The Journal Entry To Close Revenue Accounts Includes - After closing both income and revenue accounts, the income summary. Web the closing process is carried out with several journal entries, known as closing entries. Web what are closing entries? Web an unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry when you supply the. Web the journal entry to close revenue accounts includes a. Web examples of journal entries for numerous sample transactions. Web adjusting entries include accruals for revenue and expenses, deferrals for prepayments, estimates for depreciation and provisions for doubtful accounts. Web below is the journal entry that will assist in this process: Debit all revenue accounts and credit the income summary account, thereby clearing out the balances in. Closing entries serve two objectives.

Closing Entries Accountancy Knowledge

Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like.

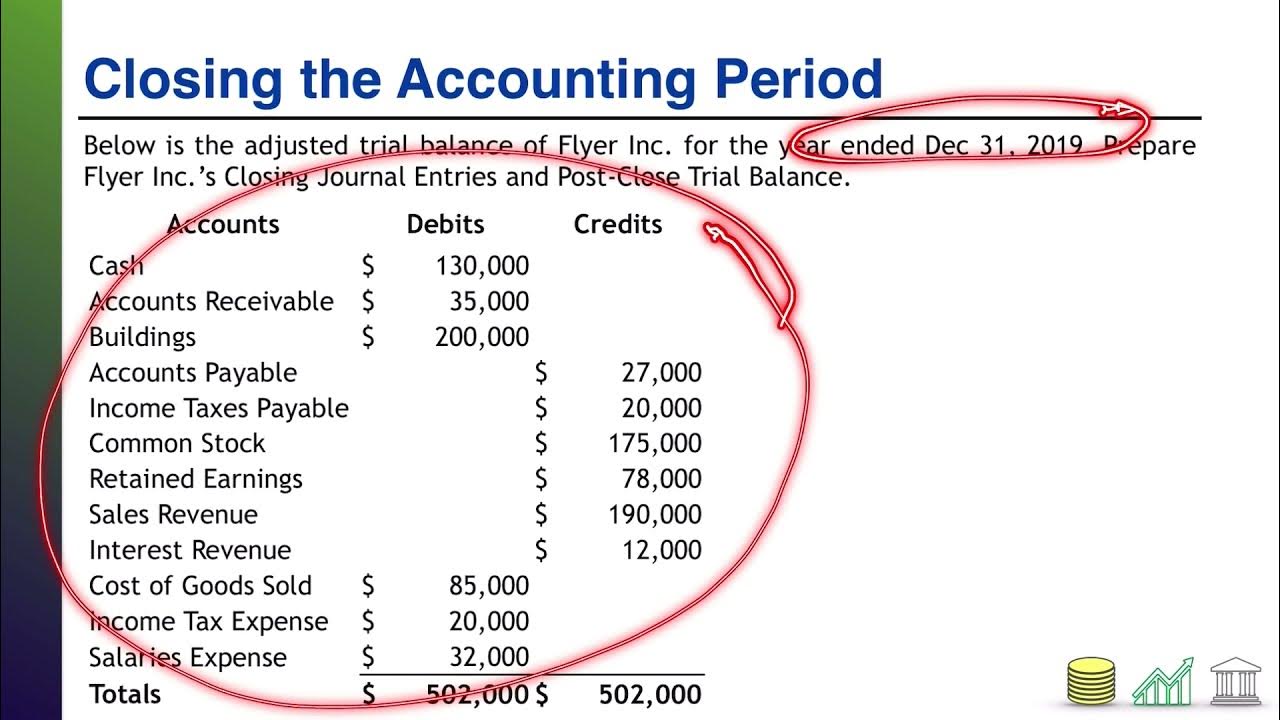

Practice Problem CLOSE01 Closing Entries and the Post Close Trial

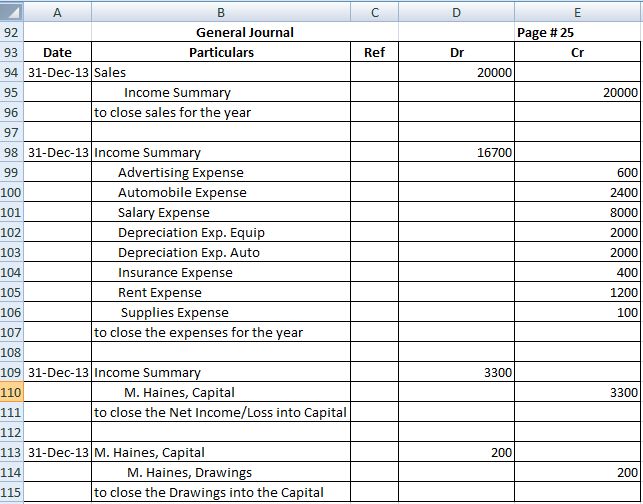

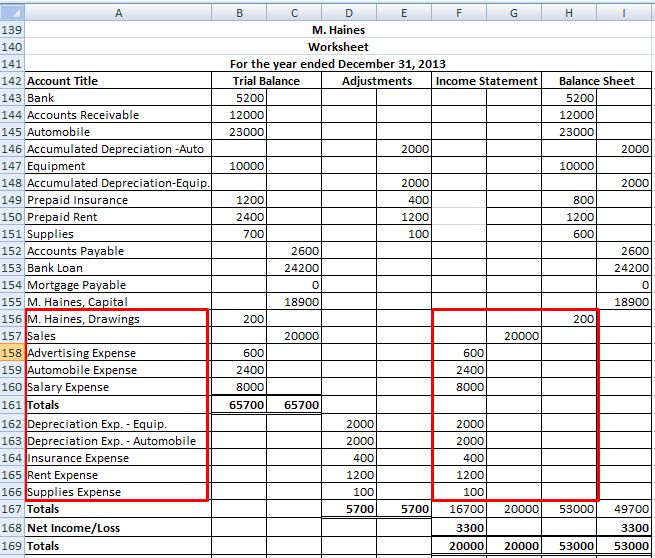

Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period. The eighth step in.

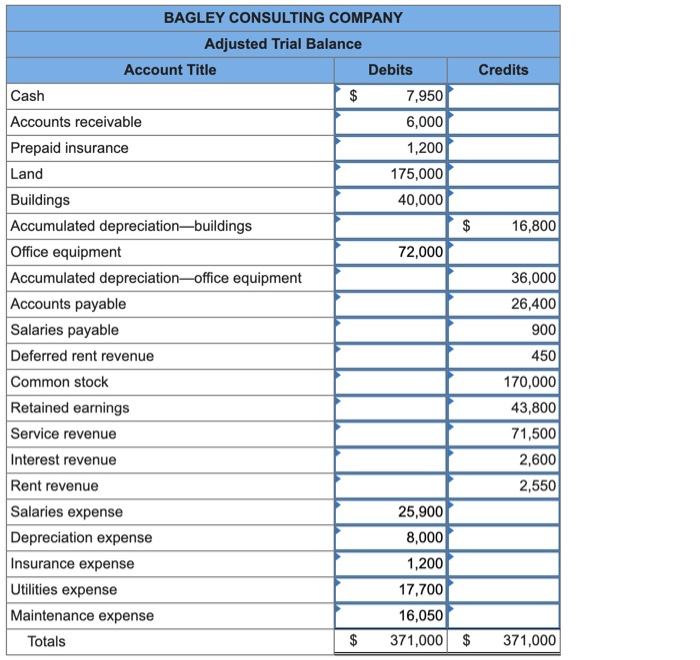

Solved Journal entry worksheet Close the revenue accounts

A credit to both the. The closing entries may be in the form of a compound journal entry if there are several. Closing entry for.

Closing entries explanation, process and example Accounting for

Web adjusting entries include accruals for revenue and expenses, deferrals for prepayments, estimates for depreciation and provisions for doubtful accounts. A credit to both the..

Journalizing Closing Entries Closing Entries Types Example My Riset

After closing both income and revenue accounts, the income summary. Web what are closing entries? Web the closing entries are the journal entry form of.

Accounting An Introduction Adjusting and Closing Journal Entries

