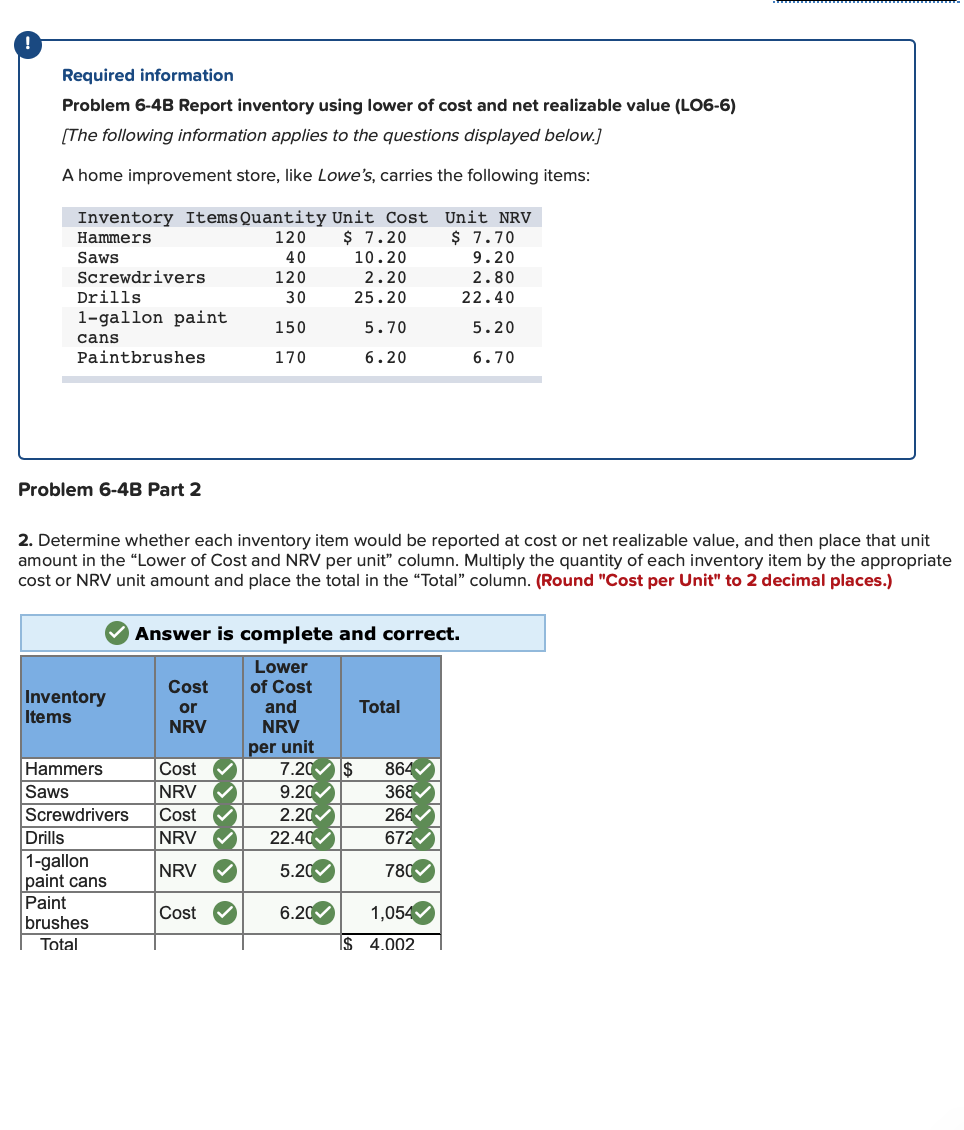

Write Down Of Inventory Journal Entry - Web 1) you would process the entry but it wouldn’t be until the end of the period as that is when you would become aware of the difference. There are two methods companies can use to write off. Web inventory is written down when its net realizable value is less than its cost. Web the company may write off some items in the inventory when it deems that they are no longer have value in the market or the business. Web there are two ways to write down inventory. There are two aspects to writing down inventory, which are the journal entry used to. Web an inventory write off is the process of reducing the value of the inventory of a business to record the fact that the inventory has no value. Web my studyguide says for ifrs, the reversal of inventory write down is a gain on the income statement, up to the original write down amount. Imagine an online store called case haven. Web the inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and.

