Amortization Journal Entry Patent - The initial value of the asset. Web amortization journal entries for vendor bills typically debit expense accounts and credit deferred expense accounts. Web amortization = $50,000/ 5 years = $10,000/year. Define patents as a type of intangible asset. For intangible assets, knowing the exact starting cost isn’t always easy. Web amortization expense is the income statement item that represents the allocated cost of the intangible asset for the period. You can also get to this page directly from your dashboard. To record an amortization journal entry, find: For example, on january 01, we have bought the patent for one of our products for $50,000 in cash. After calculating the amortization for the intangible asset based on the method used, companies can record the expense using the following journal entry.

Cómo calcular la amortización de una patente 10 pasos

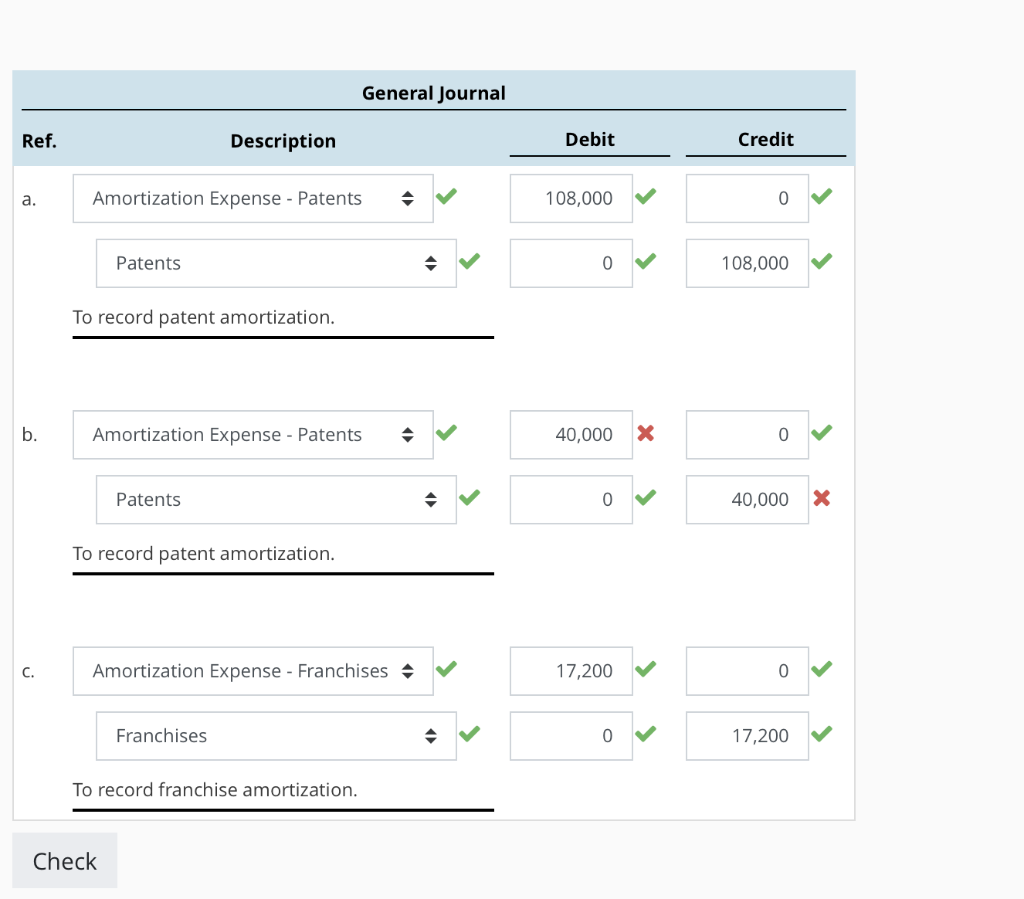

If a patent cost $40,000 and has a useful life of 10 years, the journal entries to record the patent and periodic amortization (assuming a.

How to Calculate Amortization on Patents 10 Steps (with Pictures)

The bookkeeping double entry would be: Web one way to record amortization expense of $10,000 is to debit amortization expense for $10,000 and credit accumulated.

Journal Entry for Amortization with Examples & More

Report the preliminary patent price on the corporate ledger as an asset. Web one way to record amortization expense of $10,000 is to debit amortization.

Breathtaking Amortization Of Patent Cash Flow Statement Financing

The entry is used to spread the cost of the asset over its expected life. The bookkeeping double entry would be: Define patents as a.

Solved Amortization Expense For each of the following

The accountant, or the cpa, can pass this as an annual journal entry in the books, with debit and credit to the defined chart of.

