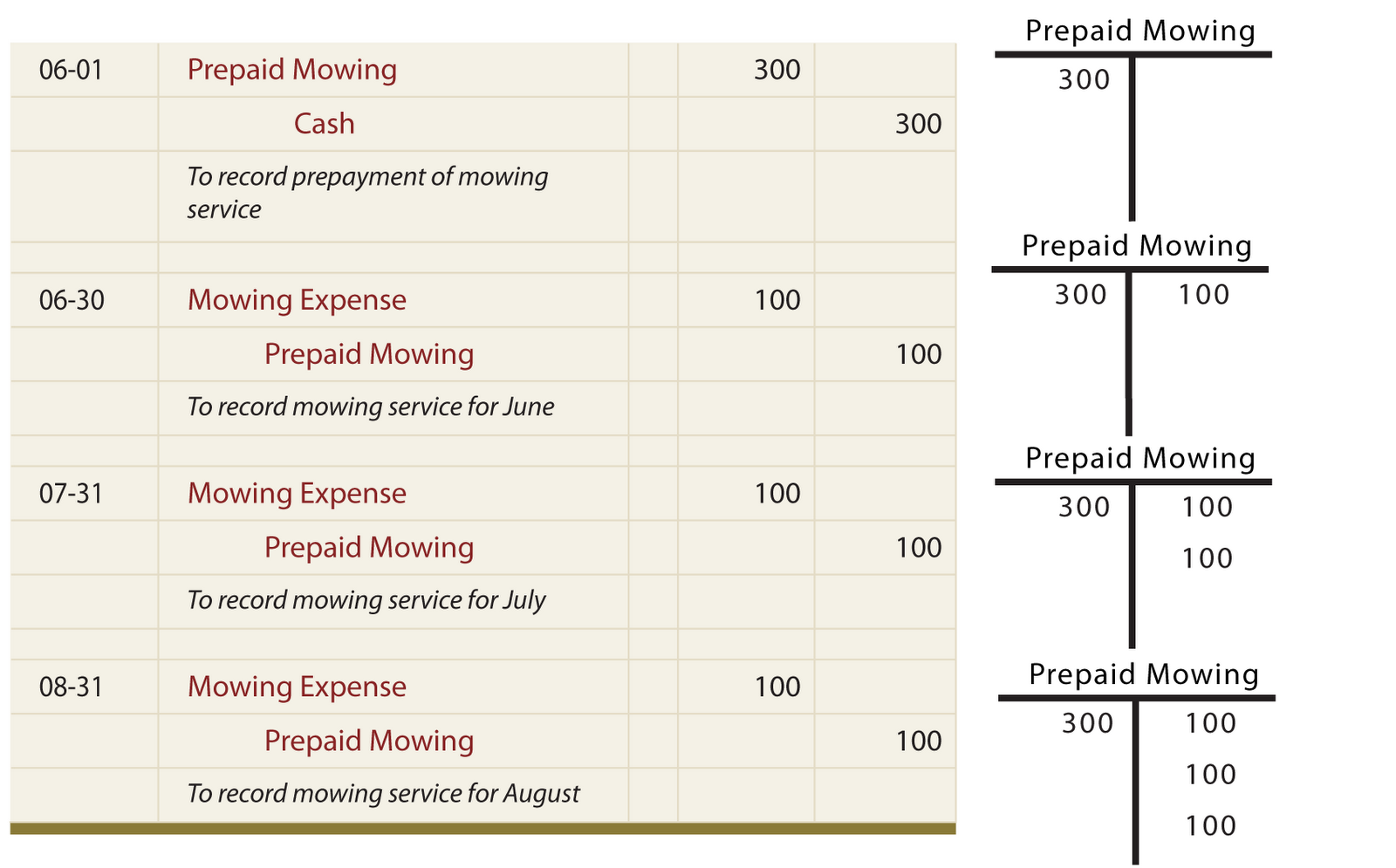

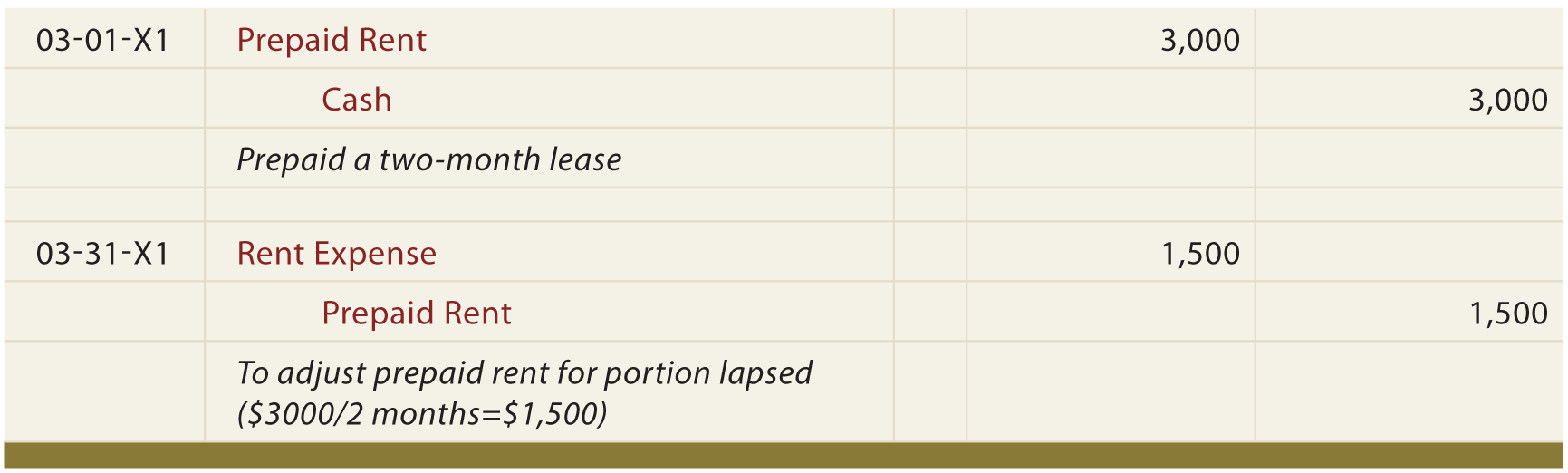

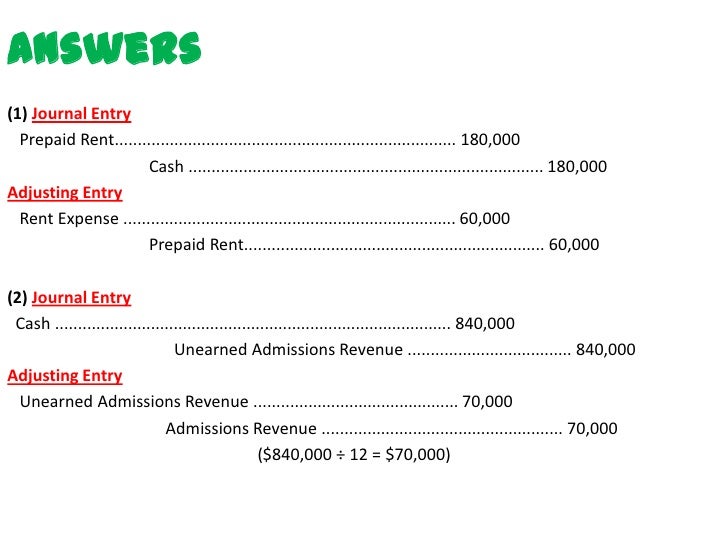

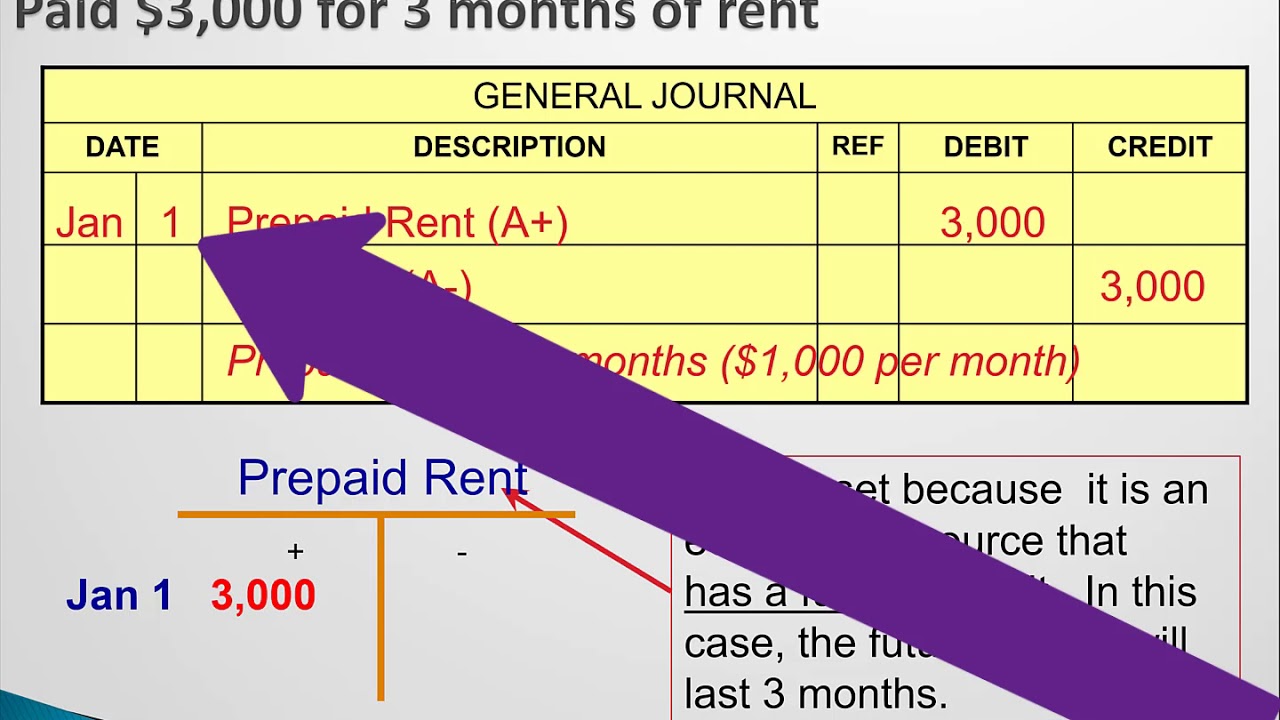

Prepaid Rent Journal Entry - Web in accounting, the rent paid in advance is an asset, not an expense, as the amount paid represents the advance payment for the future use of the rental property such as office. Jane rented office space and she paid 4. A prepayment transaction is recorded initially by debiting an asset account (such as prepaid insurance,. Prepaid rent is a current asset. Web the journal entry for company would be as follows: The journal entry in month 1 for this would be prepaid rent increasing by. Web learn how to record prepaid rent in the balance sheet and the rent expense account using journal entries. So the credit in the journal entry is minus $1,500 in the accounting. Web learn how to record prepaid expenses, such as prepaid rent and prepaid insurance, in accounting. See an example of prepaid rent accounting and the difference between.

Journal Entry For Prepaid Expenses

See examples, rules and presentation of rent expense in the financial statements. Web in accounting, the rent paid in advance is an asset, not an.

Prepaid Salary Journal Entry

So the credit in the journal entry is minus $1,500 in the accounting. See examples of journal entries, how to record prepaid rent as part.

Journal Entry For Advance Rent Received Info Loans

