The Journal Entry To Record The Factory Overhead Applied Includes - The journal entry to record the labor costs is: Web the journal entry to record manufacturing overhead applied to production includes: Web when closing overapplied manufacturing overhead to cost of goods sold, which of the following would be true? Web the overhead costs are applied to each department based on a predetermined overhead rate. If the overhead was overapplied, and the actual. Make the journal entry to record manufacturing overhead applied to job 153. Web how to record the journal entries for actual and applied overheads? The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting the. Web the journal entry to record the manufacturing overhead for job mac001 is: Web the journal entry to record the applied manufacturing overhead cost includes a credit to _____.

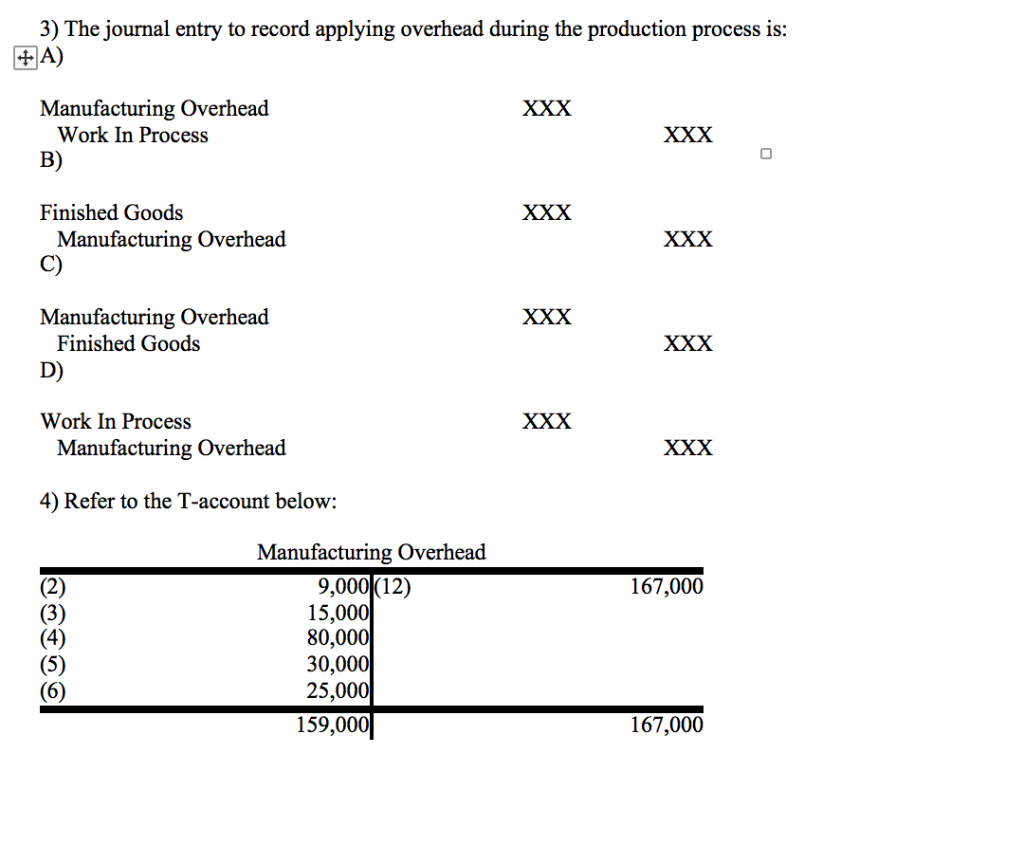

Solved 3) The journal entry to record applying overhead

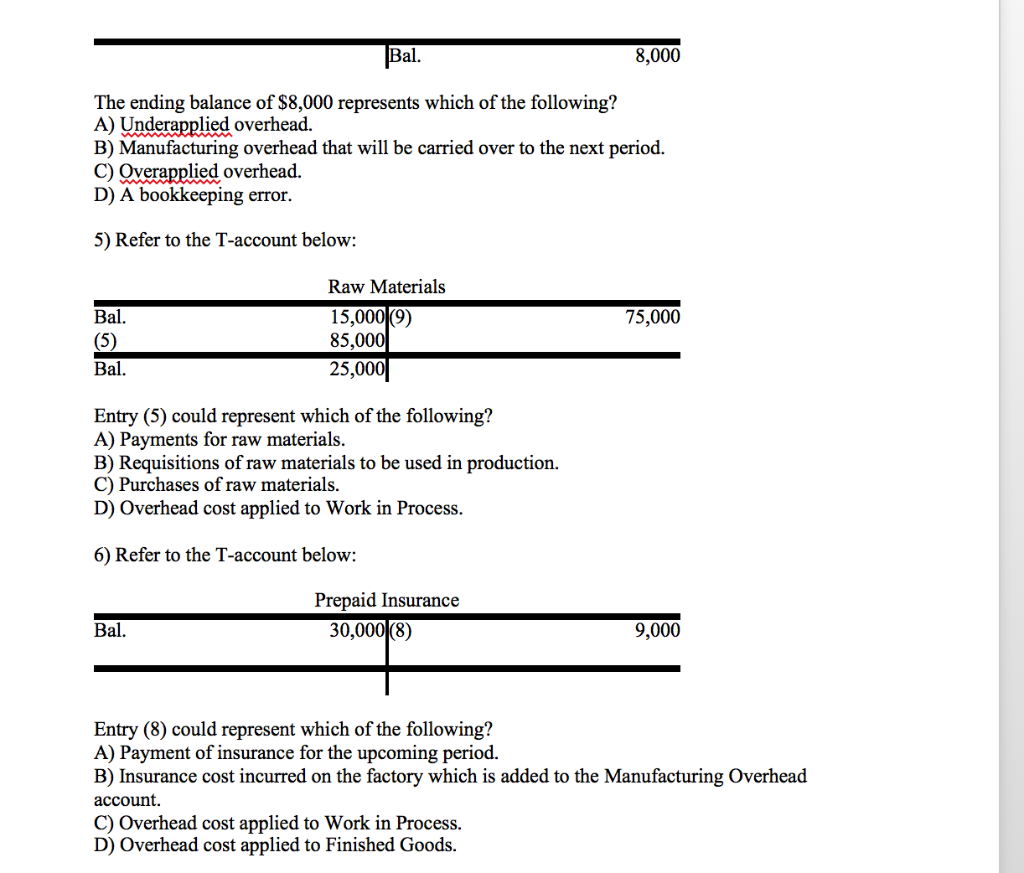

The adjusting journal entry is: B.) gross margin will increase. Web since manufacturing overhead has a debit balance, it is underapplied, as it has not.

Under & Over applied Overhead Journal Entry YouTube

The journal entry to record the labor costs is: B.) gross margin will increase. Web the journal entry to record the applied manufacturing overhead cost.

