Accrued Salary Journal Entry - Explanation example journal entries to record accrued expenses accrued expenses faqs. Journal entry for accrued income. Web journal entry for salary expense. Web accrued wages entry. As we know, the recording in the financial. The transaction will increase the bonus expense and current liability. See the journal entries for calculating and paying accrued wages with an example and explanation. Web learn what accrued salary is, how to record it in the income statement and the balance sheet, and how to adjust it when the salary is paid or overestimated. Accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not have been paid for yet. It is treated as an asset for the business.

How to Adjust Journal Entry for Unpaid Salaries

The company can make the accrued wages. Web updated on january 3, 2024. Web journal entry for salary expense. Accrued salaries are payroll expenses that.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Edited by ashish kumar srivastav. In the july 31 adjusting entry, the company abc ltd. Web accrued payroll is the money that a business owes.

Accrued Salary Journal Entry YouTube

See the journal entries for calculating and paying accrued wages with an example and explanation. Accrued salaries are the amount that the company owes to.

Payroll Journal Entry Example Explanation My Accounting Course

Accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not have been.

Reversing Entries

Web it is income earned during a particular accounting period but not received until the end of that period. The company can make the accrued.

Record The Payment Of Accrued And Current Salaries Aulaiestpdm Blog

Can make the accrued expense of journal entry for the five days of wages as below: Accrued salaries are payroll expenses that have been incurred,.

Accrued Salaries Double Entry Bookkeeping

Web learn how to record accrued salaries as current liabilities using journal entries and balance sheet extracts. There are all kinds of accrued expenses your.

Journal Entries and Trial Balance in Accounting Video & Lesson

In the july 31 adjusting entry, the company abc ltd. Web the journal entry to record accrued salaries involves debiting the salaries expense account and.

Accruals and Prepayments Journal Entries HeathldDunn

Explanation example journal entries to record accrued expenses accrued expenses faqs. The company can make the accrued wages. Web the journal entry is debiting bonus.

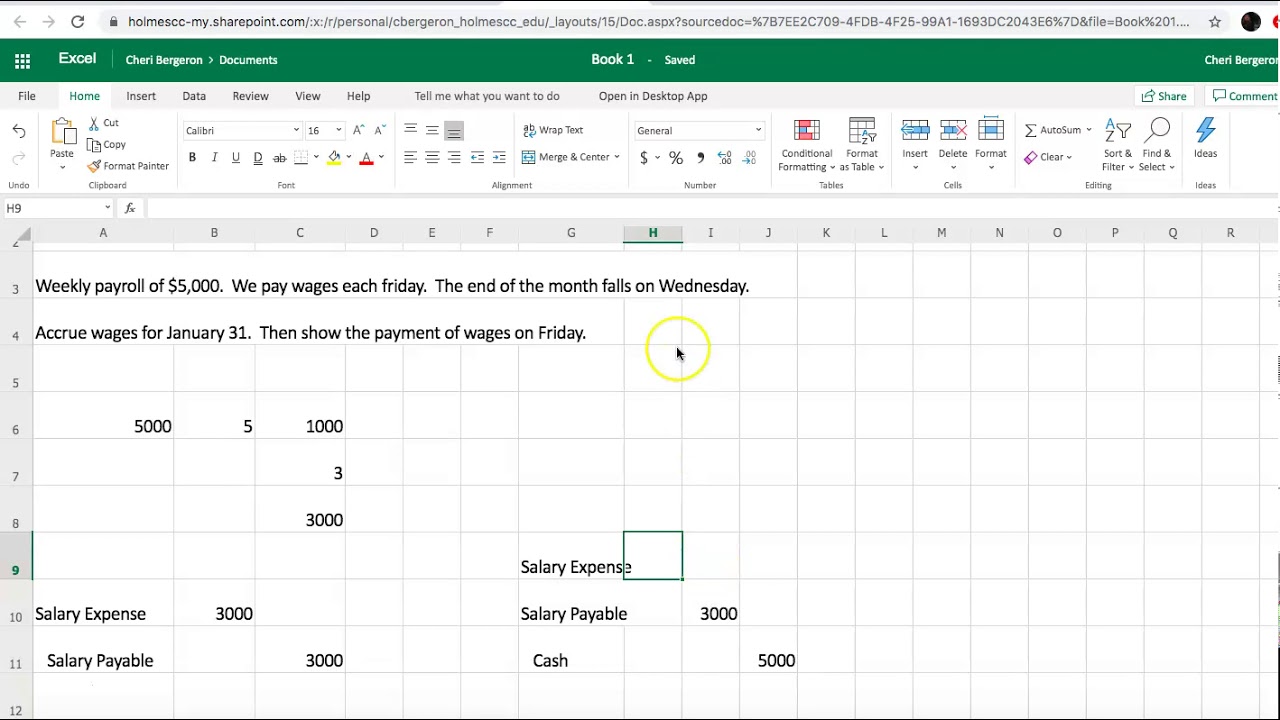

Web This Journal Entry Is Made To Eliminate The Wages Payable Of $3,000 That Company Abc Has Recorded In The January 31 Adjusting Entry.

Reviewed by dheeraj vaidya, cfa, frm. Web accrued payroll is the money that a business owes its employees for work performed during a given pay period but has not yet paid out. Journal entry for accrued income. Learn how to record accrued salaries and salaries paid in accounting with examples and journal entries.

Web Accrued Wages Entry.

Web learn how to record accrued salaries as current liabilities using journal entries and balance sheet extracts. Web an accrued expense is an expense that has been incurred within an accounting period but not yet paid for. Web when recording accrued salary expenses, a journal entry is made to record the amount of the expense. See the journal entries for calculating and paying accrued wages with an example and explanation.

Company Records Salary Expenses In The Monthly Income Statement Regardless Of The Payment.

In the july 31 adjusting entry, the company abc ltd. Edited by ashish kumar srivastav. It is one of the ways that a business. Web the journal entry to record accrued salaries involves debiting the salaries expense account and crediting the accrued salaries liability account.

Web Journal Entry For Salary Expense.

Can make the accrued expense of journal entry for the five days of wages as below: There may be an entry that is recorded at the end of each accounting period, and which is intended to record the amount of wages owed to. Accrued salaries are payroll expenses that have been incurred, but. Accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not have been paid for yet.