Unrealized Gains And Losses Accounting Journal Entry - Last week i wrote about receiving stock from donors. Web as the fair value of the equity security changes during its holding period, the unrealized gain or loss is reported on the income statement as an unrealized holding gain or loss. Journal entry examples from youtube video linked below. No impact to income statement or cash flow statement. Made this video based on a. It reduces the owner's equity. Web journal entry insights for unrealized gains. Web unrealized revaluation gains and losses refer to profits or losses that have occurred more commonly known as ‘on paper’, but the relevant closing out transactions have not been completed. Ifrs provides guidance on how organization. For example, if you buy a stock for $10 and it rises to $15, you have an unrealized gain of $5 per share.

Accounting Journal Entries For Dummies

In the case of an increase in the fair value, the journal entry will be: Web an unrealized gain is an increase in the value.

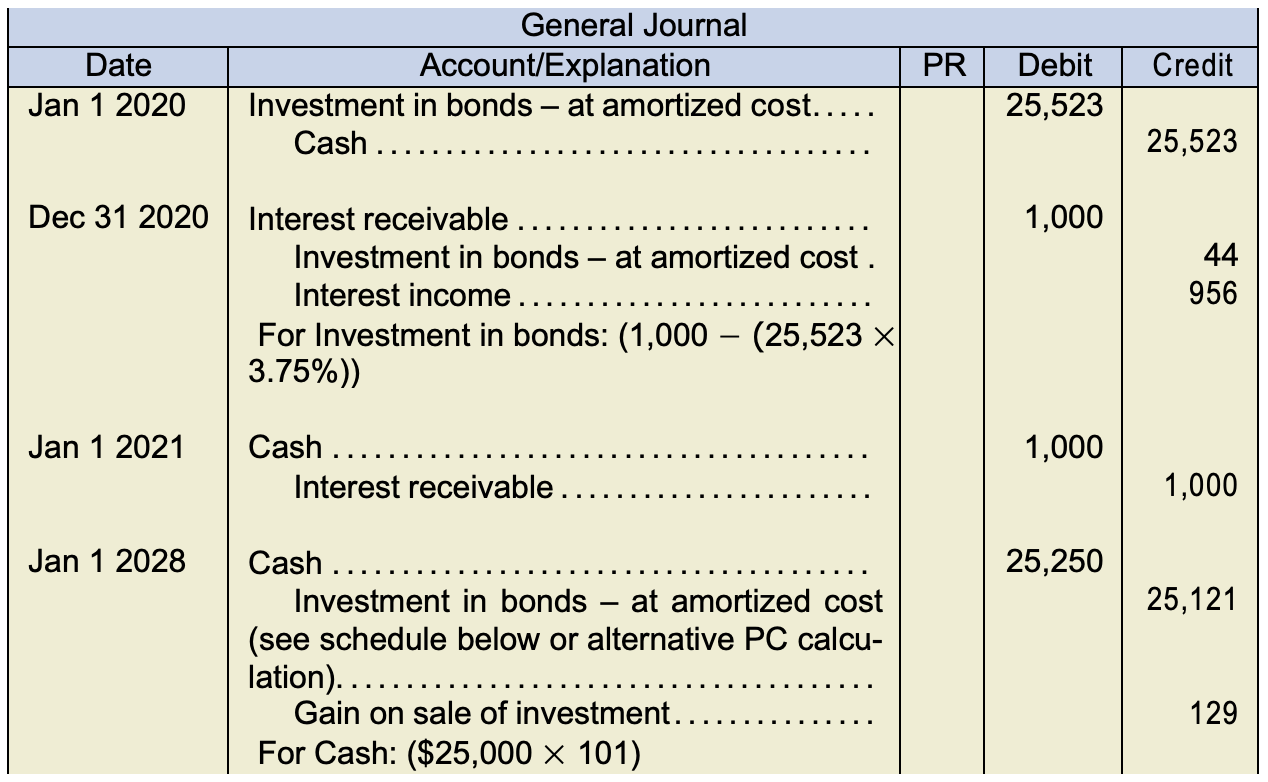

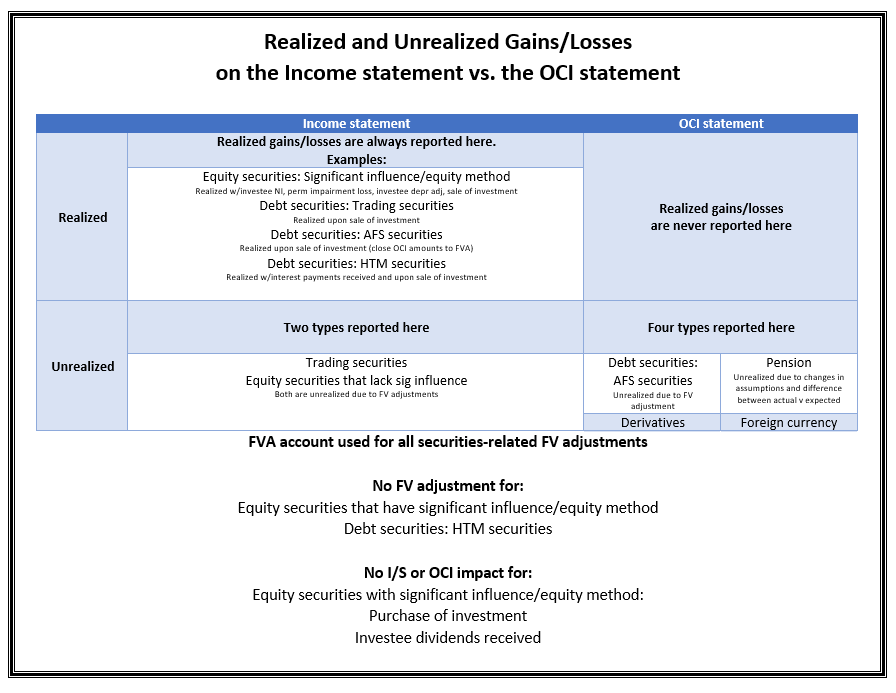

Realized and unrealized gains and losses on the statement vs OCI

Web recording unrealized gains and losses of investment accounts. Journal entry examples from youtube video linked below. Web impacts balance sheet. Web 21.3.1 presentation and.