The Journal Entry to Record Labor Costs Credits

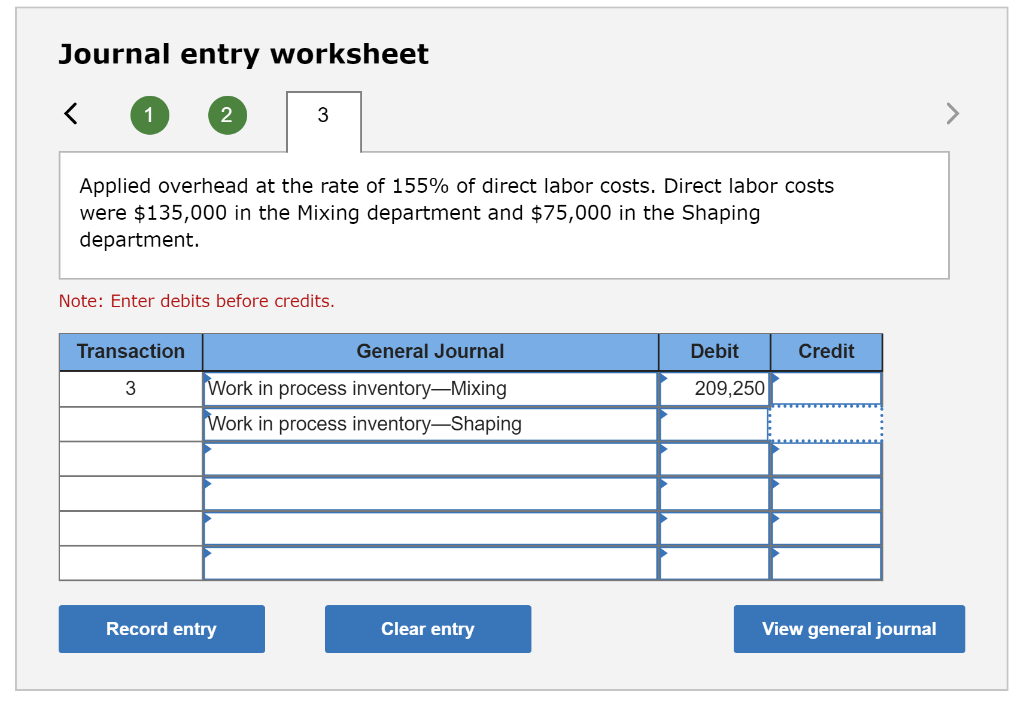

Web the journal entry to record manufacturing overhead applied to production includes: Web the journal entry to record the manufacturing overhead for job mac001 is:.

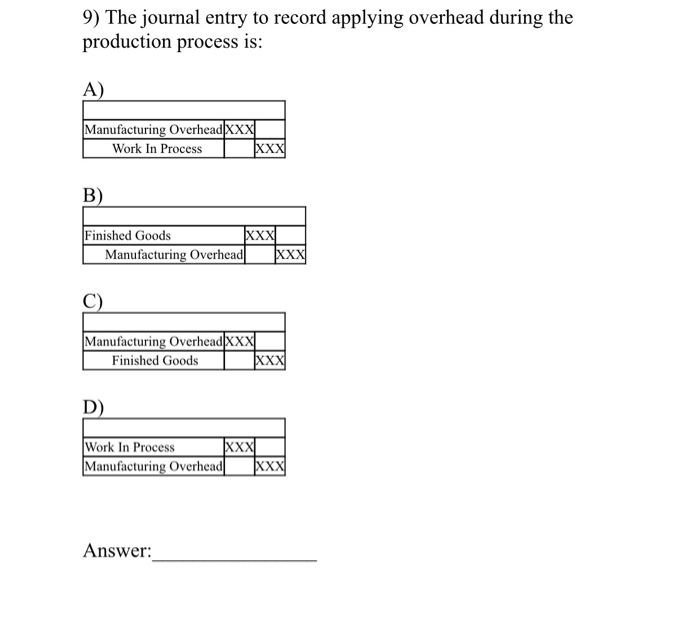

Solved 9) The journal entry to record applying overhead

Web the journal entry to record the manufacturing overhead for job mac001 is: B.) gross margin will increase. The journal entry to record the applied.

Accounting For Actual And Applied Overhead

The first stage of accounting for overheads is when calculating applied overheads. Web the overhead costs are applied to each department based on a predetermined.

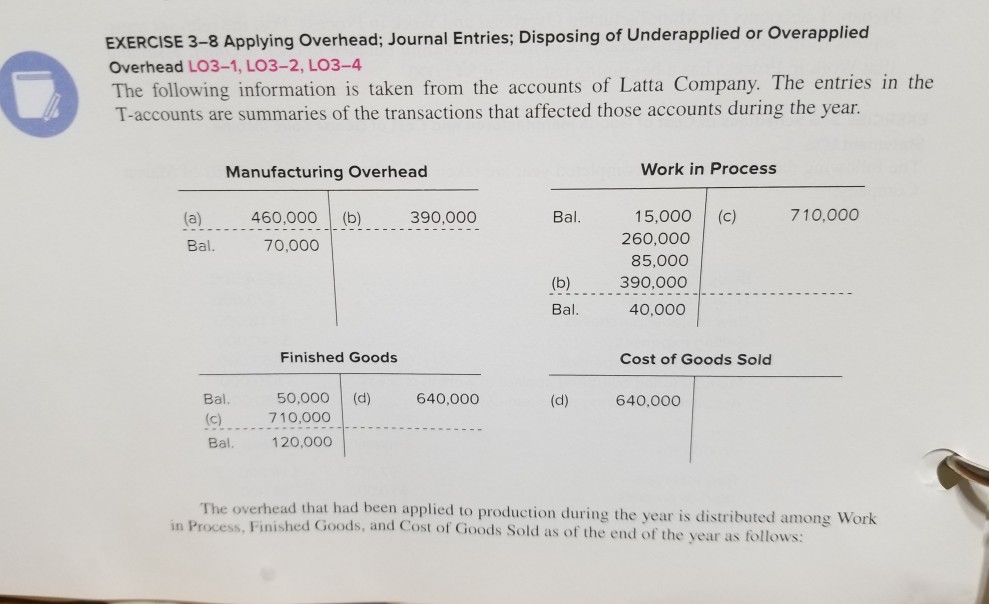

Solved EXERCISE 38 Applying Overhead; Journal Entries;

If the overhead was overapplied, and the actual. Web the journal entry to record manufacturing overhead applied to production includes: The company can make the.

