Accrual Journal Entry Examples - Adjusting entries at the end of the each accounting period to debit accrued accounts receivable and credit revenue. How to enter accruals in journal entries; Let’s assume that in march there was 30,000 as commission earned but not received due to business reasons. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. For example, in october 2020, the company abc has performed services to one of its customers that worth $500. What is the journal entry for the accrued revenue in the october 31 adjusting entry? Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Because they are still in progress, but no journal entry has been made yet. Accrued expense is the expense that has already incurred during the period but has not been paid for yet. The accounting entry required to bring accrued expenses to books is:

Accrual Accounting Concepts & Examples for Business NetSuite

The interest is charged at 1% per month. Web this is summarized in the table below. Web learn how to record accrued expenses with journal.

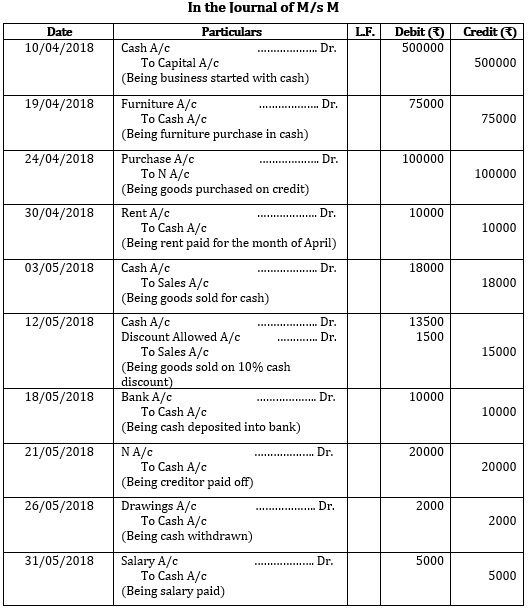

Journal Entry Problems and Solutions Format Examples MCQs

On 4 july 2014, at the time of actual payment is made, the following journal entry is made: Web to help guarantee compliance, cbp regulations.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

Web this article has been a guide to what are accrued revenue journal entries. See an example of accruing electricity expenses and paying the invoice.

Journal Entries and Trial Balance in Accounting Video & Lesson

Web how to enter accruals in journal entries. Web for example, if the company has provided a service to a customer but has not yet.

Accrued revenue how to record it in 2023 QuickBooks

How accrual basis accounting differs from cash basis accounting. See an example of accruing electricity expenses and paying the invoice later. On 4 july 2014,.

Accounting Journal Entries For Dummies

Let’s assume that in march there was 30,000 as commission earned but not received due to business reasons. Likewise, at the period end adjusting entry,.

Accruals and Prepayments Journal Entries HeathldDunn

For example, in october 2020, the company abc has performed services to one of its customers that worth $500. Web accounting for accrual of revenues.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web this article has been a guide to what are accrued revenue journal entries. Web in this article, we discuss the meaning of an accrued.

Journal Entries Accounting Examples

The effect of the above journal entry would be twofold: What is the journal entry for the accrued revenue in the october 31 adjusting entry?.

We Explain The Concept Along With Examples Of Adjusting Entries In Financial Statements.

Accrued expense is the expense that has already incurred during the period but has not been paid for yet. What is accrual basis of accounting? The accrued expense account (a newly opened account) with the amount of accrued expense in mr. The effect of the above journal entry would be twofold:

Now, You Can Record The Journal Entry In Your Accounting System.

For example, in october 2020, the company abc has performed services to one of its customers that worth $500. Adjusting entries at the end of the each accounting period to debit accrued accounts receivable and credit revenue. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. How accrual basis accounting differs from cash basis accounting.

Because They Are Still In Progress, But No Journal Entry Has Been Made Yet.

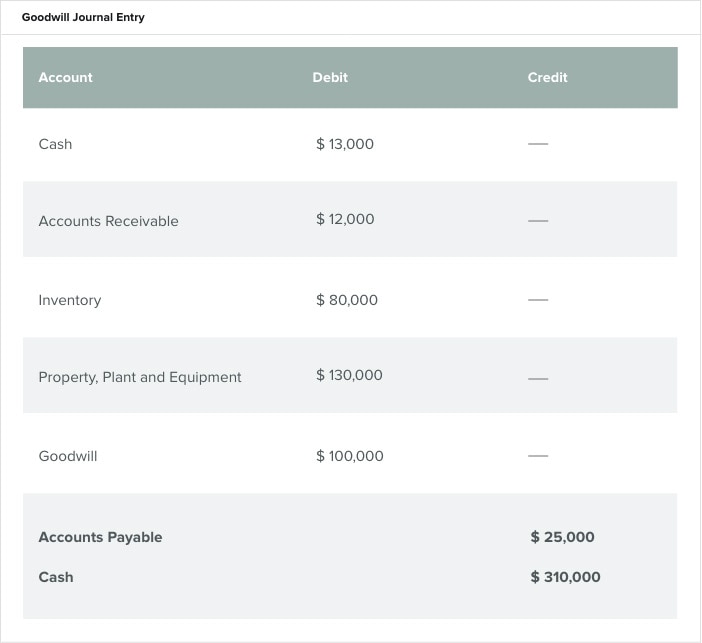

Accrued expenses are expenses incurred but not paid in the current year, such as interest, wages, utilities, etc. Web in this article, we discuss the meaning of an accrued expense journal entry, list the main types, explain the differences between accounts payable and accrued expenses, and provide practical examples. Web the concept of accruals is the basis of accrual accounting, in which a company’s revenue and expenses are recognized at the delivery of the good or service, rather than from the exchange of cash. Web journal entries to record accrued expenses.

An Example Of An Accrued Expense Might Include:

See an example of accruing electricity expenses and paying the invoice later. By definition, any revenue or expense recognized on a company’s income statement but not yet recorded in their corresponding accounts because of. The journal entry is made in the payroll journal, a subsidiary to the general ledger, for every payroll cycle. Accrual accounting requires revenues and expenses to be recorded in the accounting period that they are incurred.