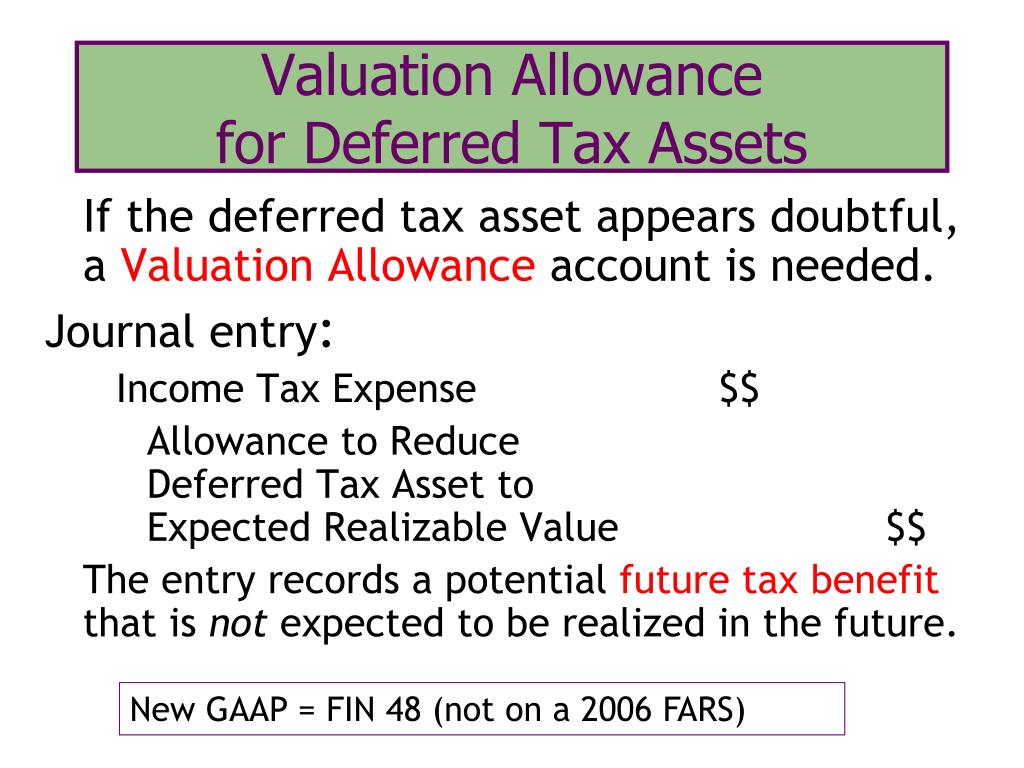

Valuation Allowance Journal Entry - Valuation allowance for deferred tax. Web request a demo to see how bloomberg tax provision untangles asc 740’s complexity. Web the entry increases income tax expense and establishes or increases the valuation allowance. Chapter 5 — valuation allowances 5.1 introduction 5.2 basic principles of valuation allowances 5.3 sources of taxable income 5.4. What is the evidence telling you? Let’s recap the effect of. Web in the world of finance and accounting, the valuation allowance journal entry holds a pivotal role in assessing a company’s financial health. In that case, the excess tax paid. This entry increases the income tax expense for the. Web understanding the valuation allowance.