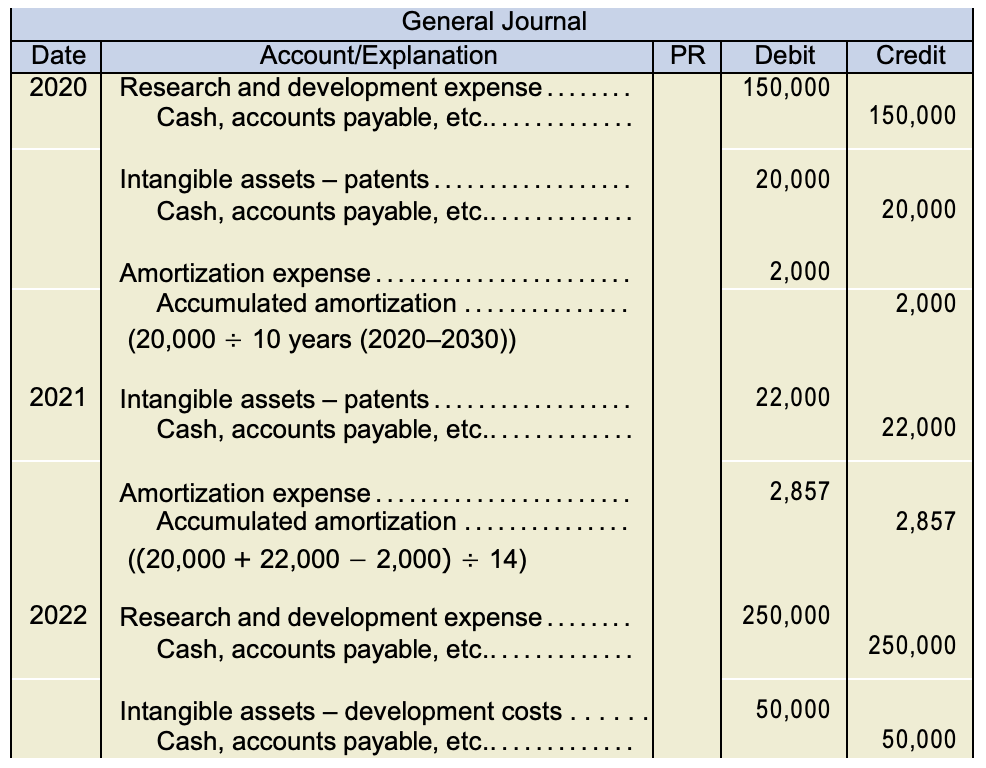

Intangibles

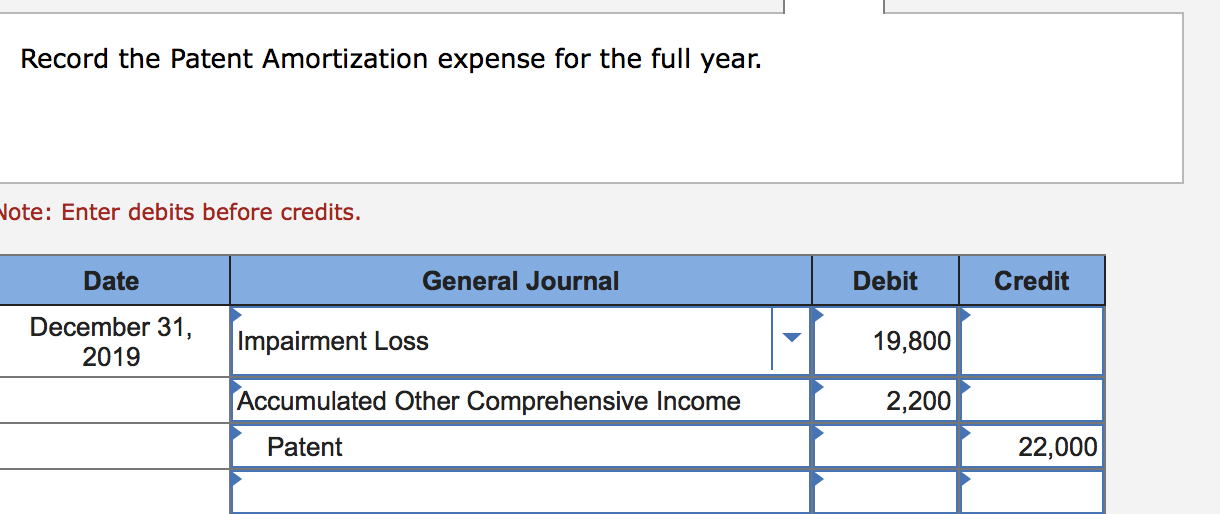

If a patent no longer provides value, or a reduced level of value, recognize an impairment to reduce or eliminate the carrying amount of the.

Chapter 10, Problem 25E Bookmark Show all steps O ON Problem Handling

Web it is simply presented as below: After calculating the amortization for the intangible asset based on the method used, companies can record the expense.

Solved Amortization Expense For Each Of The Following Unr...

Web it is simply presented as below: Web like copyrights, patents are amortized over their useful life, which can be shorter than twenty years due.

Chapter 11 Intermediate Financial Accounting 1

To record an amortization journal entry, find: For example, on january 01, we have bought the patent for one of our products for $50,000 in.

You Must Record All Amortization Expenses In Your Accounting Books.

The entry to record the purchase is: You can also get to this page directly from your dashboard. The residual value of the asset. Bought a license that costs $10,000.

Show The Entry For Amortization Expense Charged Each Year On The Patent.

For example, if the annual amortization expense were $5,000, you would enter a debit to the amortization expense account of $5,000, and a credit to the patent asset. Assume mech tech purchased the patent for a new pump system. Web let us understand the journal entry to amortize a patent with an example. The entry is used to spread the cost of the asset over its expected life.

The Lifespan Of The Asset.

Web the journal entry for the patent amortization will increase the total amortization expenses on the income statement while decreasing the total assets on the balance sheet by the same amount. The initial value of the asset. The formula used for calculating amortization expense for a particular period depends on the amortization method used. Include an annual entry for amortization expenses that reduces.

Web Amortization Journal Entries For Vendor Bills Typically Debit Expense Accounts And Credit Deferred Expense Accounts.

The license will expire in 10 years. For intangible assets, knowing the exact starting cost isn’t always easy. Web it is simply presented as below: If a patent no longer provides value, or a reduced level of value, recognize an impairment to reduce or eliminate the carrying amount of the asset.