A Merchandiser Has Four Closing Journal Entries - Close the merchandise inventory account. Concept of a perpetual inventory system: Select the correct entries below. Remember to close means to make the balance zero. Web closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. We will prepare the closing entries for hanlon. Select the correct entries below. Web the steps in preparing closing entries for a merchandiser are the same as for a service company. 9/20/20 (4,700) = (4,700) 10/31/20 (5,000) = (5,000) 11/4/20: Web each adjusting entry has a dual purpose:

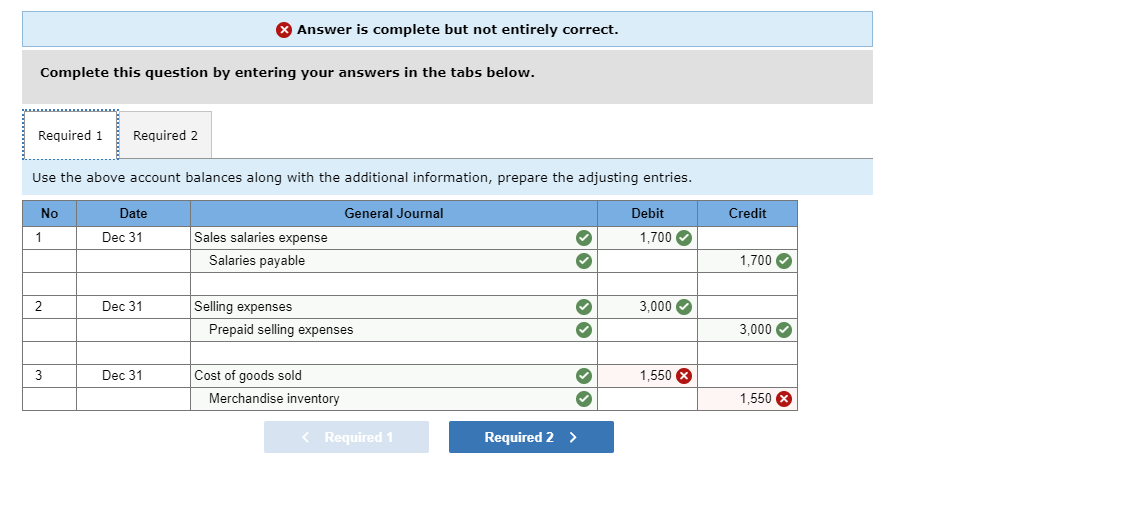

Solved Exercise 410 Preparing adjusting and closing entries

A merchandiser has four closing journal entries at the end of an accounting cycle. Web what are closing entries? When we post this adjusting journal.

