How To Record Deferred Revenue Journal Entry - Web commonly referred to as deferred revenue or unearned revenue. Recognize revenue as the service or product is delivered. Web the second journal entry reflects the reduction in deferred revenue and the recording of september rent revenue. Web deferred revenue is a liability account that represents the obligation that the company owes to its customer when it receives the money in advance. A contract liability is an entity’s obligation to transfer goods or services to a customer for which the entity has received consideration from the customer (or the payment is due, see example 2) but the transfer has not yet been completed. In simple terms,, deferred revenue deferred revenue deferred revenue, also known as unearned income, is the advance payment that a company receives for goods. How deferred revenue shows up on the balance sheet. Web you need to make a deferred revenue journal entry. Download cfi’s deferred revenue template to analyze the numbers on your own. Identify the time frame within which a product will be delivered.

What is Deferred Revenue? The Ultimate Guide (2022)

When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. Deferred revenue adjusting.

Unearned Revenue Journal Entry LizethkruwSmith

Maintain schedules for deferred revenue and amortization. In simple terms,, deferred revenue deferred revenue deferred revenue, also known as unearned income, is the advance payment.

How to use Excel for accounting and bookkeeping QuickBooks

Web the per month revenue of the company is $1000. The simple answer is that they are required to, due to the accounting principles of.

What Is Unearned Revenue? QuickBooks Global

Download cfi’s deferred revenue template to analyze the numbers on your own. Web recording deferred revenue as a journal entry. 1 determining what revenue to.

Deferred Revenue Journal Entry with Examples Financial

Deferred revenue journal entry to record influx of cash that has not yet been earned. Web the per month revenue of the company is $1000..

Deferred Revenue Journal Entry Double Entry Bookkeeping

Deferred revenue adjusting entry to record the delivery of prepaid goods or services. Web the per month revenue of the company is $1000. Even if.

Deferred Tax Liabilities Explained With Reallife

To account for this the pest control company needs to make adjusting entries. Likewise, after the company delivers goods or performs services, it can make.

What is the journal entry for deferred revenue? Leia aqui How do you

Web deferred revenue, or unearned revenue , refers to advance payments for products or services that are to be delivered in the future. How to.

What is Unearned Revenue? A Complete Guide Pareto Labs

Record the amount paid for a product. Web deferred taxes refer to the postponement of income taxes to future periods due to differences in the.

Maintain Schedules For Deferred Revenue And Amortization.

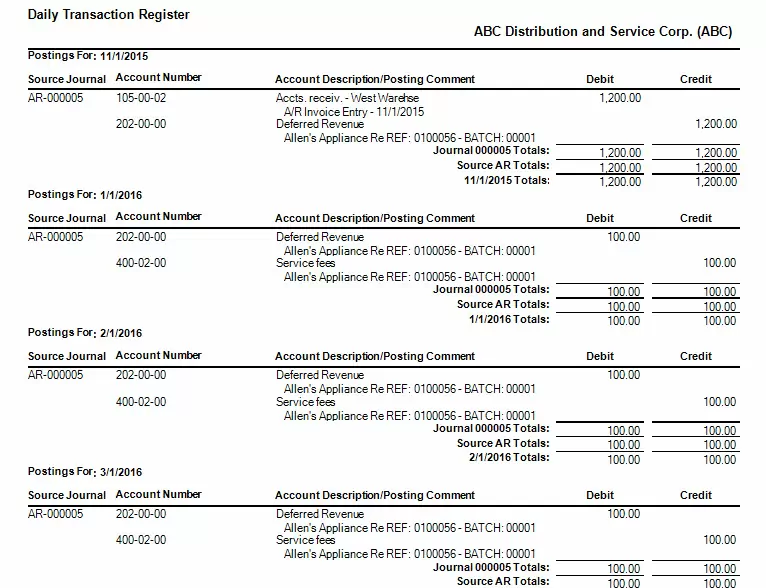

Web under accrual basis accounting, you determine you should recognize the entry as “earned” 40 percent of the revenue recorded as a deposit back in november. Web the following deferred revenue journal entry outlines the most common journal entries in accounting. Deferred revenue journal entry examples. As the company delivers goods or services over time, it can gradually recognize revenue.

The Simple Answer Is That They Are Required To, Due To The Accounting Principles Of Revenue Recognition.

When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. As another example, let’s say you currently work as an attorney, providing basic. Of course, you will want to be sure that you can fulfill your obligations to your customer. Web commonly referred to as deferred revenue or unearned revenue.

Rent Payments Received In Advance.

The accounting for deferred revenue involves a debit to the cash or accounts receivable account and a credit to the deferred revenue liability account. Defer prior year revenue accounts receivable. How deferred revenue shows up on the balance sheet. Web deferred revenue journal entry example (debit or credit) suppose a manufacturing company receives $10,000 payment for services that have not yet been delivered.

Even If You Have Not Earned It Yet, It Is Still Money That Can Be Spent.

These accounts are generally current liabilities unless you expect the project to take several years. Journal entries are rightly called the backbone of the modern accounting system as they are the first. Module • record the accounting entries for events 1 and 2 in the general ledger (gl) module, modaccrl ledger, in period 998 and. The journal entries would be as follows: