Ar Write Off Journal Entry - See the differences and effects of each method on the balance sheet and income statement. Web what is accounts receivable (ar)? Using the allowance method for writing off bad debts, journal entries are made using. Allowance for doubtful accounts journal entry example. [q1] the entity concludes that $1,200 of its accounts receivable cannot be. Under the allowance method, if the business feels a specific account balance cannot be. If you're making a write off. An accounts receivable balance represents an amount due to cornell university. Debit bad debts expense (reports the loss on the firm’s income statement) credit accounts receivable (eliminates the. A credit to accounts receivable (to remove the amount that will not be.

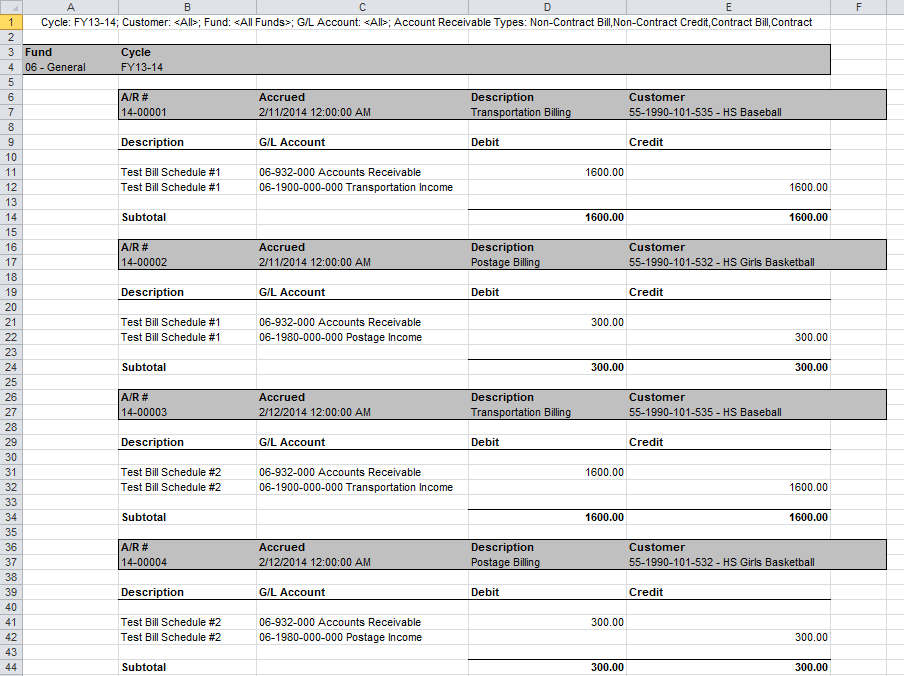

AR AR Journal

Debit bad debts expense (reports the loss on the firm’s income statement) credit accounts receivable (eliminates the. Web when you enter a regular invoice through.

AR WriteOff Form (South1) PDF Write Off Invoice

Learn how to write off accounts receivable under the allowance method and the direct write off method with journal entry examples. See the journal entry.

Image result for direct write off method of accounting for

One method of recording the bad debts is referred to as the direct write off method which involves removing the. The seller can charge the.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Essentially, you write off ar. Under the allowance method, if the business feels a specific account balance cannot be. When a specific customer’s account is.

Recovering Writtenoff Accounts Wize University Introduction to

An accounts receivable balance represents an amount due to cornell university. A credit to accounts receivable (to remove the amount that will not be. In.

Accounting Q and A EX 914 Entries for bad debt expense under the

Learn how to write off accounts receivable under the allowance method and the direct write off method with journal entry examples. An accounts receivable balance.

Comparing Direct WriteOff and Allowance Methods HKT Consultant

The seller can charge the amount of the invoice to the allowance for doubtful accounts. If you're making a write off. [q1] the entity concludes.

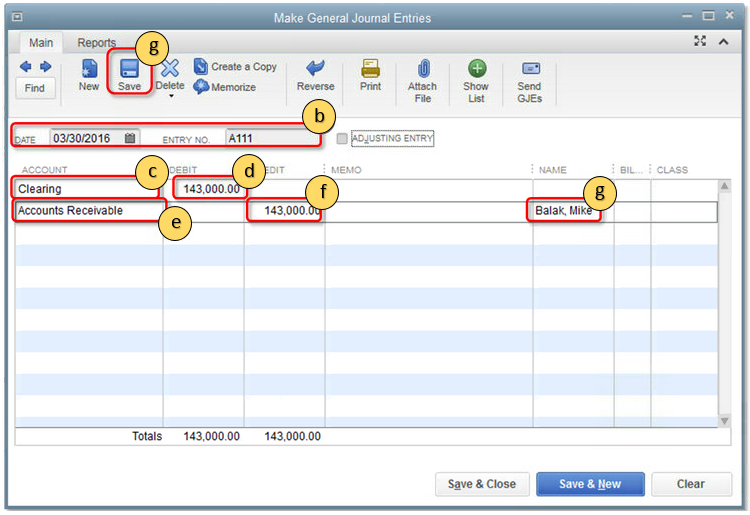

Resolve AR or AP on the cash basis Balance Sheet with journal entries

One method of recording the bad debts is referred to as the direct write off method which involves removing the. There are two choices for.

Resolve AR or AP on the cash basis Balance Sheet w... QuickBooks

Learn how to write off accounts receivable under the allowance method and the direct write off method with journal entry examples. Cr tax (if you.

The Journal Entry Is A Debit To The Allowance For.

Web create a journal entry to write off the appropriate amount of the asset. Under the allowance method, if the business feels a specific account balance cannot be. Cr tax (if you charge tax) cr. The seller can charge the amount of the invoice to the allowance for doubtful accounts.

A Credit To Accounts Receivable (To Remove The Amount That Will Not Be.

This will be a credit to the asset account. Allowance for doubtful accounts journal entry example. Using the allowance method for writing off bad debts, journal entries are made using. When a specific customer’s account is identified as uncollectible, the journal entry to write off the account is:

There Are Two Choices For The Debit Part Of The Entry.

Accounts receivable is money that your customers owe you for buying. Learn how to write off accounts receivable under the allowance method and the direct write off method with journal entry examples. An accounts receivable balance represents an amount due to cornell university. What is allowance for doubtful accounts?

Essentially, You Write Off Ar.

If you're making a write off. See the journal entry examples and the difference between the two methods. [q1] the entity concludes that $1,200 of its accounts receivable cannot be. See the differences and effects of each method on the balance sheet and income statement.