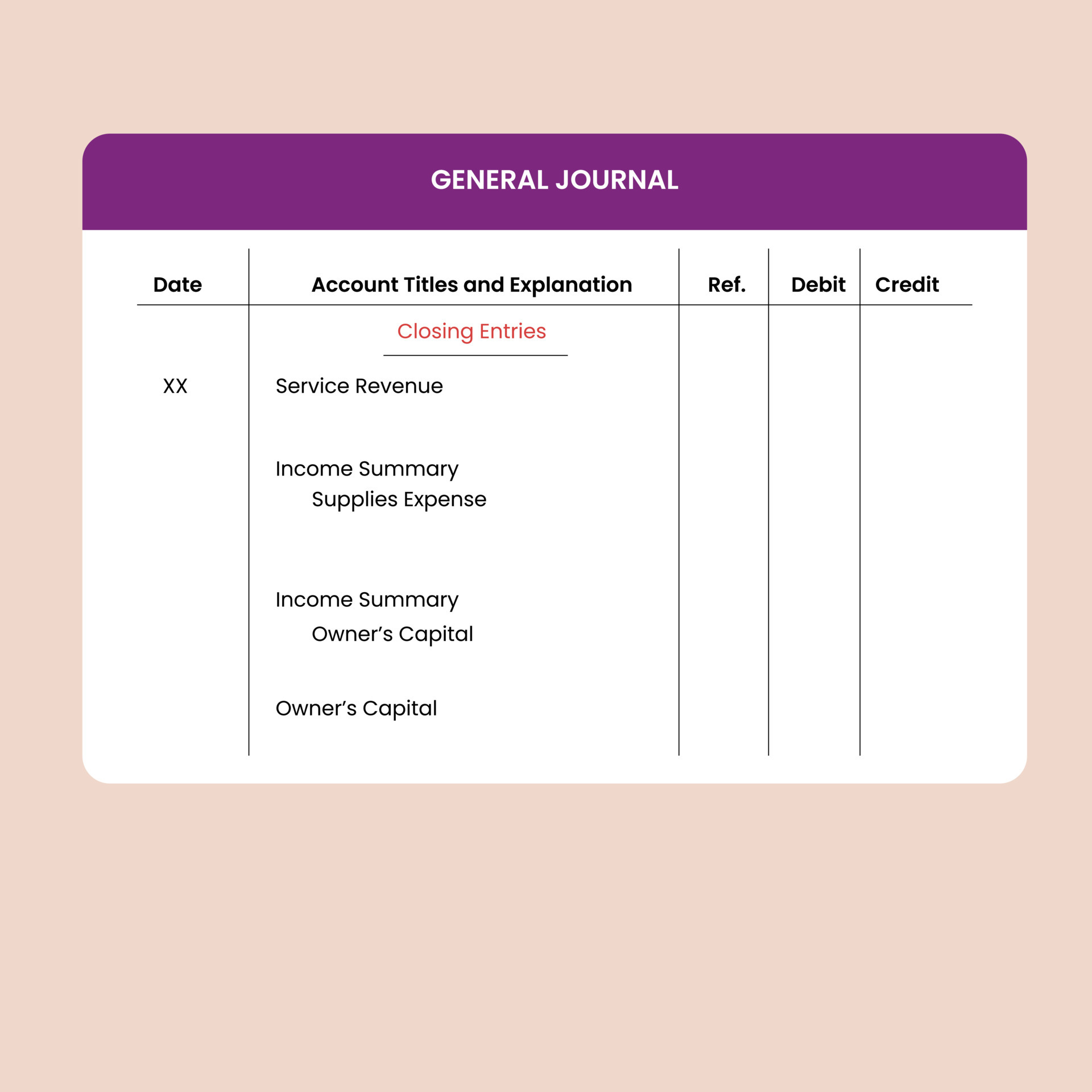

Form closing entries in accounting. Accounting, bookkeeping, audit

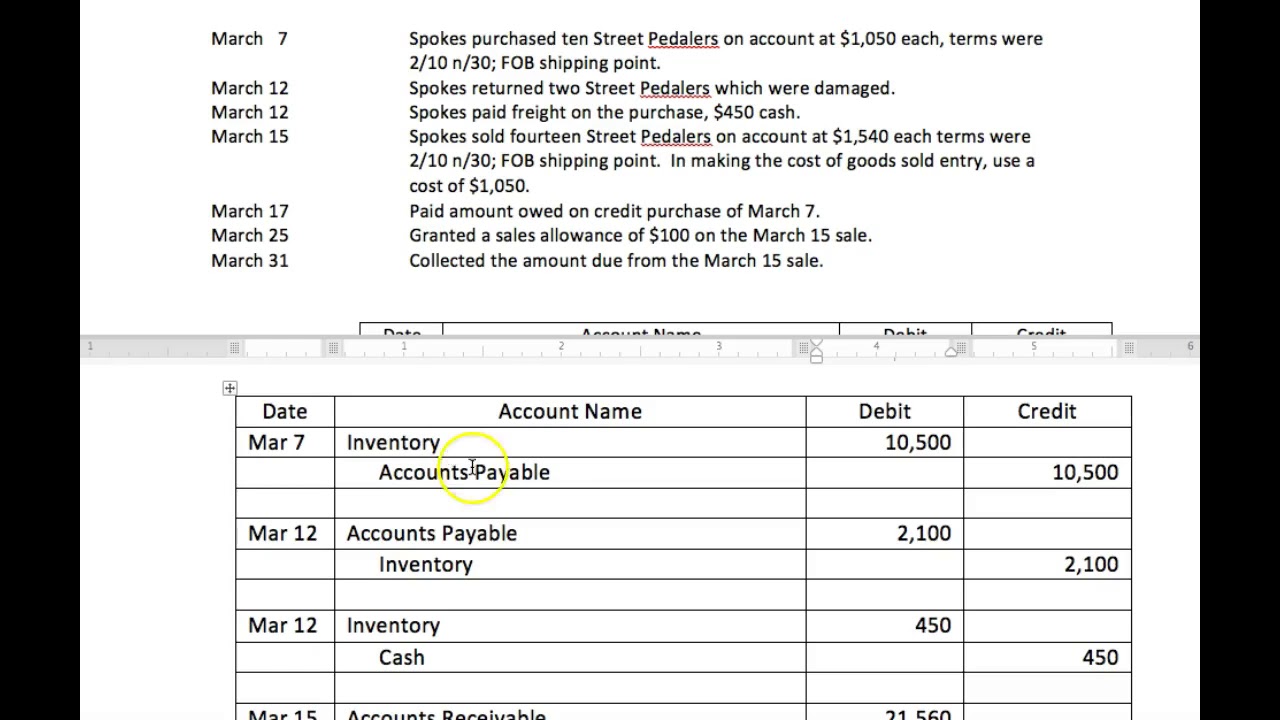

Web the following example transactions and subsequent journal entries for merchandise purchases are recognized using a perpetual inventory system. A merchandiser has four closing journal.

