Amortisation Journal Entry - Web accounting & journal entry for amortization. What is considered a lease under ifrs 16? If so, you would /should have debited the asset account, and. Have you already recorded the purchase of the asset? Web the annual journal entry is a debit of $8,000 to the amortization expense account and a credit of $8,000 to the accumulated amortization account. Amortization, in accounting, refers to the technique used by companies to lower the carrying value of either an intangible asset. How was this asset aquired? Web amortisation or amortization, is the reduction in value of an intangible asset with a finite useful life over time. Web the journal entry is debiting amortization expense and credit accumulated amortization. The amortization expense will go straight to the income.

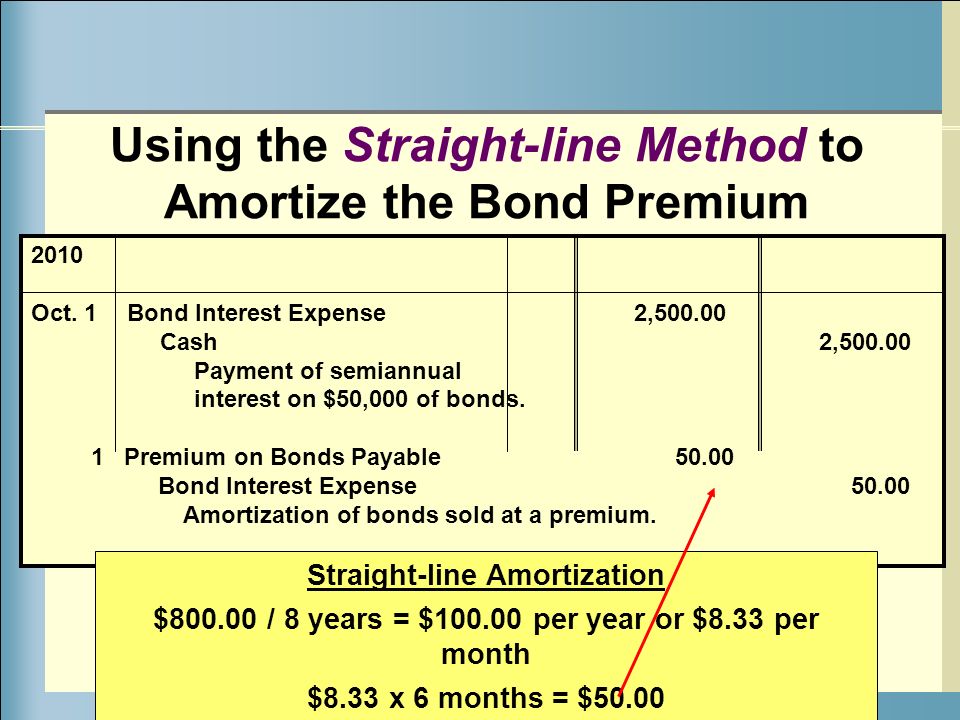

P108A, Prepare journal entries to record issuance of bonds, interest

The amortization expense will go straight to the income. Web each journal entry to record the periodic interest expense recognition would vary, and can be.

Journal Entry for Amortization with Examples & More

Web amortization expense is the income statement item that represents the allocated cost of the intangible asset for the period. If a patent cost $40,000.

