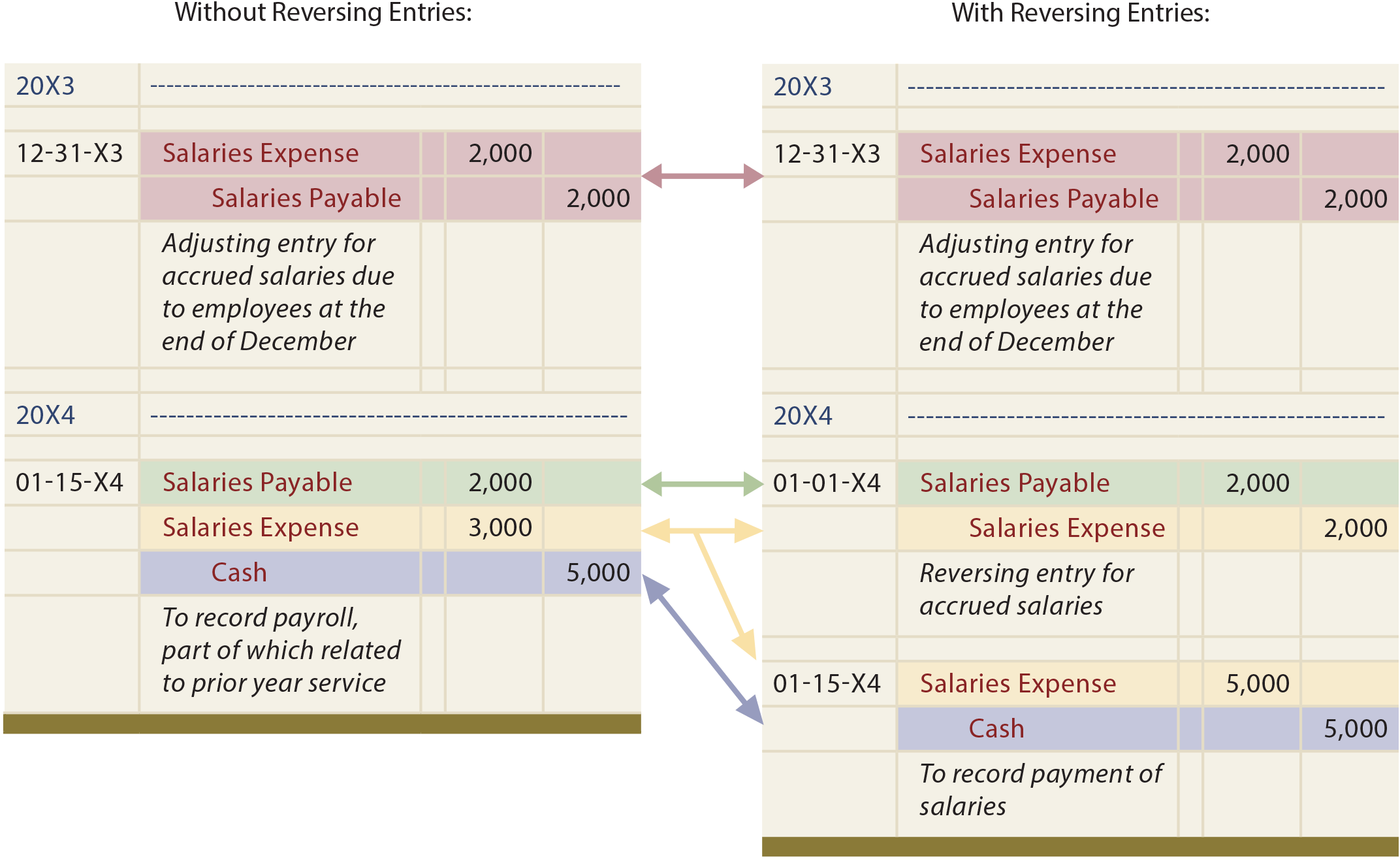

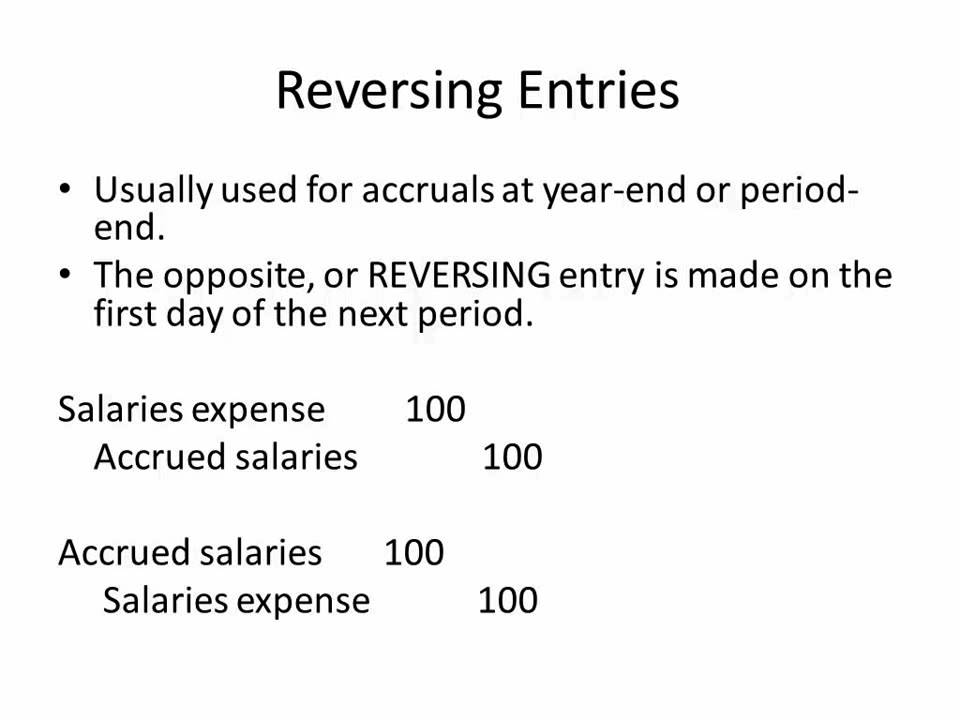

Reversing Journal Entry - Web reversing entries are journal entries made at the beginning of each accounting period. Web reversing entries typically apply to accruals and deferrals, addressing temporary adjustments made for items like accrued expenses or prepaid income. You can make them at the beginning of an accounting period, and they usually adjust some entries for accrued expenses and revenues from the end of the previous period. As these entries are no longer required to be recorded as the business’s assets or liabilities, they are reversed at the. Delete the journal > use the reversals option to post a reverse journal > manually post further journals to reverse the effect of the incorrect journals > A reversing entry is an optional journal entry that is recorded at the beginning of an accounting period to undo the prior period’s adjusting entries. Checked for updates, april 2022. Assign a reversal period and, if average balances is enabled, a reversal effective date to a journal entry if you want to generate a reversing entry from the enter journals window, or later from the reverse journals form. Not all of a company’s financial transactions that pertain to an accounting period will have been processed by the accounting software as of the end of the accounting period. Web the purpose of reversing entries is to cancel out certain adjusting entries that were recorded in the previous accounting period.

How to do entries in Reversing Journal voucher in tally in english

Learn what reversing entries are, why they are used, and how they are made with an example. A reversing entry is often used in payroll,.