Inventory Write Down Double Entry Bookkeeping

Web my studyguide says for ifrs, the reversal of inventory write down is a gain on the income statement, up to the original write down.

Inventory WriteOff Definition as Journal Entry and Example

Web inventory is written down when its net realizable value is less than its cost. There are two methods companies can use to write off..

Accounting Archive October 31, 2016

Web my studyguide says for ifrs, the reversal of inventory write down is a gain on the income statement, up to the original write down.

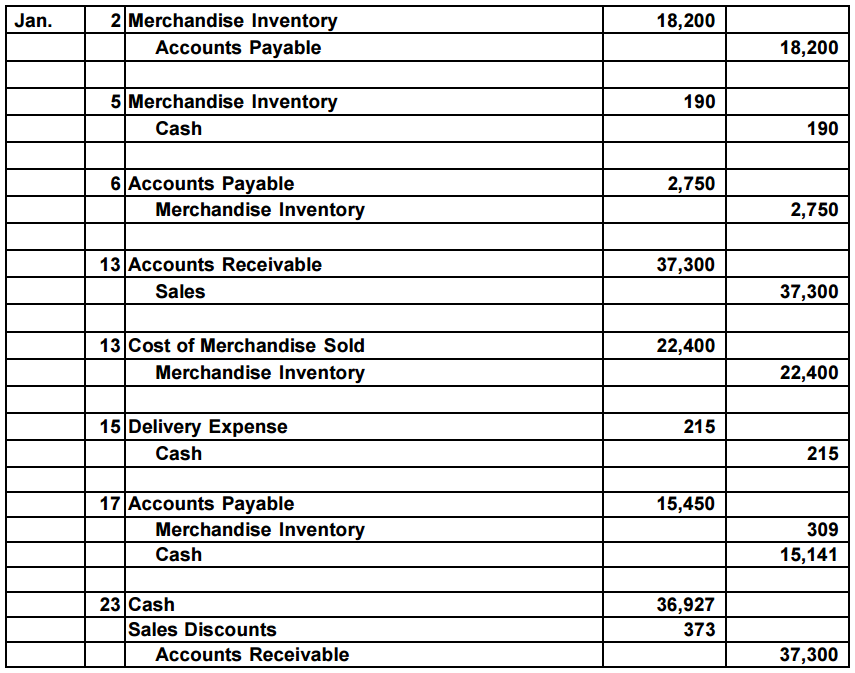

Perpetual Inventory System Journal Entry

This is done when items are no longer saleable due to being. Imagine an online store called case haven. There are two aspects to writing.

Solved 3. Prepare necessary entry to write down inventory

Web the inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and..

Accounting Q and A Appendix Ex 639 Journal entries using perpetual

There are two methods companies can use to write off. Web the company may write off some items in the inventory when it deems that.

Journal Entry for Purchase of Inventory YouTube

Web the company may write off some items in the inventory when it deems that they are no longer have value in the market or.

Inventory write down accounting YouTube

Web there are two ways to write down inventory. There are two methods companies can use to write off. Web an inventory write off is.

Perpetual Inventory System Journal Entries « Double Entry Bookkeeping

2) the impact on cogs is. In this case, the company needs to. Web 1) you would process the entry but it wouldn’t be until.

Web My Studyguide Says For Ifrs, The Reversal Of Inventory Write Down Is A Gain On The Income Statement, Up To The Original Write Down Amount.

Web an inventory write off is the process of reducing the value of the inventory of a business to record the fact that the inventory has no value. 2) the impact on cogs is. Web 1) you would process the entry but it wouldn’t be until the end of the period as that is when you would become aware of the difference. It captures the drop of the inventory's market value below its value.

Imagine An Online Store Called Case Haven.

There are two aspects to writing down inventory, which are the journal entry used to. This is done when items are no longer saleable due to being. Web the inventory system used by a business must be able to track multiple transactions as goods are received, stored, transformed into finished goods, and. Web inventory is written down when its net realizable value is less than its cost.

There Are Two Methods Companies Can Use To Write Off.

Web there are two ways to write down inventory. Web the company may write off some items in the inventory when it deems that they are no longer have value in the market or the business. In this case, the company needs to.

:max_bytes(150000):strip_icc()/Inventory-Write-Off_Final3-resized-9ab3fcc8c1234d1ea005ca1443e8ff65.jpg)