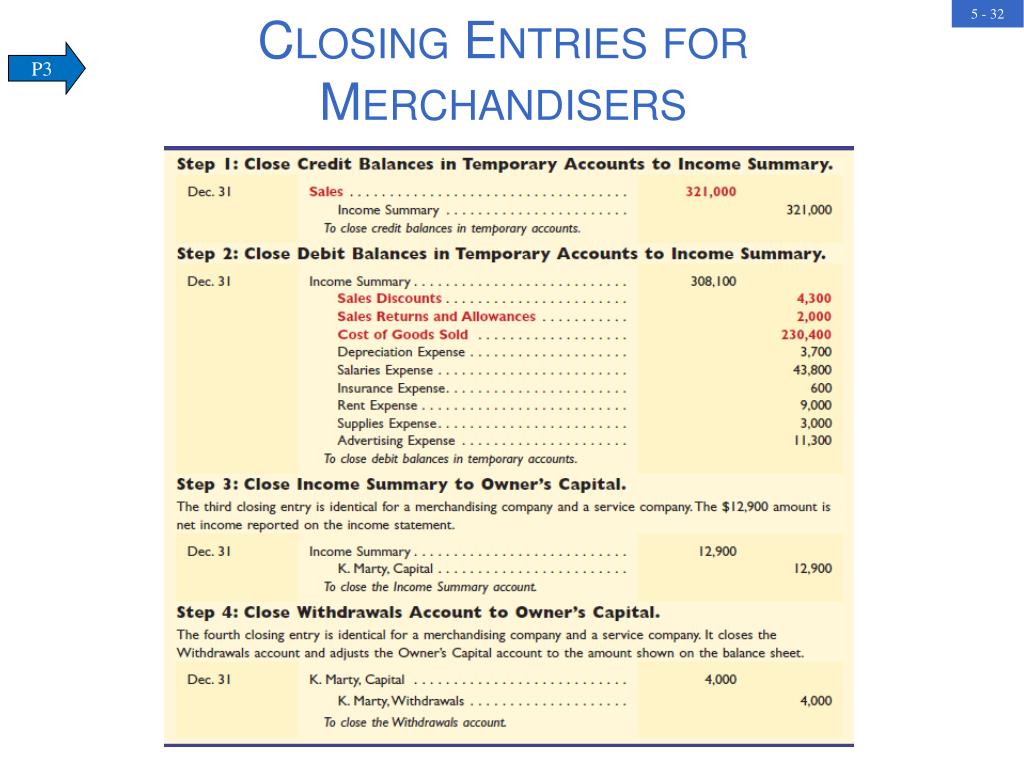

PPT Accounting for Merchandising Operations PowerPoint Presentation

Concept of a perpetual inventory system: Select the correct entries below. These journal entries condense your accounts so you can determine your retained earnings, or.

