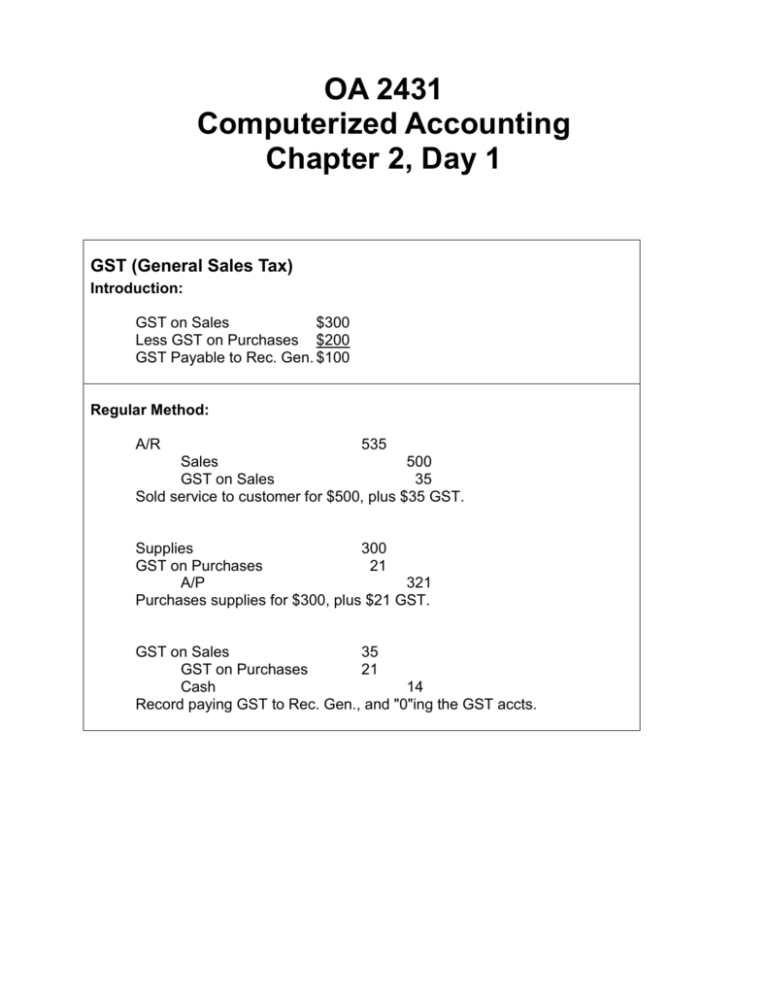

Sales Tax Journal Entry - To do that, create a journal. Web november 03, 2023 11:28 am. = 15% * $3 million = $0.45 million. Web journal entries are the worker bees of accounting, making up the structure of your accounting system. The payable includes the amount of sales tax since it will be paid to the supplier. Web what is the journal entry for sales and sales tax? [debit] cost of goods sold for $650. Web the journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or cash received, a credit to the sales. Web sales tax abc, inc. Web january 29, 2022 10:01 am.

How to Make Journal Entry for Sales and Purchase with VAT and without

The journal entry is debiting cash and credit sale tax payable. Journal entry for sales on cash. Let’s start with the simpler one first:. Web.

Enter Journal Entries with VAT

Web published on 22 aug 2019. Web the journal entry for sales tax is a debit to the accounts receivable or cash account for the.

What Is An Accounting Journal Entry

Web what is the journal entry for sales and sales tax? A sales tax is a tax a business must collect from customers and pay.

The Basics of Sales Tax Accounting Journal Entries Learn Accounting

A journal entry is a record of a transaction that’s entered. Web november 03, 2023 11:28 am. [debit] cost of goods sold for $650. Sales.

GST & PST Journal Entries

Web the sales journal entry is: Journal entry for sales on cash. Likewise, failing to remit this sales tax to the government or the taxing.

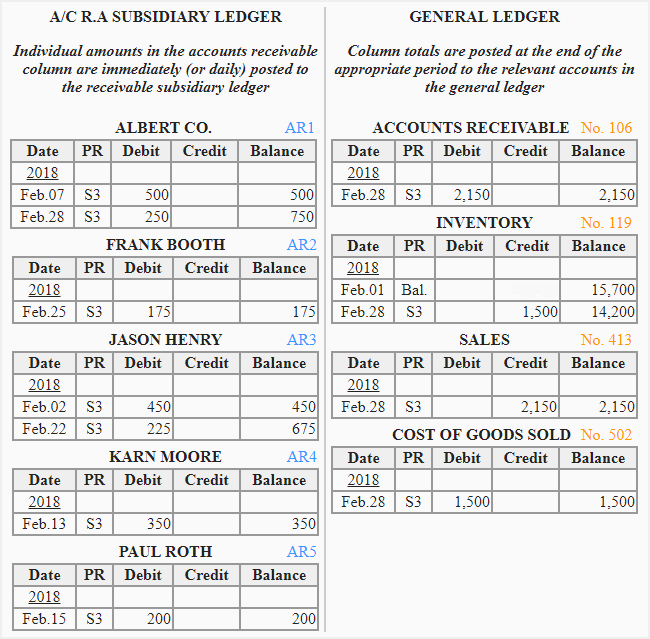

SALES JOURNAL Accountaholic

Is required to collect from xyz, inc. The journal entry is debiting cash and credit sale tax payable. Journal entry for sales on cash. Subtract.

Sales Tax Payable Journal Entries YouTube

Journal entry for sales on cash. Sale tax payable is the. Web the amount of sale tax will be recorded as the current liability on.

Entries for Sales and Purchase in GST Accounting Entries in GST

The payable includes the amount of sales tax since it will be paid to the supplier. Web january 29, 2022 10:01 am. Web the amount.

Sales journal explanation, format, example Accounting For Management

To do that, create a journal. A journal entry is a record of a transaction that’s entered. Web the amount of sale tax will be.

Web Journal Entries Are The Worker Bees Of Accounting, Making Up The Structure Of Your Accounting System.

General journal entry for sales tax. Web a sales revenue journal entry is an accounting entry recorded in the financial ledgers of a company to document the income generated from the sale of goods or services before. Web january 29, 2022 10:01 am. Here, we’ll take a look at both of these cases.

A Sales Tax Is A Tax A Business Must Collect From Customers And Pay To The Appropriate Tax Authorities, Such As The State In Which The Business Is Located.

To do that, create a journal. Is required to collect from xyz, inc. Web what is the journal entry for sales and sales tax? For an amount which shall be the sum of.

We Failed To Charge Sales Tax On Several Invoices That Have Already.

A journal entry is a record of a transaction that’s entered. It does more than record the total money a business receives. Posted on april 29, 2022. And when you purchase products, you typically pay sales tax.

Web The Sales Journal Entry Is:

Web published on 22 aug 2019. The journal entry is debiting cash and credit sale tax payable. Collected sales tax from customers;. Web journal entries for both cases are different.