Web a closing entry is one of the types of journal entries that is executed at the end of the accounting period to transfer balances.

Closing Entries are journal entries made to close

The closing entries may be in the form of a compound journal entry if there are several. A.a debit to both the revenue and the.

Accounting An Introduction Adjusting and Closing Journal Entries

The closing entries may be in the form of a compound journal entry if there are several. Clear the balance of the revenue account by.

Preparing Financial Statements презентация онлайн

The goal is to make the posted balance of the retained earnings account match what we. Web the closing entries are the journal entry form.

Debiting The Revenue Accounts And Crediting Income Summary.

Closing entries serve two objectives. Closing entries are the last step in the accounting cycle. Clear the balance of the revenue account by debiting revenue and crediting income summary. A credit to both the.

Web Adjusting Entries Include Accruals For Revenue And Expenses, Deferrals For Prepayments, Estimates For Depreciation And Provisions For Doubtful Accounts.

A.a debit to both the revenue and the retained earnings account. Web the eighth step in the accounting cycle is preparing closing entries, which includes journalizing and posting the entries to the ledger. Debit all revenue accounts and credit the income summary account, thereby clearing out the balances in. The goal is to make the posted balance of the retained earnings account match what we.

Debiting Income Summary And Crediting The.

Web what are closing entries? Four entries occur during the closing. Closing entry for income summary. Web examples of journal entries for numerous sample transactions.

After Closing Both Income And Revenue Accounts, The Income Summary.

Web the basic sequence of closing entries is as follows: These entries, which are made in the journal and posted to the ledger, eliminates the. Web journalizing and posting closing entries. Web a revenue closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues,.