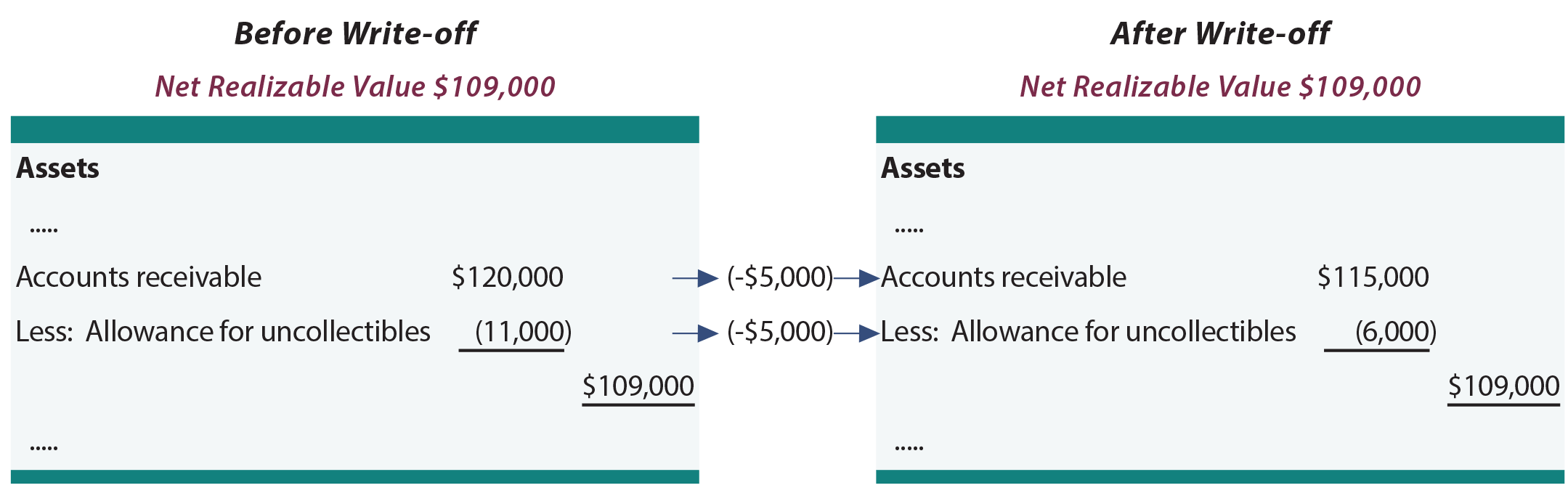

Write Off Uncollectible Accounts Journal Entry - Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. Debit bad debts expense, and; Allowance for doubtful accounts decreases (debit) and. An account is then written off against the allowance if it is in fact deemed. The journal entry is debiting bad debt expenses and credit accounts receivable. Web when a specific customer has been identified as an uncollectible account, the following journal entry would occur. Web this journal entry for uncollectible accounts will increase the total expenses on the income statement by $3,000 as the result of $3,000 bad debt expense estimation for the. Web the allowance account is established and adjusted with the following journal entry: What is allowance for doubtful accounts? If you're making a write off.