Closing Entries of Merchandiser 4 Steps Professor Victoria Chiu YouTube

Web closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. Journalize purchaser’s return of.

Journalizing Closing Entries Closing Entries Types Example My Riset

Net sales, gross profit, and net income : These journal entries condense your accounts so you can determine your retained earnings, or the amount your.

Closing Journal Entries

Web our discussion here begins with journalizing and posting the closing entries ( figure 5.2 ). The balance sheet includes an additional current asset. (check.

Purchase Considerations For Merchandising Businesses

Thus, every adjusting entry affects at least one income statement account and one balance sheet account. The balance sheet includes an additional current asset. Closing.

Accounting Questions and Answers Appendix Ex 640 Closing entries

Close the income summary account. Select the correct entries below. Web a merchandiser has four closing journal entries at the end of an accounting cycle?.

Example of Merchandising Entries YouTube

Web closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. Web a merchandiser has.

To Do This, We Will Do The Opposite Of The Balance In The Adjusted Trial Balance In A Journal Entry And Use Income Summary To Balance The Entry.

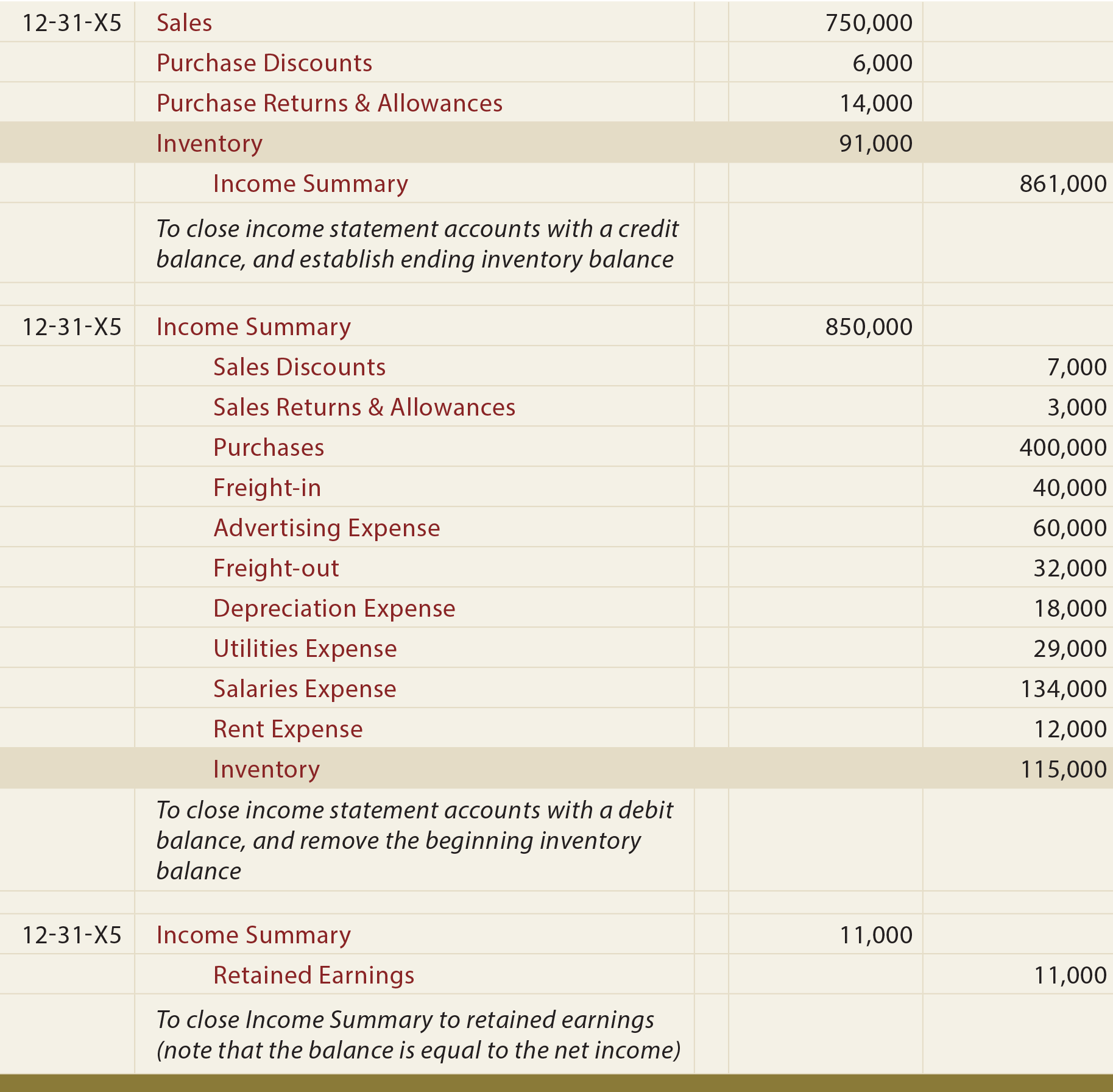

