Accounting For Leases Journal Entries - What is capital lease accounting? Web the new lease accounting standard, released by fasb in early 2016, represents one of the largest and most impactful reporting changes to accounting principles in decades. Lessees need to carefully consider the terms of. Lessors are required to classify each of their leases as either an operating lease or a. Web the two most common types of leases in accounting are operating and finance (or capital) leases. Web the company can make the finance lease journal entry by debiting the lease asset account and crediting the lease liability account. Web the finance lease accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of. The income tax accounting for lease contracts is in the scope of ias 12 income taxes. Web operating lease accounting example and journal entries. Web under asc 842, journal entries for operating leases are concise calculations on the debits of your rou assets and the credits on your lease liabilities all recorded on your general.

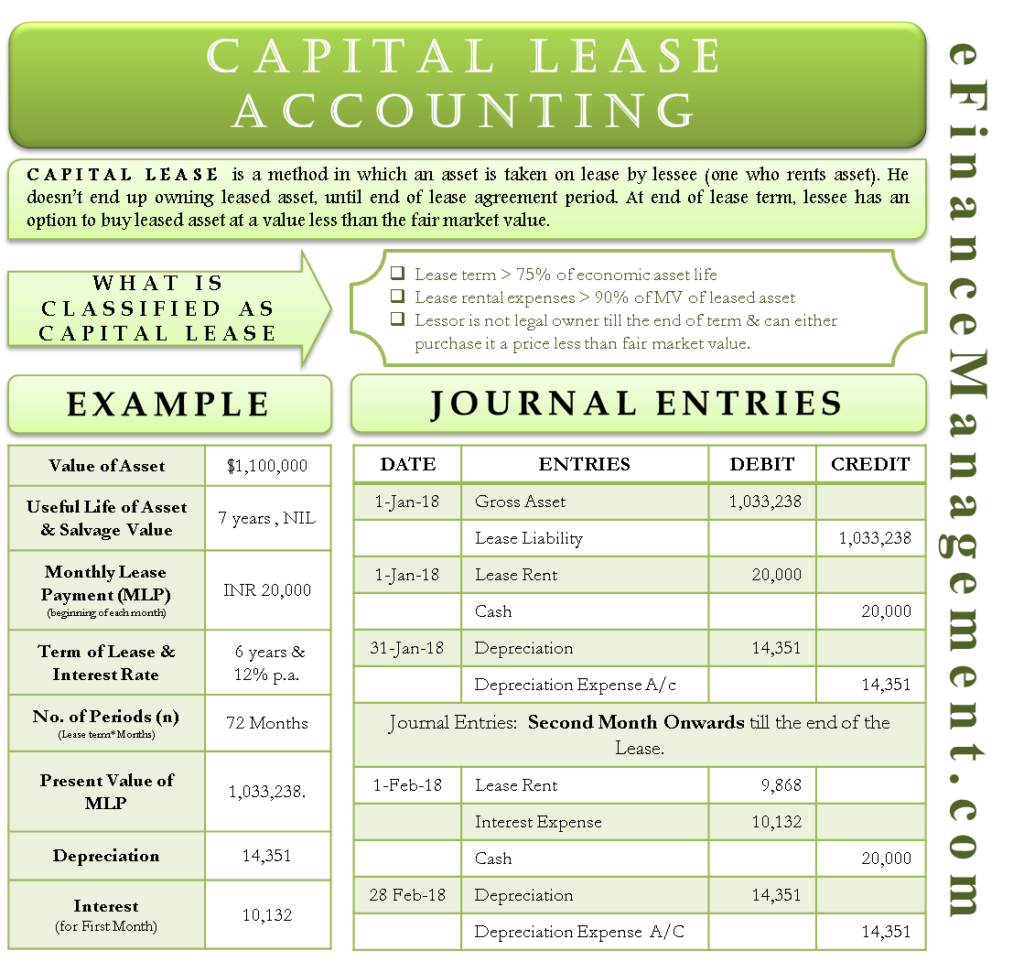

Capital Lease Accounting With Example and Journal Entries

Web the two most common types of leases in accounting are operating and finance (or capital) leases. Web the company can make the finance lease.

Journal entries for lease accounting

Whether you're an accountant or a business. Web the two most common types of leases in accounting are operating and finance (or capital) leases. It.