Unrealized Gain (loss) The Change In Value of An asset

Web recording unrealized gains and losses of investment accounts. Web unrealized gains and losses accounting is a way for companies to account for their investments..

Unrealized gain and loss Step by step guide to record unrealized

There are several different methods for achieving this under gaap, depending on what type. Unrealized gains represent potential financial benefits that have yet to be.

Unrealized Gains (Losses) on Balance Sheeet Examples Journal

Web real gross domestic product (gdp) increased at an annual rate of 1.3 percent in the first quarter of 2024 (table 1), according to the.

Foreign Currency Revaluation Definition, Process, and Examples

There is no impact to the income statement. It is, in essence, a paper profit. when an asset is sold, it becomes a realized gain..

Unrealized Gain Loss AutoCount Resource Center

Made this video based on a. Web learn how to record unrealized gain, the increase of securities value while the company has not yet sold.

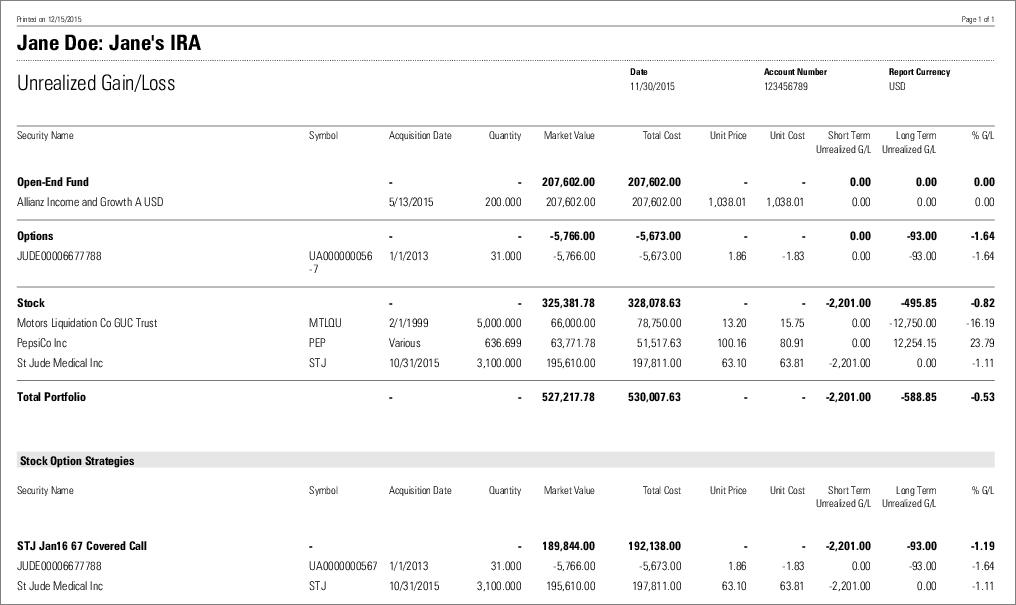

Sample Unrealized Gain/Loss Report

Web to mark an investment account to market, first create an other revenue sub account, which in my case i named unrealized gain/loss. then when.

Accounting Journal Entries for Foreign Exchange Gains and Losses

Web unrealized revaluation gains and losses refer to profits or losses that have occurred more commonly known as ‘on paper’, but the relevant closing out.

Web An Unrealized Loss Or Gain Goes On The Balance Sheet Because It Represents A Loss Or Gain In The Value Of Your Assets.

For companies that have large portfolios of equity securities that were classified as available for sale,. Web to mark an investment account to market, first create an other revenue sub account, which in my case i named unrealized gain/loss. then when you need to mark to market, take the amount of gain/loss and create a journal entry. Made this video based on a. The fair value adjustment for these investments will be a $700 holding.

Web Learn How To Record Unrealized Gain, The Increase Of Securities Value While The Company Has Not Yet Sold Them, In Journal Entry.

Web 21.3.1 presentation and disclosure of transaction gains and losses. The gdp estimate released today is based on more complete source data than. Web journal entry insights for unrealized gains. Web real gross domestic product (gdp) increased at an annual rate of 1.3 percent in the first quarter of 2024 (table 1), according to the second estimate released by the bureau of economic analysis.

Web As The Fair Value Of The Equity Security Changes During Its Holding Period, The Unrealized Gain Or Loss Is Reported On The Income Statement As An Unrealized Holding Gain Or Loss.

Web the unrealized gains and losses are recorded in the balance sheet under the section of owner’s equity. 8.3k views 1 year ago. Web impacts balance sheet. In this video on unrealized gains (losses), here we discuss practical examples along with type of securities that result.

Shall Treat Revaluation Gains And Losses Under Most Circumstances.

No impact to income statement or cash flow statement. The seller calculates the gain or loss that would have been sustained if the customer paid the invoice at the end of the accounting period. It is a profitable position that has yet to be sold in return for cash, such as a stock position. However, this gain is only on paper, as you have not realized it by selling the stock and receiving cash.