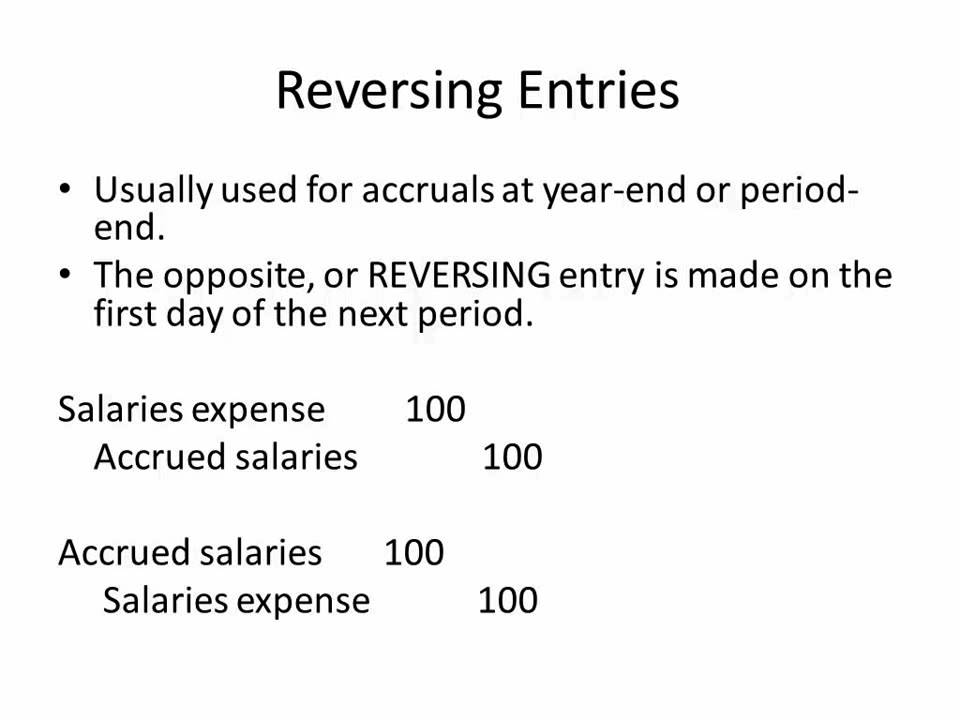

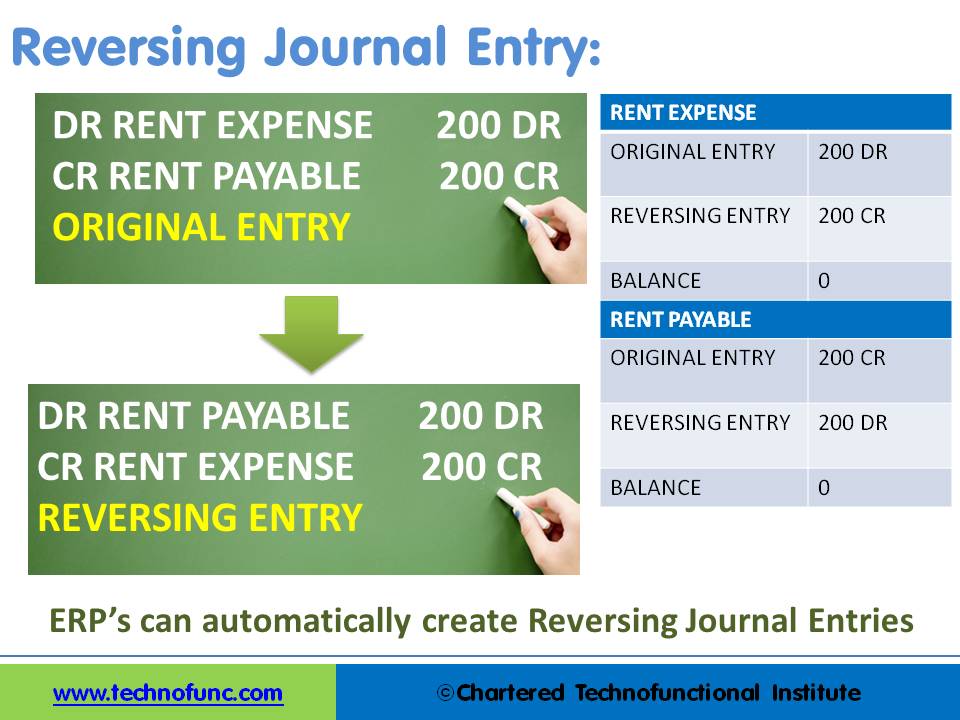

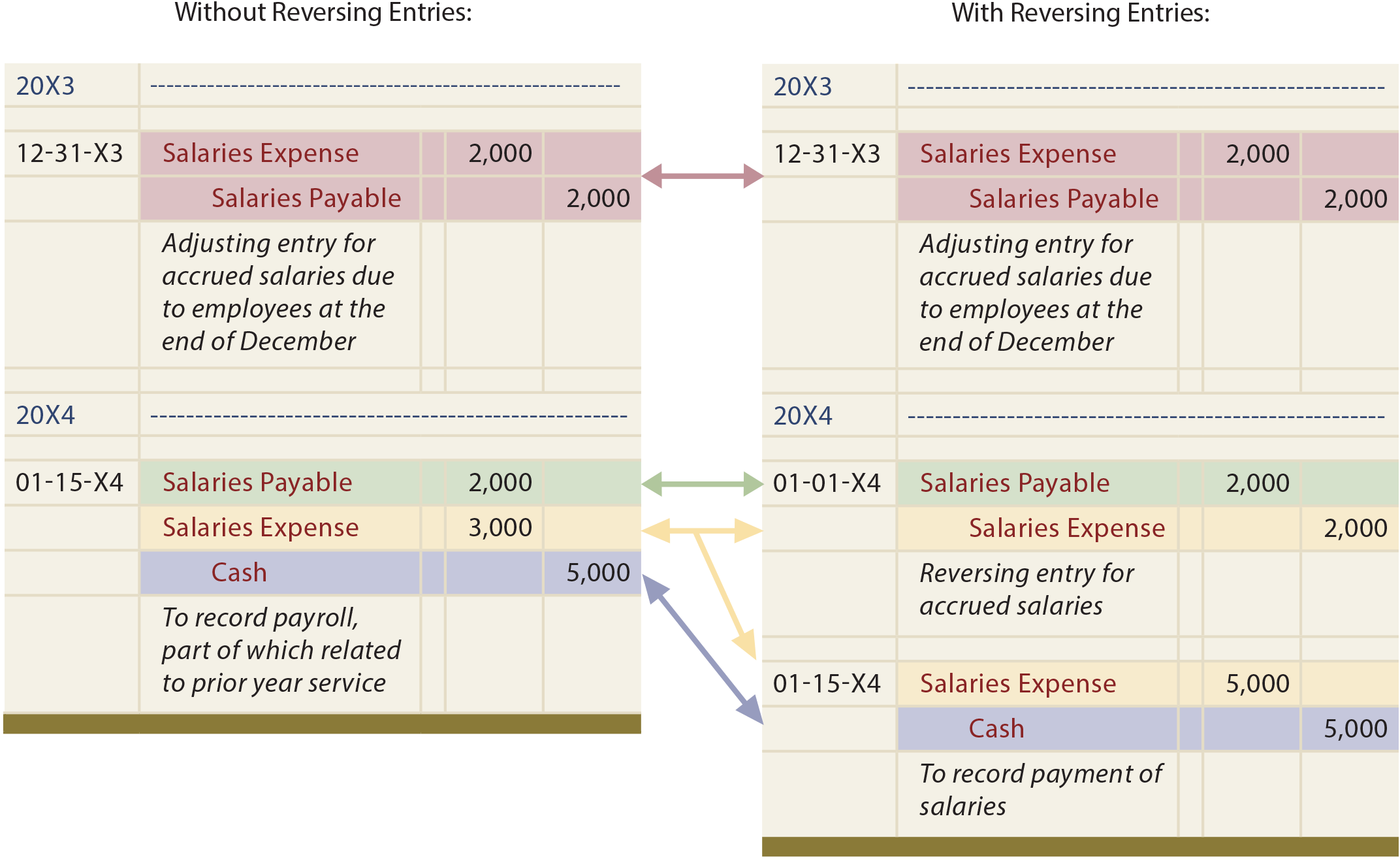

Reversing Journal Entries - Web what is a reversing entry? Web a reversing entry is an accounting journal entry made at the beginning of an accounting period to reverse or cancel out a prior entry. Web reversing entries refer to those journal entries passed in the current accounting period to offset the entries for outstanding expenses and accrued income recorded in the immediately preceding accounting period. A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period. You can make them at the beginning of an accounting period, and they usually adjust some entries for accrued expenses and revenues from the end of the previous period. Web reversing entries are journal entries made at the beginning of each accounting period. According to the going concern accounting principle, previous year prepayments and accruals will be used or paid off in the following year. In part 1, we had an introduction to reversing entries and discussed examples for accrued income and accrued expense. Web definition of reversing entries. Rather than deleting an entry, reversing entries allow you to make adjustments while still maintaining the integrity of your financial records.

