Salaries Payable Journal Entry - Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web journal entry for salary payable. Keeping accurate payroll records is important. Web a salaries payable entry will tell you exactly how much money you owe to your employees for services performed. First, a company will record a debit into the salaries expense for the gross amount paid to. This entry recognizes a wage expense in. In other words, it is to settle the salaries. Web learn how to record salaries payable in accrual based accounting, with examples and journal entries. Web a journal entry for accrued salary would comprise of an entry to the salary expense account ( in p&l) and accrued salary expense account (in bs). To record the salaries and.

How To Correctly Post Your Salary Journal

Web in this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and.

Payroll Journal Entry Example Explanation My Accounting Course

First, a company will record a debit into the salaries expense for the gross amount paid to. Web learn what salary payable is, how to.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web a salaries payable entry will tell you exactly how much money you owe to your employees for services performed. Subtract the total deductions from.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web a salaries payable entry will tell you exactly how much money you owe to your employees for services performed. Web in this section of.

How To Journalize Salaries Cagamee

One at the end of the pay period when the salaries and wages are accrued, and. Web this article on journal entries for salary payments.

Wages Payable Current Liability Accounting

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web learn how.

10 Payroll Journal Entry Template Template Guru

Web at the end of the month, the company should make journal entry by debiting salary expenses and credit cash or salary payable. To record.

What Is The Journal Entry For Payment Of Salaries Info Loans

Salary expense will impact the income. See a journal entry example and. Salary is an indirect expense incurred by every organization with employees. Web this.

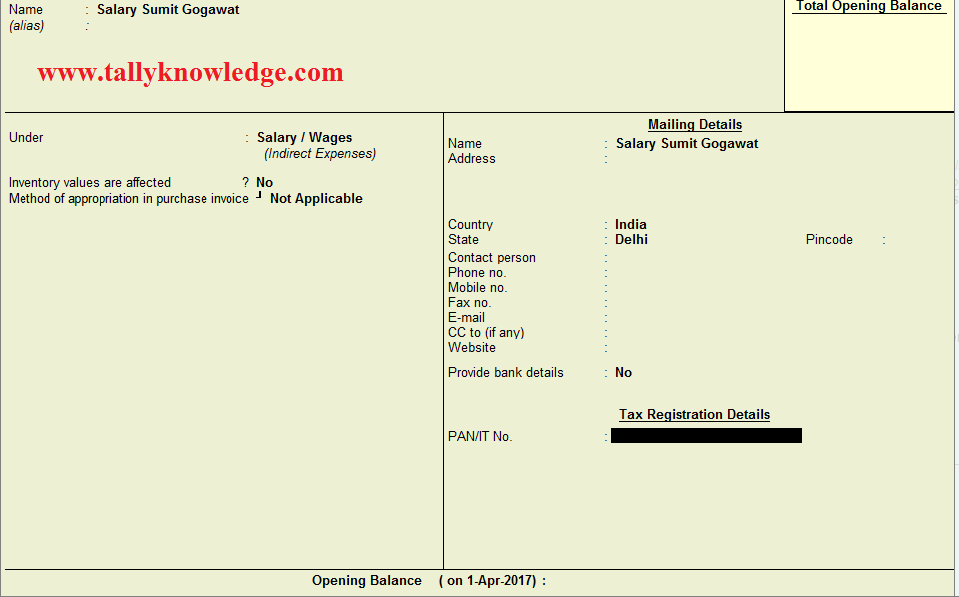

How to Pass Salary Payable voucher in Tally.ERP through Journal

First, a company will record a debit into the salaries expense for the gross amount paid to. Web learn how to record payroll expenses and.

Web Learn What Payroll Journal Entries Are, Why They Are Important, And How To Record Them In Five Steps.

It is paid as a consideration for the efforts undertaken by the employees for the business. Web this journal entry is made to recognize the liability (salaries payable) that the company has obligation to fulfil in the new future as well as to record the expense (salaries. Salary is an indirect expense incurred by every organization with employees. Web a journal entry for accrued salary would comprise of an entry to the salary expense account ( in p&l) and accrued salary expense account (in bs).

Web There Are Two Journal Entries Associated With The Wages Payable Account, Which Are As Follows:

Web when a company incurs wage expenses but hasn’t yet paid its employees, it records this liability in the general ledger by making a journal entry. Web this journal entry is to eliminate the $15,000 of liabilities that the company abc has recorded in the december 31 adjusting entry. Web a salaries payable entry will tell you exactly how much money you owe to your employees for services performed. Web in this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and employer costs related.

Subtract The Total Deductions From The Gross Pay To Find The Net Pay—The Amount That Will Actually Be Disbursed To The Employee.

Salary is among the most recurring transactions and paid on. Web salaries payable is a type of entry in business accounting journals that describes how much a company owes their employees. Web learn how to record salaries payable in accrual based accounting, with examples and journal entries. Web wages payable record the outstanding payment requirements still owed to employees, most often for employees compensated on an hourly basis.

Salary Expense Is Recorded In The Books Of Accounts With A Journal Entry For Salary Paid.

Web journal entry for salary payable. To record the salaries and. Keeping accurate payroll records is important. The $1,500 balance in wages payable is the true amount not yet paid to employees for their work through december 31.