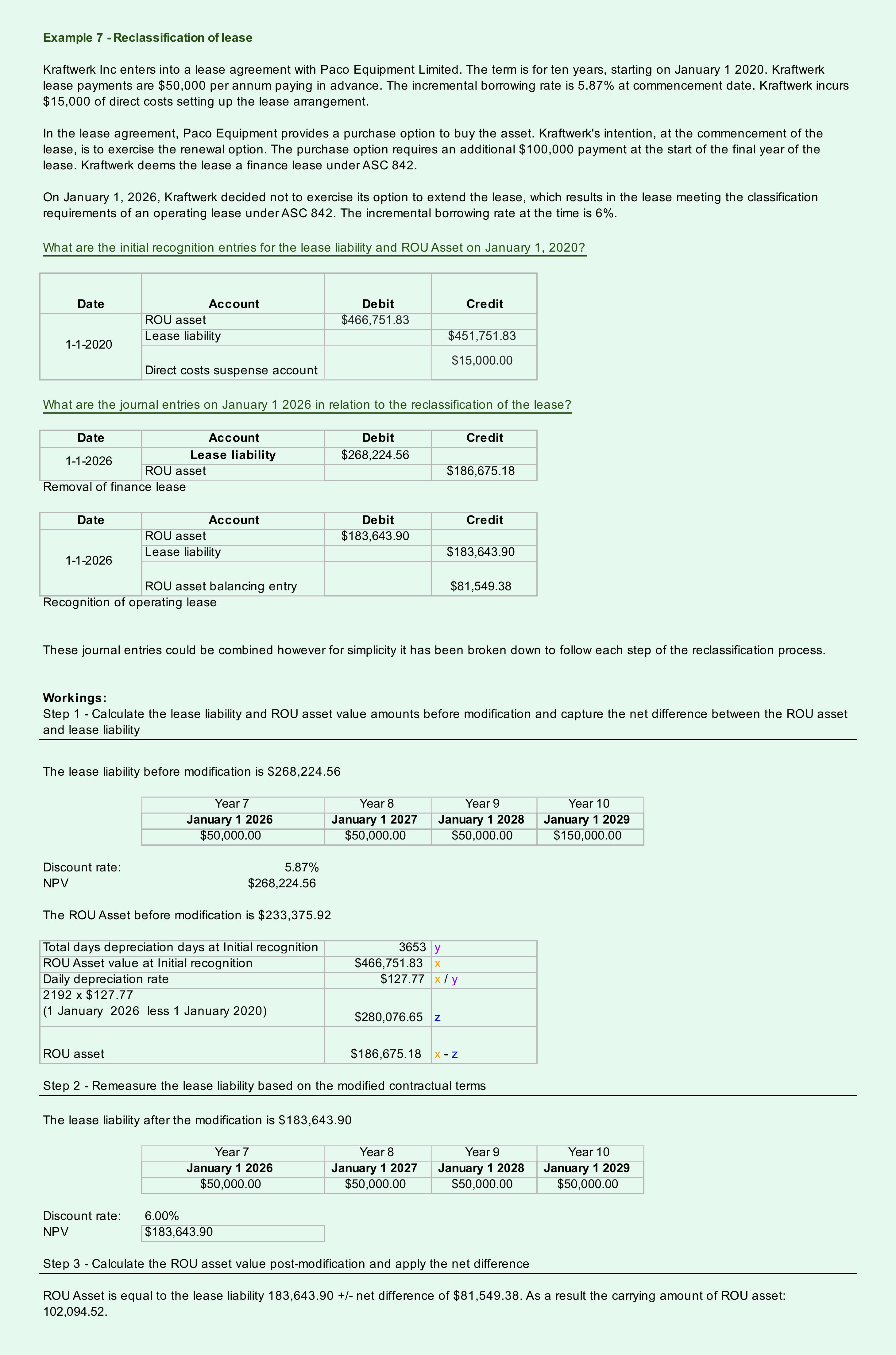

Asc 842 Example Journal Entries - Explore hot topics, common pitfalls, and more information related to why entities that have adopted asc 842 should continually monitor, evaluate, and update. Determine the total lease payments under gaap. However, under asc 842, it's no longer the classification between operating leases and capital. Web initial journal entry to record lease. Richard stuart, partner, national professional standards group, rsm us llp [email protected], +1 203 905 5027 july 2022 the fasb material is copyrighted by the financial accounting foundation, 401 merritt 7, norwalk, ct 06856, and is used with permission. The discount rate is 4.19% and the payments are $10,000 with a 3% annual increase, making the total lease payments over the course of the lease $637,096.32. Value of the right of use asset divided by total remaining useful life days. Akin to asc 840, the new lease accounting standard asc 842 prescribes the lessee to determine the lease classification. As a result the calculation will be $28,546.45 / 77 = $370.73. The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases.

