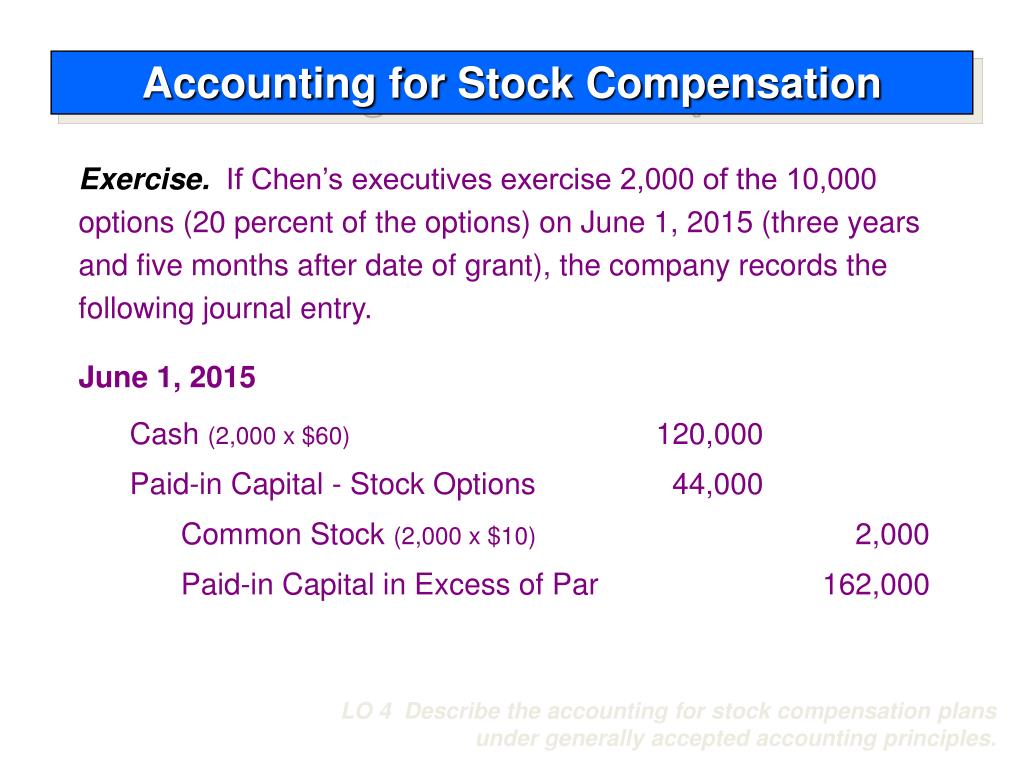

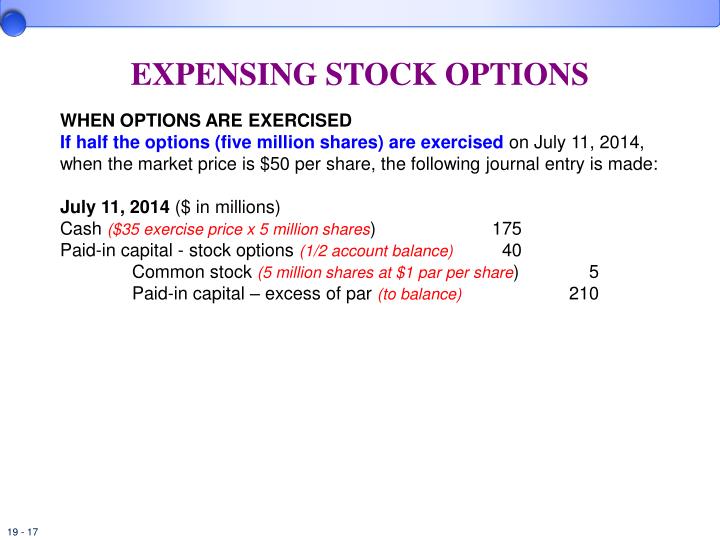

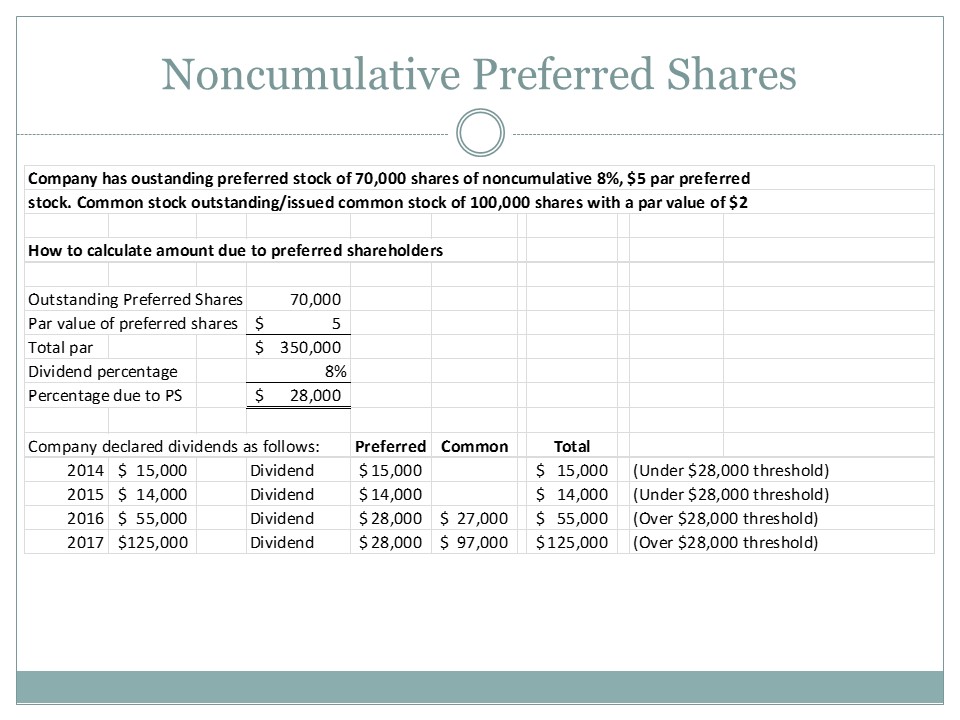

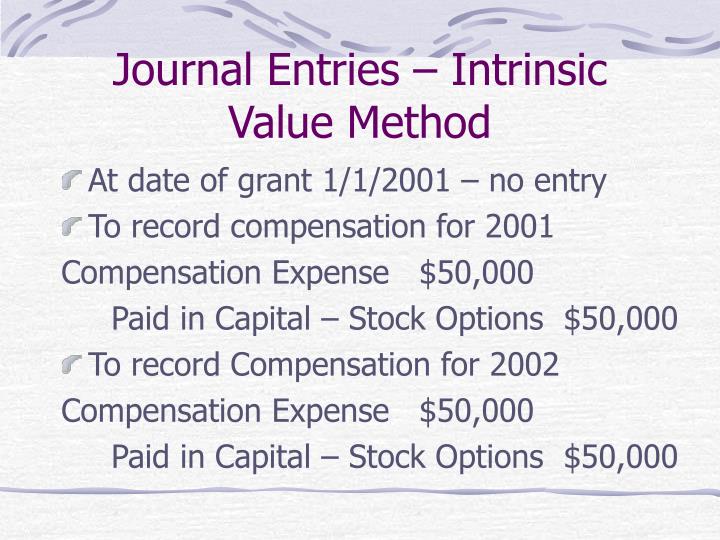

Stock Option Exercise Journal Entry - Web to create a journal entry for exercised stock options, you must first establish an exercise price and calculate any potential gains or losses resulting from fluctuations in share. What is the journal entry to record stock options being exercised? Employees are given 90 days to exercise options in the event. Journal entries are recorded in. Web on the vesting date, the following journal entry recognizes the stock option expense: Your ask joey ™ answer. The early exercise of stock options allows the option holder to purchase shares prior to the vesting period. Web to make a stock option exercise journal entry, you’ll need several pieces of information: Web on january 2, 2022, when the market value of abc company stock has risen to $35 per share, the employee exercises all of the options and pays $20,000 for stock now. First, the accountant must calculate the cash that the business.

PPT Intermediate Accounting 14th Edition PowerPoint Presentation

The number of shares issued; Your ask joey ™ answer. What is the journal entry to record stock options being exercised? Web accountants need to.

How to Make Journal Entries in Excel (with Easy Steps)

Web electing to early exercise a stock option requires the employee to pay the strike price before vesting date in order to acquire the shares..

Cashless Stock Option Exercise Journal Entries Exercise Poster

Your ask joey ™ answer. The number of shares issued; The stock option expense for year 1 (3,500) is the difference between the cumulative expense.

Stock option exercise journal entries 3 fast make money illegally online

Stock option expense dr contributed capital cr the stock option. Restricted stock and stock options. The stock option expense for year 1 (3,500) is the.

Accounting Entries For Cashless Exercise Of Stock Options « Maximize

Web journal entry for the redemption of stock appreciation rights. What is the journal entry to record stock options being exercised? Web electing to early.

Cashless Stock Option Exercise Journal Entries Exercise Poster

The stock option expense for year 1 (3,500) is the difference between the cumulative expense at the end of year 1 (3,500) and the cumulative.