Recovering Writtenoff Accounts Wize University Introduction to

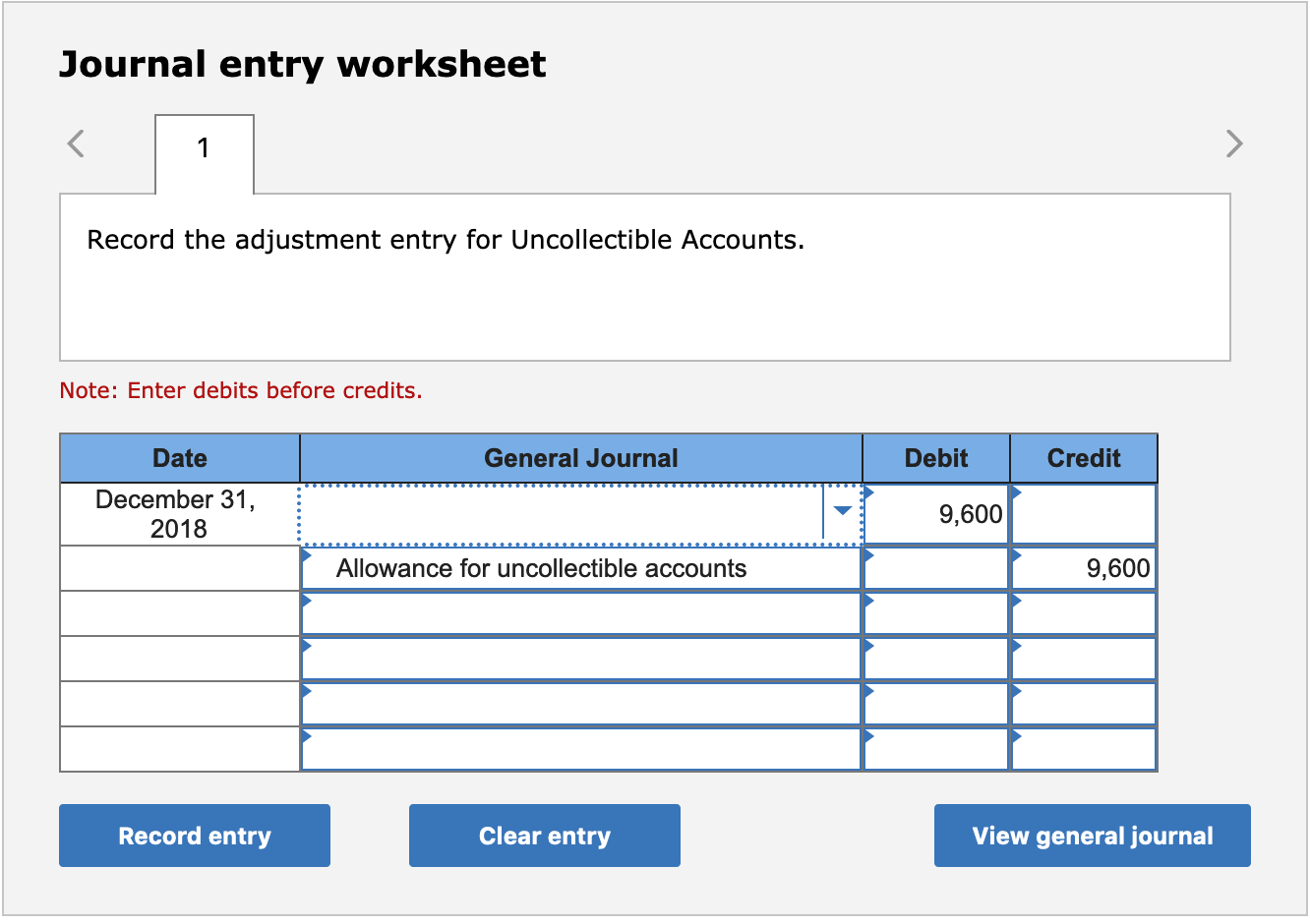

Web accounting for uncollectible accounts using the allowance method to record uncollectible accounts expense journal entries to record original estimate. The journal entry is debiting.

uncollectible accounts receivable journal entry /part 2/ YouTube

Web the allowance account is established and adjusted with the following journal entry: The journal entry is debiting bad debt expenses and credit accounts receivable..

Writing off Uncollectible Accounts Professor Victoria Chiu YouTube

One method of recording the bad debts is referred to as the direct write off method which involves removing the. Web the following entry would.

Uncollectible Accounts Written Off Accounting Methods

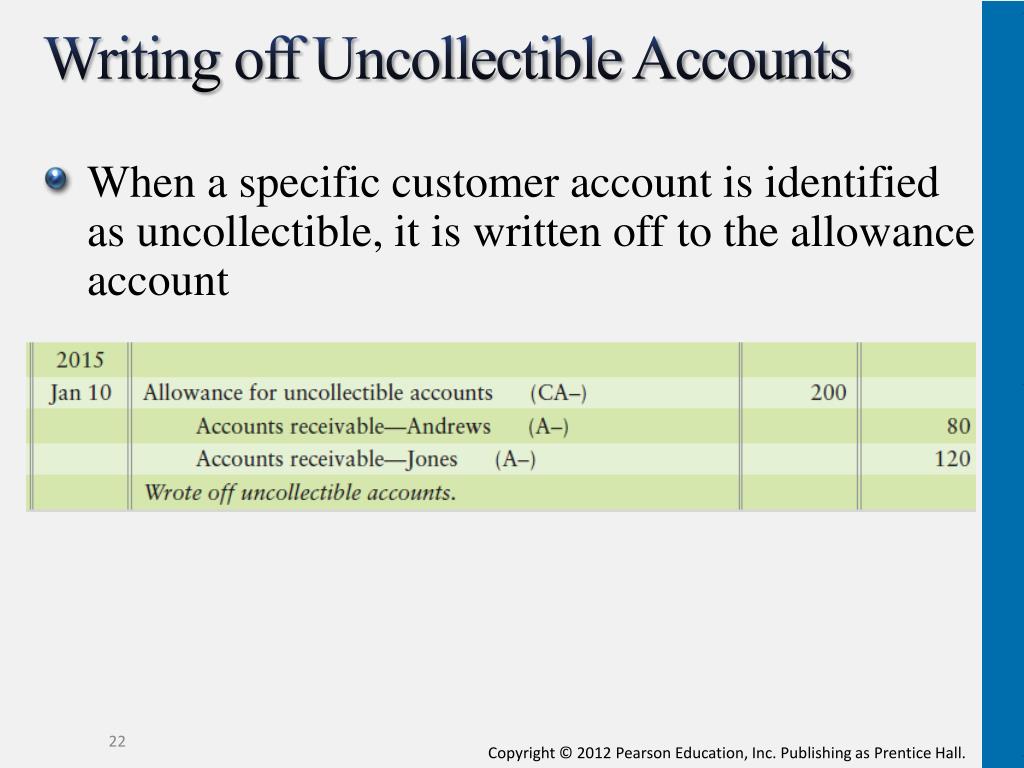

Web accounting for uncollectible accounts using the allowance method to record uncollectible accounts expense journal entries to record original estimate. Allowance for doubtful accounts decreases.

