Sales Cash Journal Entry - Web making accounting journal entries for cash are fundamental for a business. Web the layout of the journal entry for a cash sale is as follows: (being fittings sold for 10,000 to mr. The exact double entries we do depends on which inventory system the business uses. Web the cash receipts journal is used to record all transactions involving the receipt of cash, including transactions such as cash sales, the receipt of a bank loan,. Lifetime access to all back. This type of journal entry is important for several reasons: Z) depending on your specific business and chart of accounts, the specific amounts and. Web a sales revenue journal entry records the income earned from selling goods or services, debiting either cash or accounts receivable and crediting the sales revenue. Whenever a business either spends or receives cash or a cash equivalent, then an entry must be.

Cash Receipts Journal Step by Step Guide With Examples

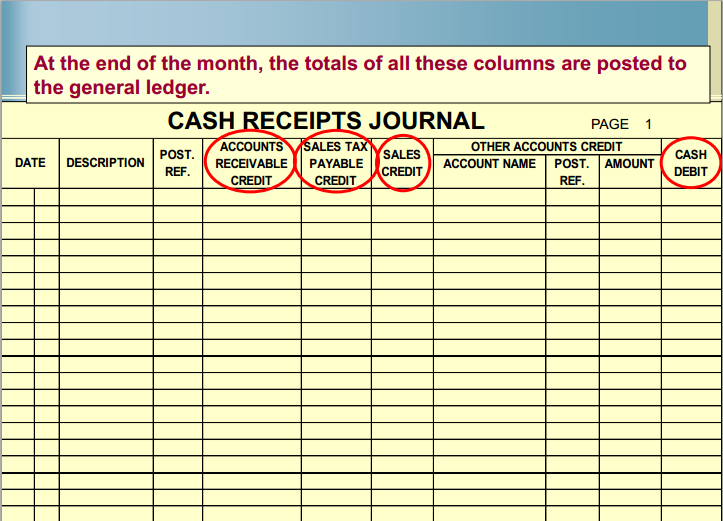

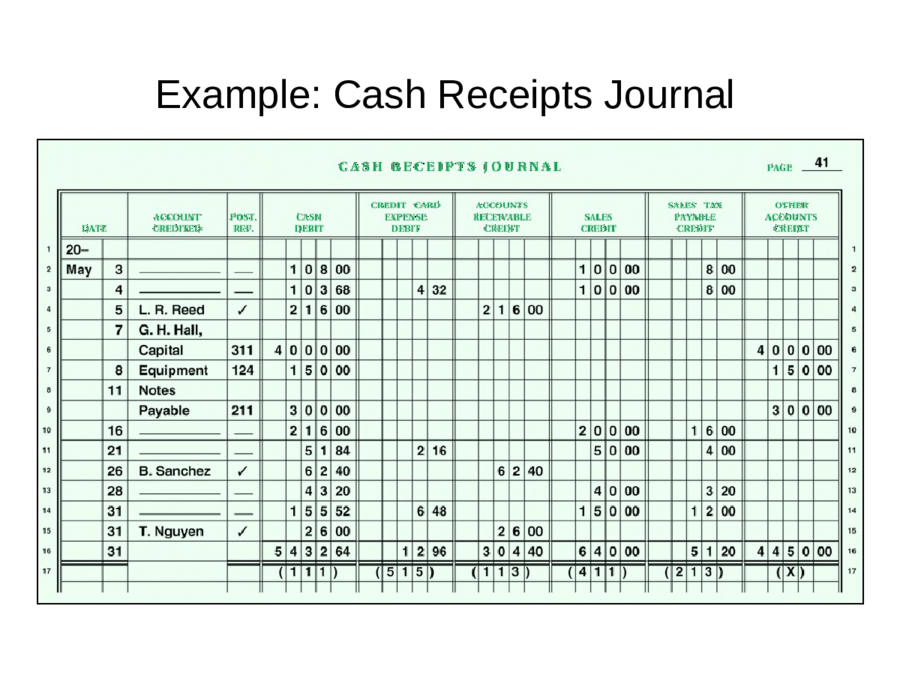

Web the cash receipts journal is used to record all transactions involving the receipt of cash, including transactions such as cash sales, the receipt of.

SALES JOURNAL Accountaholic

Web add to cart 10 free contest entries per month included for life. Lifetime access to all back. Web the layout of the journal entry.

Accounting for Sales Return Journal Entry Example Accountinguide

Web accounting and journal entry for credit sales include 2 accounts, debtor and sales. The exact double entries we do depends on which inventory system.

Sales Journal Entry How to Make Cash and Credit Entries

The exact double entries we do depends on which inventory system the business uses. Subtract the total deductions from the gross pay to find the.

Fantastic Sales And Cash Receipts Journal Template Superb Receipt

Web there are six main parts of the entry format of a sales journal. Z) depending on your specific business and chart of accounts, the.

Sales Journal Definition, Explanation, Format and Entry Examples

Z) depending on your specific business and chart of accounts, the specific amounts and. The accounting records will show the following bookkeeping entries for the.

CASH RECEIPTS JOURNAL Accountaholic

The exact double entries we do depends on which inventory system the business uses. Web journal entry for cash sales records an increase in cash.

2.4 Sales of Merchandise Perpetual System Financial and Managerial

The accounting records will show the following bookkeeping entries for the cash sale of inventory or services: Web journal entry for cash sales records an.

CASH RECEIPTS JOURNAL Accountaholic

Web journal entry for a cash sale of inventory. Web the cash receipts journal is used to record all transactions involving the receipt of cash,.

Web Accounting And Journal Entry For Credit Sales Include 2 Accounts, Debtor And Sales.

Web a sales revenue journal entry records the income earned from selling goods or services, debiting either cash or accounts receivable and crediting the sales revenue. Web cash receipts are proof that your business has made a sale. Unlike credit sales, cash sales do not result in. Web the journal entry for the above transaction will be:

When Goods/Services Are Sold For Cash, The Transactions Are Known As Cash Sales, I.e., When.

Web how to handle cash sale journal entries. The six main parts of a sales. It is where the seller receives the cash consideration at the time of delivery. Web making accounting journal entries for cash are fundamental for a business.

Web Cash Sales Are Sales Made Against Cash.

In case of a journal entry for cash sales, a cash account and sales account are used. Cash sales involve only cash and revenue accounts. Cash receipts include receipts for cash sales, sales paid for by check, and purchases on store credit. The journal entry for a cash sale actually involves two possibilities.

This Type Of Journal Entry Is Important For Several Reasons:

Z) depending on your specific business and chart of accounts, the specific amounts and. The exact double entries we do depends on which inventory system the business uses. However, if there is vat involve, we need to take into account vat payable as well. Web the layout of the journal entry for a cash sale is as follows: