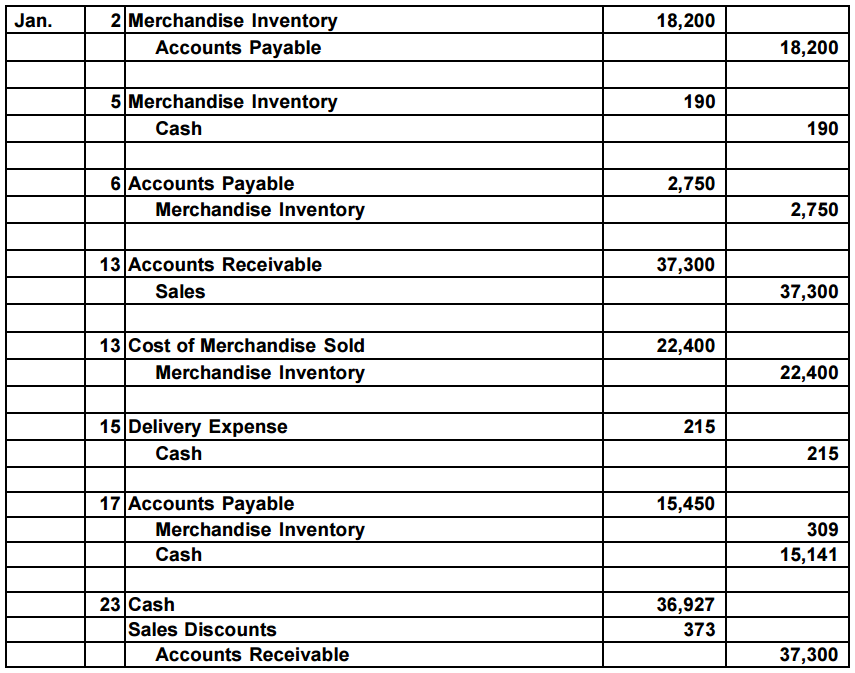

Writing Off Inventory Journal Entry - Web the journal entry would appear as such: Web the journal entry is: Likewise, in this journal entry,. How does an inventory write. Here are the most common reasons inventory is written off. Unfortunately, small and large inventory have a tendency to disappear. Inventory should be written off when it becomes obsolete or its market price has fallen to a level below the cost at which it is currently recorded in the accounting records. This completes the journal entry when you get rid of. Two standard methods of writing off inventory are discussed below: Adjusts their financial statements accordingly.

Inventory Write Off All you Need to Know with Example Zetran

Irreparable damage to inventory (e.g., flood, hurricane) spoilage of perishable inventory Once there is a sale of goods from finished goods, charge the cost of.

Accounting Q and A Appendix Ex 639 Journal entries using perpetual

In this journal entry, the loss on inventory account is an expense account that we need. On the other hand, let’s say the inventory loss.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

On the other hand, let’s say the inventory loss is considered material. Web the journal entry is: How does an inventory write. Once there is.

Inventory WriteOff Definition as Journal Entry and Example

Unfortunately, small and large inventory have a tendency to disappear. To calculate cogs, follow this formula: Irreparable damage to inventory (e.g., flood, hurricane) spoilage of.

Perpetual Inventory System Journal Entries Double Entry Bookkeeping

This step is generally taken when inventory goes bad, goes out of date, gets damaged, is lost, or is stolen. Unfortunately, small and large inventory.

Inventory WriteOff Definition As Journal Entry And, 47 OFF

This step is generally taken when inventory goes bad, goes out of date, gets damaged, is lost, or is stolen. If the ending inventory value.

Inventory WriteOff AwesomeFinTech Blog

And, its normal balance will be on the debit side. Web the journal entry is: Irreparable damage to inventory (e.g., flood, hurricane) spoilage of perishable.

Inventory Write Off Double Entry Bookkeeping

Web the journal entry would appear as such: This journal entry will remove the expired inventory goods from the balance sheet as well as record.

journal entry format accounting accounting journal entry template

Web credit your inventory account by the sum of your two debits in the previous step. This completes the journal entry when you get rid.

Once There Is A Sale Of Goods From Finished Goods, Charge The Cost Of The Finished Goods Sold To The Cost Of Goods Sold Expense Account, Thereby Transferring The Cost Of The Inventory From The Balance Sheet (Where It Was An Asset) To The Income Statement (Where It Is An Expense).

Unfortunately, small and large inventory have a tendency to disappear. Web the journal entry would appear as such: If the ending inventory value decreases as it does with a write down, the cogs will increase. This journal entry will remove the expired inventory goods from the balance sheet as well as record the loss to the income statement as an expense for the period.

Web The Journal Entry Is:

In this journal entry, the loss on inventory account is an expense account that we need. Adjusts their financial statements accordingly. To calculate cogs, follow this formula: Here are the most common reasons inventory is written off.

How Does An Inventory Write.

Web credit your inventory account by the sum of your two debits in the previous step. This completes the journal entry when you get rid of. And, its normal balance will be on the debit side. On the other hand, let’s say the inventory loss is considered material.

Let’s Try To Understand This Method With An Example.

Inventory should be written off when it becomes obsolete or its market price has fallen to a level below the cost at which it is currently recorded in the accounting records. This step is generally taken when inventory goes bad, goes out of date, gets damaged, is lost, or is stolen. Likewise, in this journal entry,. In the example, credit inventory by $48,000.

:max_bytes(150000):strip_icc()/Inventory-Write-Off_Final3-resized-9ab3fcc8c1234d1ea005ca1443e8ff65.jpg)