Supplies Journal Entry - Web november 3, 2023march 10, 2023by. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. Web write supplies expense in the general journal. Web accountants use special forms called journals to keep track of their business transactions. Contents [ show] financial data is generally structurally recorded in ledgers for storage. In business, the company usually needs to purchase office supplies for the business operation. Web the company received supplies thus we will record a debit to increase supplies. Likewise, when it paid cash for supplies, it needs to make a proper. In the journal entry, supplies expense has a debit of $100. The following is the journal entry for returning damaged inventory or inventory.

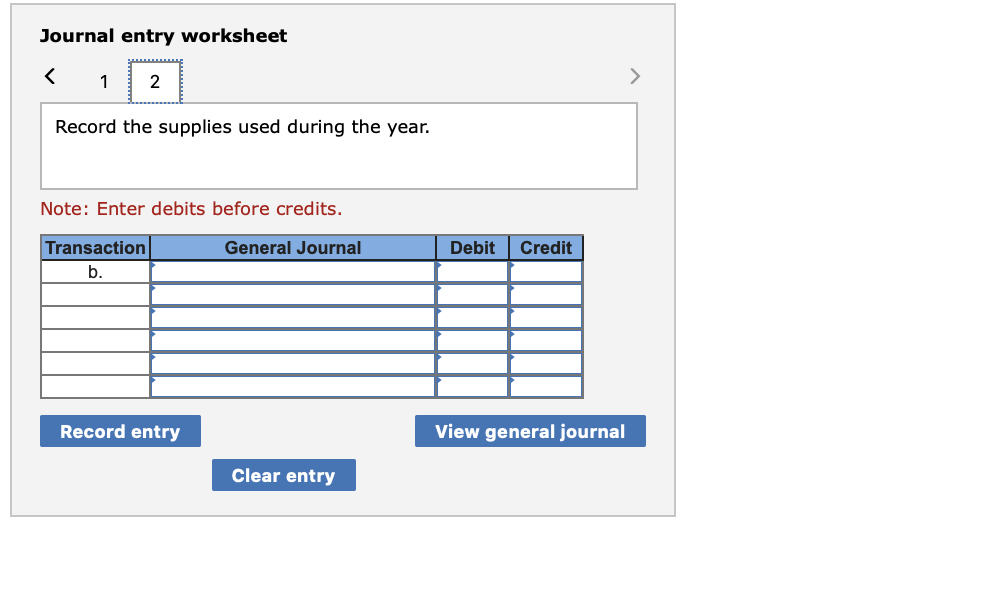

Solved Journal entry worksheet Record the supplies

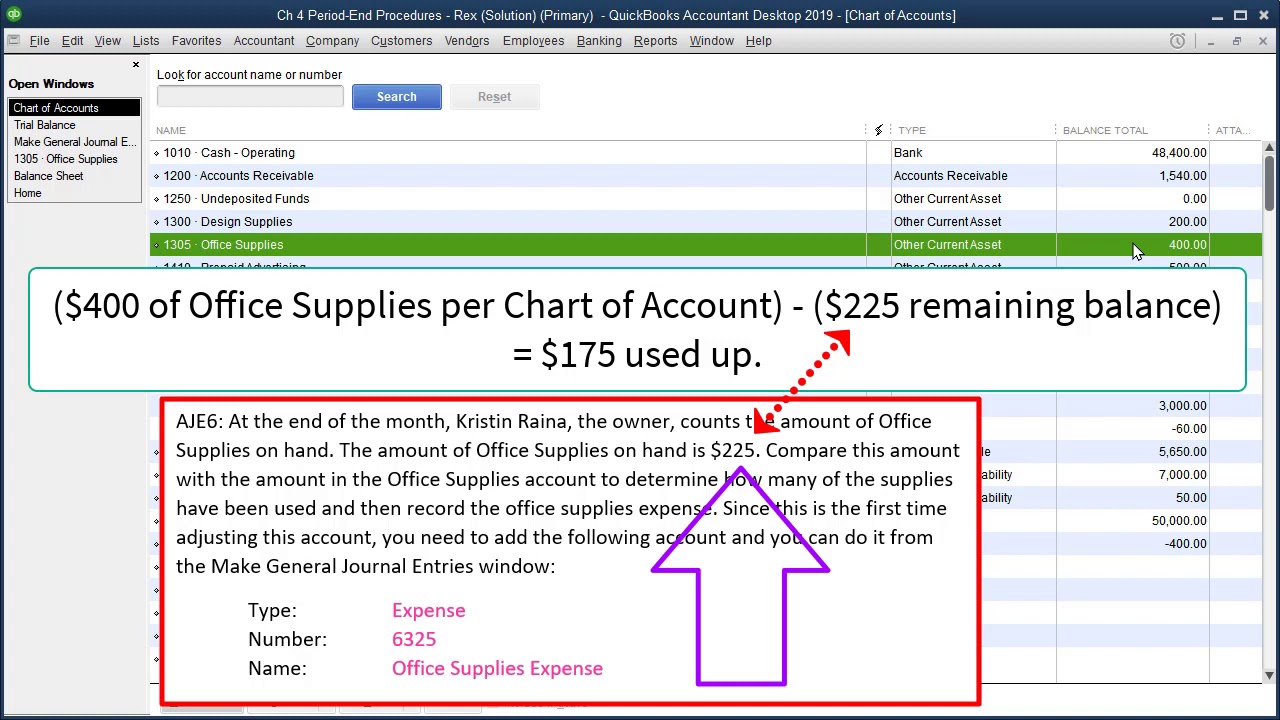

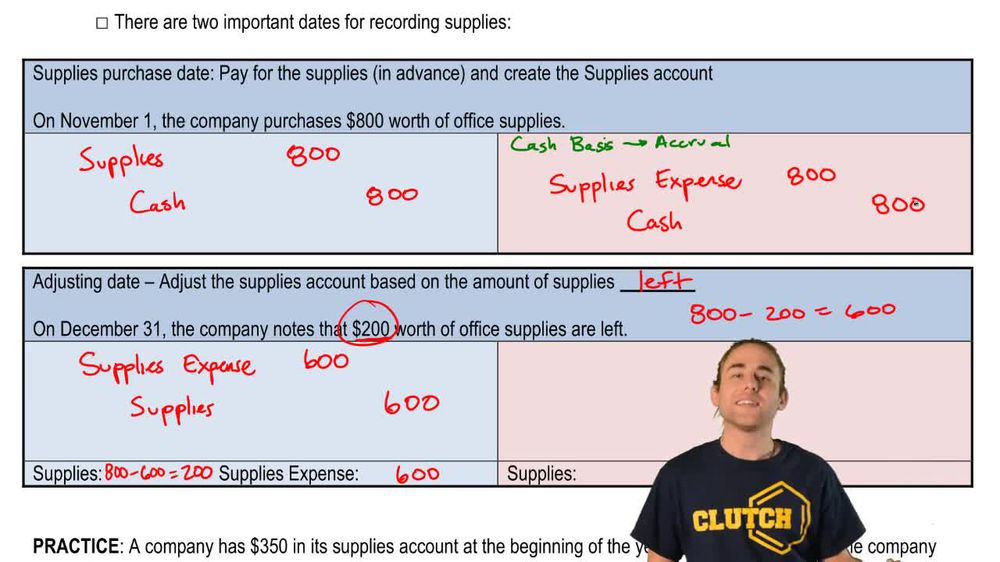

Make an adjusting entry on 31 december 2016 to record the supplies. Accounts payable journal entry is the. Web make a journal entry on 1.

