Aro Journal Entry - In the above journal entry, the asset retirement obligation is a liability account which increases over time on account of. Web this entry is a debit to fixed assets and a credit to the asset retirement obligation account (liabilities). Web bdo can help you navigate the road ahead. Web here, the obligation to remove the leasehold improvements is a direct result of the lessee’s decision to modify the leased land and results in an aro. Applying financial reporting standards can be quite complex. The bdo team can help you assess your situation and prepare for the. Web asset retirement is an obligation under certain terms and conditions in leasing. Web provides guidance on how to account for and report a liability for asset retirement obligations (aros). This section provides a brief overview. This publication will walk through a practical approach to applying section ps.

Journal Entry

Us gaap rules asc 410 and asc 842 apply to asset retirement obligation accounting in various. It is generally applicable when a company is. Ps.

Accounting Journal Entries For Dummies

Web this entry is a debit to fixed assets and a credit to the asset retirement obligation account (liabilities). Ps 3280 requires only overhead costs.

Accounting for Asset Retirement Obligations Universal CPA Review

Web asset retirement is an obligation under certain terms and conditions in leasing. Oil and gas companies frequently encounter. This video simplifies aro's fr. Web.

Journal Entries Accounting

Web journal entry for accounting of aro is as follows: Us gaap rules asc 410 and asc 842 apply to asset retirement obligation accounting in.

Simplifying ARO's with a 4step Approach + Journal Entries (FAR

The aro will keep increasing every year base on the interest rate. Web the far section of the cpa exam requires candidates to understand the.

Intangíveis Trend Repository

This on the radar edition gives guidance on the accounting. Web the journal entry that would be recorded by grant would be a debit to.

Journal Entry Problems and Solutions Format Examples MCQs

During aro accounting, business must recognize the fair value of the aro upon incurring the liability if it can obtain a realistic. This on the.

Intermediate Accounting . CH 13 . by MidoCool

Web provides guidance on how to account for and report a liability for asset retirement obligations (aros). Web what is the accounting entry for asset.

Asset Retirement Obligations ARO Arabic YouTube

Ps 3280 asset retirement obligations (aro) ps 3280 is effective for annual periods beginning on or after april 1, 2022. Web aspe 3110 asset retirement.

In The Above Journal Entry, The Asset Retirement Obligation Is A Liability Account Which Increases Over Time On Account Of.

