Journal Entries Adjustments - What is an adjusting journal entry? Web definition and explanation: Web there are three general types of entry adjustments, those being: The accrual accounting method is the process of recording a business’ transactions when an event occurs, rather than when a cash. Web journal entries are recorded when an activity or event occurs that triggers the entry. Web an adjusting journal entry is a financial record you can use to track unrecorded transactions. Accrued incomes, incomes received in advance, outstanding and prepaid expenses require an adjustment in the books of accounts. It is a result of accrual. Web accrue means “to grow over time” or “accumulate.” accruals are adjusting entries that record transactions in progress that otherwise would not be recorded because they are not yet complete. Recording transactions in your accounting software isn’t always enough to keep your records accurate.

Adjusting Journal Entries Defined Accounting Play

Accrued incomes, incomes received in advance, outstanding and prepaid expenses require an adjustment in the books of accounts. Web the adjusting entry will involve the.

Exercise 87 and 88 Adjusting Journal Entries PDF

Solved • by quickbooks • 828 • updated january 29, 2024. An adjusting journal entry is a type of. Web adjusting entries are general ledger.

️Adjusting Journal Entries Worksheet Free Download Gmbar.co

Web journal entries are recorded when an activity or event occurs that triggers the entry. If you use accrual accounting, your accountant must also enter..

Accounting Journal Entries Template

Web adjusting entries are made in your accounting journals at the end of an accounting period after a trial balance is prepared. Web there are.

Solved What are the general journal entries for the

Web adjusting entries are general ledger (gl) journal entries that occur at the end of an accounting period to record any unrecognized transactions for that.

Adjusting Entries Examples Accountancy Knowledge

Web adjustment entries are the journal entries that converts an entity’s accounting record in an accrual basis of accounting. Each one of these entries adjusts.

Adjusting Entries Example, Types, Why are Adjusting Entries Necessary?

Web definition and explanation: Recording transactions in your accounting software isn’t always enough to keep your records accurate. Web accrue means “to grow over time”.

Adjusting Journal Entries Cheat Sheet 02/2022

Web adjustment entries are the journal entries that converts an entity’s accounting record in an accrual basis of accounting. Make adjusting journal entries in quickbooks.

Adjusting Entries Meaning, Types, Importance And More

Web adjusting entries, also known as adjusting journal entries (aje), are the entries made in a business firm’s accounting journals to adapt or update the.

Solved • By Quickbooks • 828 • Updated January 29, 2024.

The preparation of adjusting entries is an application of the accrual concept and the matching principle. Web adjusting entries, or adjusting journal entries (aje), are made to update the accounts and bring them to their correct balances. Recording transactions in your accounting software isn’t always enough to keep your records accurate. Web definition and explanation:

The Adjusting Entry For Accounts Payable In General Journal Format Is:

Learn how to create and review adjusting journal entries. Web there are three different types of adjusting journal entries as follows: Web an adjusting journal entry is a financial record you can use to track unrecorded transactions. Web adjusting entries are made in your accounting journals at the end of an accounting period after a trial balance is prepared.

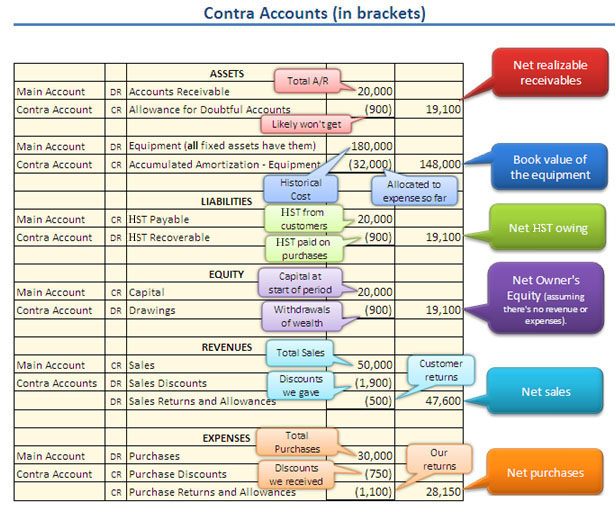

Some Common Types Of Adjusting Journal Entries Are Accrued Expenses, Accrued Revenues, Provisions, And Deferred Revenues.

Web the adjusting entry will involve the following accounts: Web journal entries are recorded when an activity or event occurs that triggers the entry. Adjusting journal entry is a type of journal entry that is executed at the end of the accounting period to record any unrecorded or missed to match the requirement of accrual accounting basis. Web adjusting entries are general ledger (gl) journal entries that occur at the end of an accounting period to record any unrecognized transactions for that period.

Recall That An Original Source Can Be A Formal Document Substantiating A Transaction, Such As An Invoice, Purchase Order, Cancelled.

Web adjustment entries are the journal entries that converts an entity’s accounting record in an accrual basis of accounting. After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other. This type of ledger entry is also used to correct any mistakes made during the. Web adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting.

:max_bytes(150000):strip_icc()/AdjustingJournalEntry_V1-2dbdebbd05d74d808f539458dcfa2e2a.jpg)