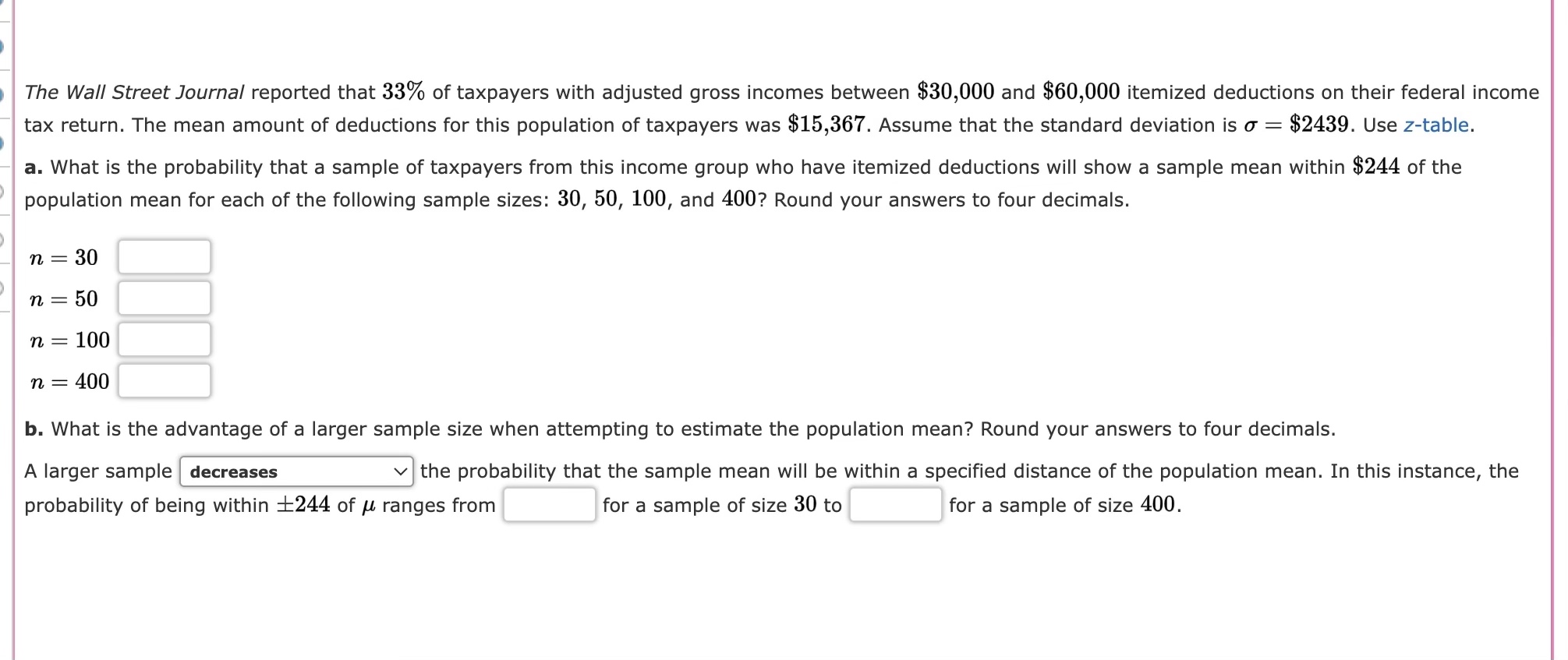

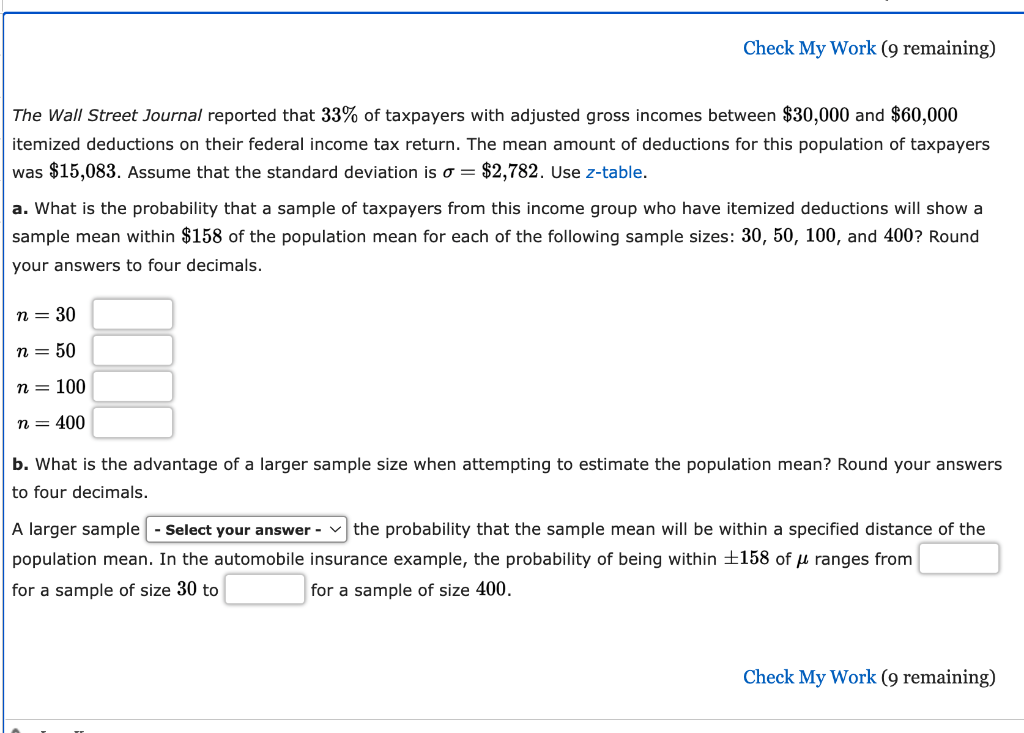

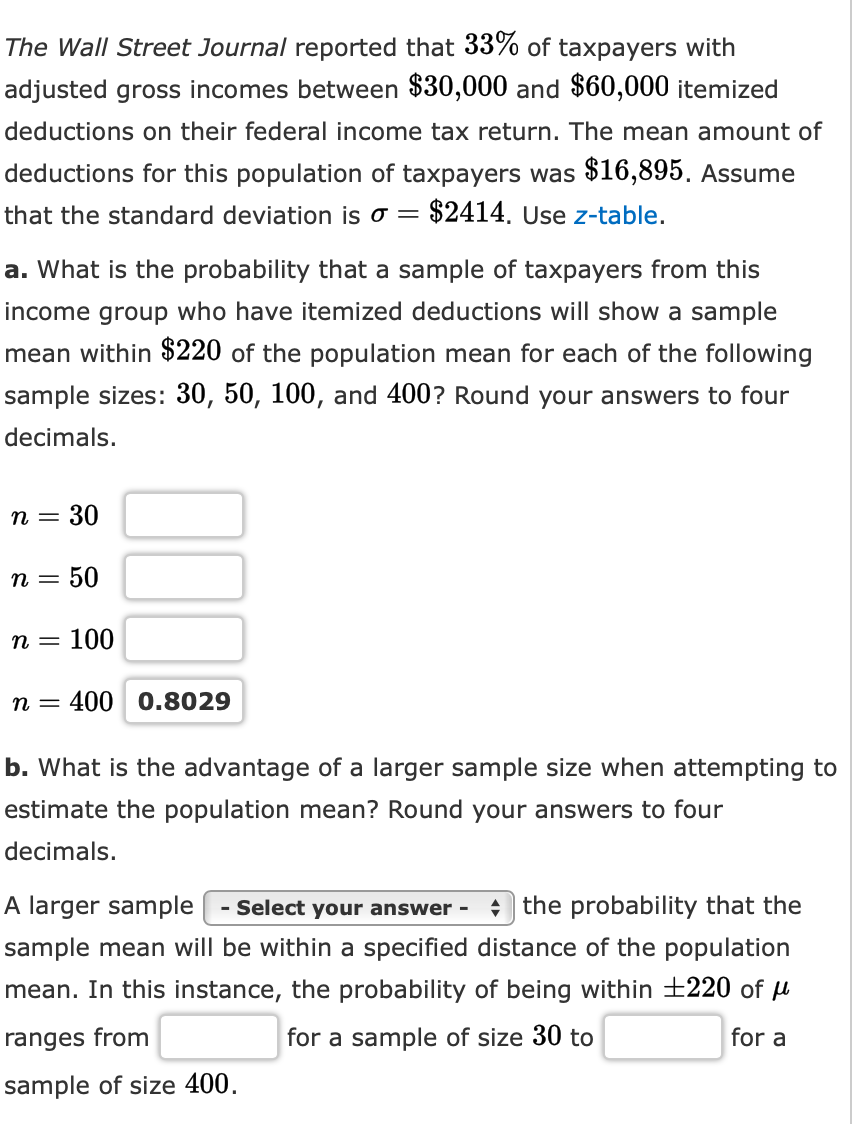

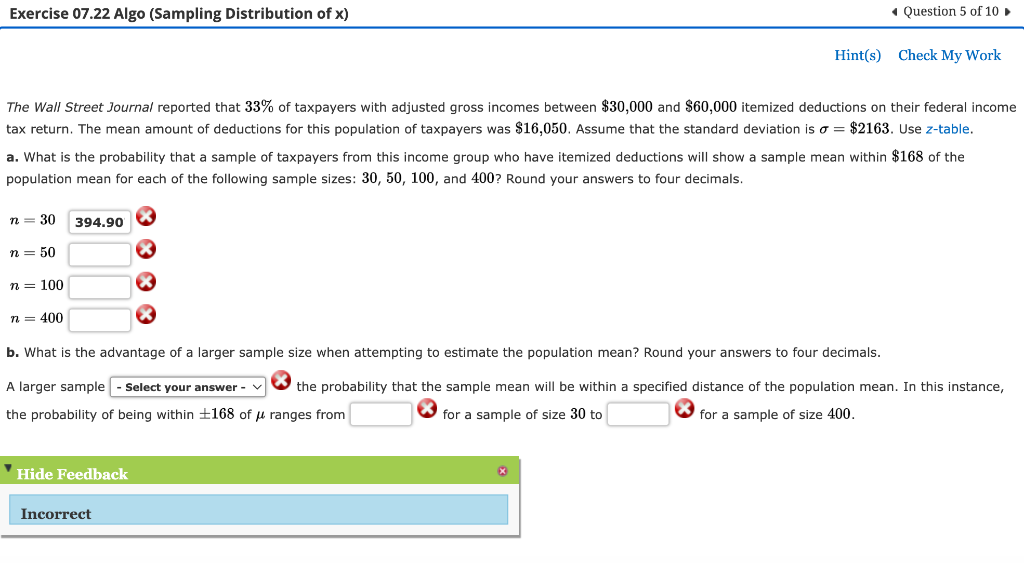

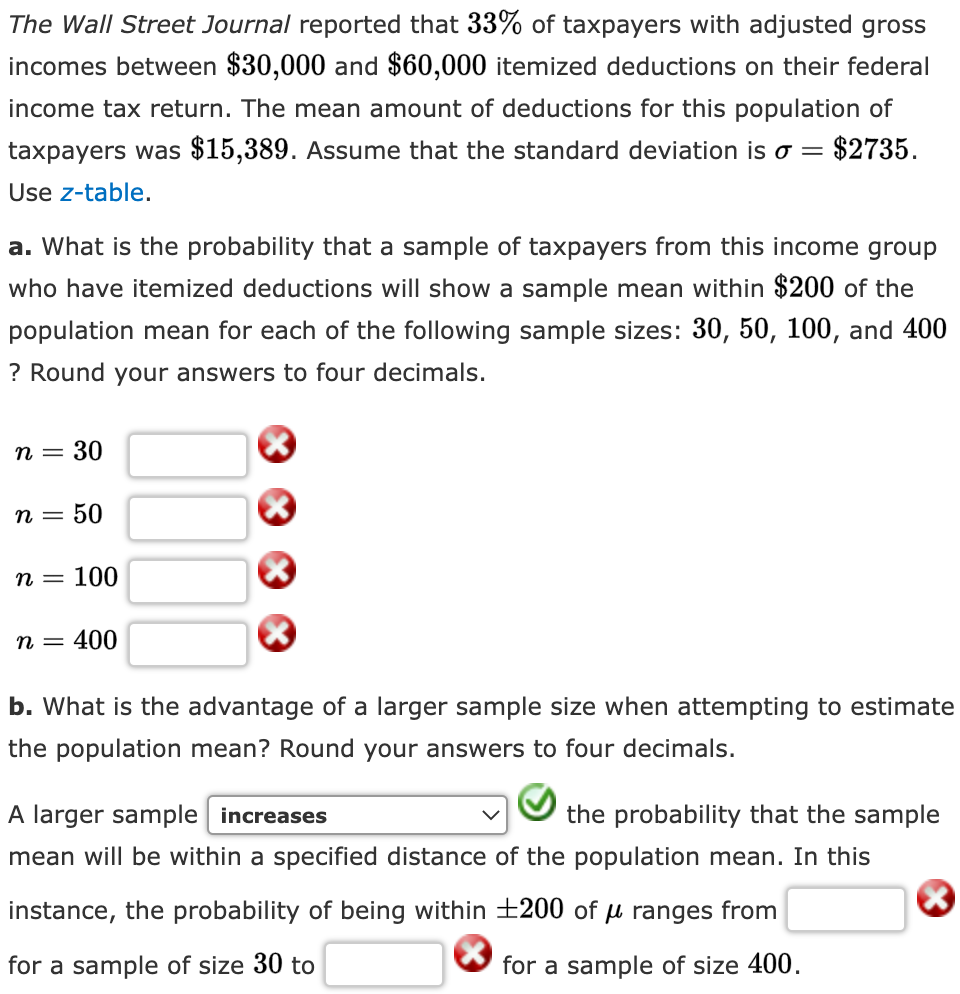

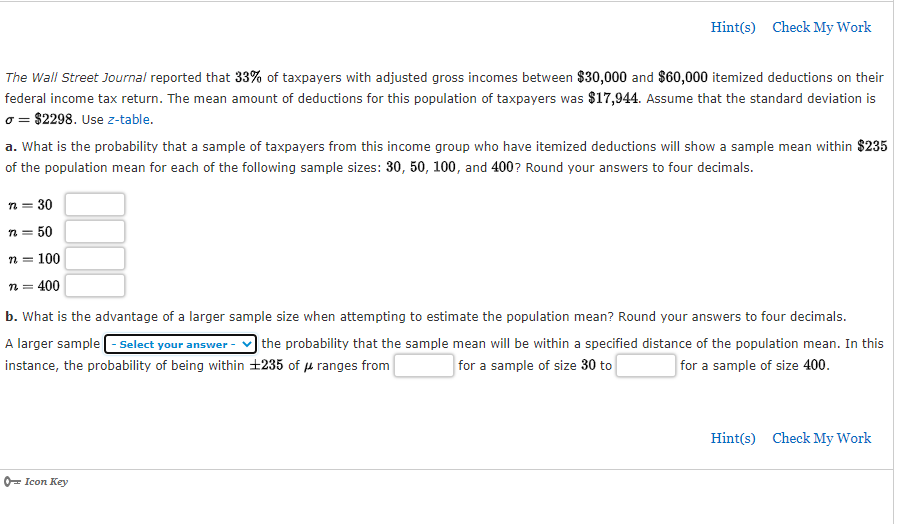

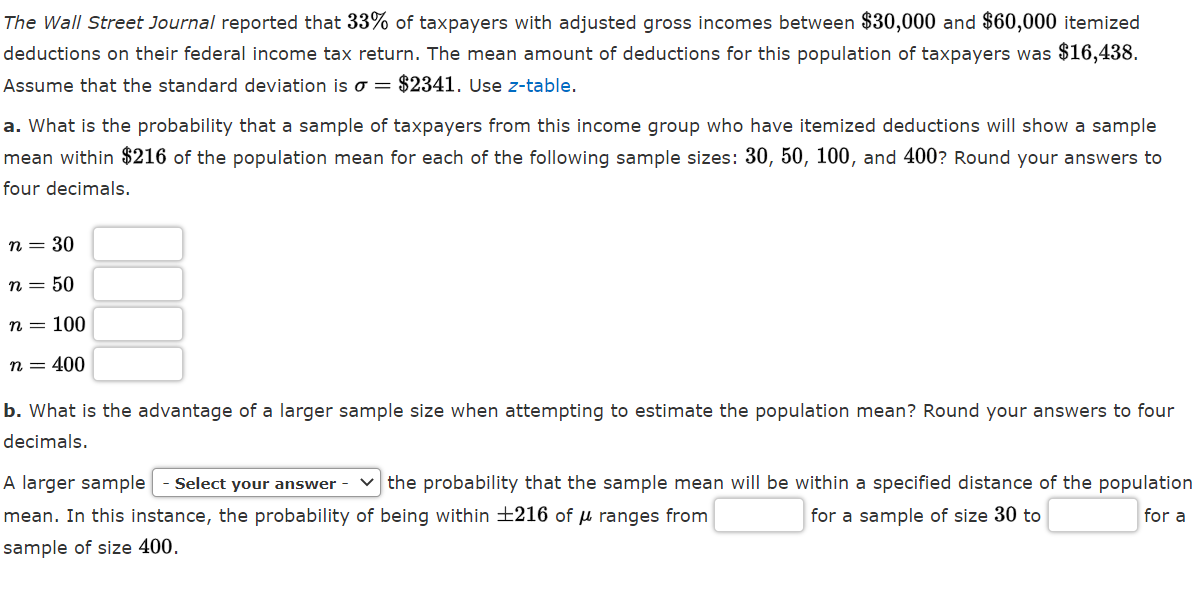

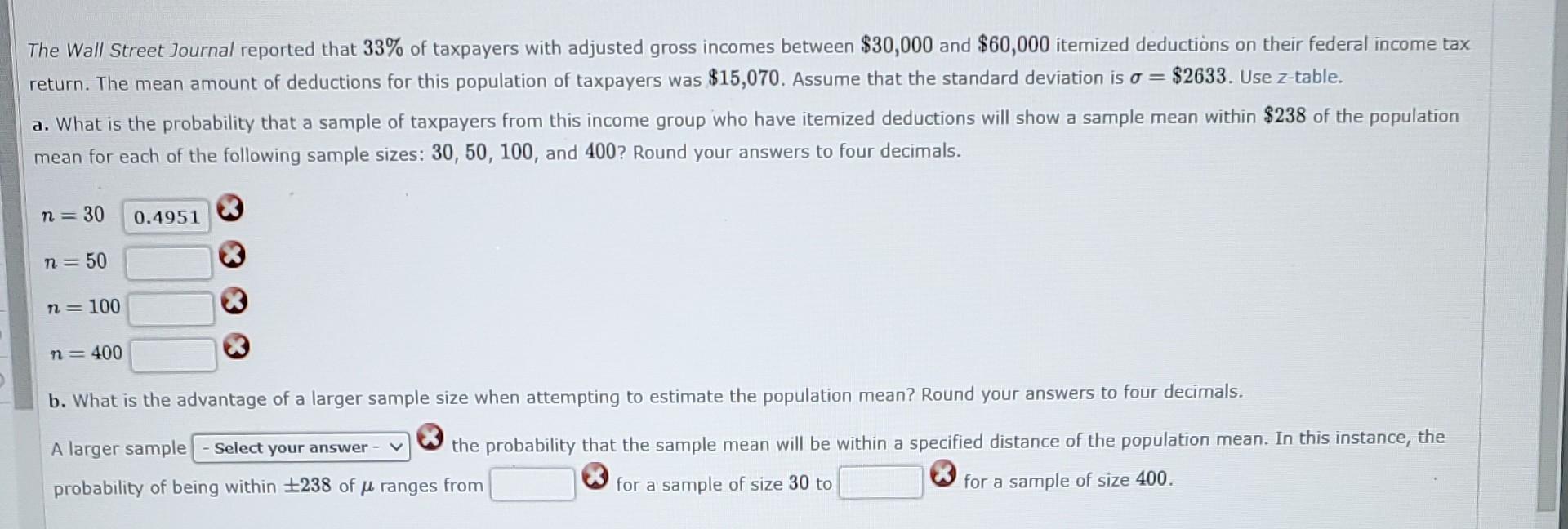

The Wall Street Journal Reported That 33 Of Taxpayers - Web the wall street journal reports that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax return. Web statistics and probability questions and answers. Web the wall street journal reported that 33 % of taxpayers with adjusted gross incomes between $ 30. The mean amount of deductions for this population of taxpayers was $16,642. The wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30000 and $60000. 