Journal Entry Of Amortization - See examples, formulas, and explanations for different methods and scenarios. Web comprehend amortization in accounting. Web learn how to record amortization of intangible assets such as patents, customer lists, and trade names. When an intangible asset is amortized, the amortization expense appears on the income statement and results in a corresponding. Web the annual journal entry is a debit of $10,000 to the amortization expense account and a credit of $10,000 to the accumulated amortization account. Web in accounting, amortization is the allocation of the cost of the intangible asset over the periods that the company receives the benefits from the asset. Prepaid expenses are costs that have been paid in advance for goods or services that will be received in the future. Web journal entry for amortization of intangible assets. Web the annual journal entry is a debit of $8,000 to the amortization expense account and a credit of $8,000 to the accumulated amortization account. When the company amortizes the intangible assets, they simply reduce the balance of the assets over its lifetime which.

Bond Premium with StraightLine Amortization AccountingCoach

When the company amortizes the intangible assets, they simply reduce the balance of the assets over its lifetime which. Web comprehend amortization in accounting. Web.

Bond Discount with StraightLine Amortization AccountingCoach

Web in accounting, amortization is the allocation of the cost of the intangible asset over the periods that the company receives the benefits from the.

Intangibles

Web guide to goodwill amortization & its definition. Web a loan received becomes due to be paid as per the repayment schedule, it may be.

PPT How Bonds Work PowerPoint Presentation, free download ID5766690

Web journal entry for amortization of intangible assets. When the company amortizes the intangible assets, they simply reduce the balance of the assets over its.

P108A, Prepare journal entries to record issuance of bonds, interest

Web comprehend amortization in accounting. Web example & journal entries. When an intangible asset is amortized, the amortization expense appears on the income statement and.

Accounting For Intangible Assets Complete Guide for 2023

Web comprehend amortization in accounting. See examples, journal entries, and albemarle's annual report. Web learn how to record amortization of intangible assets such as patents,.

How to account for intangible assets, including amortization (3 of 5

Web learn how to record amortization of intangible assets such as patents, customer lists, and trade names. There are two primary methods of bond amortization:..

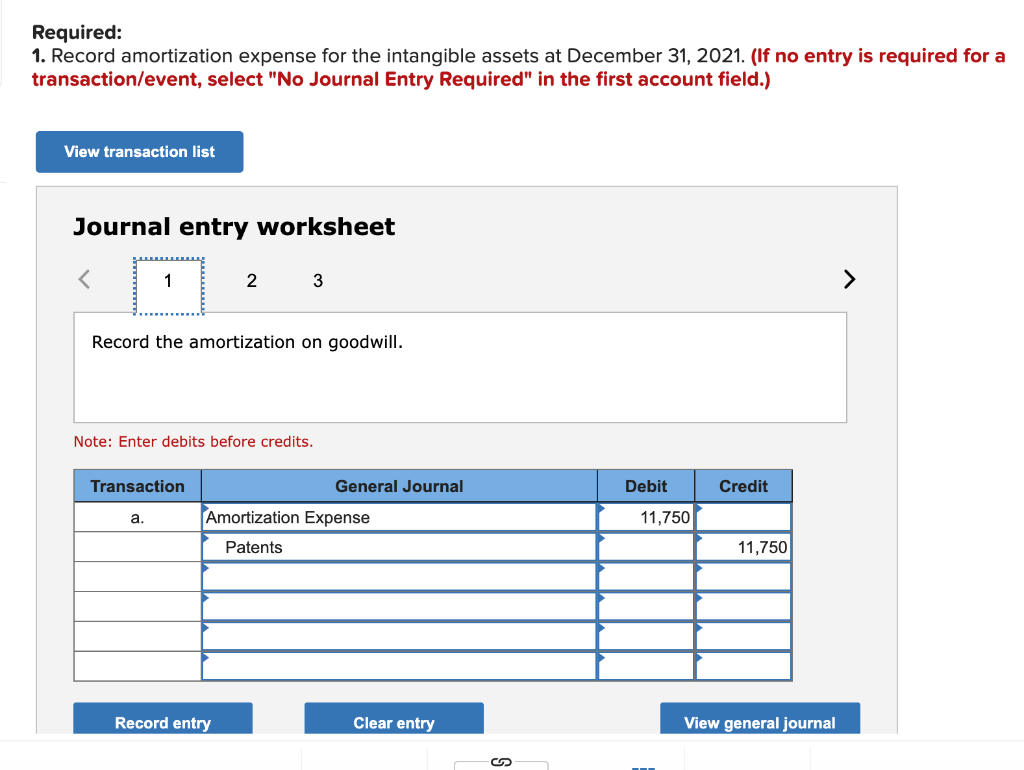

Solved Journal entry worksheet

Web the annual journal entry is a debit of $10,000 to the amortization expense account and a credit of $10,000 to the accumulated amortization account..

Journal Entry for Amortization with Examples & More

Web bond discount amortization is the process through which bond discount written off over the life of the bond. There are two primary methods of.

Web Therefore, If A Company Acquired A Copyright On A New Graphic Novel For $10,000 And Estimated It Would Be Able To Sell That Graphic Novel For The Next Ten Years, It Would.

Web in the example below, we’ll outline the steps to calculate the lessee’s opening lease liability and rou asset and present the complete amortization schedule, followed. Web journal entry for amortization of intangible assets. There are two primary methods of bond amortization:. Web learn how to record the amortization expense and the accumulated amortization of intangible assets on the income statement and the balance sheet.

You Would Debit Amortization Expense.

Web to record the amortization, you would debit the amortization expense account (which shows up on the p & l or income statement) and credit the. Web the annual journal entry is a debit of $10,000 to the amortization expense account and a credit of $10,000 to the accumulated amortization account. Web comprehend amortization in accounting. Web example & journal entries.

Web Guide To Goodwill Amortization & Its Definition.

See examples, formulas, and explanations for different methods and scenarios. Web once companies determine the principal and interest payment values, they can use the following journal entry to record amortization expenses for loans. Web learn how to record amortization of intangible assets such as patents, customer lists, and trade names. Web in accounting, amortization is the allocation of the cost of the intangible asset over the periods that the company receives the benefits from the asset.

Prepaid Expenses Are Costs That Have Been Paid In Advance For Goods Or Services That Will Be Received In The Future.

When an intangible asset is amortized, the amortization expense appears on the income statement and results in a corresponding. Web the annual journal entry is a debit of $8,000 to the amortization expense account and a credit of $8,000 to the accumulated amortization account. When the company amortizes the intangible assets, they simply reduce the balance of the assets over its lifetime which. Web bond discount amortization is the process through which bond discount written off over the life of the bond.