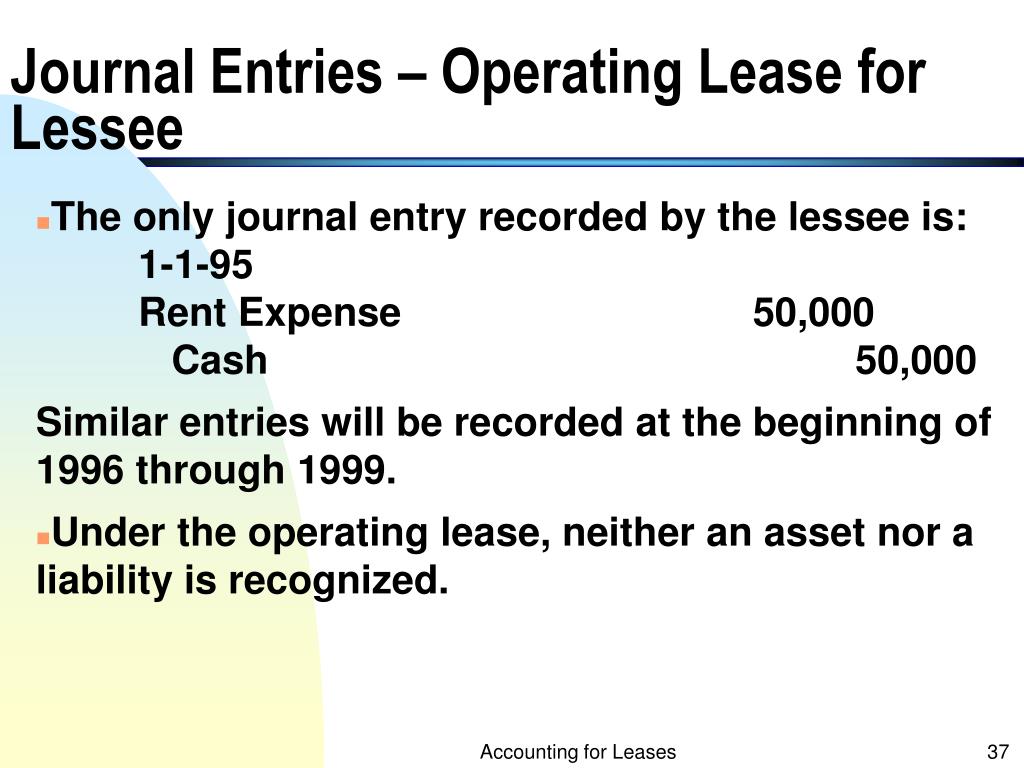

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities record the financial impact of.

Finance Lease Journal Entries businesser

Below we present the entry. Web asc 842, or topic 842, is the new lease accounting standard issued by the fasb and governs how entities.

Journal entries for lease accounting

Web about the leases guide pwc is pleased to offer our updated leases guide.the fasb’s new standard on leases, asc 842, is effective for all.

Finance Lease Journal Entries Lessor businesser

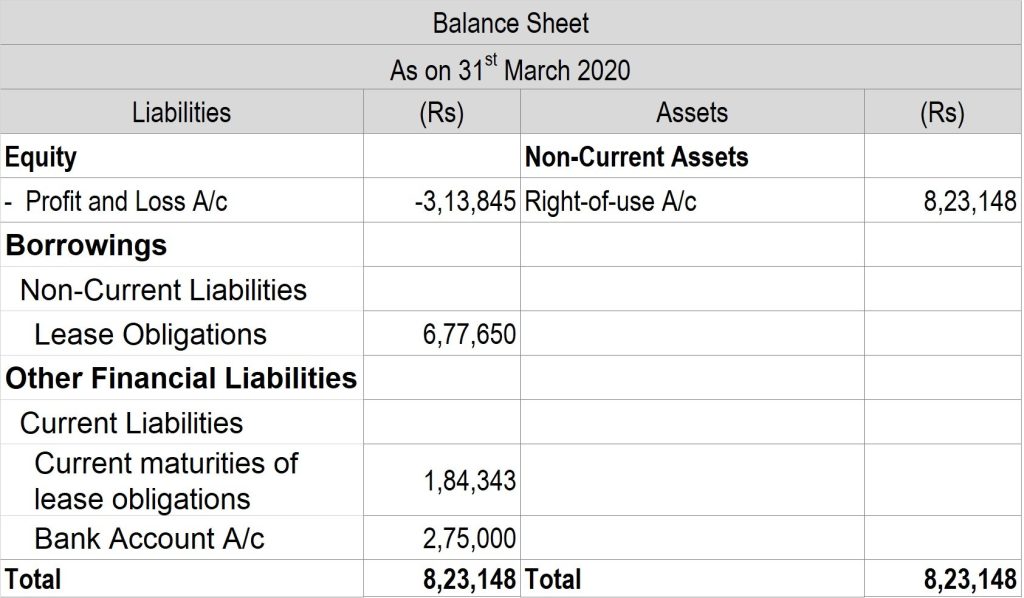

What is capital lease accounting? The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease.

Check this out about Capital Lease Accounting Journal Entries

Details on the example lease agreement. As a result, on the commencement of the lease, you will recognize the following journal entries: Lessees need to.

PPT Accounting for Leases PowerPoint Presentation, free download ID

Web updated on january 3, 2024. Web discover asc 842 journal entries with leasecrunch's guide. Web asc 842, or topic 842, is the new lease.

Journal entries for lease accounting

Whether you're an accountant or a business. Learn about operating and finance lease entries, equity impact, and cash flow requirements! The income tax accounting for.

Web The Finance Lease Accounting Journal Entries Below Act As A Quick Reference, And Set Out The Most Commonly Encountered Situations When Dealing With The Double Entry Posting Of.

Learn about operating and finance lease entries, equity impact, and cash flow requirements! Web recording journal entries appropriate for the lease accounting standard being tracked is critical for accurate financial reporting. Web updated on january 3, 2024. Web the company can make the finance lease journal entry by debiting the lease asset account and crediting the lease liability account.

Whether You're An Accountant Or A Business.

This article breaks down operating lease journal entries in a simple and. Web about the leases guide pwc is pleased to offer our updated leases guide.the fasb’s new standard on leases, asc 842, is effective for all entities. Web journal entries in case of a finance lease. Lessees need to carefully consider the terms of.

Web Under Asc 842, Journal Entries For Operating Leases Are Concise Calculations On The Debits Of Your Rou Assets And The Credits On Your Lease Liabilities All Recorded On Your General.

Lessors are required to classify each of their leases as either an operating lease or a. Right of use asset $116,357.12. As a result, on the commencement of the lease, you will recognize the following journal entries: Web according to asc 842, journal entries for operating leases are as follows:

Below We Present The Entry.

Details on the example lease agreement. It is worth noting, however, that under ifrs, all leases are regarded as finance. What is capital lease accounting? Web the new lease accounting standard, released by fasb in early 2016, represents one of the largest and most impactful reporting changes to accounting principles in decades.