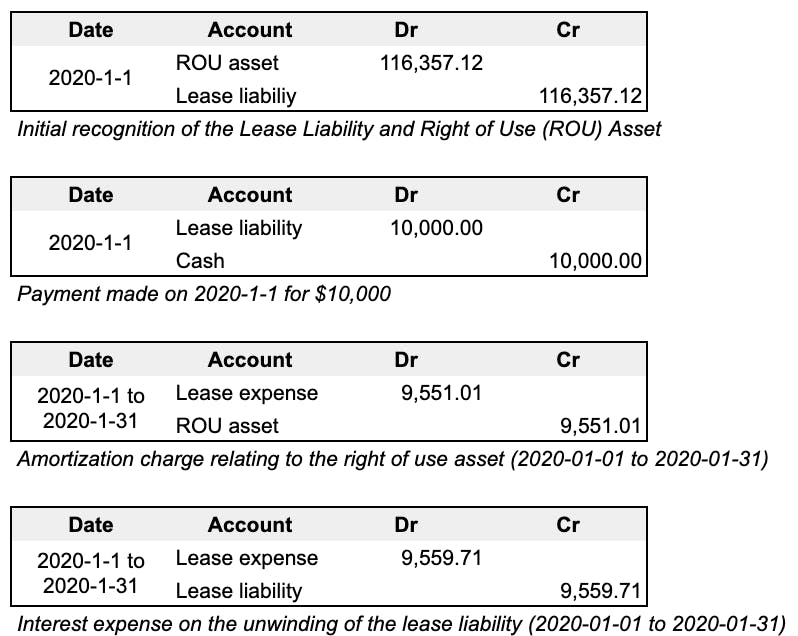

Web what are the asc 842 journal entries? What is a capital/finance lease? Web operating lease accounting example and journal entries. We often just need.

ASC 842 Guide

Entities with slightly different facts and. Web asc 842 can be overwhelming; Web the conclusions reached on the examples included in this publication are based.

Asc 842 Lease Accounting Template

Web accounting for an operating lease under asc 842; Modification accounting for an operating lease under asc 842; Entities with slightly different facts and. Web.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web the fasb’s new standard on leases, asc 842, is effective for all entities. Web to help accounting teams at businesses and nonprofits, here are.

ASC 842 Guide

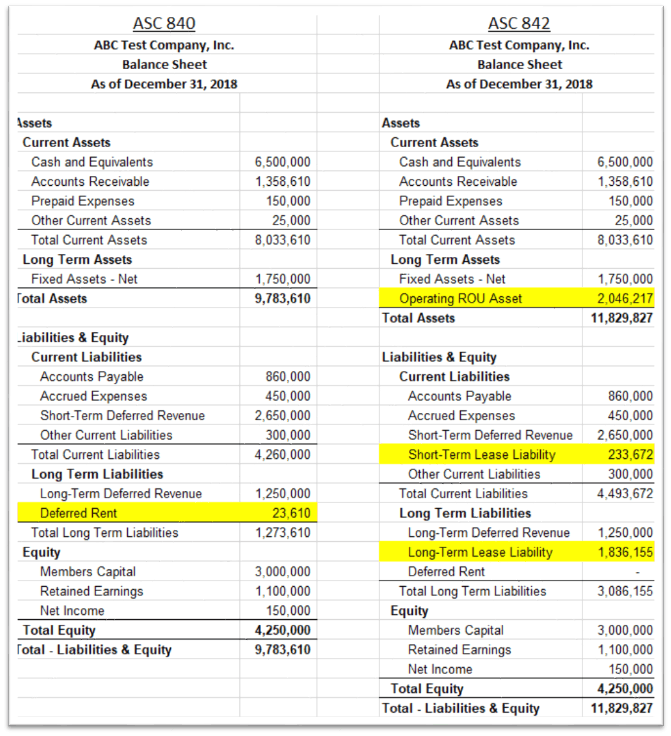

Web deferred rent journal entries under asc 842 for year 1 using the facts presented in this example, the amortization table below is for the.

Asc 842 Template

If you’re interested in seeing some examples of how. With asc 842 on the horizon, many entities. This guide discusses lessee and lessor accounting under.

ASC 842 Lease Extension & Renewal Journal Entry Example

13, 2016, the iasb issued ifrs 16, leases, and on feb. Web this piece will illustrate some examples of best practices under asc 842 of.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating.

Asc 842 Lease Accounting Template

Web lease classification and key terms. Ion diffusivity and viscosity play vital roles in this process. In the melt, phase separations and ion transport. Web.

With Asc 842 On The Horizon, Many Entities.

Determine the lease term under asc 840; Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Details on the example lease agreement; Operating lease under asc 842.

Web This Piece Will Illustrate Some Examples Of Best Practices Under Asc 842 Of Accounting For Operating Leases.

The first four chapters provide. Now, you can record the journal entry in your accounting system. Web what are the asc 842 journal entries? Web lease classification and key terms.

The Examples Below Are Identical Leases In Terms, Payments, And Discount Rates.

We often just need a quick journal entry example to understand the concept or refresh our memory. Ion diffusivity and viscosity play vital roles in this process. The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases. It’s important to appropriately identify the commencement date of a lease component and answer other questions — regarding.

13, 2016, The Iasb Issued Ifrs 16, Leases, And On Feb.

Lease accounting hot topics for entities that have adopted asc 842. In the melt, phase separations and ion transport. Web on february 25, 2016, the fasb issued accounting standards update no. Web the conclusions reached on the examples included in this publication are based on the specific facts and circumstances outlined.