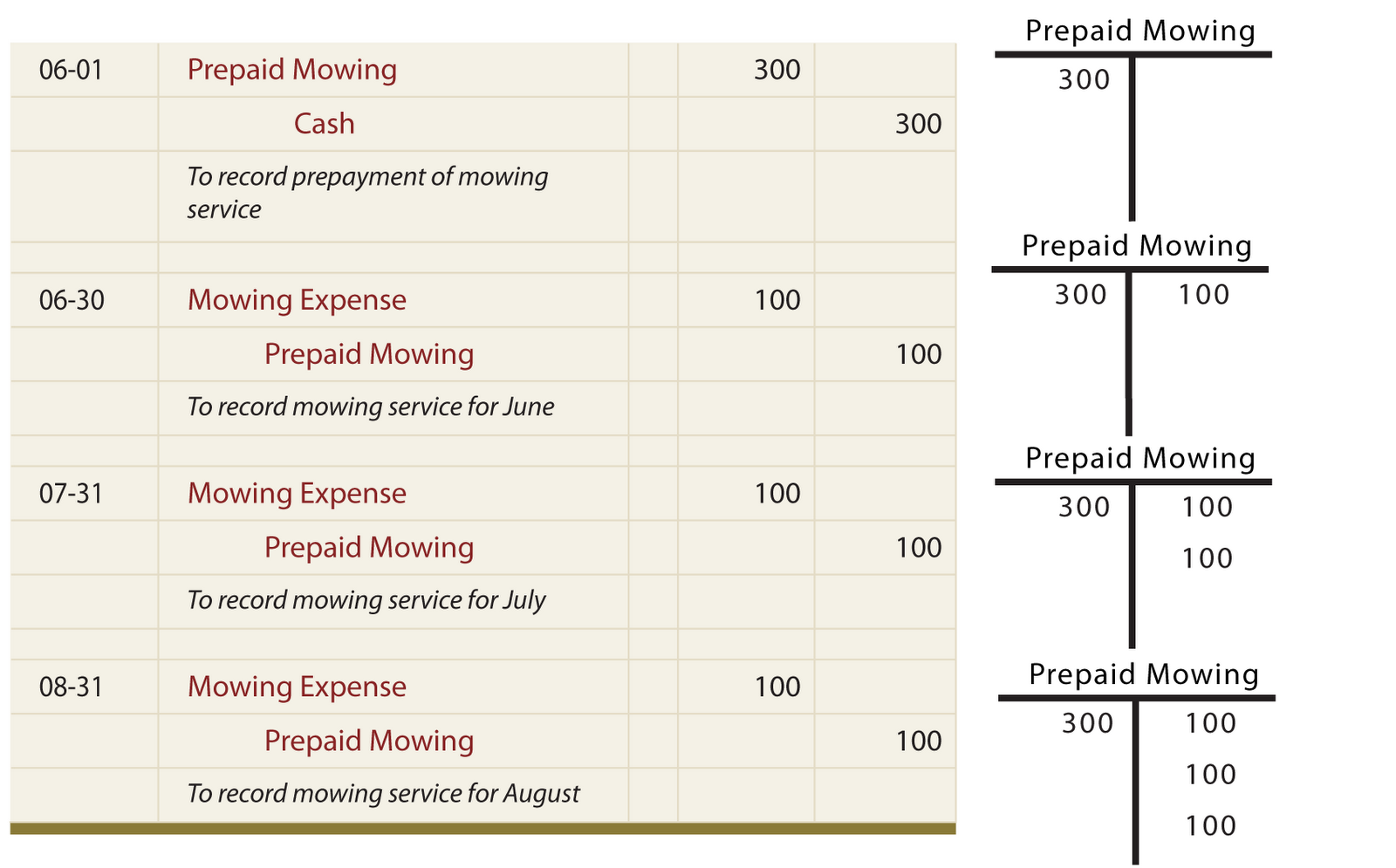

Journal entries for lease accounting

Web the journal entry is debiting amortization expense and credit accumulated amortization. Have you already recorded the purchase of the asset? Web the journal entry.

Patent In Accounting vlr.eng.br

Web amortization expense is the income statement item that represents the allocated cost of the intangible asset for the period. Web an amortization table calculates.

Amortization Expense Journal Entry

Web the annual journal entry is a debit of $8,000 to the amortization expense account and a credit of $8,000 to the accumulated amortization account..

PPT How Bonds Work PowerPoint Presentation, free download ID5766690

Ifrs 16 finance lease example (lessee) amortization schedule. Have you already recorded the purchase of the asset? It’s calculated by taking the difference between the.