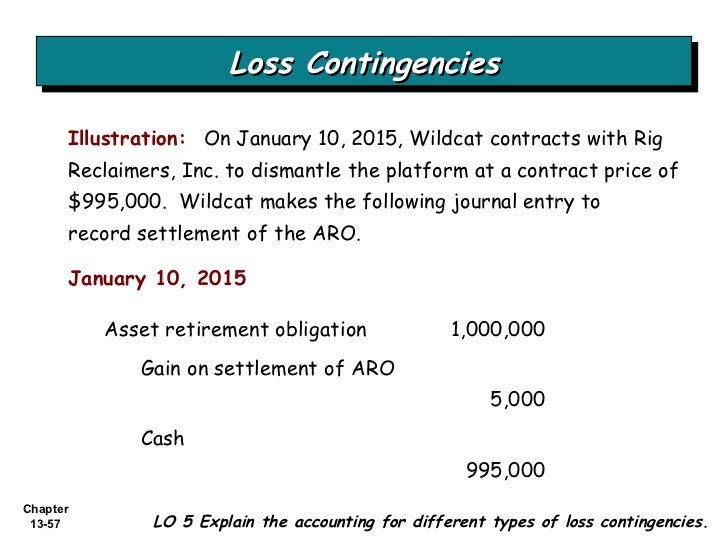

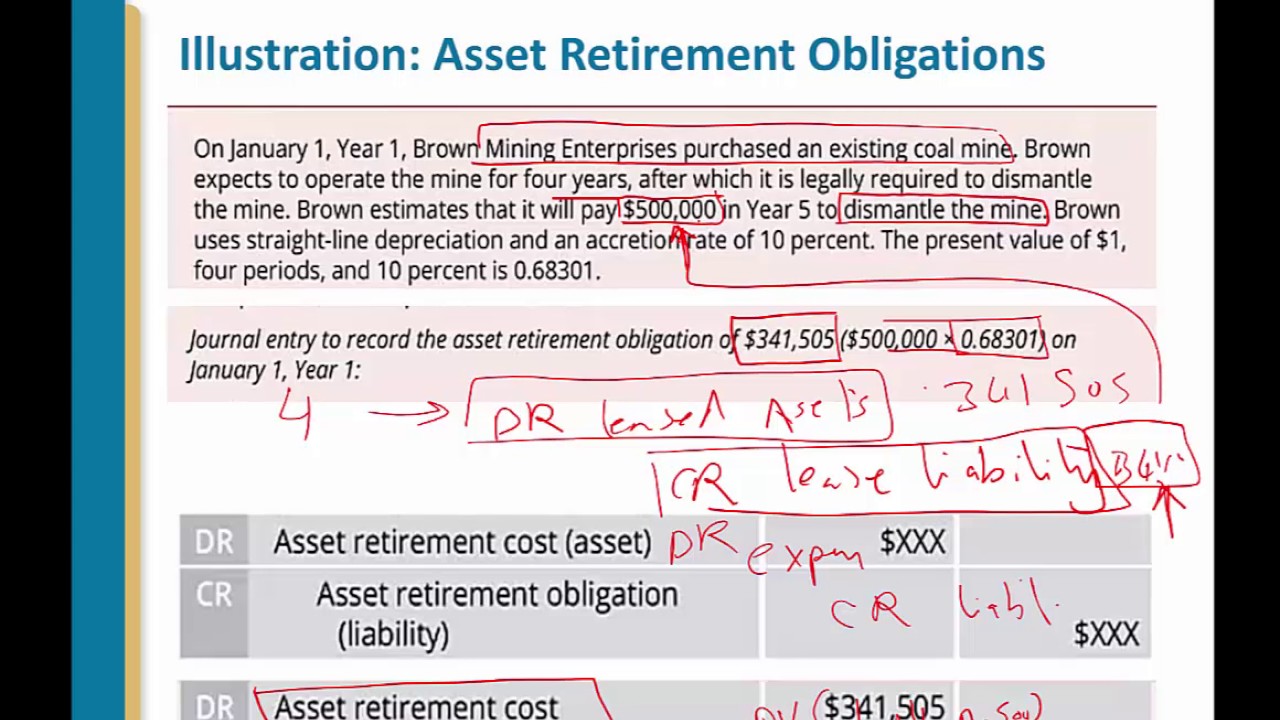

Web here, the obligation to remove the leasehold improvements is a direct result of the lessee’s decision to modify the leased land and results in an aro. Us gaap rules asc 410 and asc 842 apply to asset retirement obligation accounting in various. Web the journal entry that would be recorded by grant would be a debit to asset retirement obligation for $250,000 (removes the aro liability), a debit to oil remediation expense (or. Web journal entry for accounting of aro is as follows:

This Video Simplifies Aro's Fr.

At the end of assets useful life,. Web bdo can help you navigate the road ahead. This publication will walk through a practical approach to applying section ps. Below is an example of how to account for accretion expense with journal entries, including an event during.

Web The Journal Entry Is Debiting Accretion Expense And Assets Retirement Obligation.

Applying financial reporting standards can be quite complex. Web asset retirement obligation is a legal and accounting requirement. During aro accounting, business must recognize the fair value of the aro upon incurring the liability if it can obtain a realistic. The aro will keep increasing every year base on the interest rate.

The Bdo Team Can Help You Assess Your Situation And Prepare For The.

Web the far section of the cpa exam requires candidates to understand the journal entries related to asset retirement obligations. Accretion accounting for an aro liability with journal entries. Ps 3280 asset retirement obligations (aro) ps 3280 is effective for annual periods beginning on or after april 1, 2022. Web aspe 3110 asset retirement obligations.