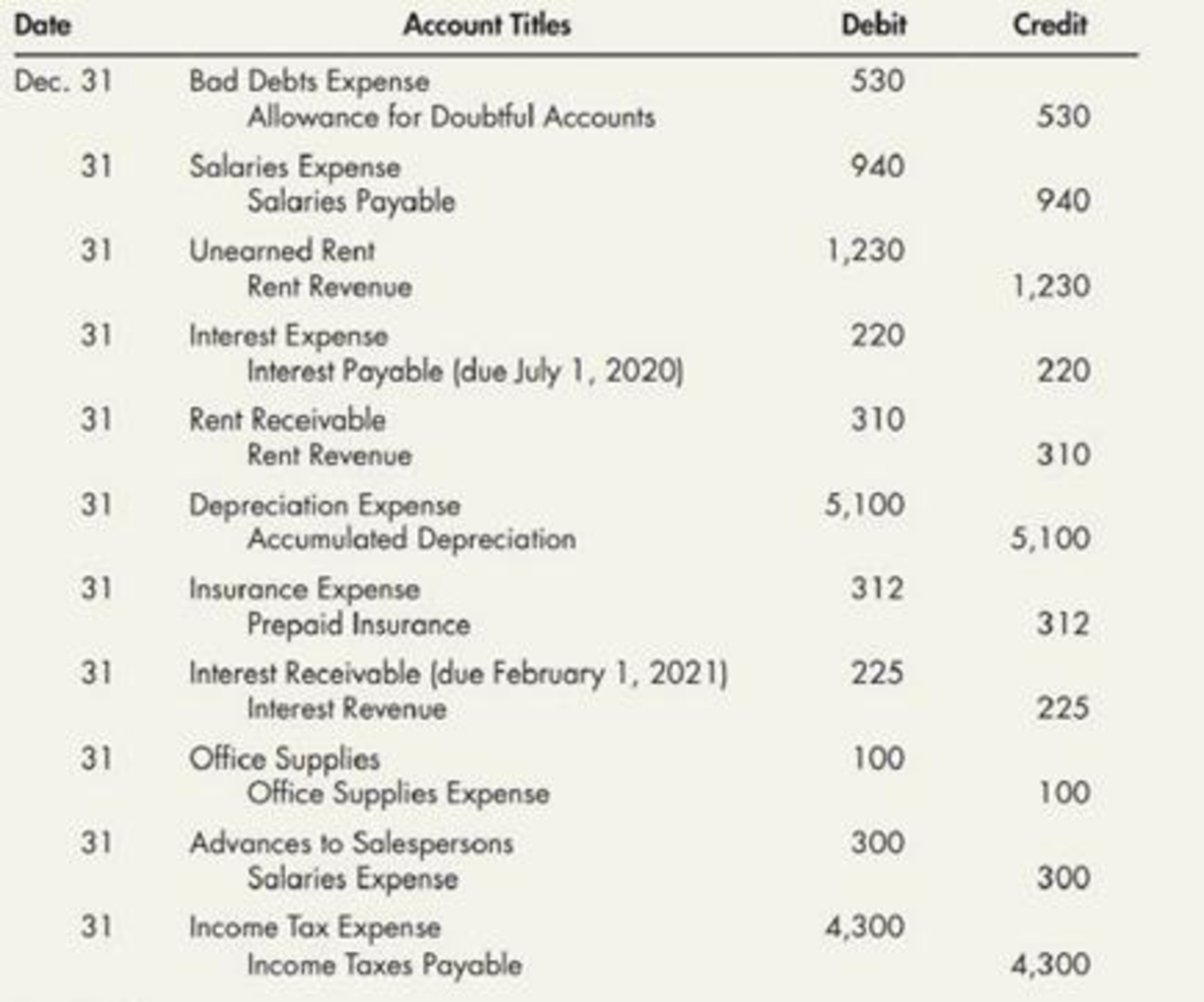

Reversing Entries On December 31, 2019, Mason Company nude the

They are usually made on the first date of the. Bookkeepers make them to simplify the records in the new accounting period, especially if they.

[Solved] PREPARE THE REVERSING ENTRIES. Activity 1 Preparing of

They are usually made on the first date of the. A journal entry made on the first day of a new accounting period to undo.

Reversing Journal Entries YouTube

Two benefits of using reversing entries are: In part 1, we had an introduction to reversing entries and discussed examples for accrued income and accrued.

Reversing Entries YouTube

Web a reversing entry is an accounting journal entry made at the beginning of an accounting period to reverse or cancel out a prior entry..

