The Journal Entry To Record Depreciation On Factory Equipment Debits - Web the journal entry to record actual depreciation on factory is a debit to manufacturing overhead control and a credit to applied manufacturing overhead. Debits depreciation expense, while the other debits. These are examples of some of the entries you may record: Credit to the balance sheet account accumulated depreciation. Manufacturing overhead $20,000 and credit accumulated depreciation $20,000. Your ask joey ™ answer. Therefore, it is very important to understand that when a depreciation expense journal entry is recognized in the. When a company records depreciation expense, the debit is. Web = $8,000 per year. Manufacturing overhead and credits accumulated depreciation when a job is completed, which.

How to write general journal entries using debits and credits

Therefore, it is very important to understand that when a depreciation expense journal entry is recognized in the. $10,000 / 5 = $2,000 now, debit..

What is the journal entry for depreciation? Leia aqui What is

Web the next journal entry shows the reduction of cost of goods sold to offset the amount of overapplied overhead: Web the journal entry to.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Credit to the balance sheet account accumulated depreciation. When a company records depreciation expense, the debit is. If you’re lucky enough to use an accounting.

Accounting Journal Entries Cheat Sheet

Web the journal entry to record depreciation expense for equipment is: Web difference b/n the entries to record depreciation on office equipment and depreciation on.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Web 1) the journal entry to record depreciation on production equipment would include a: Web difference b/n the entries to record depreciation on office equipment.

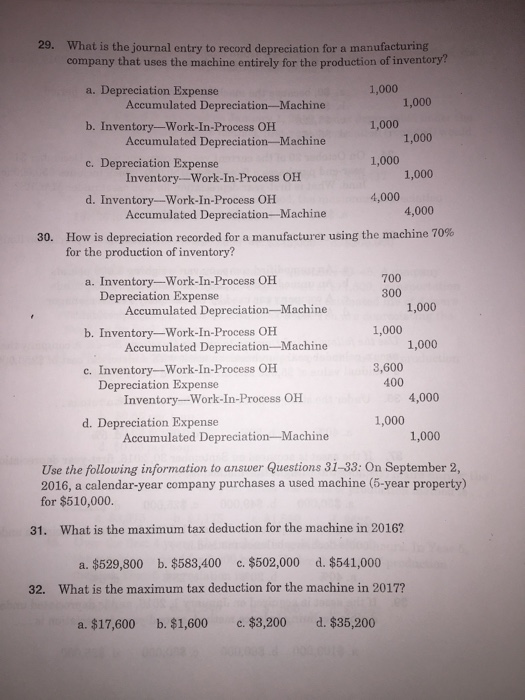

Solved 29. What is the journal entry to record depreciation

Web the journal entry to record depreciation expense for equipment is: What if the delivery van has an estimated residual value of $10,000 after 5.