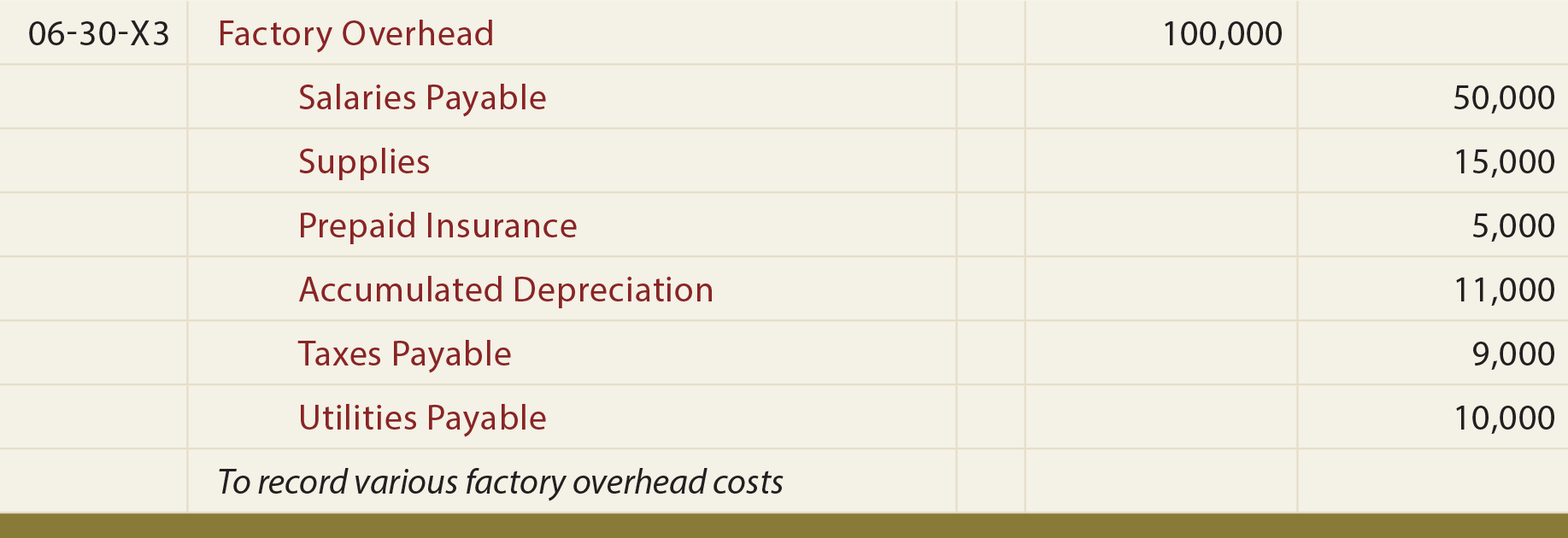

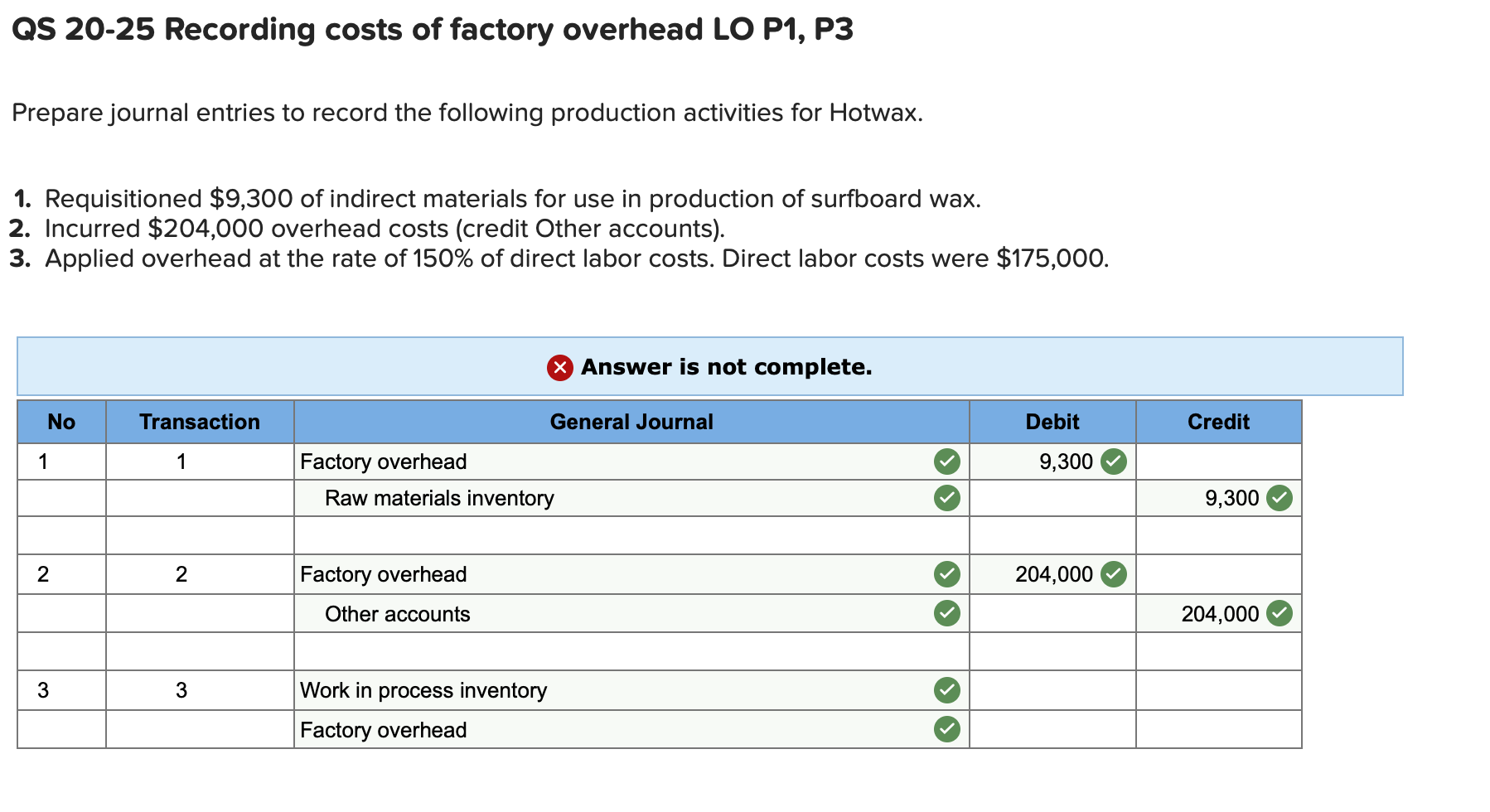

Solved QS 2025 Recording costs of factory overhead LO P1,

The cost of jobs can be calculated as completed the cost of jobs is not distorted. Debit work in process inventory and credit factory. Web.

Solved 3) The journal entry to record applying overhead

Web the overhead costs are applied to each department based on a predetermined overhead rate. A.) new income will decrease. The journal entry to record.

The Journal Entry to Record Labor Costs Credits

Decrease to work in process. Web the journal entry to record manufacturing overhead applied to production includes: What other document will include this. The journal.