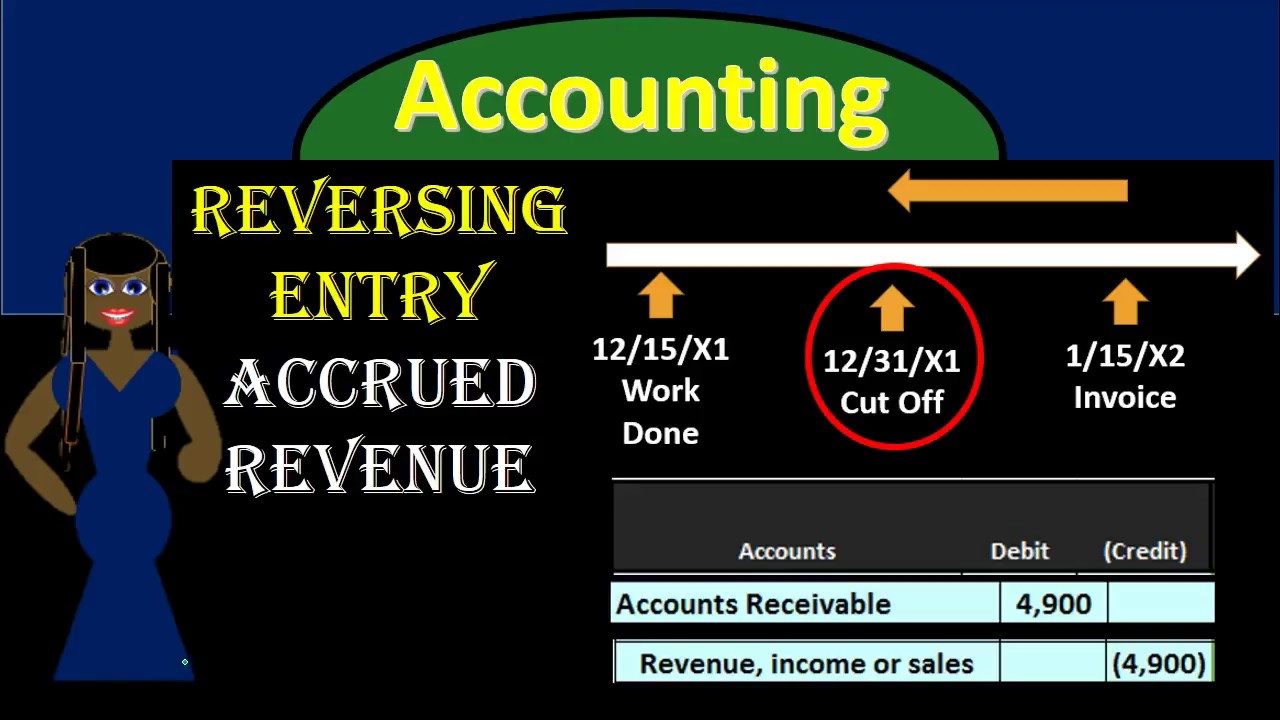

Reversing Journal Entries Accrued Revenue 11 YouTube

The reversing entry typically occurs at the beginning of an accounting period. Web definition of reversing entries. Reversing entries are typically used for accruals and.

TechnoFunc GL Reversing Journal Entry

This is done to simplify the accounting process and ensure that the financial statements are accurate. Web reversing entries are optional journal entries that you.

Reversing Entries

Checked for updates, april 2022. Web reversing entries are journal entries made at the beginning of each accounting period. In other words, these entries cancel.

Reversing Entries

Reversing entries are best explained using an example: Web reversing entries are journal entries used in the accounting to reverse an entry that was made.

300 Reversing Journal Entries Accrued Revenue YouTube

Web reversing entries refer to those journal entries passed in the current accounting period to offset the entries for outstanding expenses and accrued income recorded.

Web A Reversing Journal Entry Is A Type Of Adjusting Entry That Is Made At The Beginning Of An Accounting Period To Reverse The Effects Of A Previous Adjusting Entry.

In other words, these entries cancel out or reverse the adjusting journal entries recorded at the end of the prior accounting period. Web the purpose of reversing entries is to cancel out certain adjusting entries that were recorded in the previous accounting period. They are usually made on the first date of the. Most often, the entries reverse accrued revenues or expenses for the previous period.