office supplies on hand journal entry fashionartillustrationartworks

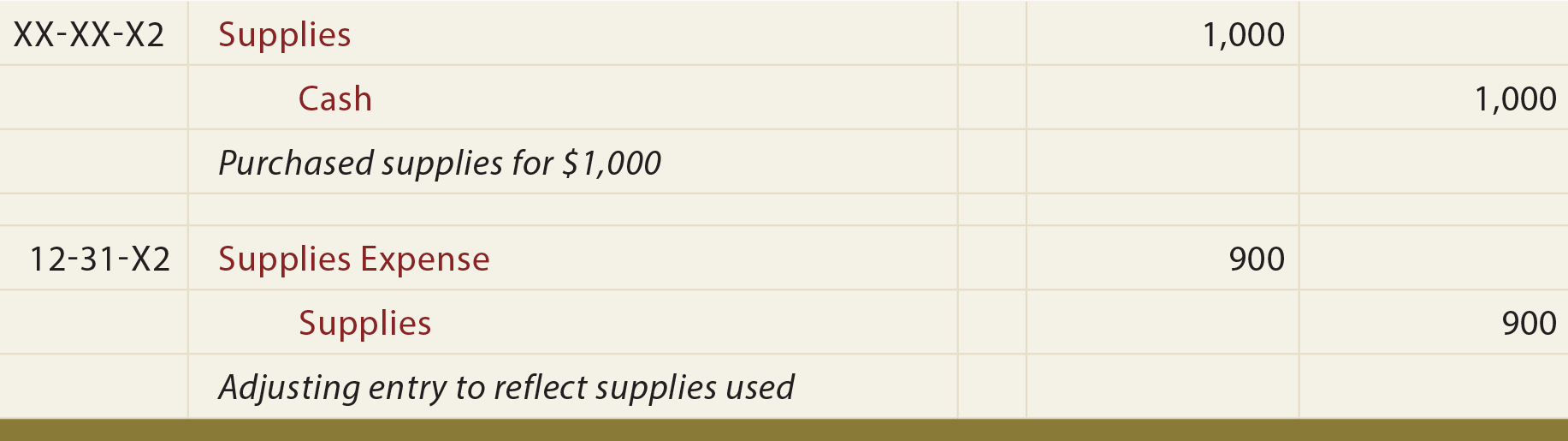

In business, the company usually needs to purchase office supplies for the business operation. Supplies are incidental items that are expected to be consumed in.

[Solved] Record following purchases transactions in JOURNAL ENTRY I

Web journal entries are used to record business transactions and events. The following is the journal entry for returning damaged inventory or inventory. Web an.

Journal Entry Problems and Solutions Format Examples

The following is the journal entry for returning damaged inventory or inventory. The accounts payable journal entries below act as a quick reference, and set.

Perpetual Inventory System Journal Entry

Every entry contains an equal debit and credit along with the names. Write the amount that corresponds with the supplies used in the debit column..

QuickBooks Adjusting Journal Entry 6 Office Supplies YouTube

By the terms on account, it means that the amount has not yet been paid; In the journal entry, supplies expense has a debit of.

journal entry format accounting accounting journal entry template

Likewise, when it paid cash for supplies, it needs to make a proper. A journal is the first place information is entered into the accounting.

The Adjusting Process And Related Entries

Write the amount that corresponds with the supplies used in the debit column. Web accountants use special forms called journals to keep track of their.

Adjusting Journal Entries Supplies (Cash Basis to Accrual Method

The accounts payable journal entries below act as a quick reference, and set out the most commonly encountered situations. The following is the journal entry.

Making Adjusting Entries For Supplies.

The following is the journal entry for returning damaged inventory or inventory. By the terms on account, it means that the amount has not yet been paid; The accounts payable journal entries below act as a quick reference, and set out the most commonly encountered situations. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system.

(Being Goods Purchased On Credit From The Vendor) (Being Payment Made To The Vendor In Cash) Note:

Make an adjusting entry on 31 december 2016 to record the supplies. Web journal entry for returning the damaged or undesirable inventory to the supplier. Web accounts payable journal entries. Write the amount that corresponds with the supplies used in the debit column.

Likewise, When It Paid Cash For Supplies, It Needs To Make A Proper.

Web journal entries are used to record business transactions and events. Web write supplies expense in the general journal. Web november 3, 2023march 10, 2023by. Supplies are incidental items that are expected to be consumed in the near future.

Web In Case You Were Wondering, The Journal Entry For The Above Would Be:

Web how to account for supplies. A journal is the first place information is entered into the accounting system. Web make a journal entry on 1 january 2016, when the office supplies are purchase. Web the journal entries in the books of xyz ltd.