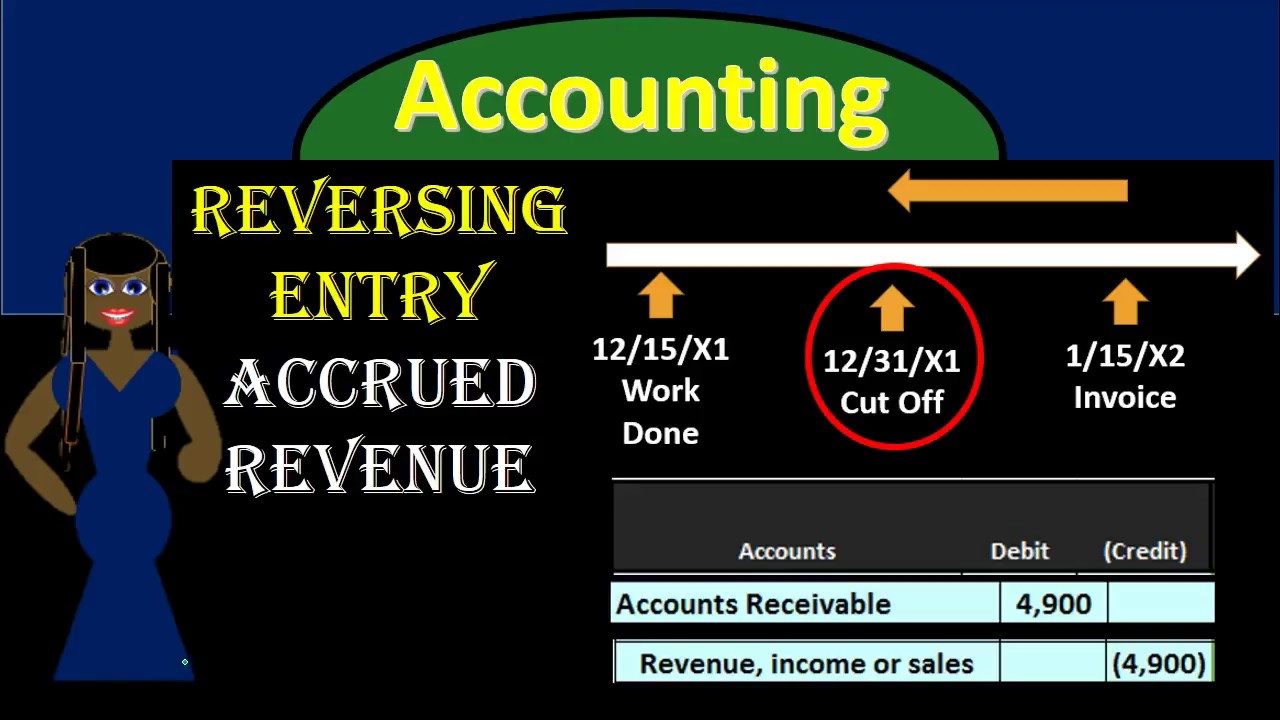

Reversing Journal Entries Accrued Revenue 11 YouTube

To reverse a journal you can: Web reversing entries refer to those journal entries passed in the current accounting period to offset the entries for.

