Amortization Expense Journal Entry - What is considered a lease under ifrs 16? See examples, journal entries, and albemarle's annual report. Furthermore, the amortization expense is given by the formula above and is. Web amortisation or amortization, is the reduction in value of an intangible asset with a finite useful life over time. Web examples of prepaid expenses. Web the amortization formula is as follows: Web learn what amortization expense is, how to calculate it, and how to record it in journal entries. You must record all amortization expenses in your accounting books. The amortization expense will go straight to the income. Web an amortization table calculates the allocation of interest and principal for each payment and is used by accountants to make journal entries.

Amortization Expense Journal Entry

What is considered a lease under ifrs 16? See the journal entry format, the calculation formula, and a practical. Learn the different methods to amortize.

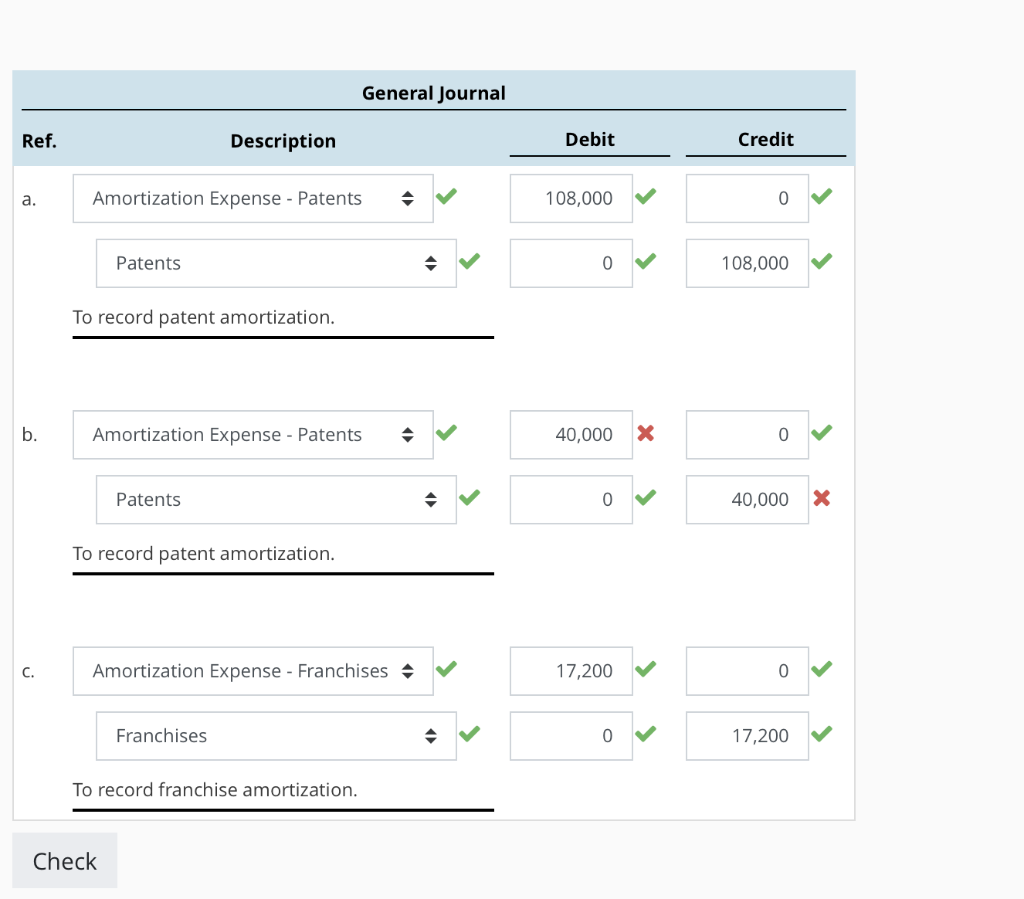

P108A, Prepare journal entries to record issuance of bonds, interest

Web examples of prepaid expenses. Web learn how to account for amortization expense, the periodic allocation of cost of intangible assets over their useful life..

How to make an amortization schedule using excel rewacam

Web learn how to record amortization of intangible assets such as patents, customer lists, and trade names. This guide also explains how amortization expense impacts.

Intangibles

Web the journal entry to recognize amortization expense of $50,000 would be a debit to amortization expense, offset by a credit to the asset being.

Solved Amortization Expense For each of the following

Web in this case the intangible asset journal entry to record the purchase of the asset would be as follows: You would debit amortization expense..

Journal Entry Examples

Web entering an amortization journal entry. When entering an amortization expense journal entry, it is important to remember that the balance sheet and income statement.

Journal Entry for Amortization with Examples & More

Learn the different methods to amortize an intangible asset. Its calculation is similar to that of straight line depreciation for a. You must record all.

How to account for intangible assets, including amortization (3 of 5

See the journal entry format, the calculation formula, and a practical. Its calculation is similar to that of straight line depreciation for a. Web amortisation.

Excel for All Prepaid expense amortization template to automate your

Web in this case the intangible asset journal entry to record the purchase of the asset would be as follows: Web therefore, if a company.

