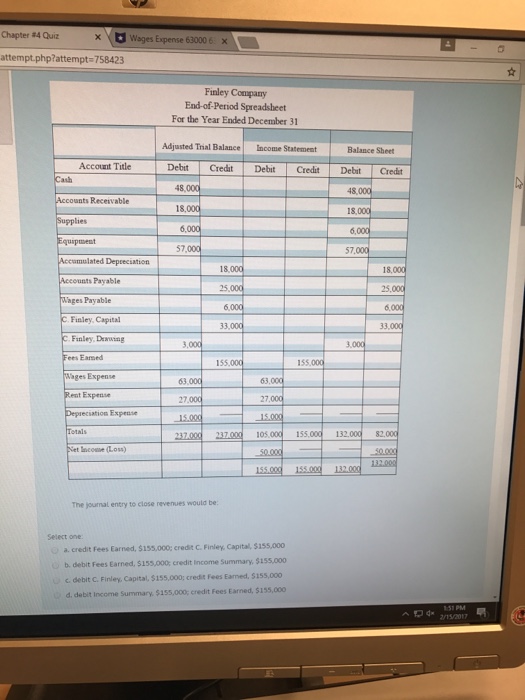

The Journal Entry To Close Revenues And Expenses Would Involve - Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends). Web the journal entry to close the revenue account would include which of the following? Web examples of journal entries for numerous sample transactions. Web accounting questions and answers. B.a debit to fees earned. A.debits to fees earned and retained earnings and credits to the expense accounts. A.debits to the expense accounts and credits to retained earnings and fees earned. Web the journal entry to close revenues and expenses would involve: Web the journal entry to close revenues and expenses would involve: Adjusting entries are necessary because the revenue recognition principle requires revenue recognition when earned, thus the need for an.

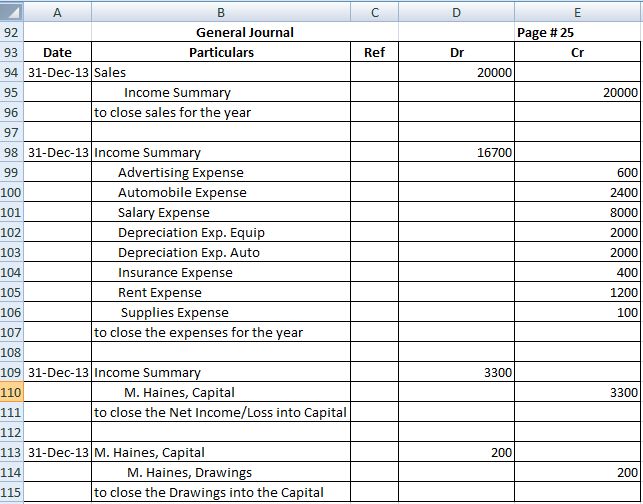

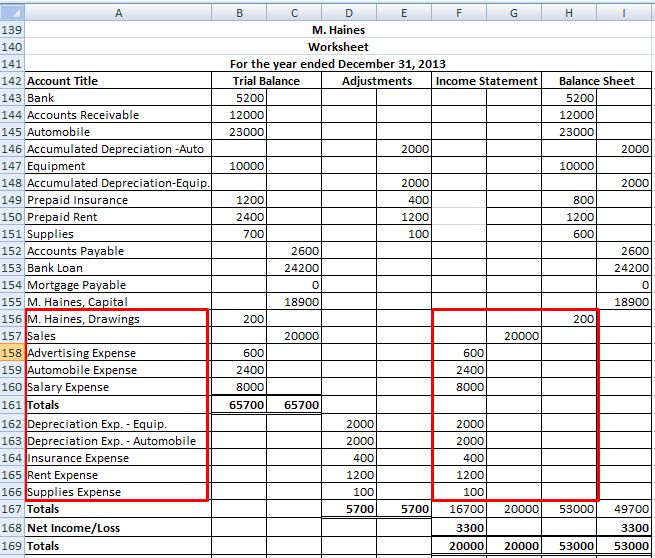

Closing Entries are journal entries made to close

Web the journal entry to close revenues and expenses would involve: A.debits to the expense accounts and credits to retained earnings and fees earned. Web.