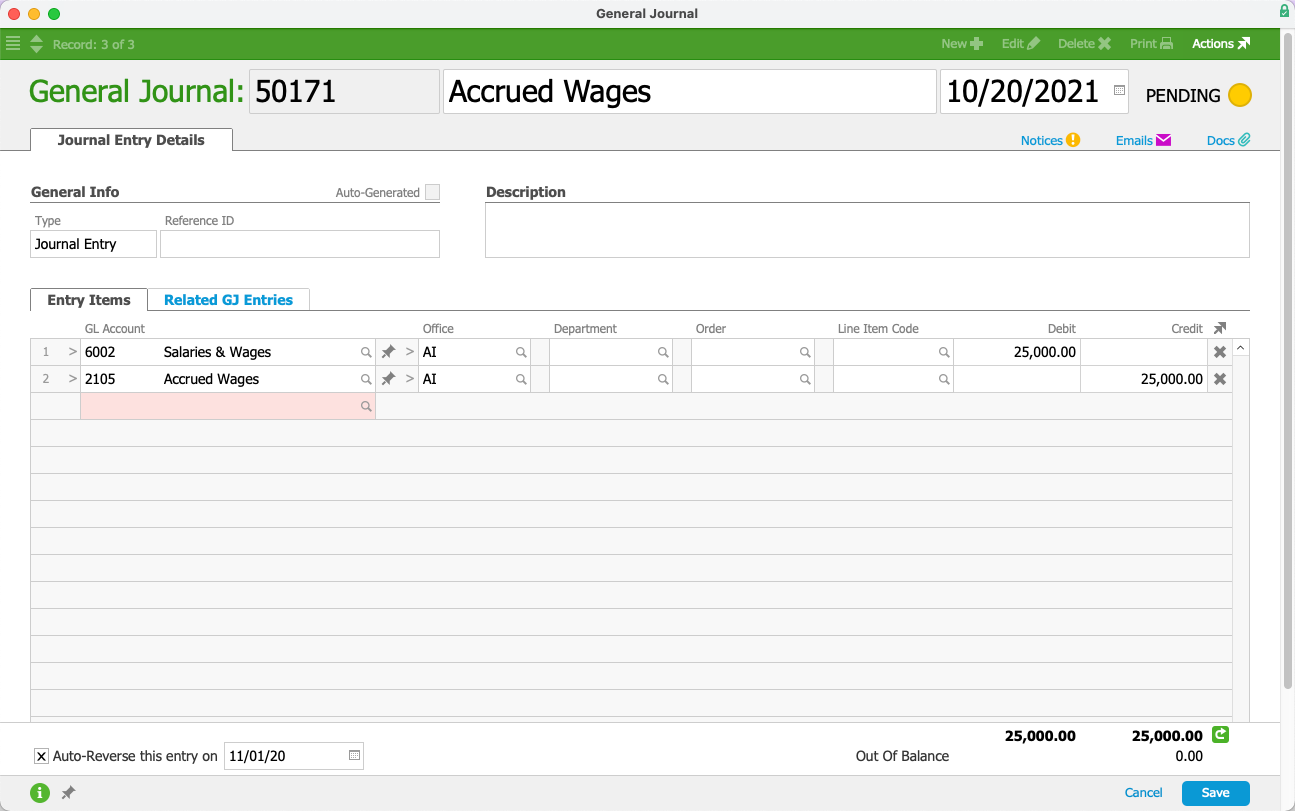

Working with AutoReversing General Journal Entries aACE 5

Web reversing entries are optional journal entries that you can make to reverse or undo the effects of the following adjusting entries that were posted.

Reversing Entries

By creating offsetting entries that. Delete the journal > use the reversals option to post a reverse journal > manually post further journals to reverse.

Reversing Journals with Scenario Management in Tally Erp 9 Advance Co

Assign a reversal period and, if average balances is enabled, a reversal effective date to a journal entry if you want to generate a reversing.

300 Reversing Journal Entries Accrued Revenue YouTube

As these entries are no longer required to be recorded as the business’s assets or liabilities, they are reversed at the. They are usually made.

Reversing Entries YouTube

If you post a journal in error, or with the wrong date or amount, it's easy to correct it in sage 50 accounts. Most often,.