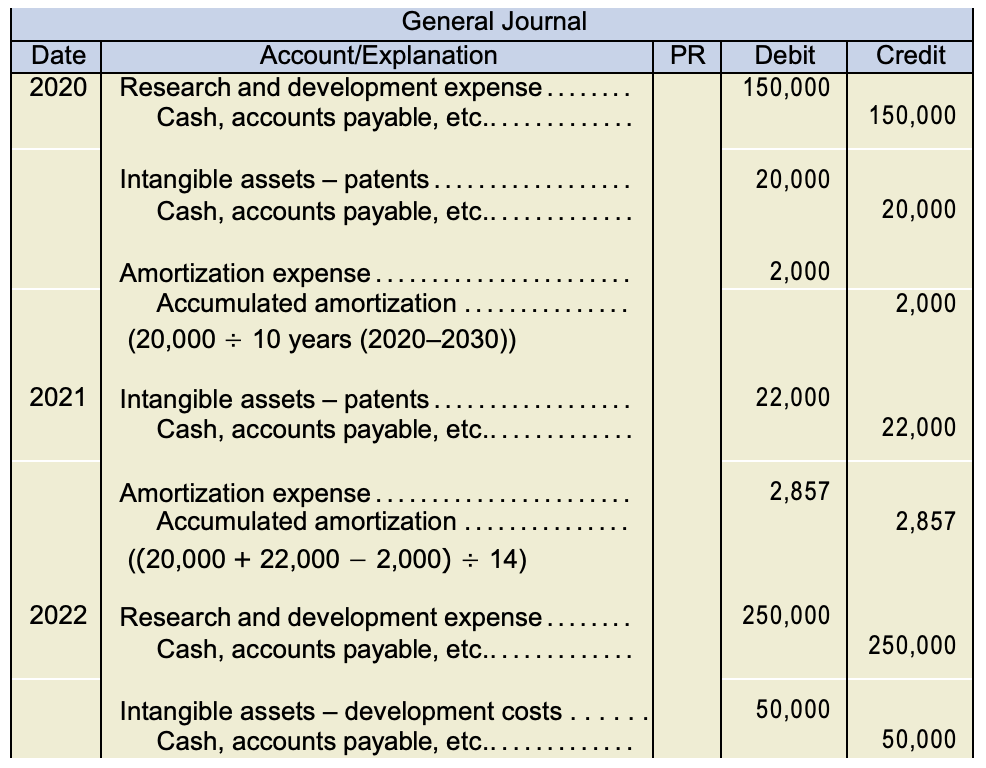

Chapter 11 Intermediate Financial Accounting 1

Web accounting & journal entry for amortization. Assuming you understand how to calculate the annual amortization expense, the journal entry to record the expense is..

Bond Discount or Premium Amortization Business Accounting

Web the journal entry is debiting amortization expense and credit accumulated amortization. Assuming that no contra account was prepared and the reduction was done directly.

Accounting For Intangible Assets Complete Guide for 2023

Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use. Web the firm would amortize.

Web The Firm Would Amortize The Cost Of A Purchased Patent Over Its Finite Life Which Reasonably Would Not Exceed Its Legal Life.

Web an amortization table calculates the allocation of interest and principal for each payment and is used by accountants to make journal entries. Assuming you understand how to calculate the annual amortization expense, the journal entry to record the expense is. The initial value of the. Web amortization is the process of gradually writing off an asset's initial cost, and it only applies to intangible assets.

How Was This Asset Aquired?

You must record all amortization expenses in your accounting books. It does not apply to intangible assets with infinite useful life, such as goodwill. Web amortization applies to only those intangible assets that have a finite useful life. Web the journal entry is debiting amortization expense and credit accumulated amortization.

Web What Is The Amortization Expenses?

The amortization expense will go straight to the income. Have you already recorded the purchase of the asset? Web when the prepaid expense is used or consumed, it is then recorded as an expense on the income statement. Its calculation is similar to that of straight line depreciation for a.

Web Amortisation Or Amortization, Is The Reduction In Value Of An Intangible Asset With A Finite Useful Life Over Time.

Web amortization expense is the income statement item that represents the allocated cost of the intangible asset for the period. Web the journal entry of amortization expense will debit the expense and credit the accumulated amortization. Web the annual journal entry is a debit of $8,000 to the amortization expense account and a credit of $8,000 to the accumulated amortization account. It’s calculated by taking the difference between the asset's cost and.