Allowance For Uncollectible Accounts Journal Entry Accounting Methods

Web write off an uncollectible account. Allowance for doubtful accounts journal entry example. Record the journal entry by debiting bad debt expense and crediting allowance.

PPT Chapter 6 PowerPoint Presentation, free download ID6475406

One method of recording the bad debts is referred to as the direct write off method which involves removing the. Record the journal entry by.

Uncollectible Accounts Allowance Method Accounting Methods

Allowance for doubtful accounts journal entry example. The account is removed from the. An account is then written off against the allowance if it is.

Allowance Method For Uncollectibles

As the name suggests, this method will directly remove accounts receivable to bad debt expenses. The account is removed from the. What is allowance for.

Uncollectible Accounts Example Accounting Methods

Web accounting for uncollectible accounts using the allowance method to record uncollectible accounts expense journal entries to record original estimate. Web write off an uncollectible.

Credit Allowance For Doubtful Accounts.

Web companies use two methods for handling uncollectible accounts. Accounting document from bryant & stratton college, 1 page, week 4: If you're making a write off. The account is removed from the.

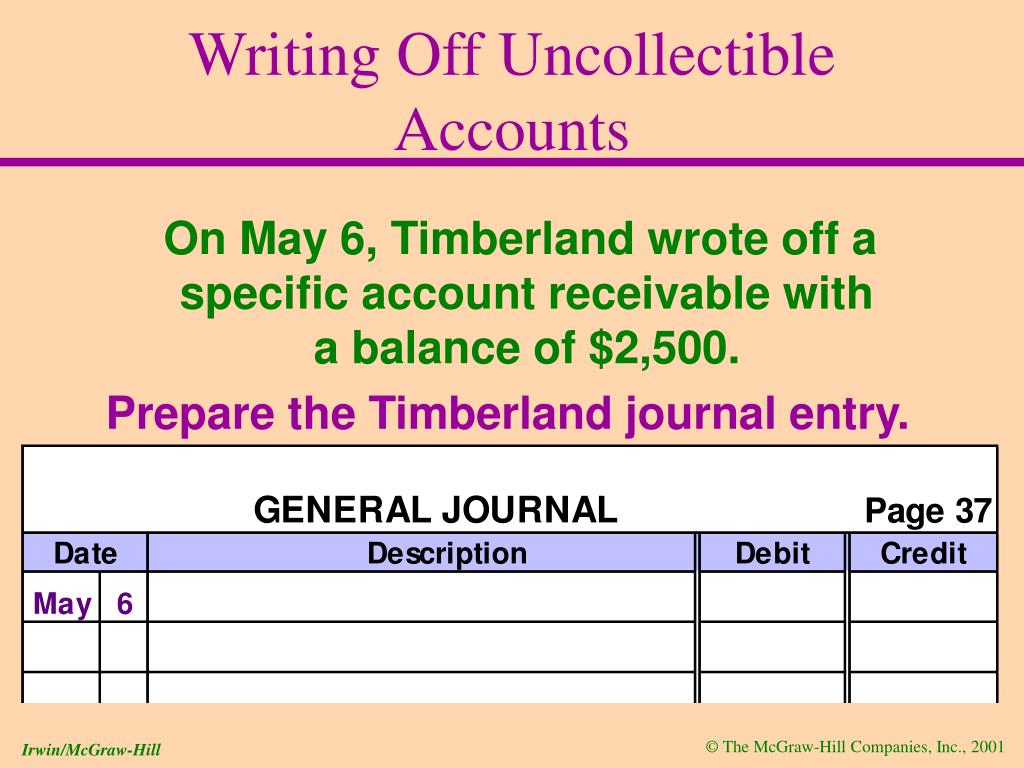

Web The Following Entry Would Be Needed To Write Off A Specific Account That Is Finally Deemed Uncollectible:

The journal entry is debiting bad debt expenses and credit accounts receivable. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. Web write off an uncollectible account. Web here is an example of a journal entry for writing off uncollectible accounts:

Web When A Specific Customer Has Been Identified As An Uncollectible Account, The Following Journal Entry Would Occur.

Allowance for doubtful accounts journal entry example. Debit bad debts expense, and; Web this journal entry for uncollectible accounts will increase the total expenses on the income statement by $3,000 as the result of $3,000 bad debt expense estimation for the. When you decide to write off an.

Web The Allowance Account Is Established And Adjusted With The Following Journal Entry:

An account is then written off against the allowance if it is in fact deemed. That is, when an account is officially considered. As the name suggests, this method will directly remove accounts receivable to bad debt expenses. Web accounting for uncollectible accounts using the allowance method to record uncollectible accounts expense journal entries to record original estimate.