33% of the population was itemizing and our original distribution was individuals. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax return. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax. The wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000. Web the wall street journal reported that 33 % of taxpayers with adjusted gross incomes between $ 30, 000 and $ 60, 000 itemized deductions on their federal income tax.

Solved The Wall Street Journal reported that 33 of

000 itemized deductions on their federal income tax return. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000.

Solved The Wall Street Journal reported that 33 of

Add more to the pile. Web the wall street journal reports that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions.

Solved The Wall Street Journal reported that 33 of

000 itemized deductions on their federal income tax return. Add more to the pile. The wall street journal reported that 33% of taxpayers with adjusted.

Solved Hint(s) The Wall Street Journal reported that 33 of

Instead of explaining where the money went, mr. The wall street journal reports that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000.

Solved The Wall Street Journal reported that 33 of

Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax.

SOLVEDThe Wall Street Journal reported that 33 of taxpayers with

The wall street journal reported that 33% of taxpayers with adjusted gross incomes. The wall street journal reported that 33% of taxpayers with adjusted gross.

Solved The Wall Street Journal reported that 33 of

Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax.

Solved The Wall Street Journal reported that 33 of

Web statistics and probability questions and answers. The mean of the deduction was 16,642, that's how much they itemized in the. 000 itemized deductions on.

Solved The Wall Street Journal reported that 33 of

Web statistics and probability questions and answers. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000.

Web The Wall Street Journal Reported That 33% Of Taxpayers With Adjusted Gross Incomes Between $30,000 And $60,000 Itemized Deductions On Their Federal Income Tax Return.

The mean amount of deductions for this population of taxpayers was $16,642. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax return. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax return. Web the wall street journal reported that 33 \% 33% of taxpayers with adjusted gross incomes between \$ 30,000 $30,000 and \$ 60,000 $60,000 itemized deductions on their.

The Wall Street Journal Reports That 33% Of Taxpayers With Adjusted Gross Incomes Between $30,000 And $60,000 Itemized Deductions On Their Federal Income Tax.

Instead of explaining where the money went, mr. The wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax. Web statistics and probability questions and answers. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax return.

The Mean Of The Deduction Was 16,642, That's How Much They Itemized In The.

Werfel asked the house to look away. The mean amount of deductions for this population of taxpayers was $ 16. Web the wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000 itemized deductions on their federal income tax return:. The wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30000 and $60000.

000 Itemized Deductions On Their Federal Income Tax Return.

Add more to the pile. Web the wall street journal reported that 33 % of taxpayers with adjusted gross incomes between $ 30. The wall street journal reported that 33% of taxpayers with adjusted gross incomes between $30,000 and $60,000. The wall street journal reported that 33% of taxpayers with adjusted gross incomes.