Credit Card Journal Entry - Detail type = other misc income. Credit card rewards are recognized when earned. Should i use debit or credit? Debits and credits in accounting. Quickbooks online allows you to record credit card payments in multiple ways. I had to adjust the opening balance of a credit card so i can start reconciling. Rules of debit and credit. Net, gross, and accounts receivable. Web journal entry for credit card rewards. There is also a difference in how they show up in your.

Sales Credit Journal Entry What Is It, Examples, How to Record?

Web assuming that the credit card purchases had not been previously entered into the accounts, there will be many debits in order to record each.

How do you match a deposit to a receipt when the credit card refund is

Thanks for sharing your concern in detail, bant bitterwood. October 15, 2018 07:25 pm. When the company receives a credit card reward, account has to.

Credit Card Journal Entry Accounts Recevable Accounting YouTube

It will impact the purchase transaction and increase liability to ward the bank. Web recording a credit card payment involves the detailed entry of information.

Solved How to create Journal entry for credit note for a

Create a journal called “credit cards” or you may prefer to have a. Web sales credit journal entry means recording the journal entry by the.

3 Purchase goods for Cash journal entry YouTube

Web journal entry accounting. Debits and credits in accounting. Web february 09, 2024 03:06 pm. Web learn how to record payments you make to your.

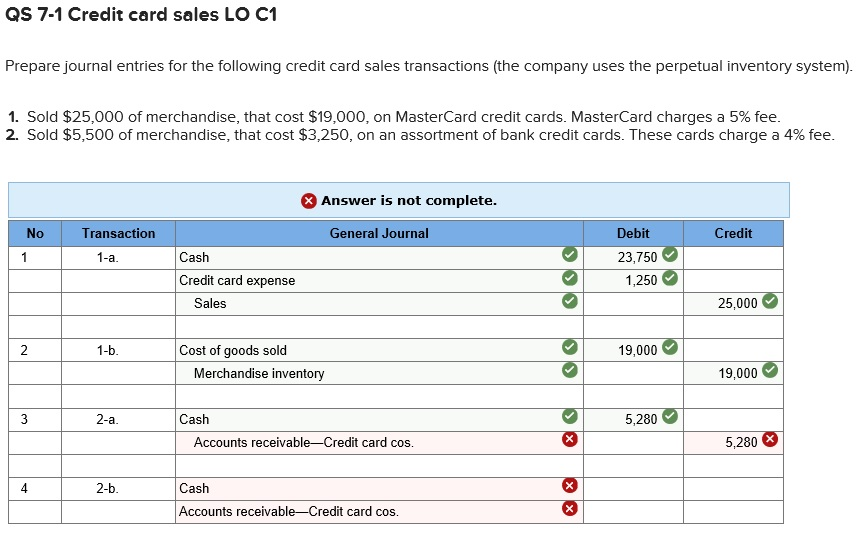

Solved QS 71 Credit card sales LO C1 Prepare journal

Debits and credits in accounting. Web in this journal entry, the total assets on the balance sheet increase by $4,850 while the net income before.

Explain the Revenue Recognition Principle and How It Relates to Current

Web in this journal entry, the total assets on the balance sheet increase by $4,850 while the net income before interest and tax on the.

Journal Entry for Credit Card System Loaner YouTube

Typically this is when the underlying purchase that earns rewards has. Web a credit increases your liability and equity accounts. The first journal entry is.

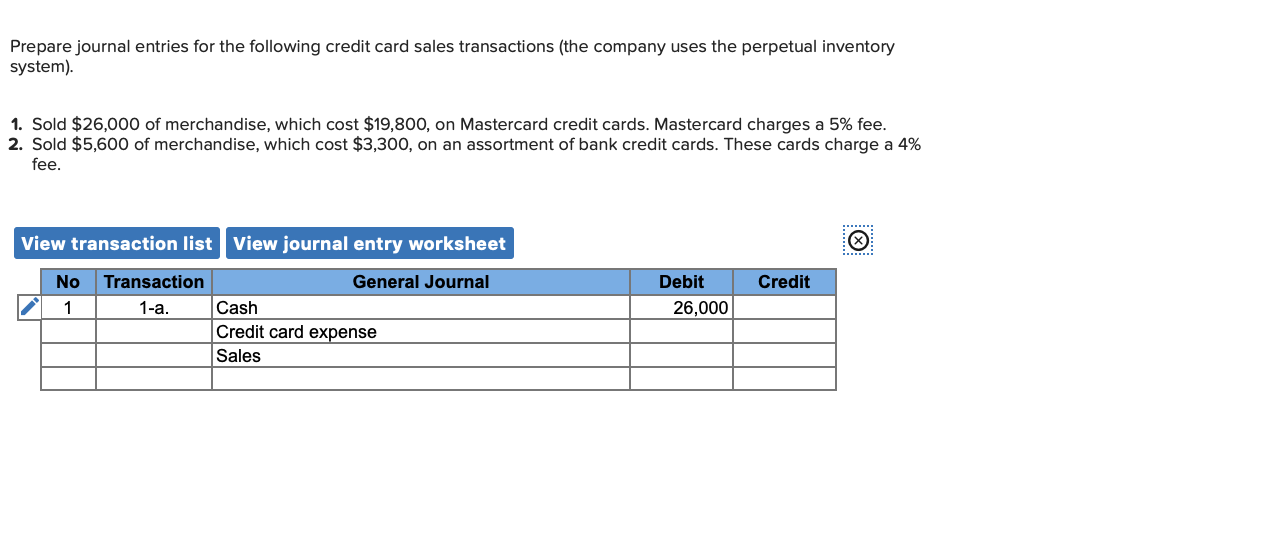

Solved Prepare journal entries for the following credit card

See examples of journal entries, credit card statements, and accounts. Should i use debit or credit? Frequent credit card payments mean businesses have to deal.

Web In This Journal Entry, The Total Assets On The Balance Sheet Increase By $4,850 While The Net Income Before Interest And Tax On The Income Statement Increase By The Same Amount Of.

Rules of debit and credit. I created a journal entry. October 15, 2018 07:25 pm. Web assuming that the credit card purchases had not been previously entered into the accounts, there will be many debits in order to record each of the many credit card.

Should I Use Debit Or Credit?

Thanks for sharing your concern in detail, bant bitterwood. Create a journal called “credit cards” or you may prefer to have a. Web sales credit journal entry means recording the journal entry by the company in its sales journal if the company makes any inventory sale to a third party on. When paying your business credit card transactions using your personal.

It Will Impact The Purchase Transaction And Increase Liability To Ward The Bank.

Debits and credits in accounting. But it decreases your asset and expense accounts. There are two ways to enter. See examples of journal entries, credit card statements, and accounts.

Web Journal Entry For Credit Card Purchase.

When the company receives a credit card reward, account has to record it as the other income in the other comprehensive income. Credit card rewards are recognized when earned. Web february 09, 2024 03:06 pm. I can guide you through the process of recording personal credit card and debit card.