Sales Type Lease Journal Entries - At the end of the term, the asset is typically returned to the lessor since the lessee isn’t granted an option to purchase or assume ownership. Web asc 842 defines leases as contracts, or portions of contracts, granting “control” of an identifiable asset for a specific period of time in exchange for payment. Leases that transfer control of the underlying asset to a lessee are classified as finance. Web a sale and leaseback, or more simply, a leaseback, is a contract between a seller and a buyer where the former sells an asset to the latter and then enters into a second contract to lease the asset back from the buyer. Web • ifrs 16 leases requires lessees to put most leases on their balance sheets. These three types are generally consistent with existing gaap; Pwc refers to the us member firm or one of its subsidiaries or affiliates, and may sometimes refer to the pwc network. On january 1, 2021, tweenix corp. Under the fasb model, a lessee should classify a lease based on whether the arrangement is effectively a purchase of the underlying asset. Why were these changes implemented?

Finance Lease Journal Entries businesser

Web • ifrs 16 leases requires lessees to put most leases on their balance sheets. A fourth type, leveraged leases, is eliminated by the new.

Finance Lease Journal Entries businesser

The accounting treatment is best explained using a numeric example. Web ifrs 16 summary. A fourth type, leveraged leases, is eliminated by the new guidance..

Journal entries for lease accounting

• for lessors, the accounting is substantially unchanged from the accounting under ias 17 leases. Web ifrs 16 summary. These three types are generally consistent.

Accounting for Sales Type Finance/Capital Leases IFRS & ASPE (rev 2020

Web a lease is a contract between two parties for the temporary use of an asset in return for payment. Web • ifrs 16 leases.

PPT leases PowerPoint Presentation, free download ID899285

For clarity, we’ll present two distinct scenarios: • ifrs 16 is effective for annual periods beginning on or after On january 1, 2021, tweenix corp..

In an Operating Lease the Lessee Records JaelynhasCox

Companies previously following the lease accounting guidance under ias 17 likely transitioned to ifrs 16 during their 2019 fiscal year, in accordance with the standard’s.

Check this out about Capital Lease Accounting Journal Entries

Lease accounting under the old standards. These three types are generally consistent with existing gaap; A fourth type, leveraged leases, is eliminated by the new.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web • ifrs 16 leases requires lessees to put most leases on their balance sheets. Businesses use many types of leases, tailoring them to include.

Journal entries for lease accounting

For clarity, we’ll present two distinct scenarios: New lease accounting standards, changes, and full examples. Web a lease is a contract between two parties for.

A Direct Financing Lease Is A Specific Leasing Arrangement In Which The Lessor’s Primary Role Is That Of A Financier Who Derives Income From Interest.

• for lessors, the accounting is substantially unchanged from the accounting under ias 17 leases. The term “control” carries a distinct meaning in this definition. Under the fasb model, a lessee should classify a lease based on whether the arrangement is effectively a purchase of the underlying asset. New lease accounting standards, changes, and full examples.

Web A Sale And Leaseback, Or More Simply, A Leaseback, Is A Contract Between A Seller And A Buyer Where The Former Sells An Asset To The Latter And Then Enters Into A Second Contract To Lease The Asset Back From The Buyer.