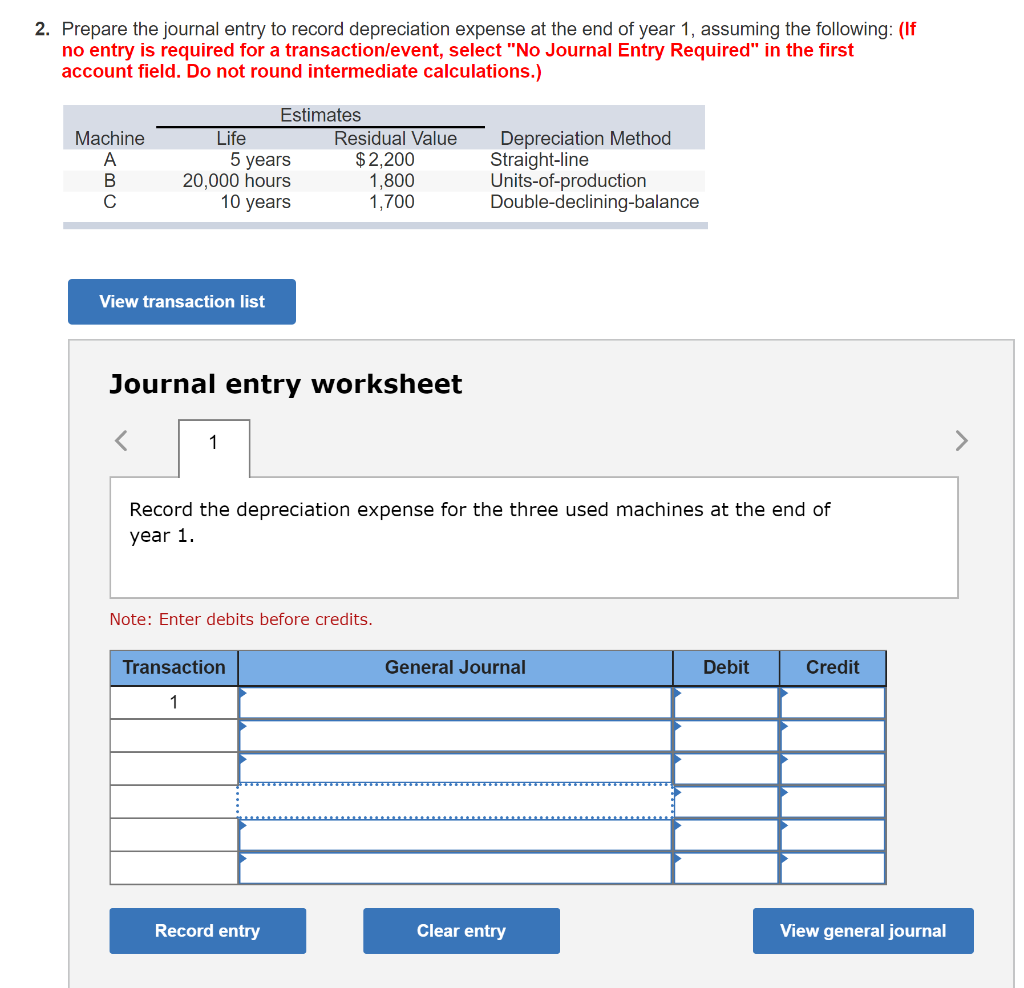

Solved 2. Prepare the journal entry to record depreciation

The journal entry to record depreciation on office equipment. Web the journal entry to record depreciation expense for equipment is: Web to determine the amount.

Debits and Credits Accounting Play

Web difference b/n the entries to record depreciation on office equipment and depreciation on factory equipment is that one: Web a journal entry that debits.

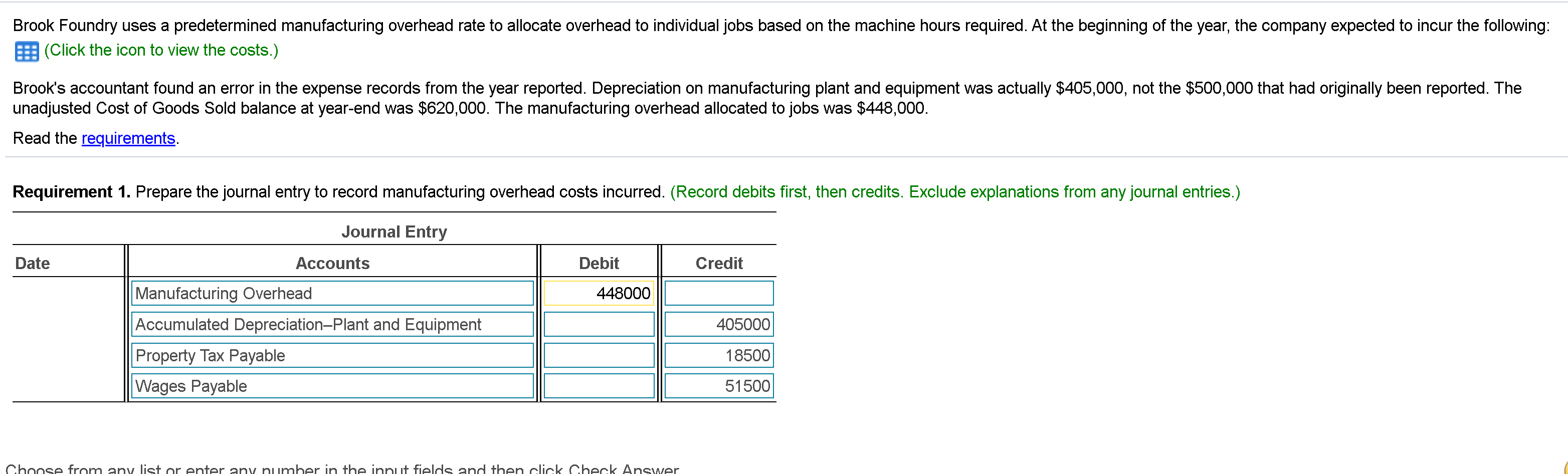

Solved Requirements 1. Prepare the journal entry to record

What is the journal entry to record depreciation expense? The journal entry to record depreciation on office equipment. Web the entry generally involves debiting depreciation.

The Journal Entry To Record Depreciation On Office Equipment.

Always keep in mind that the goal is to “zero out” the factory. Web record wages earned but unpaid c: Manufacturing overhead $20,000 and credit accumulated depreciation $20,000. Web the next journal entry shows the reduction of cost of goods sold to offset the amount of overapplied overhead:

Web = $8,000 Per Year.

The journal entry to record accrued property taxes for a. From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Therefore, it is very important to understand that when a depreciation expense journal entry is recognized in the. Web the journal entry to record depreciation expense for equipment is:

Web The Journal Entry To Record Depreciation On Factory Equipment Debits:

Web the journal entry to record $20,000 in depreciation on factory equipment is debit _____. Web 1) the journal entry to record depreciation on production equipment would include a: Your ask joey ™ answer. These are examples of some of the entries you may record:

Web To Determine The Amount Of Each Equipment Depreciation Journal Entry, Divide The Value Of The Computers By The Predicted Useful Life:

Web the journal entry to record actual depreciation on factory is a debit to manufacturing overhead control and a credit to applied manufacturing overhead. Debit to the income statement account depreciation expense. If you’re lucky enough to use an accounting software. Credit to the balance sheet account accumulated depreciation.