Cashless Stock Option Exercise Journal Entries Exercise Poster

Web to make a stock option exercise journal entry, you’ll need several pieces of information: Web on january 2, 2022, when the market value of.

Journal entry for net settlement of stock options

Employees are given 90 days to exercise options in the event. Journal entry for the expiration of stock appreciation rights. The exercise price of the.

Cashless Stock Option Exercise Journal Entries Exercise Poster

Sc corporation would record the following journal entries. Your ask joey ™ answer. The exercise price of the options is $10 per share. It is.

The Plan Comes In The Form Of A Regular Call Option That Allows Employees To Buy Shares At A.

Web stock options o a contract that gives the holder the right, but not the obligation, either to purchase (to call) or to sell (to put) a certain number of shares at a predetermined price. Sc corporation would record the following journal entries. On january 1, 2018, jones motors issued 900,000 stock options to employees; When the employee exercises the stock options, the company must record the following journal entry:

The Number Of Shares Issued;

The date when the transaction occurred; Web stock based compensation journal entries. Employees are given 90 days to exercise options in the event. Web journal entries for stock option exercise.

Gaap Accounting Is Slightly Di.

The exercise price of the options is $10 per share. Web a stock option exercise journal entry is the bookkeeping transaction that occurs when an individual exercises their stock option. Web to create a journal entry for exercised stock options, you must first establish an exercise price and calculate any potential gains or losses resulting from fluctuations in share. Web electing to early exercise a stock option requires the employee to pay the strike price before vesting date in order to acquire the shares.

The Early Exercise Of Stock Options Allows The Option Holder To Purchase Shares Prior To The Vesting Period.

Web on january 2, 2022, when the market value of abc company stock has risen to $35 per share, the employee exercises all of the options and pays $20,000 for stock now. Company xyz provides 1,000 stock options to the cfo, it allows him to purchase the stock at $10 per share in the next two years. Your ask joey ™ answer. Web accountants need to book a separate journal entry when the employees exercise stock options.