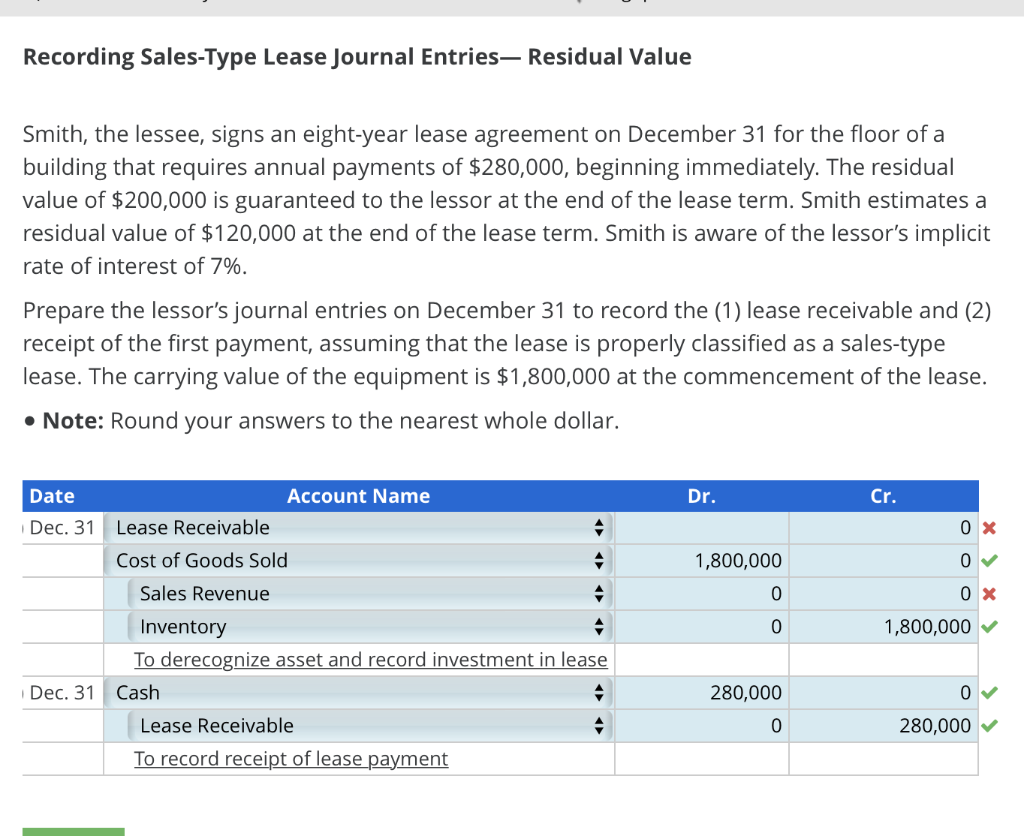

These three types are generally consistent with existing gaap; To determine the type of lease you have, use the following rules. At the end of the term, the asset is typically returned to the lessor since the lessee isn’t granted an option to purchase or assume ownership. Web while the direct financing accounting recognizes income over time as payments come in, the sales type lease accounts for a portion of that income immediately upon the inception of the.

Consequently, This Results In The Following Accounting At The Commencement Date Of The Lease:

Web a lease is a contract between two parties for the temporary use of an asset in return for payment. (lessee) entered into an agreement to lease a piece of landscaping equipment from. Lease accounting under the old standards. • ifrs 16 is effective for annual periods beginning on or after

Why Were These Changes Implemented?

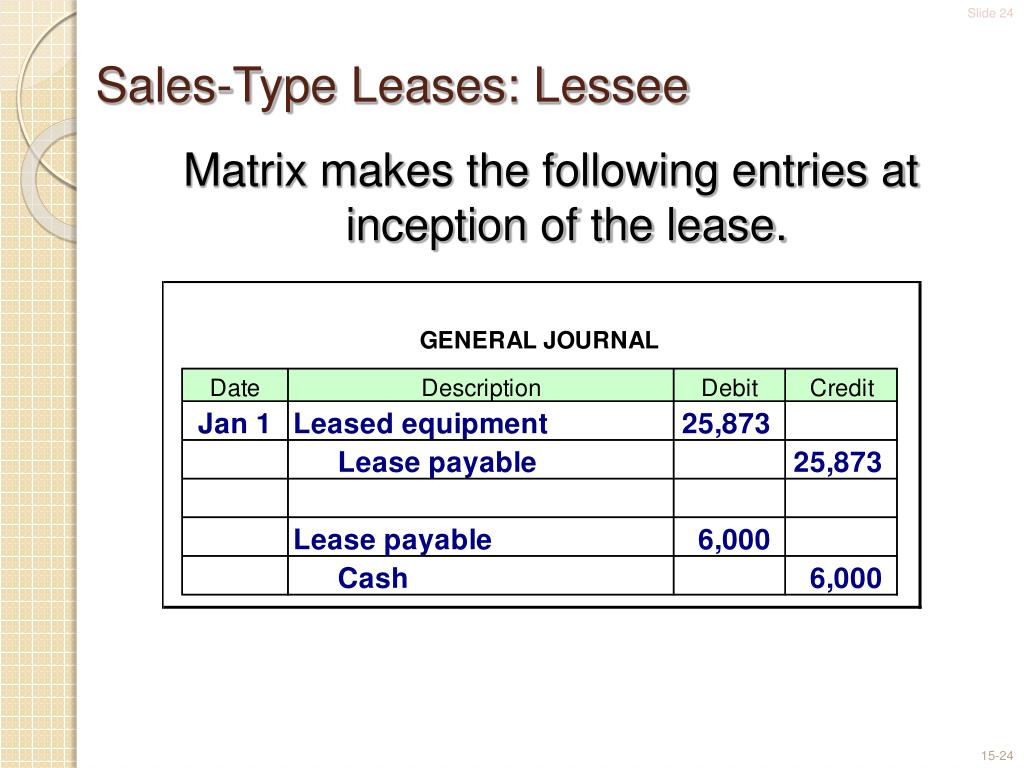

At the outset of the lease, the lessor recognizes a lease receivable and sales revenue (as if the asset. Web asc 842 defines leases as contracts, or portions of contracts, granting “control” of an identifiable asset for a specific period of time in exchange for payment. Web in contrast to the lessee model, the lessor model under fasb’s new lease accounting standard has three different types of leases: Lease accounting calculations you need to know.