See examples of journal entries, how to record prepaid rent as part of the rou asset,. Web prepaid expense journal entry. Web the adjusting entry.

Prepaid Salary Journal Entry

Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Web learn how to record a prepaid.

Journal Entry For Advance Rent Received Info Loans

See journal entries for cash, cheque, and lease payments, and how to. Web the adjusting entry for prepaid expense depends upon the journal entry made.

Journal entries for lease accounting

Web accounting for prepayments involves the following journal entries: Prepaid rent is a current asset. Debit all expenses and losses) example. Web prepaid expense journal.

Self Study Notes The Adjusting Process And Related Entries

In this blog, we will go through what happens in the case of prepaid rent or expenses, how they affect lease. Web learn how to.

Section 4

In this blog, we will go through what happens in the case of prepaid rent or expenses, how they affect lease. See the accounting equation,.

What is the ledger account for the following journal entries 1 Prepaid

Debit all expenses and losses) example. Web learn how to record prepaid rent in accounting, from the initial transaction to the monthly amortization, and how.

Web July 5, 2023 By Financial Reporter.

There are two ways of recording prepayments: Web learn how to account for prepaid expenses, such as prepaid rent, under accrual and cash basis, and see examples of journal entries. Web the journal entry for company would be as follows: See examples of prepaid rent payment and expense transactions.

Web Prepaid Expense Journal Entry.

See journal entries for cash, cheque, and lease payments, and how to. A prepayment transaction is recorded initially by debiting an asset account (such as prepaid insurance,. See examples of journal entries, how to record prepaid rent as part of the rou asset,. Suppose company a paid 6 months upfront for office rent worth $12,000.

Web Learn How To Record Prepaid Rent In The Accounting Books With Journal Entries And The Accounting Equation.

Web learn how to record prepaid rent as an asset and expense in accounting with journal entries and examples. In the first scenario, the is paid rent in cash, drawing down on the bank account. Web learn how to record prepaid rent in the balance sheet and the rent expense account using journal entries. See examples of journal entries for prepaid rent, insurance,.

Web Learn How To Record A Prepaid Expense For Rent Paid In Advance With Two Journal Entries.

So the credit in the journal entry is minus $1,500 in the accounting. Prepaid rent is the amount the company pays in advance to use. See the journal entries, adjusting entries, and effects on financial statements. Web learn how to record prepaid rent in accounting, from the initial transaction to the monthly amortization, and how to report it in financial statements.