Journalizing Closing Entries Closing Entries Types Example My Riset

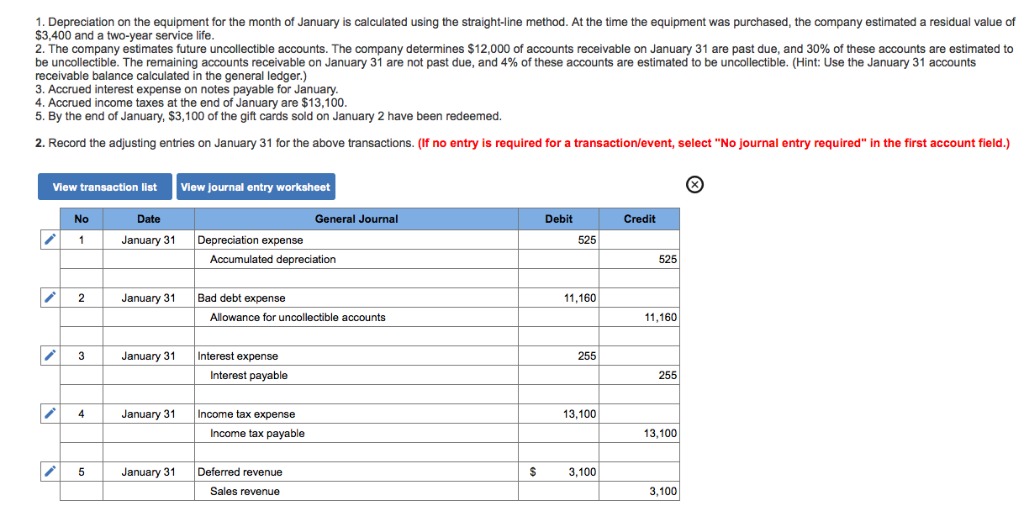

We now record the adjusting entries from january. Web closing entries are journal entries used to empty temporary accounts at the end of a reporting.

Closing entries explanation, process and example Accounting For

A credit to both the. Accounting for accrual of revenues involves the following journal entries: Web the journal entry to close revenues and expenses would.

Accounting An Introduction Adjusting and Closing Journal Entries

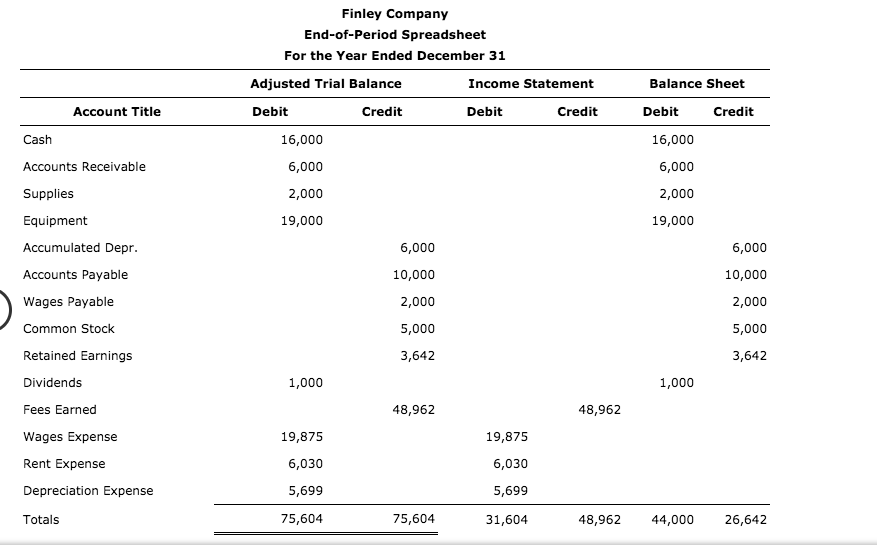

Typical financial statement accounts with debit/credit rules and disclosure conventions. Web closing entries, also called closing journal entries, are entries made at the end of.

Closing Entries Examples

Web the journal entry to close the revenue account would include which of the following? Web closing entries, also called closing journal entries, are entries.

How To Close Expense Account Journal Entry

Web the journal entry to close revenues and expenses would involve: Web a revenue closing entry is a journal entry made at the end of.

Solved The journal entry to close revenues would be credit

It typically relates to the balance. B.a debit to fees earned. A.debits to the expense accounts and credits to retained earnings and fees earned. Web.

Accounting An Introduction Adjusting and Closing Journal Entries

Web a closing entry is a journal entry made at the end of accounting periods that involves shifting data from temporary accounts on the income.

Solved The journal entry to close revenues would be.

Accounting for accrual of revenues involves the following journal entries: Web the eighth step in the accounting cycle is preparing closing entries, which includes journalizing.

Web A Closing Entry Is A Journal Entry That Is Made At The End Of An Accounting Period To Transfer Balances From A Temporary Account To A Permanent Account.

Web closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings. Web the journal entry to close revenues and expenses would involve: Web the journal entry to close revenues and expenses would involve: Web the closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period.

Accountants May Perform The Closing Process Monthly Or Annually.

B.a debit to fees earned. Web the eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger. Web the journal entry to close revenues and expenses would involve: Web a closing entry is a journal entry made at the end of accounting periods that involves shifting data from temporary accounts on the income statement to.

It Typically Relates To The Balance.

Web the journal entry to close the revenue account would include which of the following? Web an adjusting journal entry involves an income statement account (revenue or expense) along with a balance sheet account (asset or liability). Web examples of journal entries for numerous sample transactions. Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends).

Debits To Fees Earned And Retained Earnings And.

Adjusting entries are necessary because the revenue recognition principle requires revenue recognition when earned, thus the need for an. A.debits to fees earned and retained earnings and credits to the expense accounts. Four entries occur during the closing. Adjusting entries at the end of the each accounting period to debit accrued accounts.