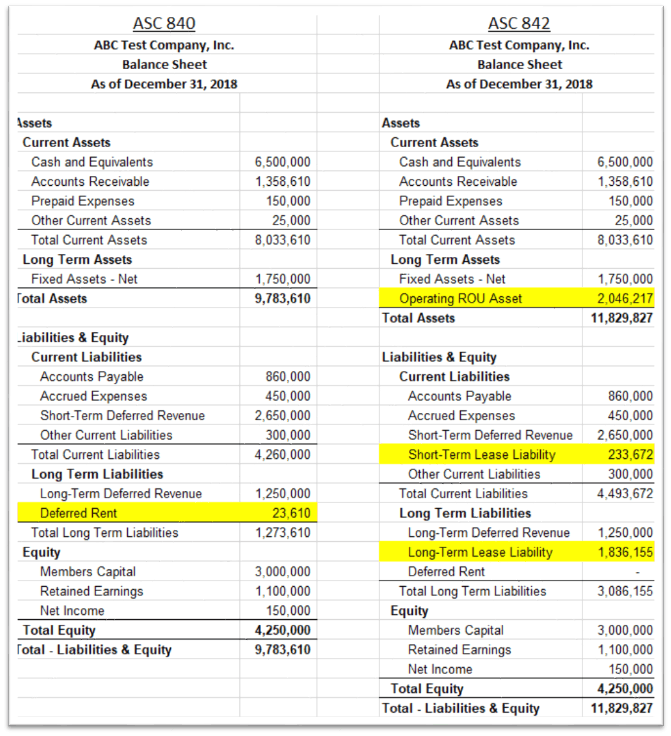

ASC 842 Summary of Balance Sheet Changes for 2020

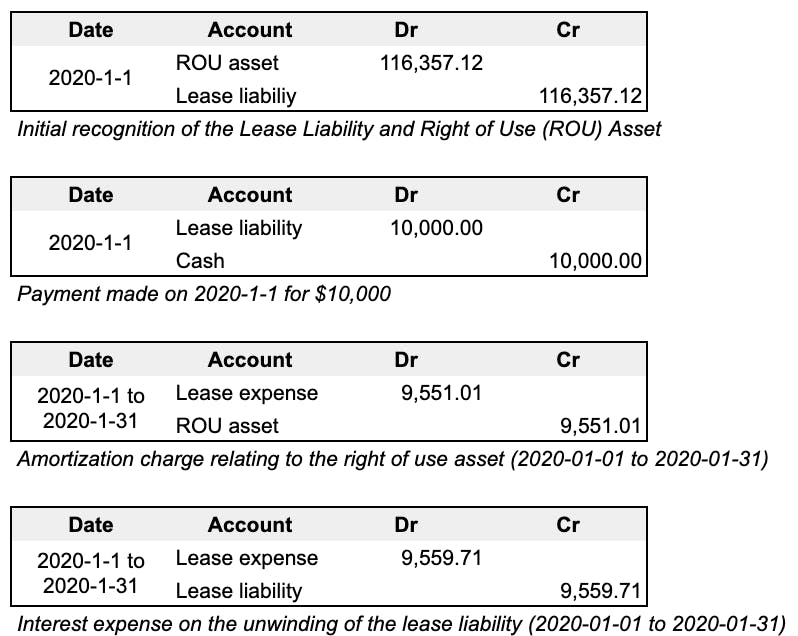

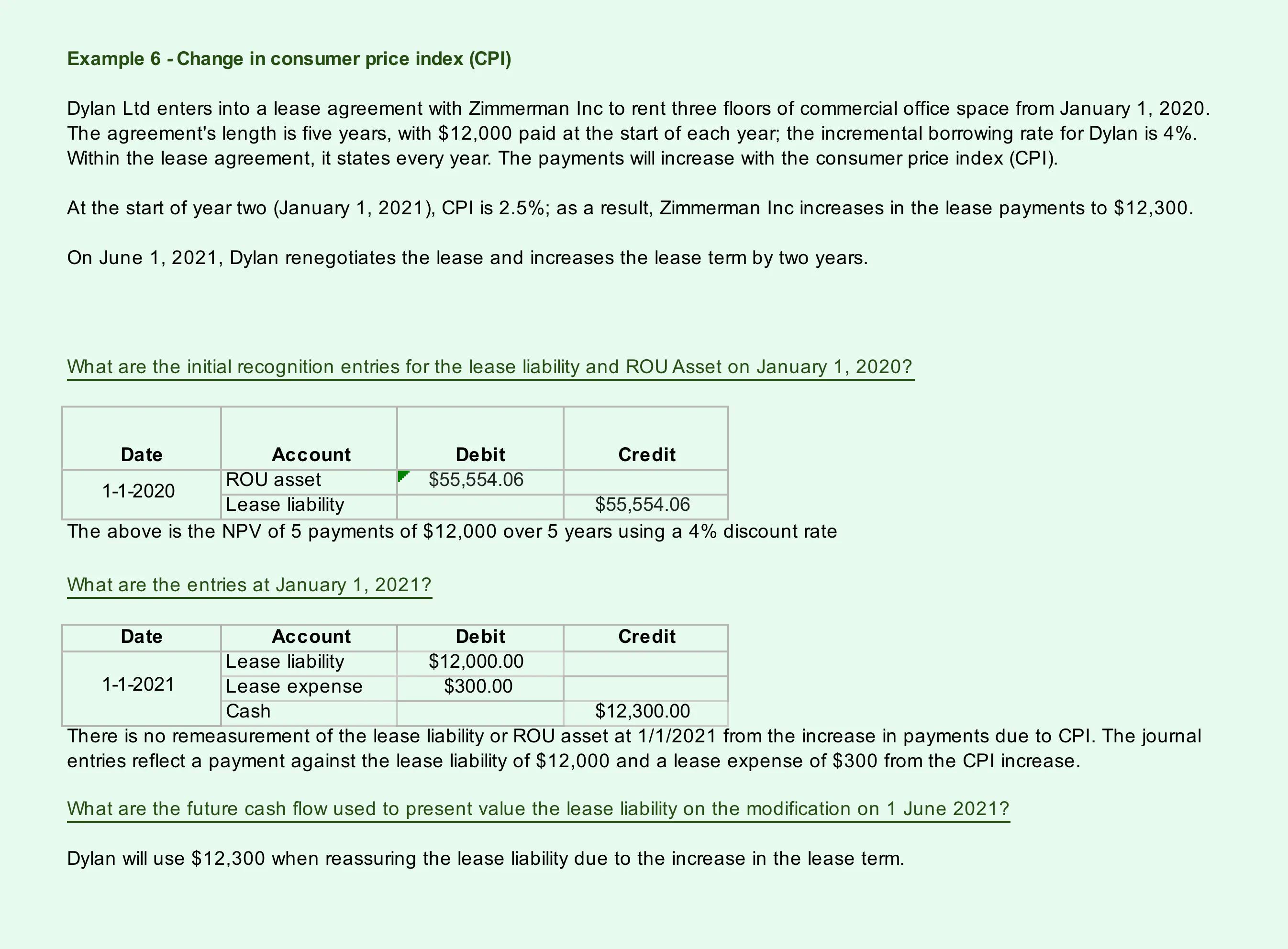

Web once we determine the present value of the lease payment, we will record the following entry: Per asc 842, an asset must be recognized.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

