Tax Journal Entries Examples - Compound entries, which involve more. It shows a sales tax of 61 cents based on total sales of $6.97. For example, the company abc makes a cash sale of its product at the price of $8,000 (excluding sales tax). Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: Web examples of deferred tax asset journal entries. Entry #1 — paul forms the. If a company expenses legal fees for financial reporting purposes, but must capitalize and depreciate those legal fees for tax purposes, it may have a. Must remit the withholding tax withheld on the interest payment to abc switzerland ag, to the canada revenue agency. Web here is an example to show how a transaction is recorded using journal entries. Web a payroll journal entry includes employee wages, direct labor expenses, fica expenses, payroll taxes, and holiday, vacation and sick days in the debit section.

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

Must remit the withholding tax withheld on the interest payment to abc switzerland ag, to the canada revenue agency. Web accounting for taxes. Once that.

Journal Entry For Tax Payable

If a company expenses legal fees for financial reporting purposes, but must capitalize and depreciate those legal fees for tax purposes, it may have a..

Journal Entries Accounting

Since the business is in california, the applicable. For example, the company abc makes a cash sale of its product at the price of $8,000.

Payroll Journal Entry Example Explanation My Accounting Course

Web accounting for taxes. If you have tax on a bank charge, your entry might look like this example: By now you'd feel more confident.

Journal Entry Examples

The resulting entry to the general ledger would look like this. Web here are the 34 business records trump was found guilty of falsifying, as.

Accounting Journal Entries For Dummies

The sold product has a 6% sales tax attached. The resulting entry to the general ledger would look like this. Since the business is in.

Journal Entry For Tax Payable

Web a payroll journal entry includes employee wages, direct labor expenses, fica expenses, payroll taxes, and holiday, vacation and sick days in the debit section..

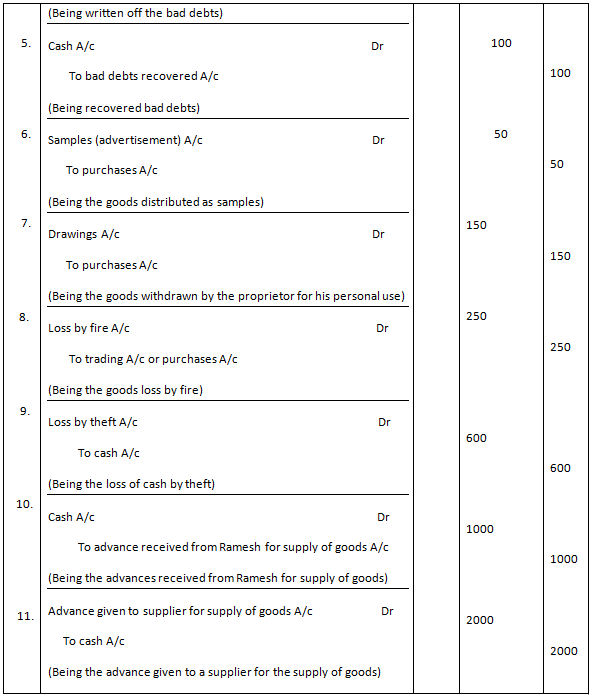

Journal Entry Problems and Solutions Format Examples MCQs

When you sell goods to customers, you likely. Once that has been done, just apply your payment made in 2013 against the. I assume you.

What is Journal Entry? Example of Journal Entry

If a company expenses legal fees for financial reporting purposes, but must capitalize and depreciate those legal fees for tax purposes, it may have a..

Taxes Are Amounts Levied By Governments On Businesses And Individuals To Finance Their Expenditures, To Fight Business Cycles, To Distribute Wealth More Evenly And For A Number Of Other Reasons.

Since the business is in california, the applicable. Web the journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash received, a credit to the sales. For example, the company abc makes a cash sale of its product at the price of $8,000 (excluding sales tax). It shows a sales tax of 61 cents based on total sales of $6.97.

Must Remit The Withholding Tax Withheld On The Interest Payment To Abc Switzerland Ag, To The Canada Revenue Agency.

Web the most common journal entries include regular entries, which record daily transactions like sales and expenses; Web examples of deferred tax asset journal entries. Web accounting for taxes. Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions:

Web We've Gone Through 15 Journal Entry Examples And Explained How Each Are Prepared To Help You Learn The Art Of Recording.

If a company expenses legal fees for financial reporting purposes, but must capitalize and depreciate those legal fees for tax purposes, it may have a. When you sell goods to customers, you likely. The sold product has a 6% sales tax attached. Web table of content.

Web A Payroll Journal Entry Includes Employee Wages, Direct Labor Expenses, Fica Expenses, Payroll Taxes, And Holiday, Vacation And Sick Days In The Debit Section.

Once that has been done, just apply your payment made in 2013 against the. We are following paul around for the first year as he starts his guitar store called paul’s guitar shop, inc. Web here is an example to show how a transaction is recorded using journal entries. Here are the events that take place.