Sales Tax Payable Journal Entry - The process begins with identifying all tax obligations incurred during the accounting period. Enter all necessary details to create your journal entry. Access your quickbooks online company. See how to use the sales tax formula, create a. Web learn how to record sale tax as a liability and payable in the accounting system. Web debit the amount of sales tax you pay the tax authority to the sales taxes payable account in a new journal entry when you send the payment. Web learn how to record sales taxes collected from customers, remitted to taxing authorities, and paid on purchases using journal entries. For an amount which shall be the sum of. This involves a thorough review of transactions to determine the tax liabilities associated with income, sales, and payroll. At the time of collection of sales taxes from customers 2.

Sales Tax Payable Journal Entries YouTube

See the steps and examples of sales tax journal entry for. For an amount which shall be the sum of. The journal entries for sales.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Debit your cash account for the amount of sales tax you collected on your sales tax payable balance. Web learn how to create a sales.

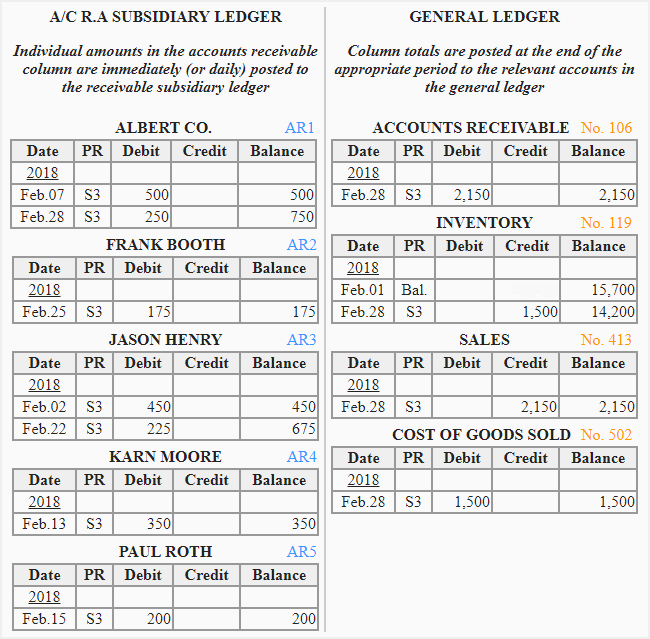

SALES JOURNAL Accountaholic

Web to record your sales tax payable: For an amount which shall be the sum of. Web the sales tax rate is 6%. Web go.

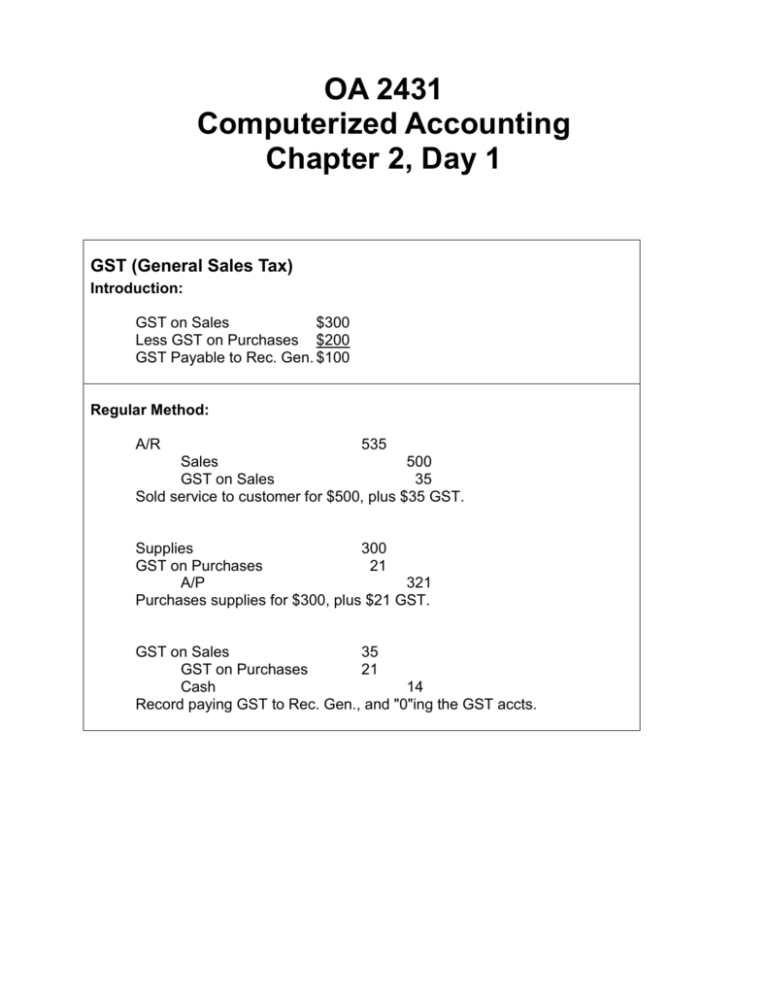

GST & PST Journal Entries

Web learn how to record sales tax as a liability and an expense in your accounting system. See examples of sales tax accounting for different..

Sales journal explanation, format, example Accounting For Management

115 x 15/115 = $15. Is required to collect from xyz, inc. Web the following general journal entry was made to record the return. Web.

Enter Journal Entries with VAT

The process begins with identifying all tax obligations incurred during the accounting period. Debit your cash account for the amount of sales tax you collected.

Sales Journal With Vat Explained With Examples Otosection

Cash increases (debit) for the sales amount plus sales tax. Web learn how to record sales tax paid when you have a sales tax payable.

Sales Tax Payable YouTube

= 15% * $3 million = $0.45 million. The following revenue entry would occur. Enter all necessary details to create your journal entry. The journal.

Sales Journal Entry Cash and Credit Entries for Both Goods and

At the time of collection of sales taxes from customers 2. Web sales tax abc, inc. Web learn how to record sales tax collected from.

Web Go To The Company Menu, Then Select Make General Journal Entries.

Deducting sales tax from the gross purchase, we may now arrive at the tax exclusive purchase value: Web learn how to record sales tax paid when you have a sales tax payable liability account in quickbooks online. See examples, tips, and faqs. Web if all cash receipts were originally included in sales revenue, the journal entry to adjust for sales taxes payable would include:

This Involves A Thorough Review Of Transactions To Determine The Tax Liabilities Associated With Income, Sales, And Payroll.

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. For an amount which shall be the sum of. [1] tax compliance refers to policy actions and individual. Web learn how to record sale tax as a liability and payable in the accounting system.

A Journal Entry Is Not.

See the steps and examples of sales tax journal entry for. See examples of sales tax accounting for different. Web learn how to record sales tax collected from customers and paid on purchases in your accounting books. Web the sales tax rate is 6%.

Access Your Quickbooks Online Company.

Cash increases (debit) for the sales amount plus sales tax. Web to record your sales tax payable: At the time of collection of sales taxes from customers 2. Journal entries are rightly called the backbone of the modern accounting system as they are the first.