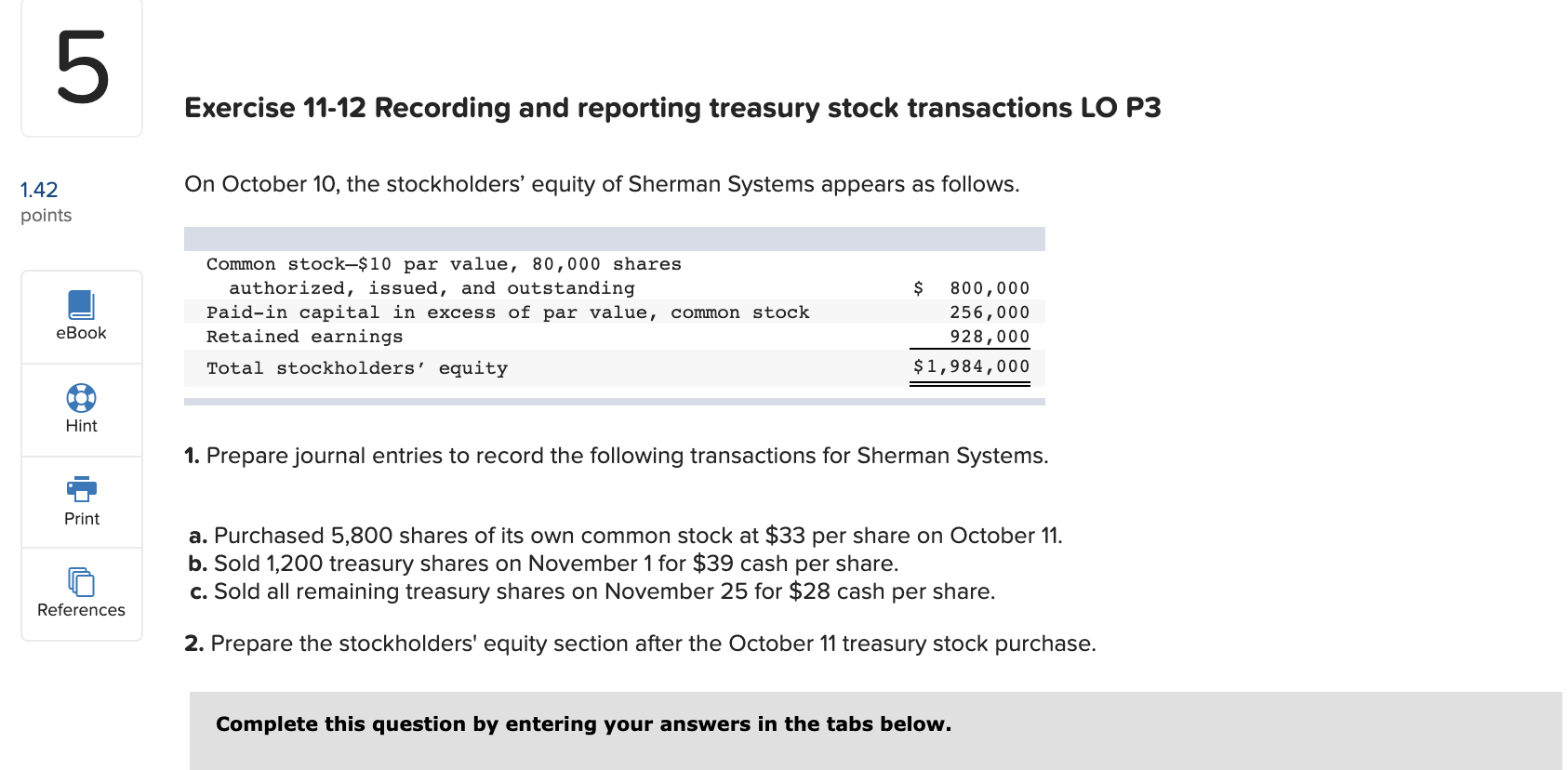

Treasury Stock Journal Entry - Do gains and losses arise on treasury stock transactions? Par value may be any amount—1 cent, 10 cents, 16 cents, $ 1, $5, or $100. Web the company can record the sale of treasury stock with the journal entry of debiting the cash account and crediting the treasury stock account when the sale price equals its cost. Opposite to the purchase, the sale of treasury stock. Once a reporting entity has acquired its own shares it may choose to retire the reacquired shares or hold them as treasury stock. Web record the issuance of preferred stock. Because it has been issued, we cannot. Define “treasury stock” and provide reasons for a corporation to spend its money to acquire treasury stock. The company can make the journal entry for the purchase of treasury stock by debiting the treasury stock account and crediting. Even though the company is purchasing stock, there is no asset recognized for the purchase.