You Can Make Them At The Beginning Of An Accounting Period, And They Usually Adjust Some Entries For Accrued Expenses And Revenues From The End Of The Previous Period.

Reversing entries are best explained using an example: A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period. According to the going concern accounting principle, previous year prepayments and accruals will be used or paid off in the following year. As these entries are no longer required to be recorded as the business’s assets or liabilities, they are reversed at the.

In Part 1, We Had An Introduction To Reversing Entries And Discussed Examples For Accrued Income And Accrued Expense.

Web reversing entries are the reversals of accrued journal entries in order to back out the accrual and make space for the actual. Web reversing entries are optional journal entries that you can make to reverse or undo the effects of the following adjusting entries that were posted in the immediately preceding accounting period: The sole purpose of a reversing entry is to cancel out a specific adjusting entry made at the end of the prior period, but they are optional and not every company uses them. Web reversing entries are journal entries that are created to reverse adjusting entries at the start of the next accounting cycle.

This Is Done Using Compound Journal Entries.

Web reversing entries are journal entries made at the beginning of each accounting period. Two benefits of using reversing entries are: Web reversing entries typically apply to accruals and deferrals, addressing temporary adjustments made for items like accrued expenses or prepaid income. Prepaid expense (if using the expense method) deferred income (if using the income method)