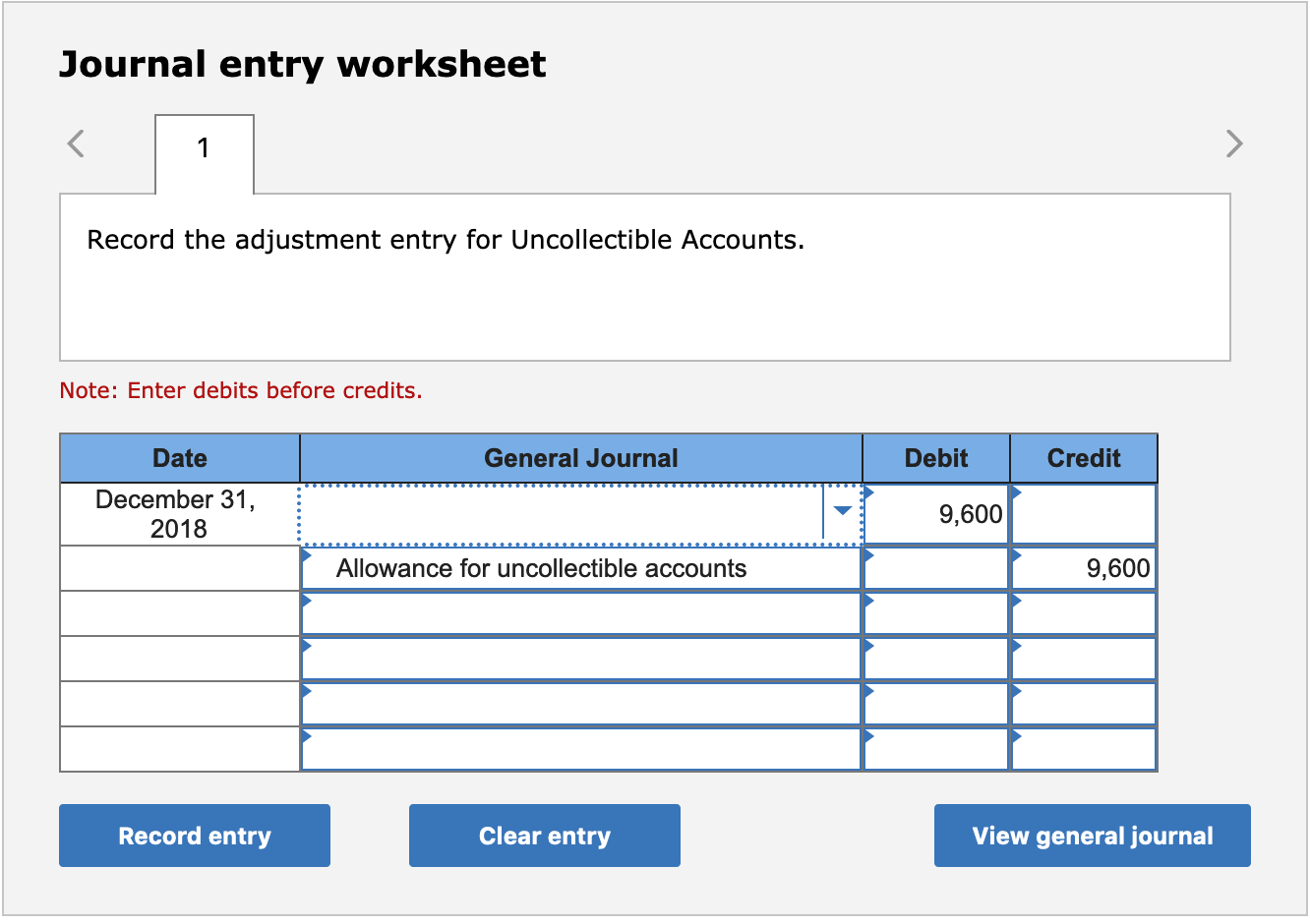

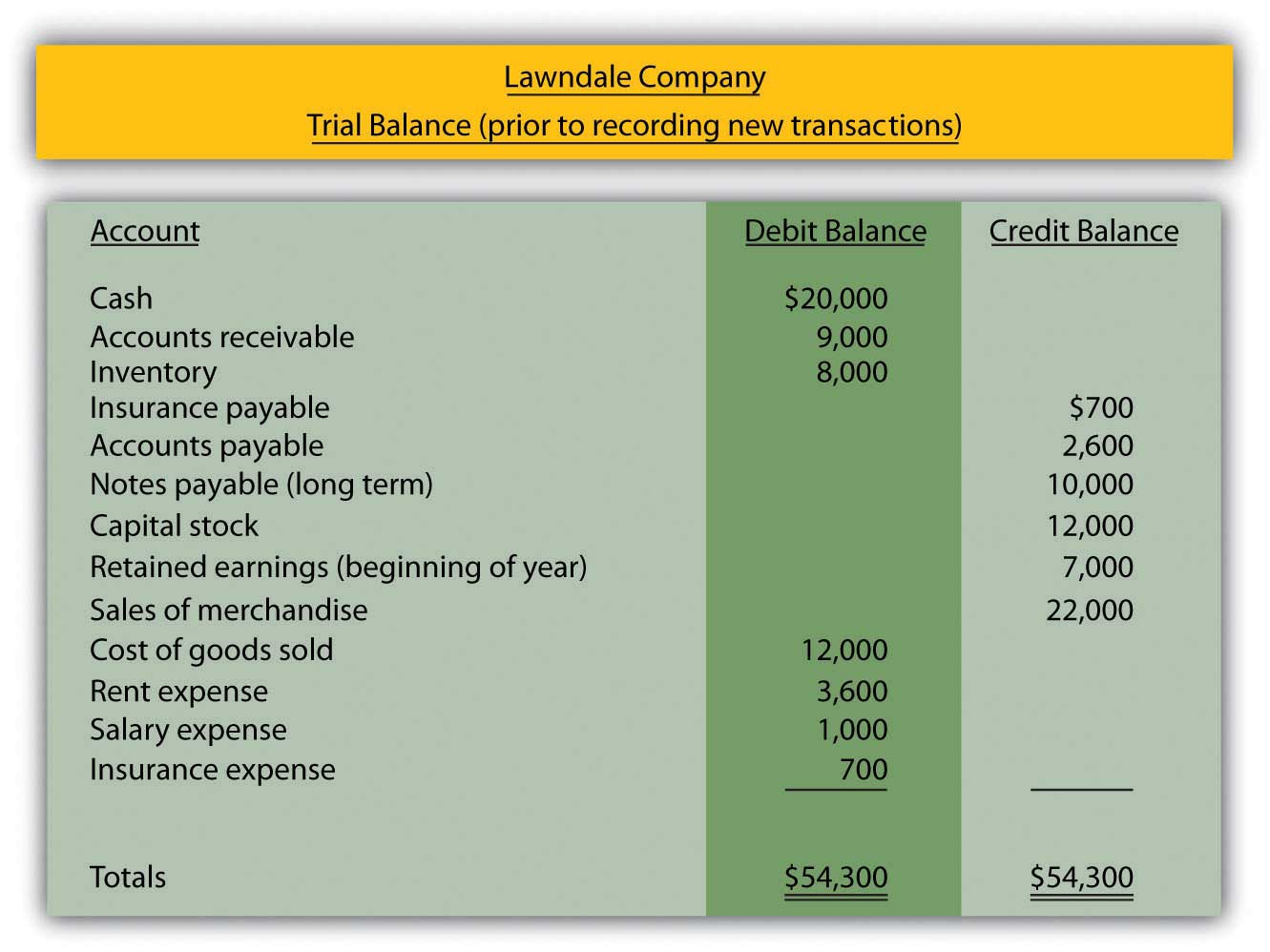

Allowance For Uncollectible Accounts Journal Entry Accounting Methods

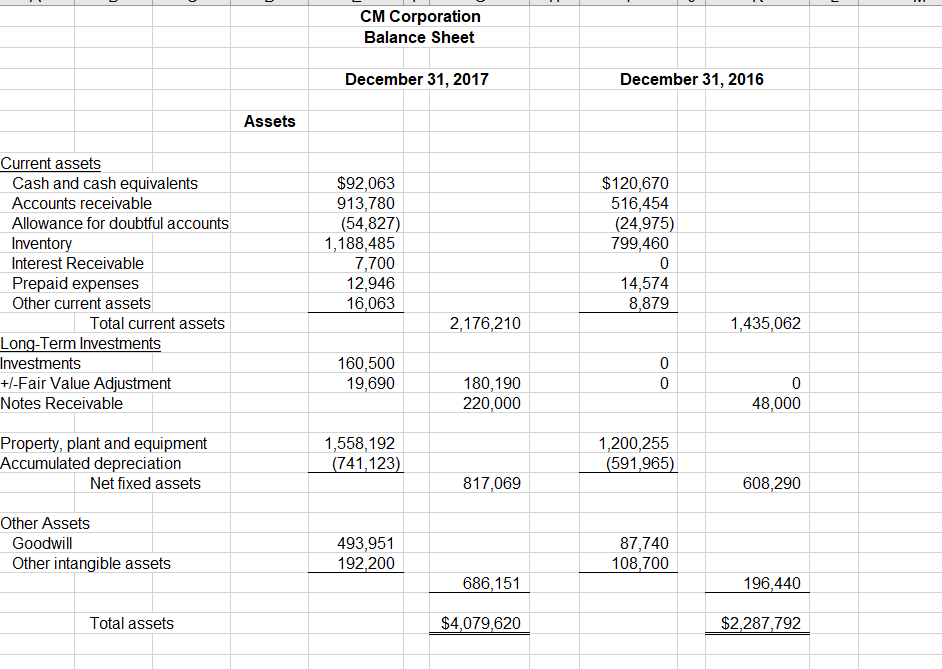

Company a should present the nol carryforwards net of the liability for unrecognized tax benefit of $5 ($20 deduction x 25%). See examples of journal.

Valuation Allowance

Under fasb’s asc 740 , deferred tax assets must be reduced by a valuation. Create journal entries to adjust inventory to nrv. Web journal entry.