Close the merchandise inventory account. Web the following example transactions and subsequent journal entries for merchandise purchases are recognized using a perpetual inventory system. Web a merchandiser has four closing journal entries at the end of an accounting cycle? Web the journal entry would be:

Close The Revenue Accounts With Credit Balances.

Concept of a perpetual inventory system: (check all that apply.) close asset accounts. Sales, sales returns and allowances, sales discounts, and cost of goods sold. Select the correct entries below.

Closing The Revenue Accounts With Credit Balances—Transferring The Credit Balances In The Revenue Accounts To A Clearing Account Called Income Summary.

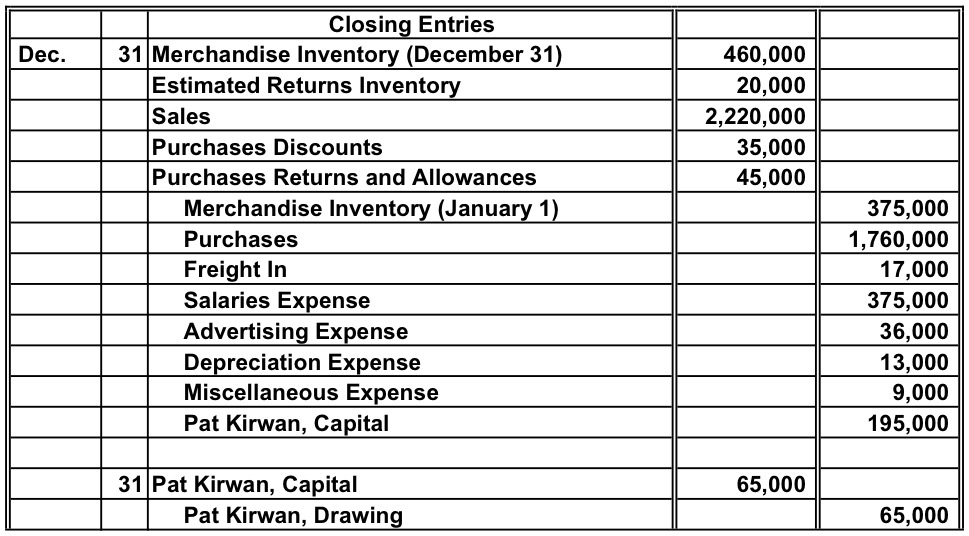

A merchandiser has four closing journal entries at the end of an accounting cycle. Thus, every adjusting entry affects at least one income statement account and one balance sheet account. Close the income summary account. Web the four basic steps in the closing process are modified slightly:

We Will Prepare The Closing Entries For Hanlon.

A merchandiser has four closing journal entries at the end of an accounting cycle. Journalize purchaser’s return of inventory. When we post this adjusting journal entry, you can see the ending inventory balance matches the physical inventory count and cost of good sold has been increased. Journalize purchase of inventory on account :