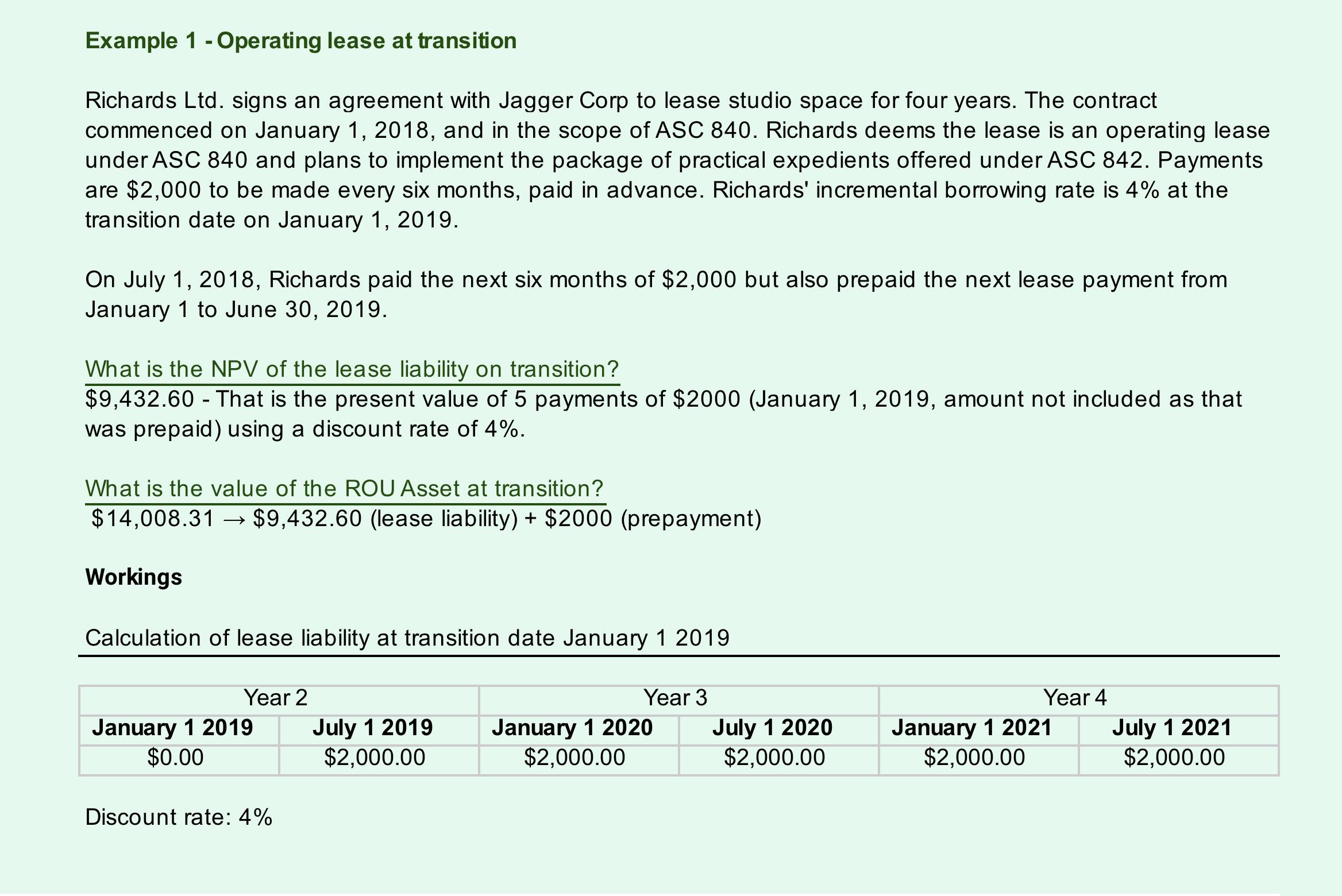

Web operating lease accounting example and journal entries. $450 month paid in advance. However, under asc 842, it's no longer the classification between operating leases.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web changes the adoption of asc 842 will make to the lessor’s accounting treatment of operating leases compared to asc 840. Several economic factors have.

Asc 842 Lease Accounting Template

Under asc 842, this is no longer the matching entry to the cash payment on the p & l. As a result the calculation will.

Asc 842 Template

Web deferred rent journal entries under asc 842 for year 1. Common control arrangements, on november 30, 2022, and received 29 comment letters in response.

Leases 101 New Accounting Standard Asc 842 Part 2 Finacco

Web we’ll tackle accounting for operating leases under asc 842 much like the standard (or “topic”) released by the fasb does. Richard stuart, partner, national.

ASC 842 Journal Entries for Finance & Operating Leases Visual Lease

This blueprint was updated in april 2023 for fasb amendments to asc 842 and bdo’s views on practice issues. The new lease accounting standard, asc.

ASC 842 Guide

The discount rate is 4.19% and the payments are $10,000 with a 3% annual increase, making the total lease payments over the course of the.

ASC 842 Lease Extension & Renewal Journal Entry Example

$450 month paid in advance. Value of the right of use asset divided by total remaining useful life days. Web the fasb’s new standard on.

Determine The Lease Term Under Asc 840.

On the asc 842 effective date,. Value of the right of use asset divided by total remaining useful life days. This guide discusses lessee and lessor accounting under asc 842. This blueprint was updated in april 2023 for fasb amendments to asc 842 and bdo’s views on practice issues.

Upon Transitioning To Asc 842, In Addition To Recording The Amount Calculated Above, If The Entity Has A Deferred Rent Balance, Accrued Rent Balance Or An Unamortized Lease Incentive Liability Balance On.

Significant changes to this update are listed in appendix b. Common control arrangements, on november 30, 2022, and received 29 comment letters in response to the amendments in that proposed update. Under asc 842, this is no longer the matching entry to the cash payment on the p & l. Several economic factors have affected the lease accounting for many commercial real estate entities, including owners, operators, and developers.

Leveraged Lease Accounting Under Asc 842 Under Topic 840, A Leveraged Lease Is Defined As An Agreement In Which The Lessor Borrows Funds From A Lender To Help Pay For The Purchase Of An Asset.

The journal entries to be booked by the lessor for an operating lease under asc 842. This article cuts through the confusion and provides a clear roadmap for mastering asc 842 lease accounting. Web the fasb’s new standard on leases, asc 842, is effective for all entities. Web when the journal entry report is pulled in leasecrunch, chances are, the first month detailed will show the initial recognition of the rou asset, the liability, and the subsequent journal entries for the month.

The First Four Chapters Provide An Introduction And Guidance On Determining Whether An Arrangement Is (Or Contains) A Lease And How To Classify And Account For Lease And Nonlease Components.

For many businesses, navigating the complexities of asc 842 journal entries can be a daunting task. The board considered respondents’ comments in reaching the conclusions in this update, as discussed further below. The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases. Web summarizing key aspects of asc 842, the blueprint helps all companies, public or private, understand and comply with the leases guidance.