Deferred Tax Asset Valuation Allowance Example Bloomberg Tax

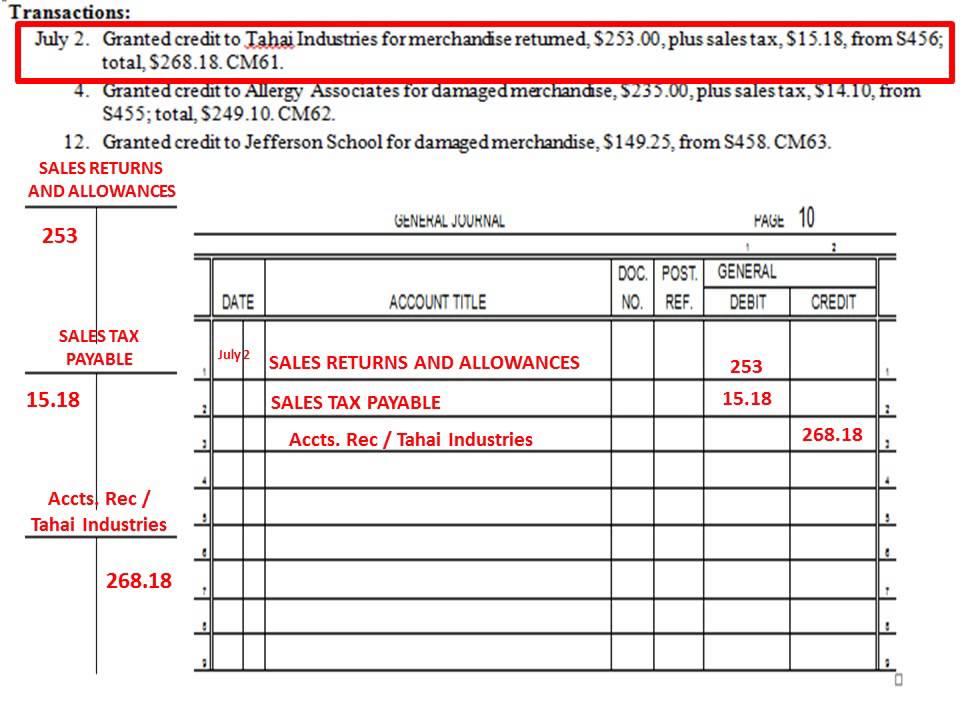

Web journal entry for valuation allowance : Web adjusting journal entries for net realizable value | financial accounting. Web request a demo to see how.

Chapter 10.3 Journalizing Sales Returns and Allowances Using a General

Web the entry increases income tax expense and establishes or increases the valuation allowance. In that case, the excess tax paid. Web when is it.

Accounting for Sales Return Journal Entry Example Accountinguide

Web in this example, a $500 valuation allowance would be recorded in acquisition accounting (i.e., $1,500 of the $2,000 acquired deferred tax assets are expected.

PPT Accounting for Taxes PowerPoint Presentation, free

Web request a demo to see how bloomberg tax provision untangles asc 740’s complexity. Multiple factors that enter into the assessment to. See examples of.

Accounting Journal Entries For Dummies

Suppose a company has overpaid its tax or paid advance tax for a given financial period. Web request a demo to see how bloomberg tax.

Examples Archives Double Entry Bookkeeping

Asc 740 valuation allowances for deferred tax assets. View all / combine content. Web journal entry for valuation allowance : What is a deferred tax.

PPT C H A P T E R 19 PowerPoint Presentation, free download ID3041049

What is a deferred tax asset valuation allowance? Web do you need a valuation allowance? What is the evidence telling you? The tax valuation allowance.

This Example Demonstrates The Key Concepts For Determining A Valuation.

Chapter 5 — valuation allowances 5.1 introduction 5.2 basic principles of valuation allowances 5.3 sources of taxable income 5.4. The basic journal entry is: Web the entry increases income tax expense and establishes or increases the valuation allowance. Create journal entries to adjust inventory to nrv.

Web Learn How To Account For Net Operating Losses And Tax Credits Under U.s.

Valuation allowance for deferred tax. Web journal entries for deferred tax assets. Under fasb’s asc 740 , deferred tax assets must be reduced by a valuation. Company a should present the nol carryforwards net of the liability for unrecognized tax benefit of $5 ($20 deduction x 25%).

Web In This Example, A $500 Valuation Allowance Would Be Recorded In Acquisition Accounting (I.e., $1,500 Of The $2,000 Acquired Deferred Tax Assets Are Expected To Be Realized), And.

The $5 liability would be a source. Web request a demo to see how bloomberg tax provision untangles asc 740’s complexity. Web understanding the valuation allowance. This entry increases the income tax expense for the.

In That Case, The Excess Tax Paid.

Web adjusting journal entries for net realizable value | financial accounting. Web the entry to establish a tax valuation allowance debits income tax expense and credits the deferred tax asset valuation allowance. What is a deferred tax asset valuation allowance? Asc 740 valuation allowances for deferred tax assets.