Treasury Stock Journal Entries Exercise YouTube

Web treasury stock journal entry. Last updated october 26, 2022. 7 5 par value common stock. Its balance represents the owners' claims that have been.

Problem 132A Treasury Stock Journal Entries (part a) YouTube

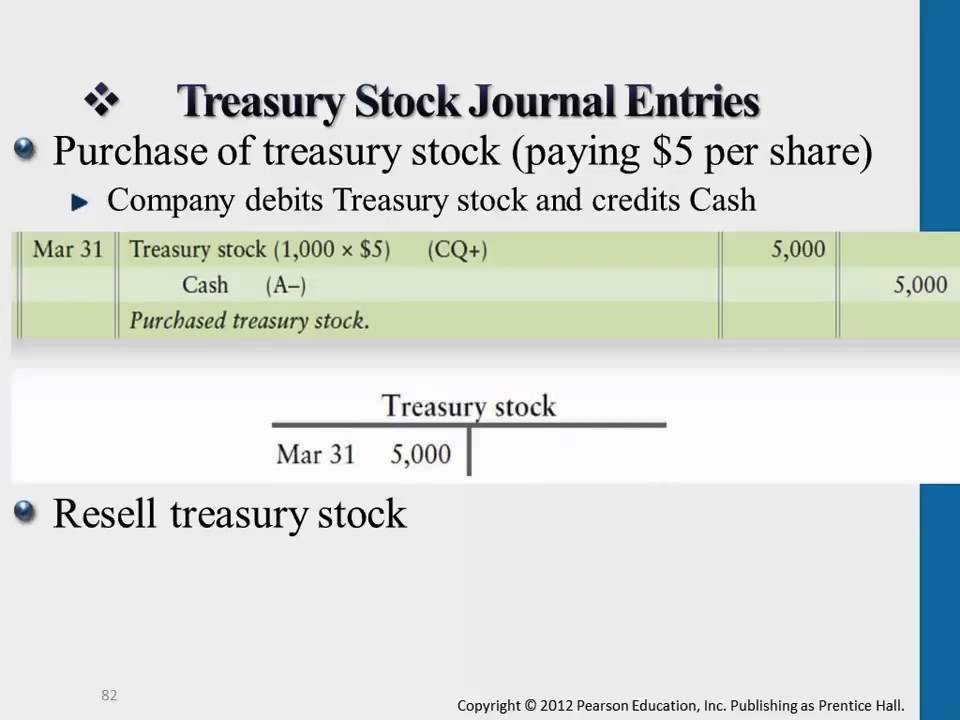

Web the following journal entry is recorded for the purchase of the treasury stock under the cost method. Web record the issuance of preferred stock..

(How to) Recording Treasury Stock Journal Entry Transactions Part 1

Web in this journal entry of the sale of treasury stock, both total assets and total equity in the balance sheet increase by $75,000. This.

Treasury Stock Journal Entries YouTube

Let us understand the journal entries in a case when the entity decides not to issue back these shares and instead retire them permanently. Increase.

Treasury Stock Journal Entries YouTube

Web updated on april 29, 2023. Each share of common or preferred capital stock either has a par value or lacks one. Let us understand.

View 27 Treasury Stock Journal Entry greatsomethingstock

Web record the issuance of preferred stock. credit common stock for $8,250d. Web such journal entry for the recording of the purchase (and retirement) of.

Issuing Stock & Treasury Stock (Journal Entries) YouTube

For example, the company abc purchases 1,000 shares of its own common stock on the market at the price of $100 per share. Once a.

Journalizing Treasury Stock Transactions (Cost Method) YouTube

Web such journal entry for the recording of the purchase (and retirement) of the treasury stock may look like below instead: Prepare a journal entry.

Buying & Selling Treasury Stock (Journal Entries) YouTube

An entity cannot own part of itself, so no asset is acquired. Web treasury stock journal entry. Web record the issuance of preferred stock. Web.

Web Also, The Journal Voucher Must Explain The Circumstances That Caused The Adjustment.

