Utilities Expense Journal Entry - Web how do you record a journal entry for an expense? To increase an expense, we debit and to decrease. The entry must have at. Web expense journal entries are the critical accounting entries that reflect the expenditures incurred by the entity. Web journal entries are the way we capture the activity of our business. Web debit and credit journal entries for utilities expense. Web the journal entry to record the accrued utility expense and related liability would be as follows: In the journal entry, utility expense has a debit balance of $300. Examples of utilities expense debit and credit journal entries. Reasons to accrue for expenses.

Journal Entry Examples

In the journal entry, utility expense has a debit balance of $300. Web debit and credit journal entries for utilities expense. When a business transaction.

3.3 Use Journal Entries to Record Transactions and Post to TAccounts

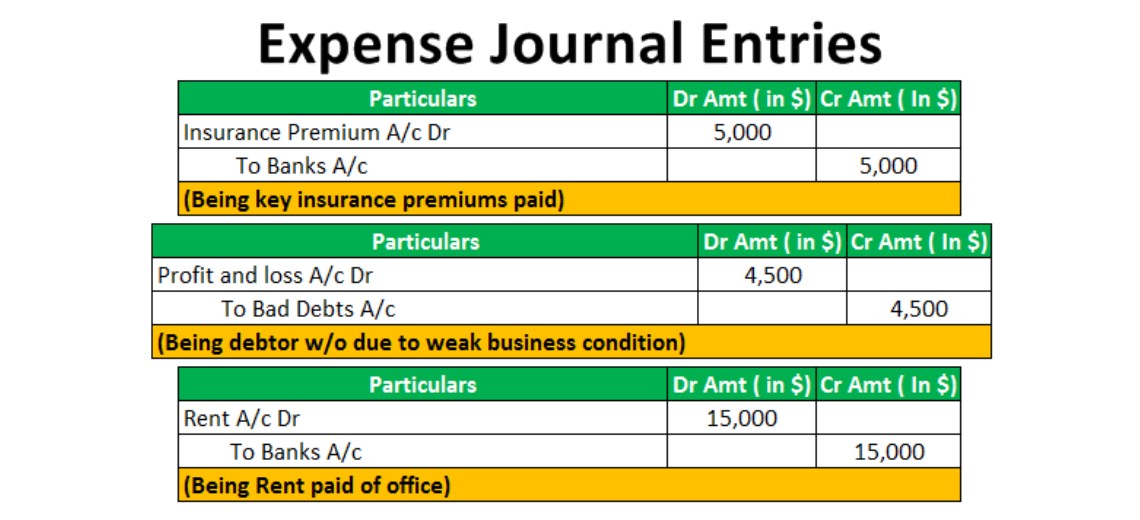

To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising. We analyzed this.

[Solved] Record following purchases transactions in JOURNAL ENTRY I

In accounting, the matching principle states that expenses are to be matched with revenues. Web journal entries are the way we capture the activity of.

Journal Entry Problems and Solutions Format Examples

In accounting, the matching principle states that expenses are to be matched with revenues. Utilities expense is the cost consumed in a reporting period related.

Examples of How to Record a Journal Entry for Expenses Hourly, Inc.

Cash has a credit of $300. This is posted to the utility expense t. To increase an expense, we debit and to decrease. Web the.

How to Adjust Journal Entry for Unpaid Salaries

In accounting, the matching principle states that expenses are to be matched with revenues. Web journal entries are the way we capture the activity of.

What is the adjusting entry for expenses? Leia aqui What is the

We analyzed this transaction to increase utilities expense and decrease cash since we paid cash. Web a journal entry is used to record utility expenses.

300 utility bill with cash. On in 2021 Journal entries, Accounting

*appropriate expense account (such as utilities expense, rent expense, interest expense, etc.). Utilities expense is the cost consumed in a reporting period related to electricity,.

Journal entry for outstanding expenses JEthinomics

Examples of utilities expense debit and credit journal entries. Web the following journal entry must be made: In the journal entry, utility expense has a.

On January 12, 2019, Pays A $300 Utility Bill With Cash.

A company receives an invoice for $2,000 in electricity and records it in the accounting records using the utility expense bookkeeping journal. To increase an expense, we debit and to decrease. Reasons to accrue for expenses. Journal entries are the base of accounting.

Web Expense Journal Entries Are The Critical Accounting Entries That Reflect The Expenditures Incurred By The Entity.

Web a journal entry is used to record utility expenses and includes debiting utility expenses and crediting either accrued expenses or accounts payable. This is posted to the utility expense t. In the journal entry, utility expense has a debit balance of $300. To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising.

Web Journal Entries Are The Way We Capture The Activity Of Our Business.

When a business transaction requires a journal entry, we must follow these rules: On 4 july 2014, at the time of actual payment is made, the following journal entry is made: Web utility expense journal entry. Debit and credit journal entries for a utilities.

The Entry Must Have At.

Utilities expense is the cost consumed in a reporting period related to electricity, heat, sewer, and water expenditures. Web debit and credit journal entries for utilities expense. Web written by cfi team. In accounting, the matching principle states that expenses are to be matched with revenues.