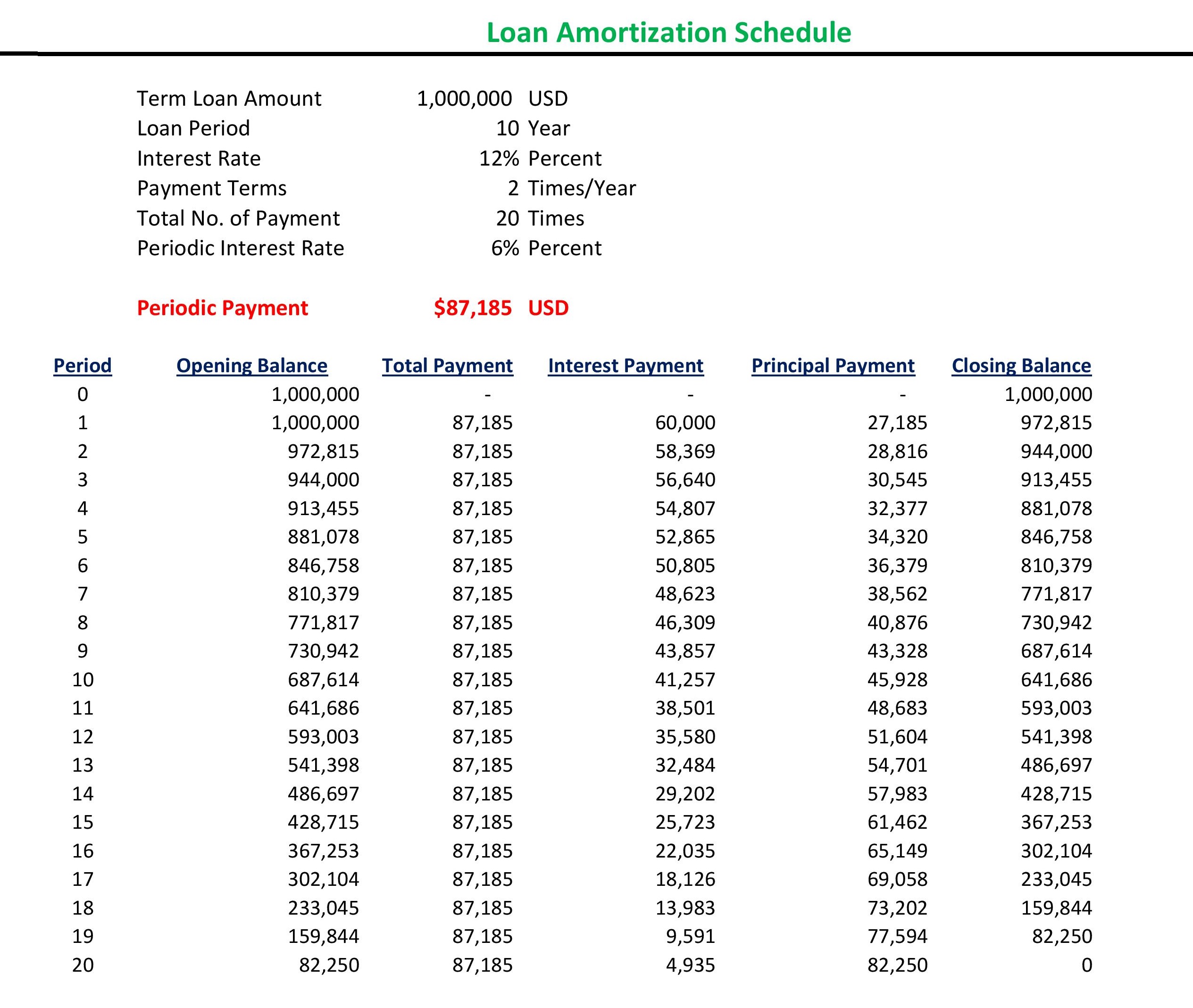

Web An Amortization Table Calculates The Allocation Of Interest And Principal For Each Payment And Is Used By Accountants To Make Journal Entries.

You must record all amortization expenses in your accounting books. Web amortisation or amortization, is the reduction in value of an intangible asset with a finite useful life over time. The amortization expense will go straight to the income. Its calculation is similar to that of straight line depreciation for a.

Intangible Assets Usually Do Not Have Residual Value.

See an example of amortization expense for a taxi license and the. Learn the different methods to amortize an intangible asset. Web the amortization formula is as follows: You would debit amortization expense.

The Amortization Expense Will Increase $ 5,000 On The Income.

The initial value of the. Web in this case the intangible asset journal entry to record the purchase of the asset would be as follows: What is amortization in accounting?. Web learn how to record amortization expense for intangible assets like patents, trademarks, or goodwill.

What Is Considered A Lease Under Ifrs 16?

Ifrs 16 finance lease example (lessee) amortization schedule. Web learn how to account for amortization expense, the periodic allocation of cost of intangible assets over their useful life. Web therefore, if a company acquired a copyright on a new graphic novel for $10,000 and estimated it would be able to sell that graphic novel for the next ten years, it would. When entering an amortization expense journal entry, it is important to remember that the balance sheet and income statement are.