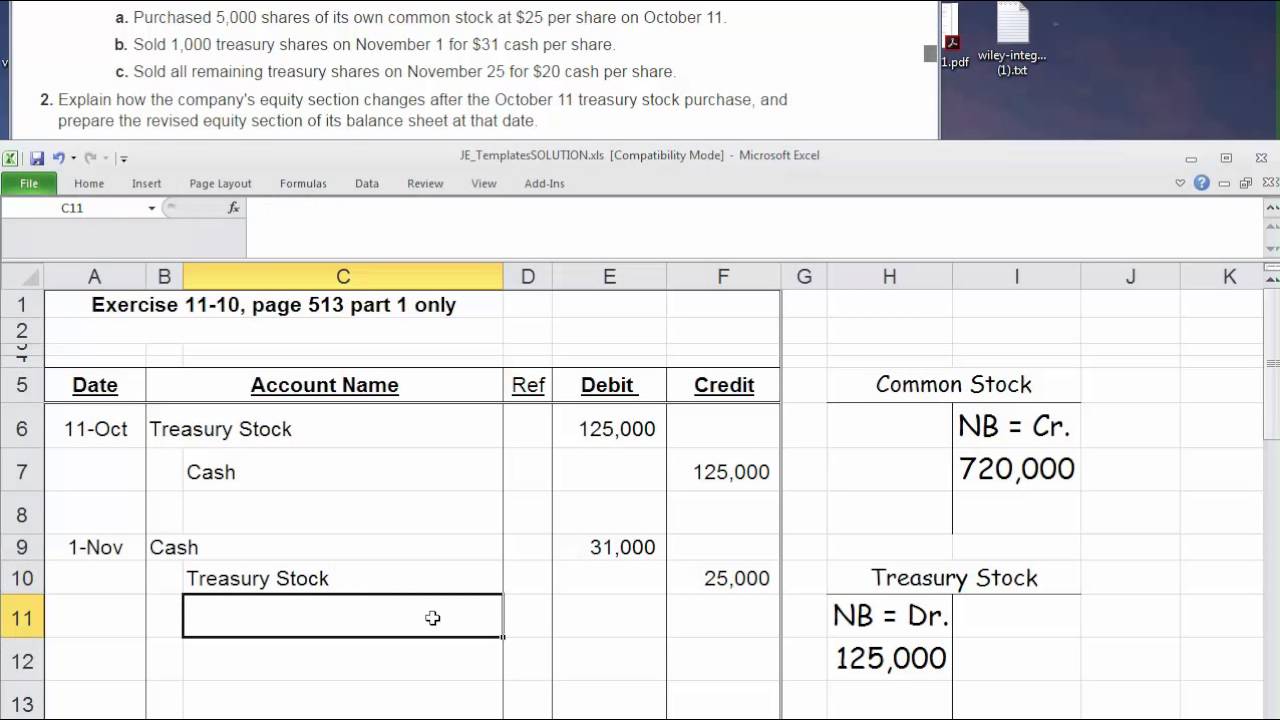

On december 1, 20×1, entity a purchased 6,000 shares of its own common stock at $25 per share. Web which of thefollowing is part of the journal entry to record the purchase?a. Par value may be any amount—1 cent, 10 cents, 16 cents, $ 1, $5, or $100. Web the journal entry to record this sale of the treasury shares at cost is:

Once A Reporting Entity Has Acquired Its Own Shares It May Choose To Retire The Reacquired Shares Or Hold Them As Treasury Stock.

When a reporting entity repurchases its common shares, it is distributing cash to existing shareholders to reacquire a portion of its outstanding equity. Web such journal entry for the recording of the purchase (and retirement) of the treasury stock may look like below instead: Web the following journal entry is recorded for the purchase of the treasury stock under the cost method. Web in the journal entry, the controller is eliminating the $100,000 originally credited to the common stock account and associated with its par value.

Stock 75, 000 Retained Earnings 410, 000 Total Stockholders' Equity $ 985, 000 During The Year, The.

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web sacramento corporation reports the following components of stockholders' equity on january 1. Even though the company is purchasing stock, there is no asset recognized for the purchase. Web the journal entries would be recorded as follows:

Define “Treasury Stock” And Provide Reasons For A Corporation To Spend Its Money To Acquire Treasury Stock.

Can retained earnings be increased or decreased as a result of treasury stock transactions? Increase in treasury stock is recorded on the debit side. Each share of common or preferred capital stock either has a par value or lacks one. The par value method is based on the assumption that the acquisition of treasury stock is essentially a permanent reduction in stockholders' equity.