Web The Journal Entry To Record The Manufacturing Overhead For Job Mac001 Is:

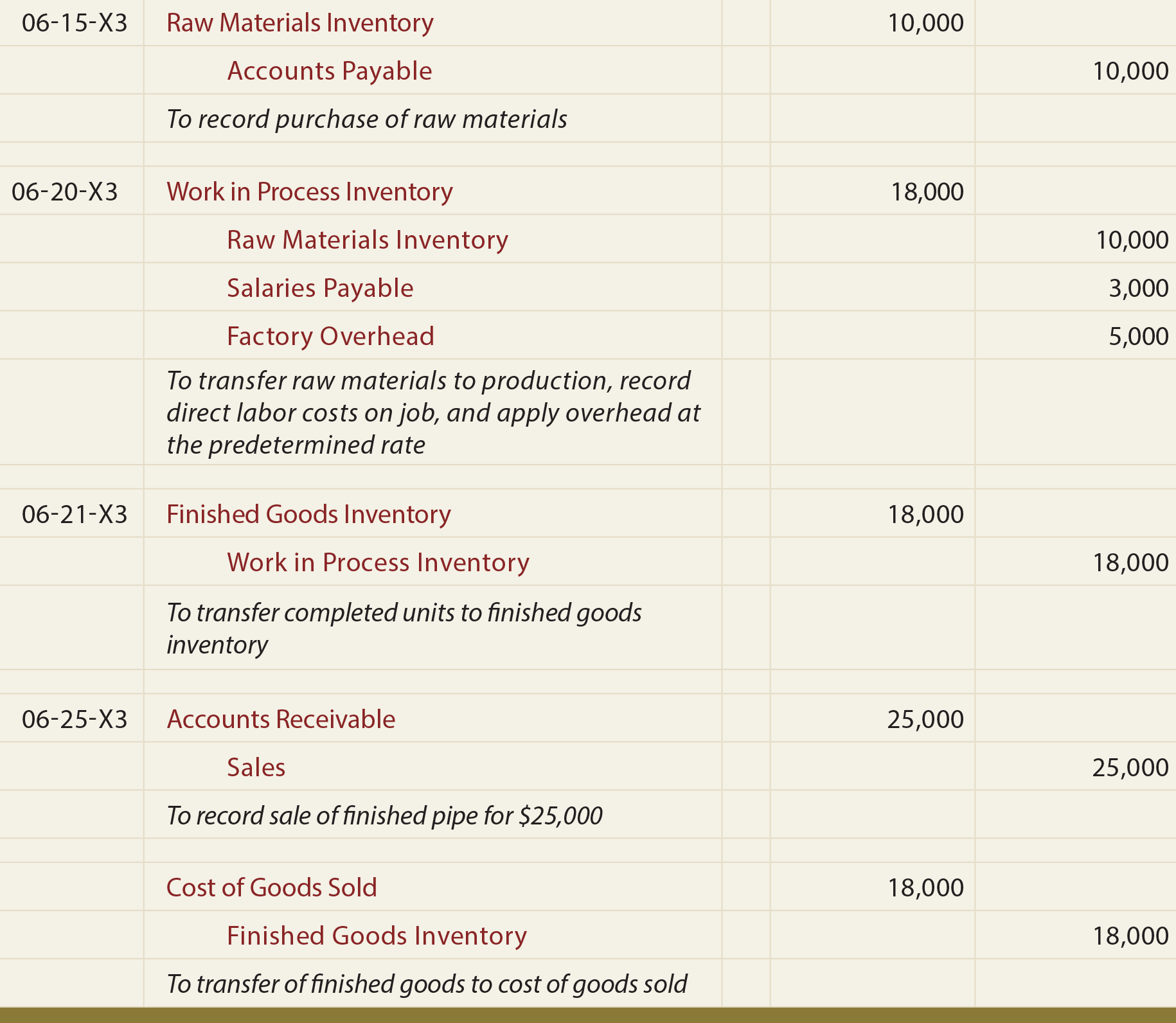

Web job 153 used a total of 2,000 machine hours. Web during july, the packaging department incurred $13,000 of direct labor costs and indirect labor of $1,000. The journal entry to record the applied factory overhead is to: Application of underapplied overhead to cost of goods sold.

The Total Overhead Incurred Is The Total Of:

If the overhead was overapplied, and the actual. In the example, assume that there was an indirect material cost for water of. The adjusting journal entry is: A.) new income will decrease.

A Credit To Work In Process.

In a standard costing system the process of recording manufacturing overhead is split into three steps: When each job and job order cost. Web how to record the journal entries for actual and applied overheads? What other document will include this.

Web The Journal Entry To Record Manufacturing Overhead Applied To Production Includes:

The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting the. Instead, it is a “suspense” or “clearing”. Web the overhead costs are applied to each department based on a predetermined overhead rate. It does not represent an asset, liability, expense, or any other element of financial statements.