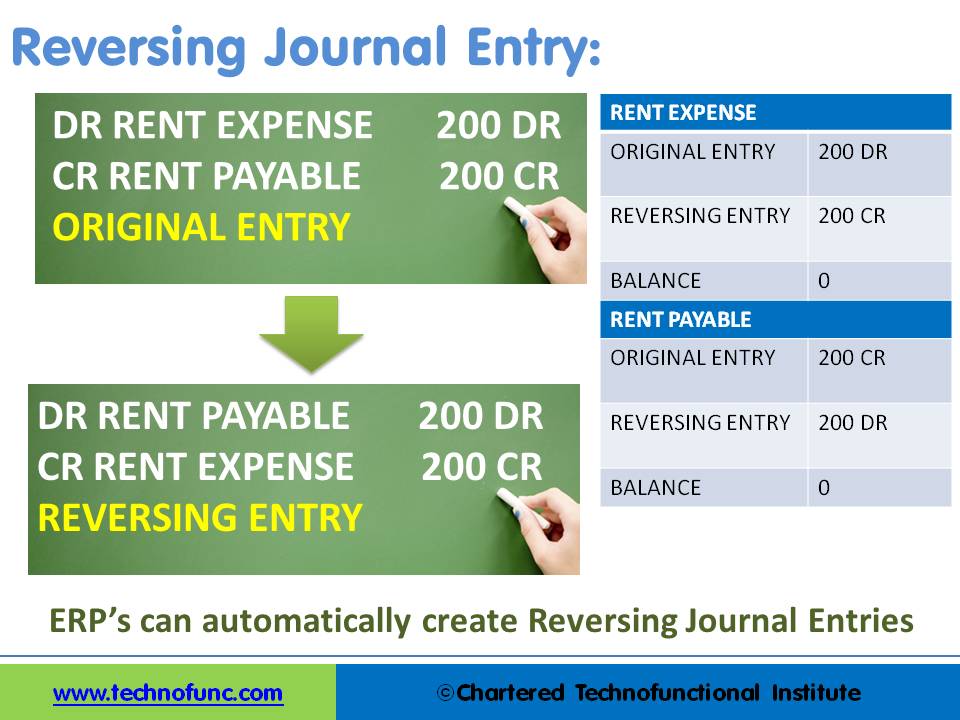

TechnoFunc Reversing Journal Entry

A journal entry made on the first day of a new accounting period to undo the accrual type adjusting entries made prior to the preparation.

Reversing Entries

Web reversing entries typically apply to accruals and deferrals, addressing temporary adjustments made for items like accrued expenses or prepaid income. Most often, the entries.

By Creating Offsetting Entries That.

A reversing journal entry is a type of accounting entry that is made to reverse an original journal entry. They are usually made on the first date of the. You can manually record reversing entries or have them entered automatically. Web the purpose of reversing entries is to cancel out certain adjusting entries that were recorded in the previous accounting period.

Assign A Reversal Period And, If Average Balances Is Enabled, A Reversal Effective Date To A Journal Entry If You Want To Generate A Reversing Entry From The Enter Journals Window, Or Later From The Reverse Journals Form.

Web reversing entries are the reversals of accrued journal entries in order to back out the accrual and make space for the actual. Two benefits of using reversing entries are: This is typically done to correct errors or to adjust for accruals or deferrals that were recorded in the previous accounting period. Web the decarbonization of the built environment, both in new construction and renovation, is crucial to mitigate its relevant impact on climate change and achieve the paris agreement goals.

A Reversing Entry Is Often Used In Payroll, But May Also Be Used To Fix Errors Like Miscalculating Revenue.

Web reversing entries refer to those journal entries passed in the current accounting period to offset the entries for outstanding expenses and accrued income recorded in the immediately preceding accounting period. If you post a journal in error, or with the wrong date or amount, it's easy to correct it in sage 50 accounts. Bookkeepers make them to simplify the records in the new accounting period, especially if they use a cash basis system. Web here are three situations that describe why adjusting entries are needed:

Web Reversing Entries Are Accounting Journal Entries You Make In A Certain Period To Reverse, Or Cancel Out, Some Entries Of A Previous Accounting Period.

Reversing entries are optional journal entries that cancel out previous. Reversing entries are made on the first day of an accounting period to remove accrual adjusting entries that were made at the end of the previous accounting period. A journal entry made on the first day of a new accounting period to undo the accrual type adjusting entries made prior to the preparation of the financial statements dated one day earlier. In other words, these entries cancel out or reverse the adjusting journal entries recorded at the end of the prior accounting period.